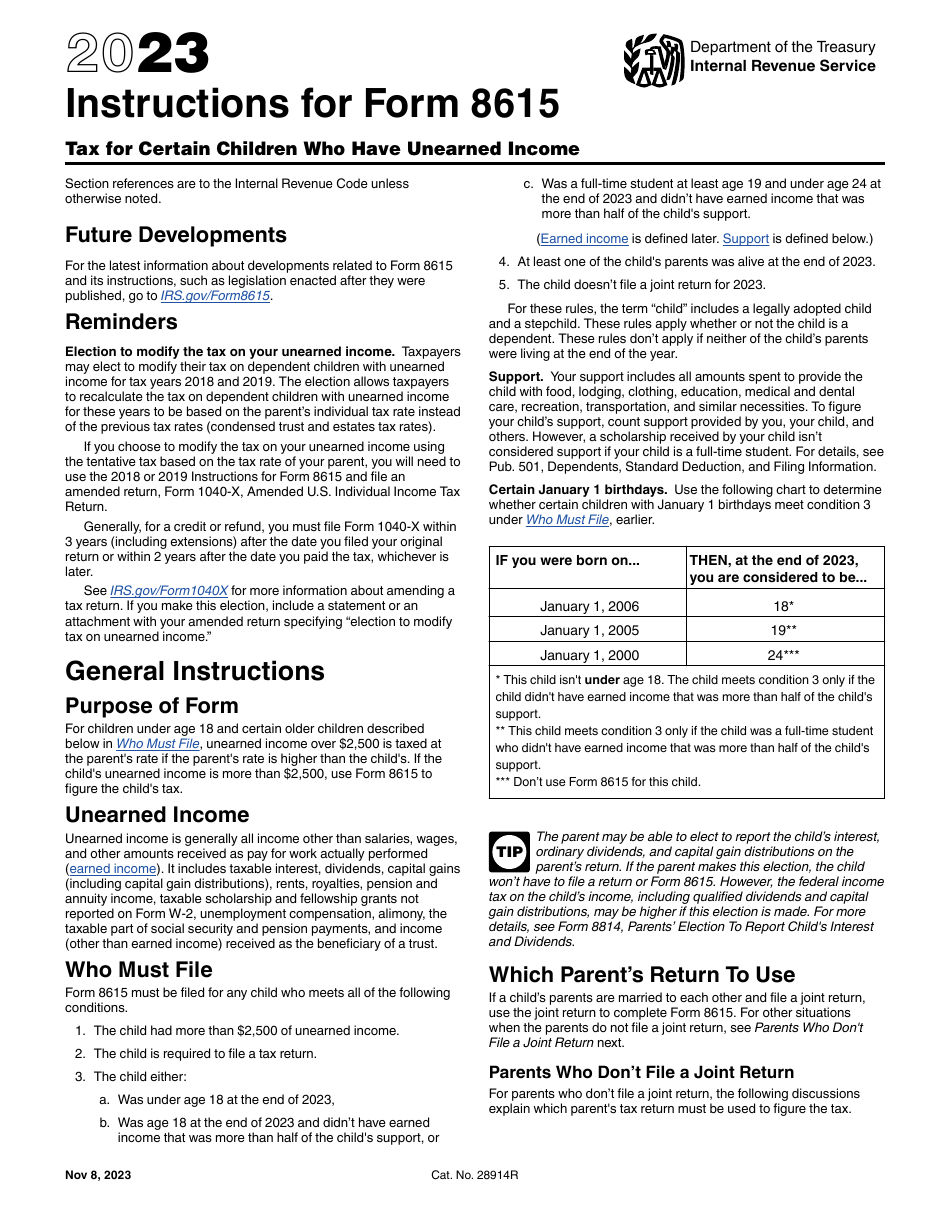

8615 Form Instructions

8615 Form Instructions - The form will help you. Form 8615 must be filed for any child who meets all of the following conditions. Form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: The child had more than $2,500 of unearned income. Per irs instructions for form 8615 on page 1: Use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return.

Use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in. Per irs instructions for form 8615 on page 1: Form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: The form will help you. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,500 of unearned income.

Form 8615 must be filed for any child who meets all of the following conditions. Use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in. Form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: The child had more than $2,500 of unearned income. Per irs instructions for form 8615 on page 1: The form will help you. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return.

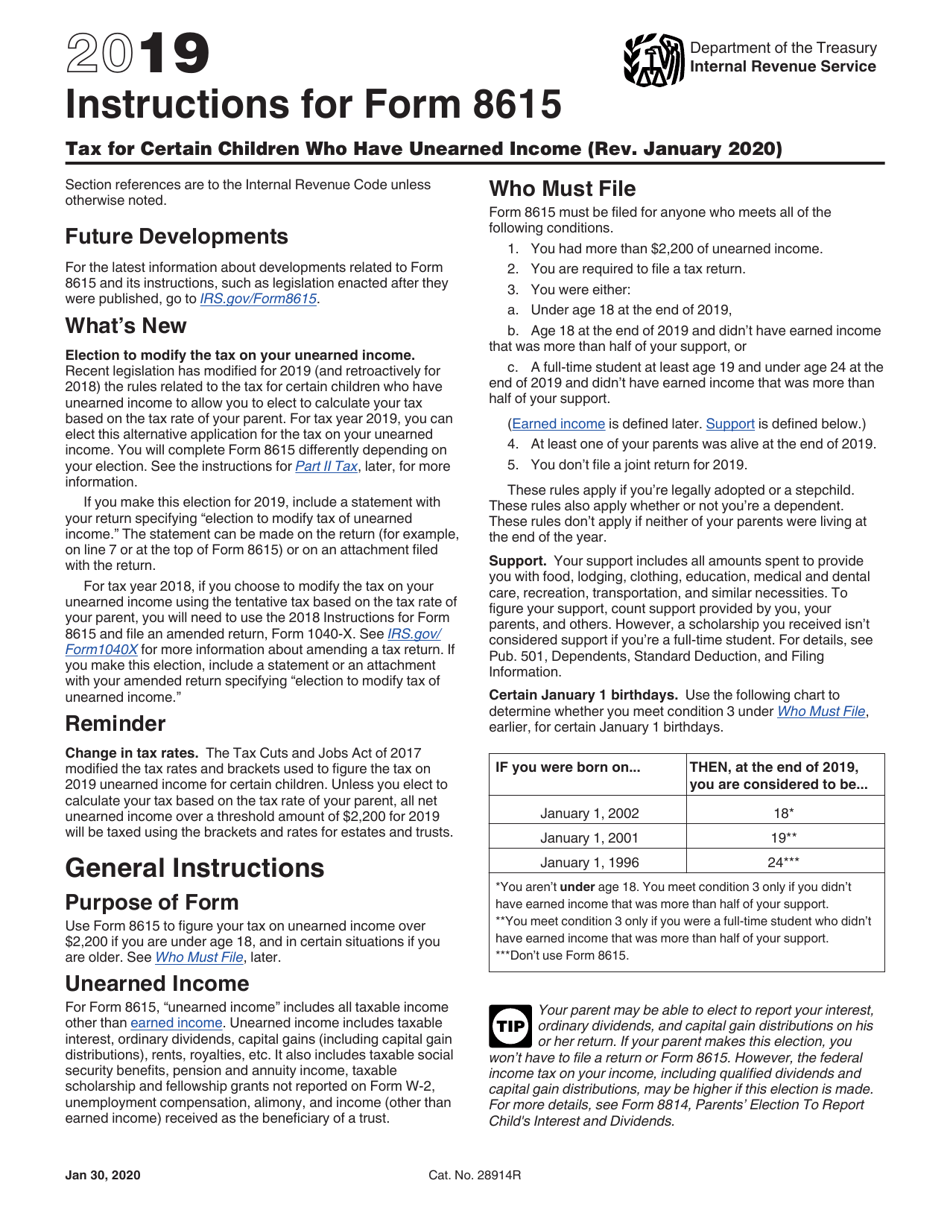

Download Instructions for IRS Form 8615 Tax for Certain Children Who

The child had more than $2,500 of unearned income. Per irs instructions for form 8615 on page 1: Form 8615 must be filed for any child who meets all of the following conditions. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Form 8615, tax for certain children who have unearned.

IRS Form 8615 Instructions

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: Use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in. The.

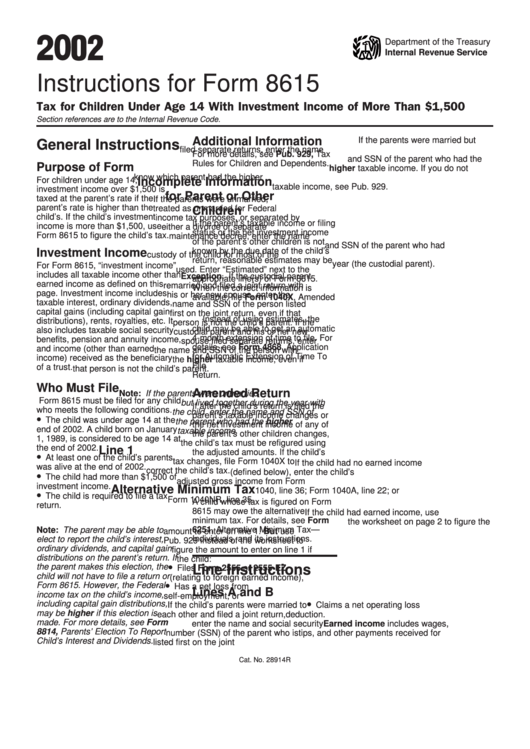

2002 Instructions For Form 8615 printable pdf download

Use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in. Form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Per.

Instructions for Filling Out Form 8615 Pilot Blogs Pilot Blog

The form will help you. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Form 8615 must be filed for any child who meets all of the following conditions. Per irs instructions for form 8615 on page 1: The child had more than $2,500 of unearned income.

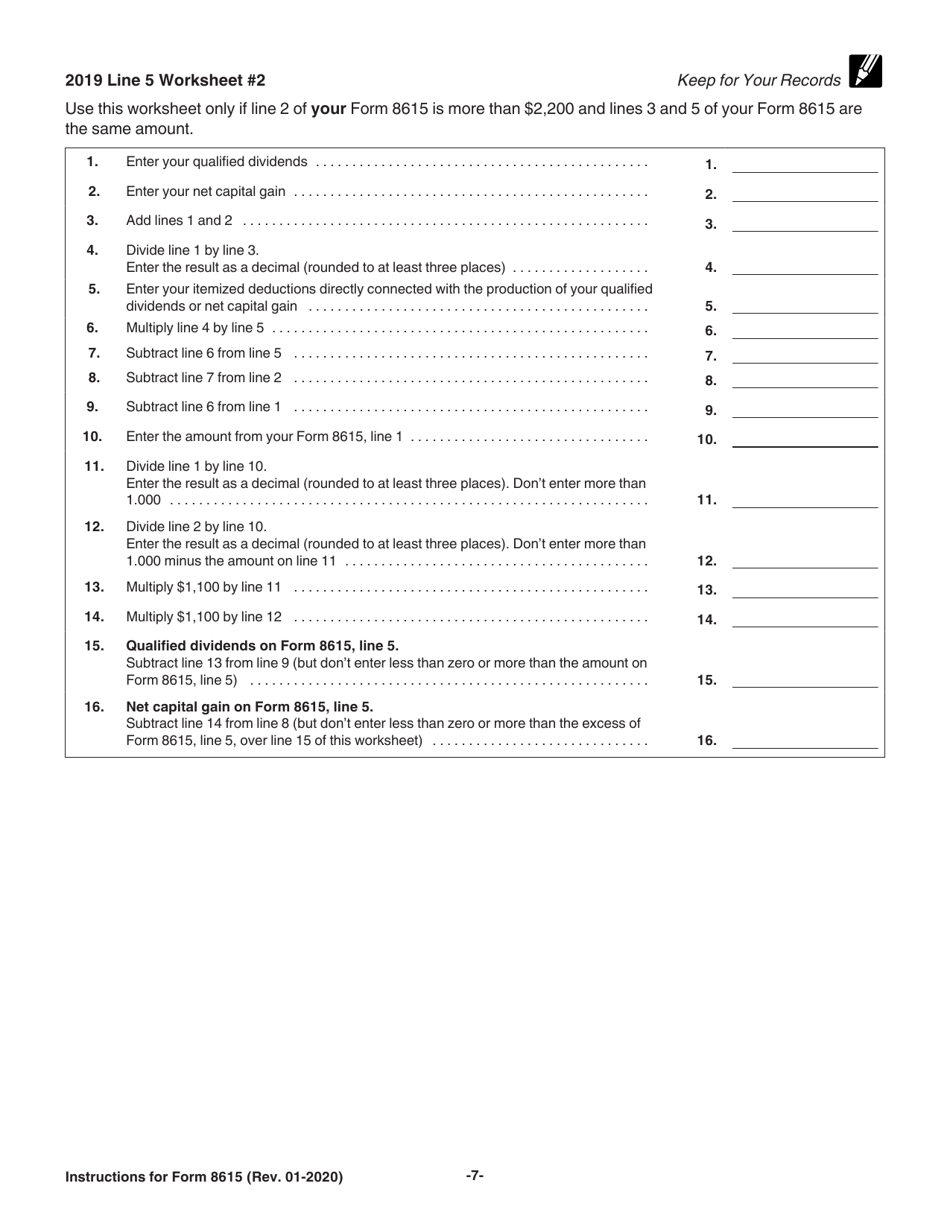

Download Instructions for IRS Form 8615 Tax for Certain Children Who

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. The form will help you. The child had more than $2,500 of unearned income. Form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: Use form 8615 to figure your tax.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Per irs instructions for form 8615 on page 1: Form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Use form 8615 to figure your tax on unearned income over $2,200.

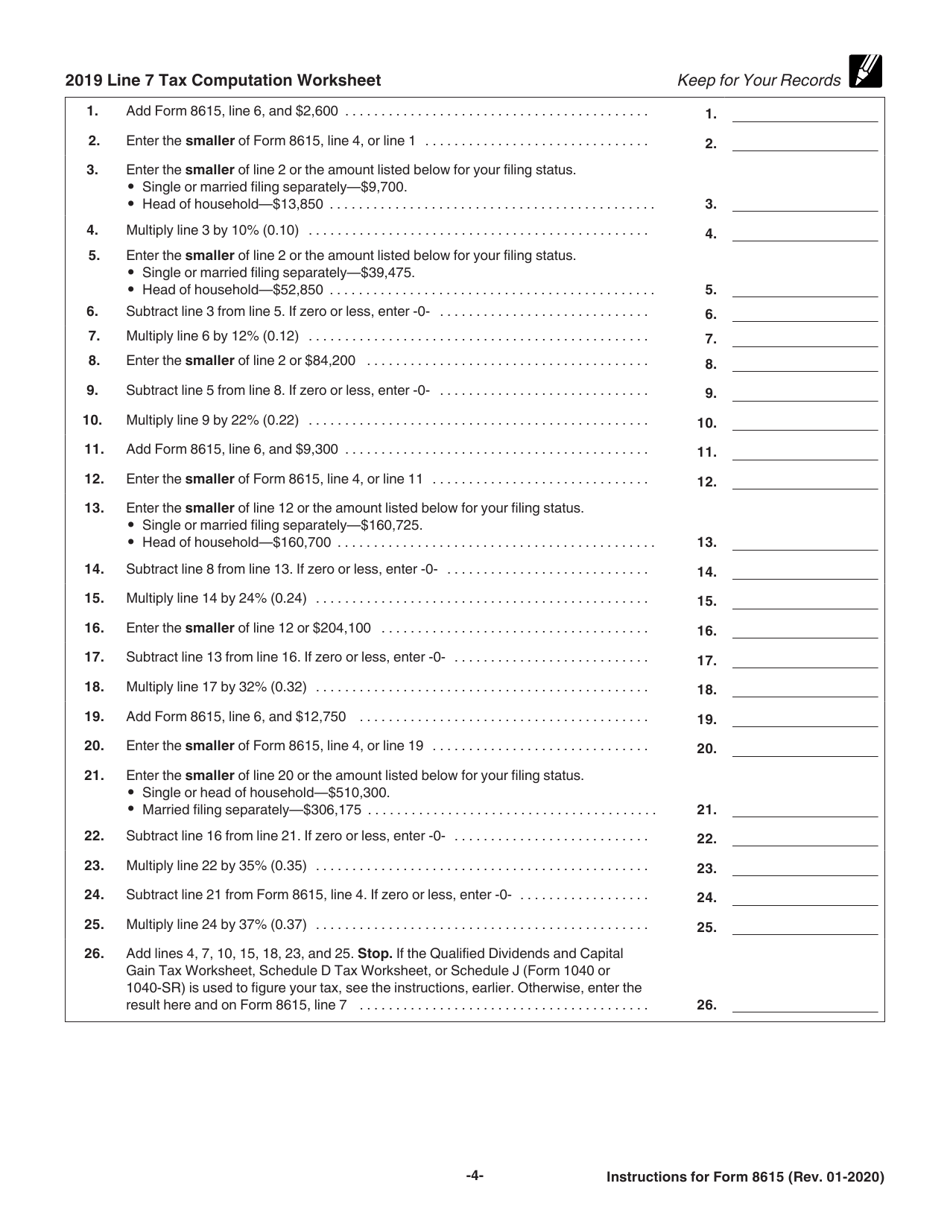

Form 8615 ≡ Fill Out Printable PDF Forms Online

Form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,500 of unearned income. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Form 8615, tax for certain children who have unearned income, is required when a child meets all of.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

The child had more than $2,500 of unearned income. Use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in. Per irs instructions for form 8615 on page 1: Form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: If.

Form 8615 Edit, Fill, Sign Online Handypdf

Use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in. Form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return. Form.

Form 8615 Tax for Certain Children Who Have Unearned (2015

Per irs instructions for form 8615 on page 1: The form will help you. Form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: The child had more than $2,500 of unearned income. Form 8615 must be filed for any child who meets all of the following conditions.

The Form Will Help You.

Form 8615 must be filed for any child who meets all of the following conditions. Use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in. The child had more than $2,500 of unearned income. Form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions:

Per Irs Instructions For Form 8615 On Page 1:

If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate return.