8815 Tax Form

8815 Tax Form - Savings bonds issued after 1989, the cashed us savings bonds must meet. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. If you redeemed series ee or series i u.s. Savings bonds this year that were issued after 1989, you may be able to exclude from your. Use form 8815 to figure the interest income you can exclude from income. Irs form 8815 titled exclusion of interest from series ee and i u.s. If you cashed series ee or i u.s. The interest income exclusion is phased out at higher income. You cash the qualifying savings bonds in the same tax year for which you are claiming. Savings bonds to pay for higher education expenses, use form 8815 to.

Savings bonds this year that were issued after 1989, you may be able to exclude from your. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. The interest income exclusion is phased out at higher income. Irs form 8815 titled exclusion of interest from series ee and i u.s. Savings bonds to pay for higher education expenses, use form 8815 to. If you redeemed series ee or series i u.s. If you cashed series ee or i u.s. Use form 8815 to figure the interest income you can exclude from income. You cash the qualifying savings bonds in the same tax year for which you are claiming. Savings bonds issued after 1989, the cashed us savings bonds must meet.

You cash the qualifying savings bonds in the same tax year for which you are claiming. The interest income exclusion is phased out at higher income. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. Savings bonds issued after 1989, the cashed us savings bonds must meet. If you cashed series ee or i u.s. Savings bonds this year that were issued after 1989, you may be able to exclude from your. Savings bonds to pay for higher education expenses, use form 8815 to. Irs form 8815 titled exclusion of interest from series ee and i u.s. Use form 8815 to figure the interest income you can exclude from income. If you redeemed series ee or series i u.s.

img_8815.jpg Free image hosting service

Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. Irs form 8815 titled exclusion of interest from series ee and i u.s. The interest income exclusion is phased out at higher income. Use form 8815 to figure the interest income you can exclude from income. Savings bonds issued after.

Paying For College A Tax Dodge For College Students

Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. Irs form 8815 titled exclusion of interest from series ee and i u.s. The interest income exclusion is phased out at higher income. Savings bonds issued after 1989, the cashed us savings bonds must meet. Use form 8815 to figure.

IRS Form 8815 Instructions TaxFree Savings Bonds for College

Irs form 8815 titled exclusion of interest from series ee and i u.s. Savings bonds issued after 1989, the cashed us savings bonds must meet. If you redeemed series ee or series i u.s. If you cashed series ee or i u.s. Savings bonds this year that were issued after 1989, you may be able to exclude from your.

HUGO BOSS 8815Ainak.pk

You cash the qualifying savings bonds in the same tax year for which you are claiming. Savings bonds this year that were issued after 1989, you may be able to exclude from your. The interest income exclusion is phased out at higher income. Irs form 8815 titled exclusion of interest from series ee and i u.s. Form 8815 helps taxpayers.

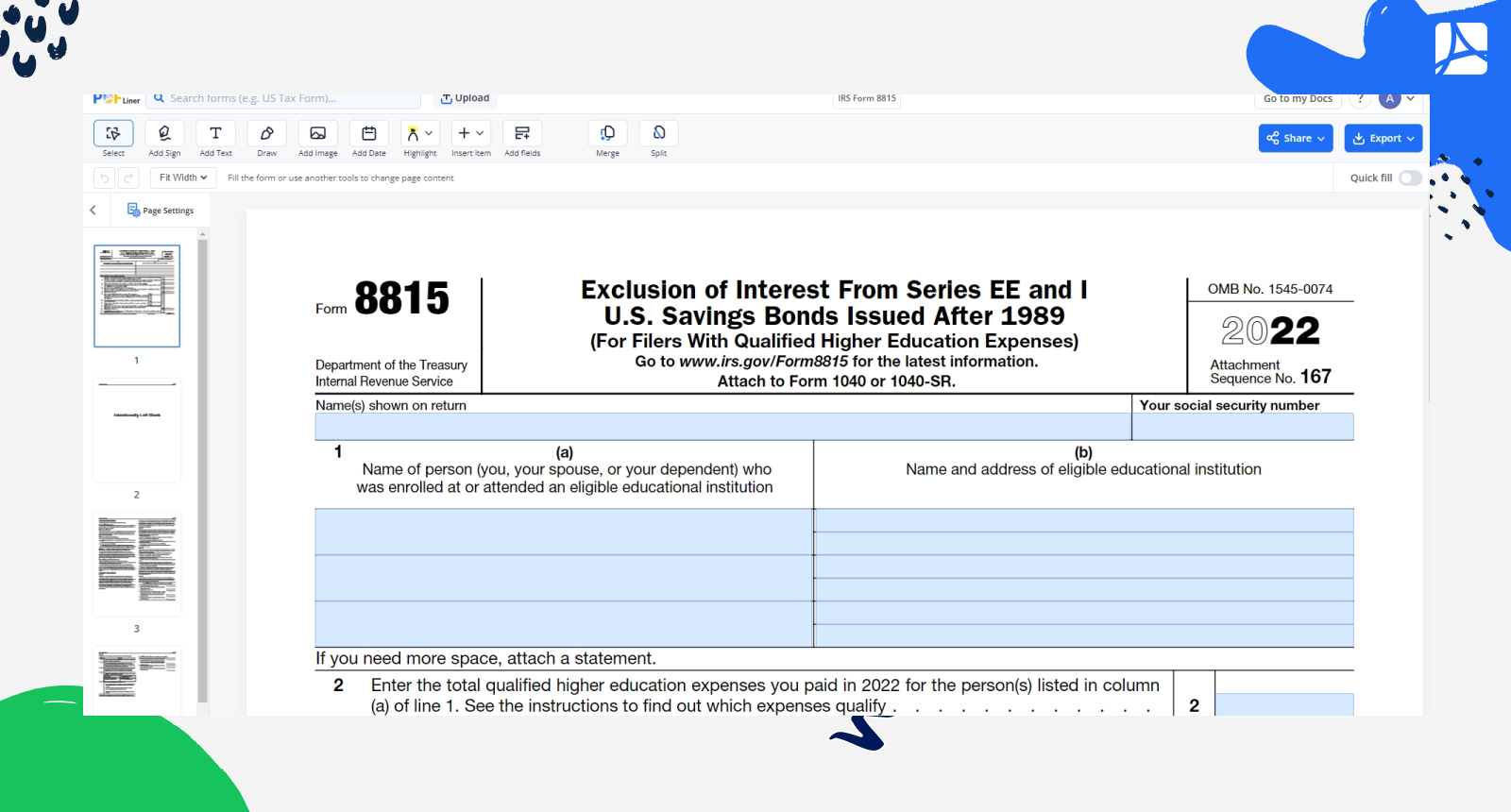

Form 8815 Printable IRS Form 8815 blank, sign form online — PDFliner

If you cashed series ee or i u.s. Savings bonds issued after 1989, the cashed us savings bonds must meet. You cash the qualifying savings bonds in the same tax year for which you are claiming. Savings bonds to pay for higher education expenses, use form 8815 to. Form 8815 helps taxpayers calculate the amount of interest that can be.

IRS Form 8815 Instructions TaxFree Savings Bonds for College

Irs form 8815 titled exclusion of interest from series ee and i u.s. If you cashed series ee or i u.s. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. If you redeemed series ee or series i u.s. You cash the qualifying savings bonds in the same tax.

Online IRS Form 8815 2019 Fillable and Editable PDF Template

If you redeemed series ee or series i u.s. The interest income exclusion is phased out at higher income. Form 8815 helps taxpayers calculate the amount of interest that can be excluded from their income, thus potentially reducing their. Savings bonds to pay for higher education expenses, use form 8815 to. If you cashed series ee or i u.s.

IRS Form 8815 Instructions TaxFree Savings Bonds for College

You cash the qualifying savings bonds in the same tax year for which you are claiming. Savings bonds this year that were issued after 1989, you may be able to exclude from your. Savings bonds issued after 1989, the cashed us savings bonds must meet. If you cashed series ee or i u.s. Use form 8815 to figure the interest.

IRS Form 8815 Instructions TaxFree Savings Bonds for College

Irs form 8815 titled exclusion of interest from series ee and i u.s. Savings bonds to pay for higher education expenses, use form 8815 to. If you redeemed series ee or series i u.s. Savings bonds this year that were issued after 1989, you may be able to exclude from your. Form 8815 helps taxpayers calculate the amount of interest.

511_8815.jpg Free image hosting service

Irs form 8815 titled exclusion of interest from series ee and i u.s. Savings bonds to pay for higher education expenses, use form 8815 to. Savings bonds issued after 1989, the cashed us savings bonds must meet. Savings bonds this year that were issued after 1989, you may be able to exclude from your. Use form 8815 to figure the.

Form 8815 Helps Taxpayers Calculate The Amount Of Interest That Can Be Excluded From Their Income, Thus Potentially Reducing Their.

Use form 8815 to figure the interest income you can exclude from income. If you cashed series ee or i u.s. Savings bonds issued after 1989, the cashed us savings bonds must meet. Savings bonds this year that were issued after 1989, you may be able to exclude from your.

If You Redeemed Series Ee Or Series I U.s.

The interest income exclusion is phased out at higher income. You cash the qualifying savings bonds in the same tax year for which you are claiming. Savings bonds to pay for higher education expenses, use form 8815 to. Irs form 8815 titled exclusion of interest from series ee and i u.s.