Arizona Tax Lien

Arizona Tax Lien - Assignment requests for state liens ; You may be eligible if you owe more tax than you can pay. Form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Request a monthly installment plan. Make an online payment at aztaxes.gov. The treasurer’s tax lien auction web site will be. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). Upon receipt of a cashier’s check or certified funds, the arizona department of revenue will immediately provide a notice of intent to release state tax.

Assignment requests for state liens ; You may be eligible if you owe more tax than you can pay. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). Make an online payment at aztaxes.gov. Upon receipt of a cashier’s check or certified funds, the arizona department of revenue will immediately provide a notice of intent to release state tax. Request a monthly installment plan. The treasurer’s tax lien auction web site will be.

Upon receipt of a cashier’s check or certified funds, the arizona department of revenue will immediately provide a notice of intent to release state tax. Make an online payment at aztaxes.gov. The treasurer’s tax lien auction web site will be. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Assignment requests for state liens ; Request a monthly installment plan. You may be eligible if you owe more tax than you can pay. Form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s).

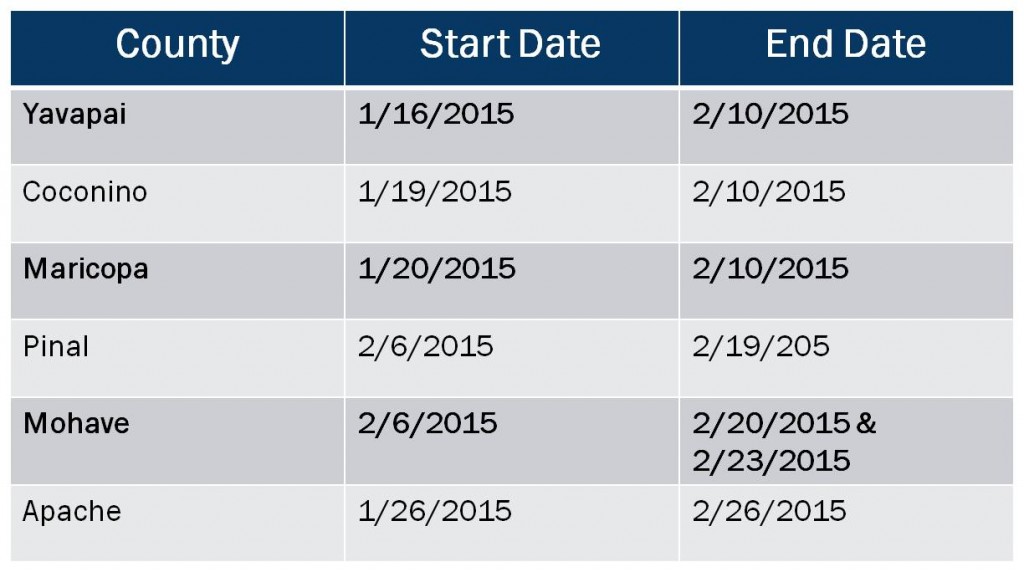

Arizona Tax Lien Sales Tax Lien Investing Tips

The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). Form 140ptc is used by qualified individuals to claim a refundable income tax credit.

Investing in Tax Lien Seminars and Courses

Form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned. Request a monthly installment plan. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). The treasurer’s tax lien.

Arizona Lien Records

Upon receipt of a cashier’s check or certified funds, the arizona department of revenue will immediately provide a notice of intent to release state tax. The treasurer’s tax lien auction web site will be. You may be eligible if you owe more tax than you can pay. The tax lien sale of unpaid 2023 real property taxes will be held.

Arizona Lien Waiver Form Fill Online, Printable, Fillable, Blank

Upon receipt of a cashier’s check or certified funds, the arizona department of revenue will immediately provide a notice of intent to release state tax. Request a monthly installment plan. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). The tax lien sale of.

tax lien PDF Free Download

The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned. Upon receipt of a cashier’s check or certified funds, the department of revenue.

Tax Lien Sale Download Free PDF Tax Lien Taxes

Form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned. Upon receipt of a cashier’s check or certified funds, the arizona department of revenue will immediately provide a notice of intent to release state tax. Make an online payment at aztaxes.gov. Upon receipt of.

Arizona Tax Liens Primer PDF Foreclosure Tax Lien

The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Upon receipt of a cashier’s check or certified funds, the arizona department of revenue will immediately provide a notice of intent to release state tax. Assignment requests for state liens ; Request a monthly installment plan. The treasurer’s tax.

The Complete Guide to Arizona Lien & Notice Deadlines National Lien

The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Assignment requests for state liens ; Make an online payment at aztaxes.gov. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). You may.

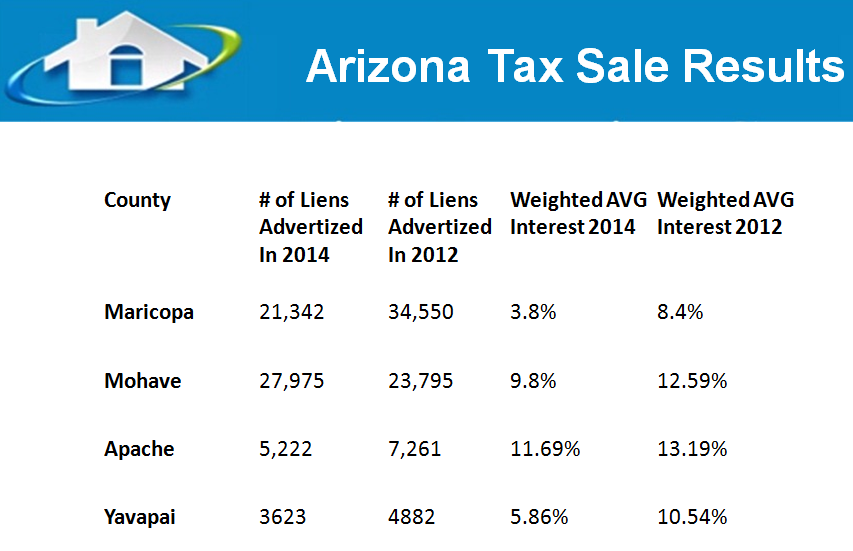

Results From The Arizona Online Tax Lien Sales Tax Lien Investing Tips

Form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned. Upon receipt of a cashier’s check or certified funds, the arizona department of revenue will immediately provide a notice of intent to release state tax. Make an online payment at aztaxes.gov. Request a monthly.

Real Property Tax Lien Hymson Goldstein Pantiliat & Lohr, PLLC

Make an online payment at aztaxes.gov. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. The treasurer’s tax lien auction web site will be. Upon receipt of a cashier’s check or certified funds, the arizona department of revenue will immediately provide a notice of intent to release state.

The Treasurer’s Tax Lien Auction Web Site Will Be.

Request a monthly installment plan. Make an online payment at aztaxes.gov. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Upon receipt of a cashier’s check or certified funds, the arizona department of revenue will immediately provide a notice of intent to release state tax.

Upon Receipt Of A Cashier’s Check Or Certified Funds, The Department Of Revenue Will Immediately Provide A Notice Of Intent To Release State Tax Lien(S).

Form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned. You may be eligible if you owe more tax than you can pay. Assignment requests for state liens ;