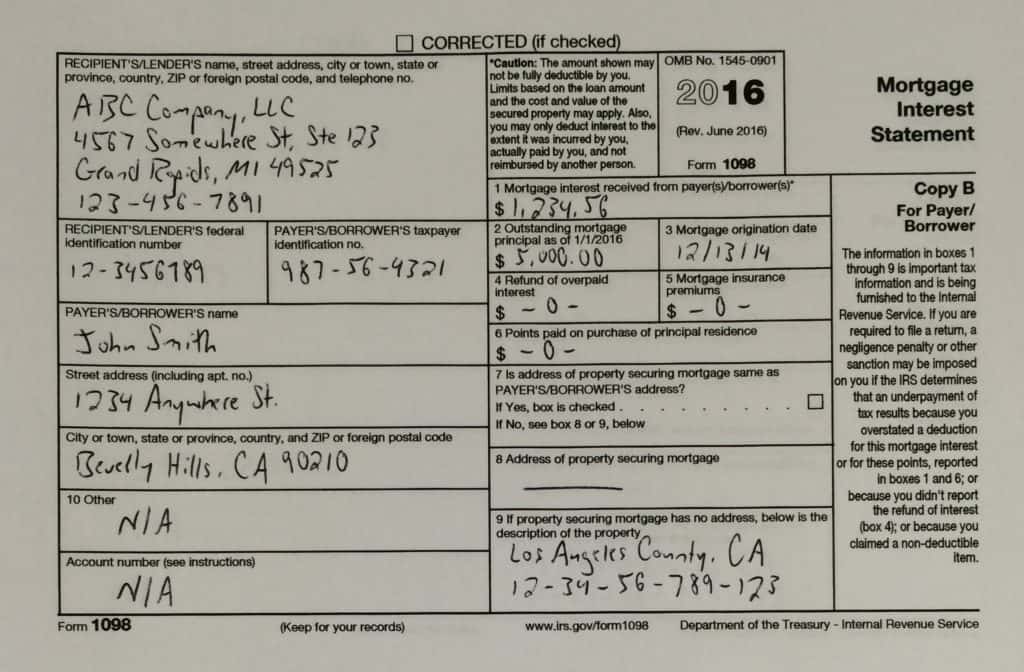

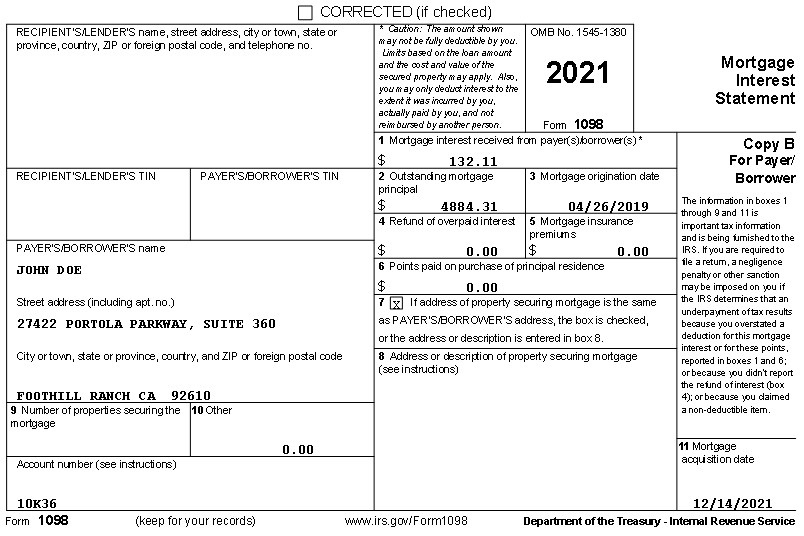

Box 10 Form 1098

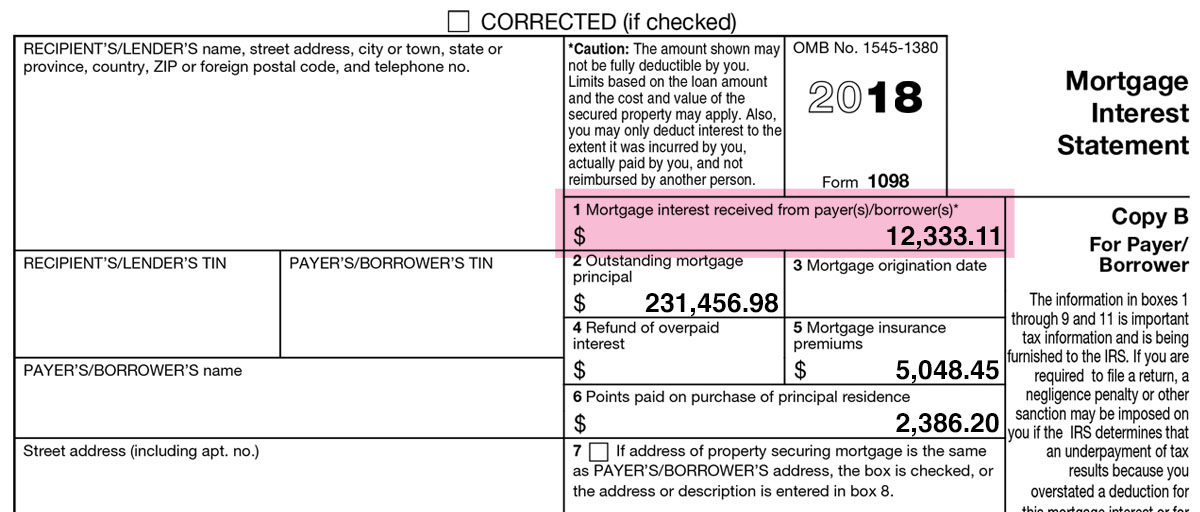

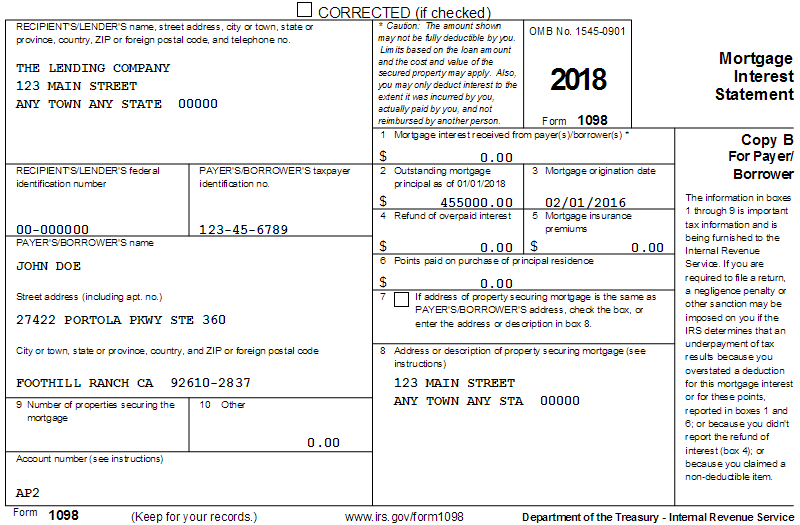

Box 10 Form 1098 - What is 1098 box 10? Box 10 on form 1098 is used by lenders to report any other item that they wish to inform you of, such as. Learn how to report mortgage interest and mortgage insurance premiums of $600 or more received from individuals in the course of your. If you have an amount in your box 10, you will just need to enter it beneath box 5 in. Box 10 on your 1098 is real estate taxes paid. Learn how to report mortgage interest or mortgage insurance premiums of $600 or more received from an individual in the course of your trade or. This is a pdf document of irs form 1098, which reports mortgage interest and points paid or received by payer/borrower.

Learn how to report mortgage interest and mortgage insurance premiums of $600 or more received from individuals in the course of your. This is a pdf document of irs form 1098, which reports mortgage interest and points paid or received by payer/borrower. What is 1098 box 10? Box 10 on form 1098 is used by lenders to report any other item that they wish to inform you of, such as. Box 10 on your 1098 is real estate taxes paid. If you have an amount in your box 10, you will just need to enter it beneath box 5 in. Learn how to report mortgage interest or mortgage insurance premiums of $600 or more received from an individual in the course of your trade or.

If you have an amount in your box 10, you will just need to enter it beneath box 5 in. Box 10 on your 1098 is real estate taxes paid. What is 1098 box 10? Learn how to report mortgage interest and mortgage insurance premiums of $600 or more received from individuals in the course of your. This is a pdf document of irs form 1098, which reports mortgage interest and points paid or received by payer/borrower. Box 10 on form 1098 is used by lenders to report any other item that they wish to inform you of, such as. Learn how to report mortgage interest or mortgage insurance premiums of $600 or more received from an individual in the course of your trade or.

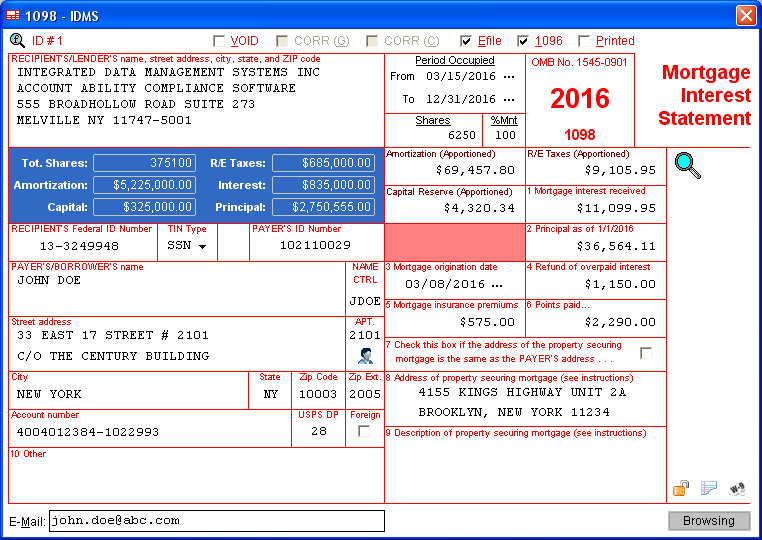

IRS Modifies Form 1098 for Reporting Year 2016 IDMS Account Ability

Learn how to report mortgage interest or mortgage insurance premiums of $600 or more received from an individual in the course of your trade or. If you have an amount in your box 10, you will just need to enter it beneath box 5 in. Box 10 on form 1098 is used by lenders to report any other item that.

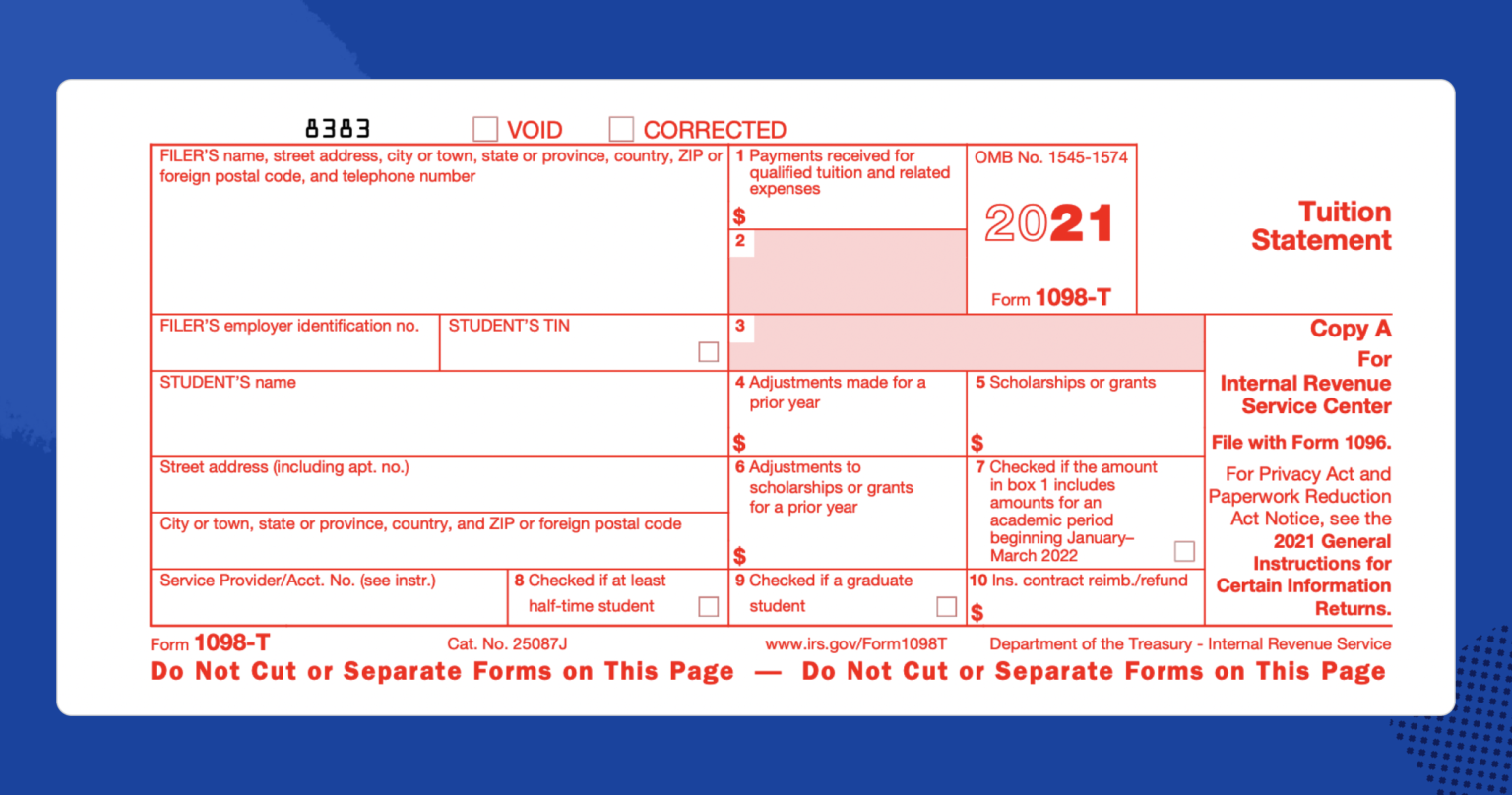

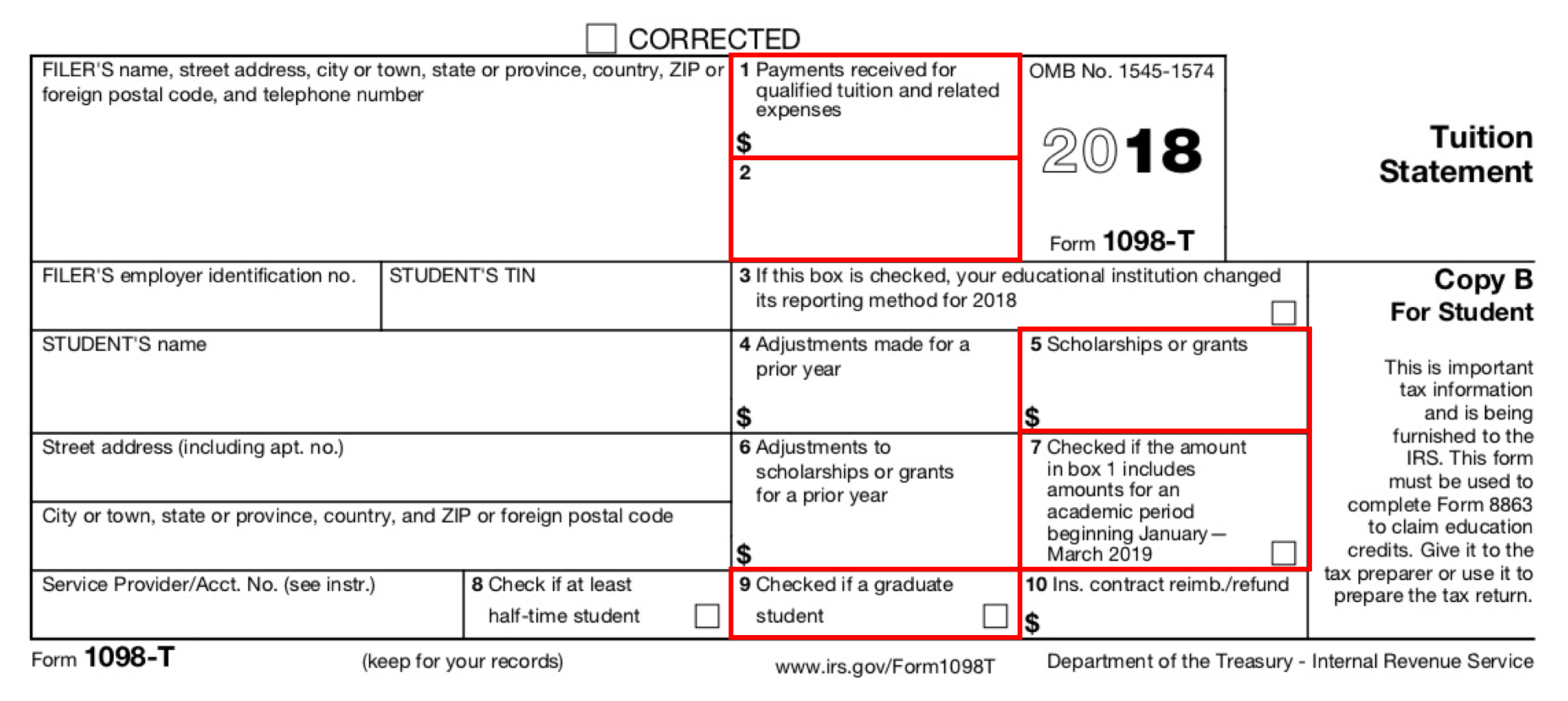

1098T Form Elgin Community College (ECC)

Box 10 on form 1098 is used by lenders to report any other item that they wish to inform you of, such as. This is a pdf document of irs form 1098, which reports mortgage interest and points paid or received by payer/borrower. Box 10 on your 1098 is real estate taxes paid. Learn how to report mortgage interest and.

Définition du formulaire 1098

Box 10 on your 1098 is real estate taxes paid. This is a pdf document of irs form 1098, which reports mortgage interest and points paid or received by payer/borrower. Learn how to report mortgage interest or mortgage insurance premiums of $600 or more received from an individual in the course of your trade or. Box 10 on form 1098.

1098T Form How to Complete and File Your Tuition Statement

What is 1098 box 10? Learn how to report mortgage interest and mortgage insurance premiums of $600 or more received from individuals in the course of your. Learn how to report mortgage interest or mortgage insurance premiums of $600 or more received from an individual in the course of your trade or. If you have an amount in your box.

Form 1098T Still Causing Trouble for Funded Graduate Students

If you have an amount in your box 10, you will just need to enter it beneath box 5 in. Box 10 on form 1098 is used by lenders to report any other item that they wish to inform you of, such as. Learn how to report mortgage interest and mortgage insurance premiums of $600 or more received from individuals.

51+ where do i get my 1098 mortgage interest statement RalphPhyllis

If you have an amount in your box 10, you will just need to enter it beneath box 5 in. Box 10 on form 1098 is used by lenders to report any other item that they wish to inform you of, such as. Learn how to report mortgage interest or mortgage insurance premiums of $600 or more received from an.

IRS Tax Forms

What is 1098 box 10? If you have an amount in your box 10, you will just need to enter it beneath box 5 in. This is a pdf document of irs form 1098, which reports mortgage interest and points paid or received by payer/borrower. Box 10 on your 1098 is real estate taxes paid. Box 10 on form 1098.

1098 Ez Form Printable Printable Forms Free Online

If you have an amount in your box 10, you will just need to enter it beneath box 5 in. This is a pdf document of irs form 1098, which reports mortgage interest and points paid or received by payer/borrower. What is 1098 box 10? Box 10 on your 1098 is real estate taxes paid. Learn how to report mortgage.

IRS Tax Forms

If you have an amount in your box 10, you will just need to enter it beneath box 5 in. What is 1098 box 10? Learn how to report mortgage interest and mortgage insurance premiums of $600 or more received from individuals in the course of your. Box 10 on your 1098 is real estate taxes paid. Learn how to.

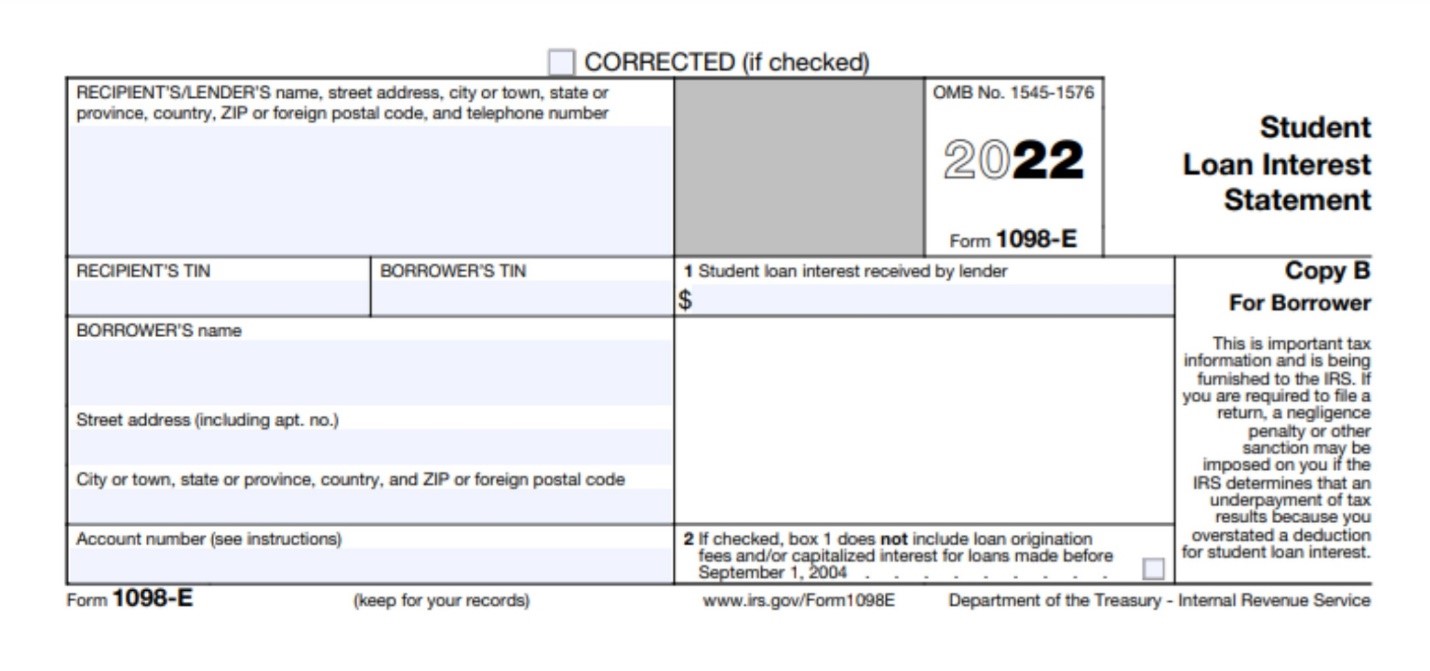

How to Get a Copy of IRS Form 1098E

This is a pdf document of irs form 1098, which reports mortgage interest and points paid or received by payer/borrower. Box 10 on form 1098 is used by lenders to report any other item that they wish to inform you of, such as. What is 1098 box 10? If you have an amount in your box 10, you will just.

Learn How To Report Mortgage Interest And Mortgage Insurance Premiums Of $600 Or More Received From Individuals In The Course Of Your.

What is 1098 box 10? Box 10 on form 1098 is used by lenders to report any other item that they wish to inform you of, such as. This is a pdf document of irs form 1098, which reports mortgage interest and points paid or received by payer/borrower. Learn how to report mortgage interest or mortgage insurance premiums of $600 or more received from an individual in the course of your trade or.

Box 10 On Your 1098 Is Real Estate Taxes Paid.

If you have an amount in your box 10, you will just need to enter it beneath box 5 in.

/prod01/cdn-pxl-elginedu-prod/media/elginedu/current-students/1098T-form-sample.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png)