Can You Purchase A Home With A Tax Lien

Can You Purchase A Home With A Tax Lien - Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). The buyer can include the lien in their offer, but the seller can use a short sale to sell. This article takes a deep dive into everything you should know about homes and. However, buying a house with a tax lien can be risky if you don’t know what you’re doing. But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. But what happens to those houses. You can buy a home with a lien against it, but the seller must clear the lien before the sale. It’s simply a matter of doing your homework on the reason for the. Read about buying tax lien properties and how to invest in them.

Read about buying tax lien properties and how to invest in them. You can buy a home with a lien against it, but the seller must clear the lien before the sale. However, buying a house with a tax lien can be risky if you don’t know what you’re doing. Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). But what happens to those houses. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. This article takes a deep dive into everything you should know about homes and. It’s simply a matter of doing your homework on the reason for the. The buyer can include the lien in their offer, but the seller can use a short sale to sell.

But what happens to those houses. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. However, buying a house with a tax lien can be risky if you don’t know what you’re doing. The buyer can include the lien in their offer, but the seller can use a short sale to sell. You can buy a home with a lien against it, but the seller must clear the lien before the sale. It’s simply a matter of doing your homework on the reason for the. Read about buying tax lien properties and how to invest in them. This article takes a deep dive into everything you should know about homes and. Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase.

Property Tax Lien Search Nationwide Title Insurance

You can buy a home with a lien against it, but the seller must clear the lien before the sale. The buyer can include the lien in their offer, but the seller can use a short sale to sell. But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect.

Tax Lien Sales Can You Buy Tax Lien Properties to Save Big?

But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. You can buy a home with a lien against it, but the seller must clear the lien before the sale. The buyer can include the lien in their offer, but the seller can use a short sale.

Why Tax Lien Investing A Good Business? Tax Lien Certificate School

But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. You can buy a home with a lien against it, but the seller must clear the lien before the sale. The buyer can include the lien in their offer, but the seller can use a short sale.

Real Property Tax Lien Hymson Goldstein Pantiliat & Lohr, PLLC

Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). Read about buying tax lien properties and how to invest in them. But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home.

How to Buy Tax Lien and Auction Properties (Live Webinar + Replay)

You can buy a home with a lien against it, but the seller must clear the lien before the sale. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. This article takes a deep dive into everything you should know about homes and. The buyer can include the lien.

How To Purchase Tax Lien Properties Part 1 With Bill Williams Tax

You can buy a home with a lien against it, but the seller must clear the lien before the sale. This article takes a deep dive into everything you should know about homes and. But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. Buying a tax.

What Causes a Tax Lien? Clean Slate Tax

It’s simply a matter of doing your homework on the reason for the. The buyer can include the lien in their offer, but the seller can use a short sale to sell. This article takes a deep dive into everything you should know about homes and. You can buy a home with a lien against it, but the seller must.

SELL MY HOUSE EVEN WITH A TAX LIEN WE BUY FAST AND CASH

However, buying a house with a tax lien can be risky if you don’t know what you’re doing. But what happens to those houses. This article takes a deep dive into everything you should know about homes and. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. Normally when.

Tax Lien Investing For Beginners FortuneBuilders

This article takes a deep dive into everything you should know about homes and. Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). But what happens to those houses. You can buy a home with a lien against it, but the seller must.

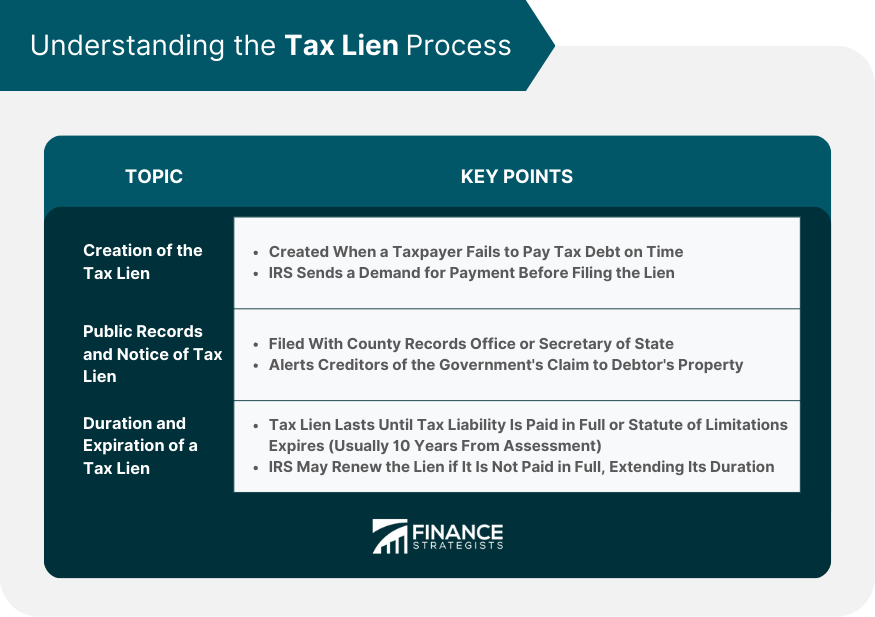

Tax Lien Definition, Process, Consequences, How to Handle

However, buying a house with a tax lien can be risky if you don’t know what you’re doing. You can buy a home with a lien against it, but the seller must clear the lien before the sale. Buying a tax lien gives you a legal claim on a home if the owner fails to repay their taxes. Read about.

The Buyer Can Include The Lien In Their Offer, But The Seller Can Use A Short Sale To Sell.

This article takes a deep dive into everything you should know about homes and. But what happens to those houses. It’s simply a matter of doing your homework on the reason for the. Read about buying tax lien properties and how to invest in them.

Buying A Tax Lien Gives You A Legal Claim On A Home If The Owner Fails To Repay Their Taxes.

However, buying a house with a tax lien can be risky if you don’t know what you’re doing. Normally when you buy a house, you don’t want a home with any outstanding liens against it (that’s also why you pay for a title company). But more often than not, a tax lien on a property doesn’t need to get in the way of your perfect home purchase. You can buy a home with a lien against it, but the seller must clear the lien before the sale.