Colorado Sales Tax Form

Colorado Sales Tax Form - Any retailer that is required to collect colorado sales tax must obtain and maintain a colorado sales tax license. Enter total receipts from all sales and services both. They must also file returns. If you are looking for a colorado sales or use tax form that is not listed on this page, please email dor_taxpayerservice@state.co.us. Did you know 82% of colorado sales tax returns are filed electronically? Sales tax returns and payment are due on the 20th of the month following the taxable period. Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due. Please note the colorado department of revenue will eventually.

Did you know 82% of colorado sales tax returns are filed electronically? Please note the colorado department of revenue will eventually. They must also file returns. Enter total receipts from all sales and services both. Sales tax returns and payment are due on the 20th of the month following the taxable period. If you are looking for a colorado sales or use tax form that is not listed on this page, please email dor_taxpayerservice@state.co.us. Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due. Any retailer that is required to collect colorado sales tax must obtain and maintain a colorado sales tax license.

Please note the colorado department of revenue will eventually. Enter total receipts from all sales and services both. They must also file returns. Did you know 82% of colorado sales tax returns are filed electronically? Sales tax returns and payment are due on the 20th of the month following the taxable period. If you are looking for a colorado sales or use tax form that is not listed on this page, please email dor_taxpayerservice@state.co.us. Any retailer that is required to collect colorado sales tax must obtain and maintain a colorado sales tax license. Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due.

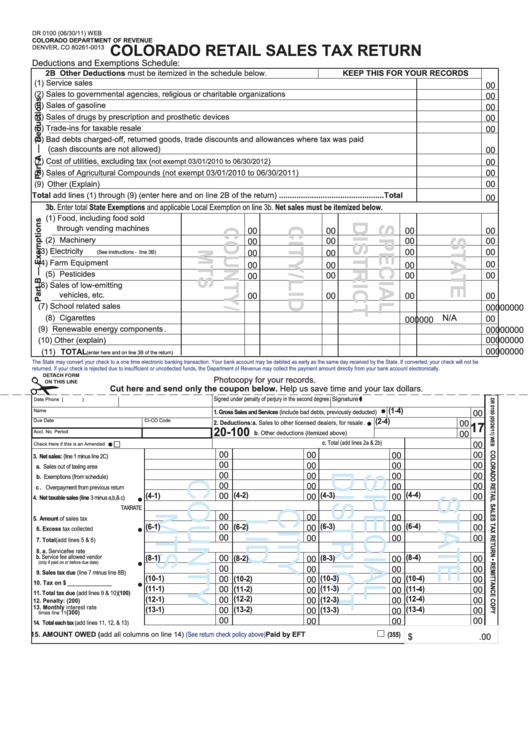

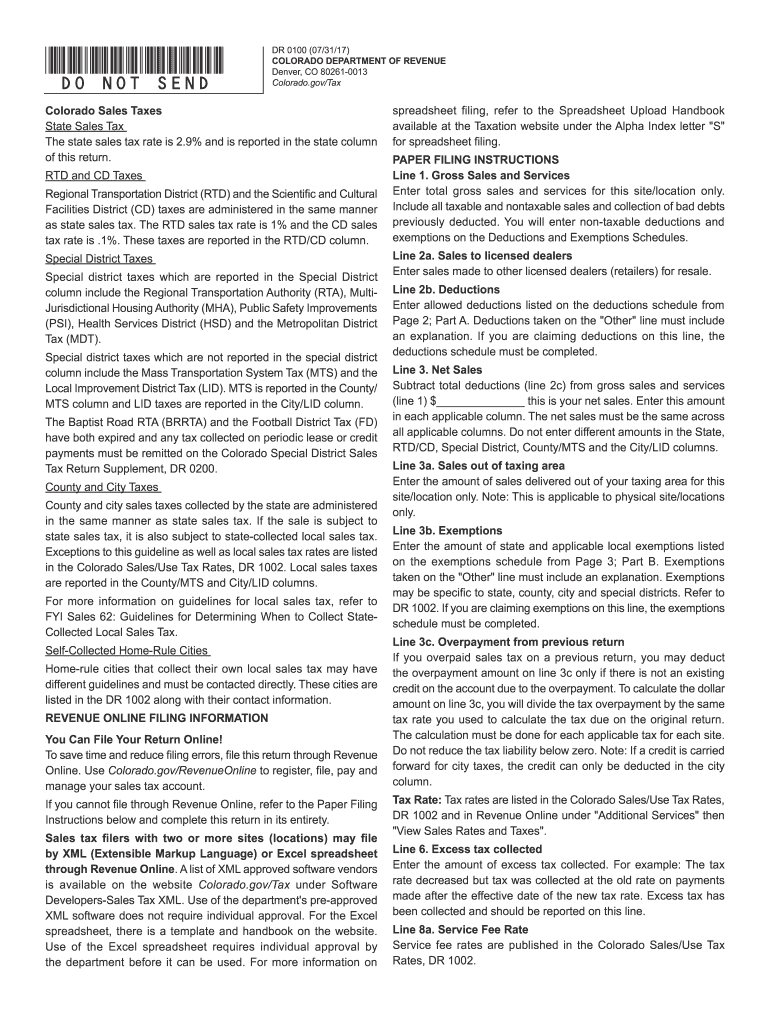

Dr 0100 Fillable Form Printable Forms Free Online

Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due. Please note the colorado department of revenue will eventually. They must also file returns. Any retailer that is required to collect colorado sales tax must obtain and maintain a colorado sales tax license. If.

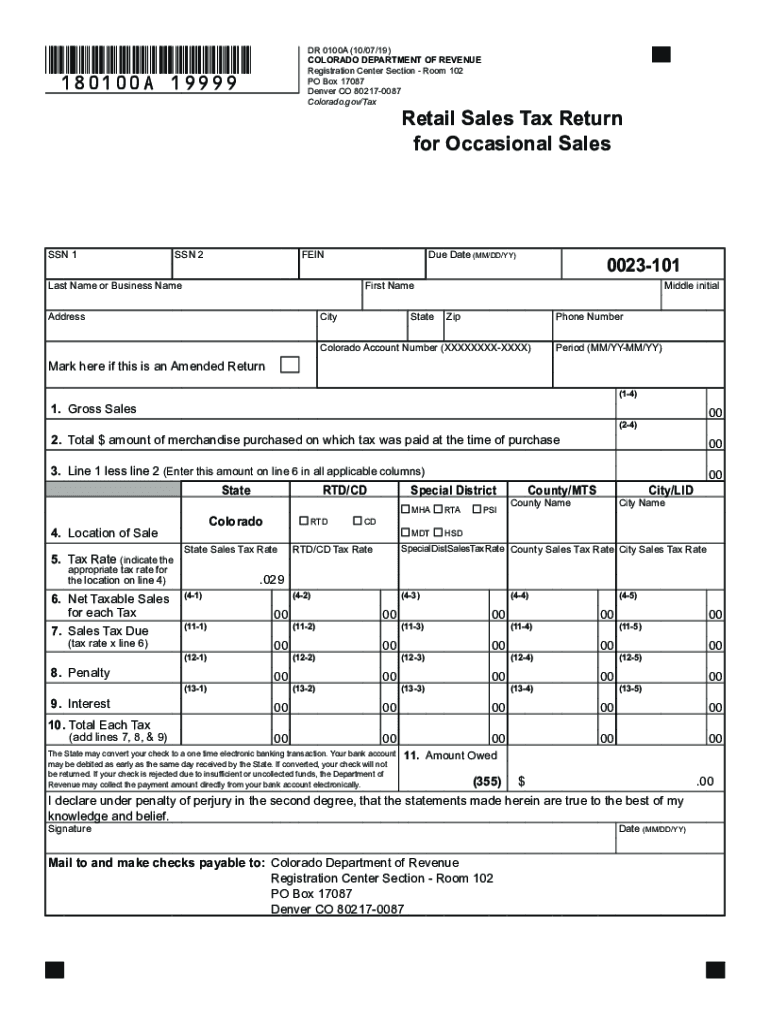

Tax Colorado 20192024 Form Fill Out and Sign Printable PDF

If you are looking for a colorado sales or use tax form that is not listed on this page, please email dor_taxpayerservice@state.co.us. Any retailer that is required to collect colorado sales tax must obtain and maintain a colorado sales tax license. Did you know 82% of colorado sales tax returns are filed electronically? Sales tax returns and payment are due.

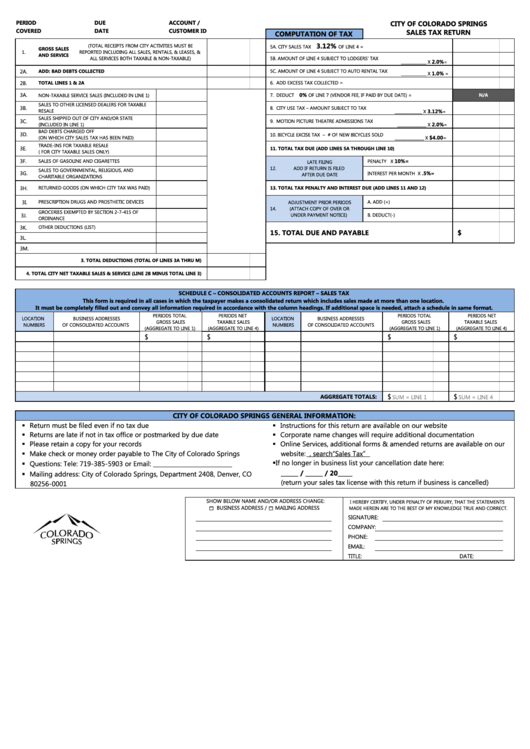

Sales Tax Return City Of Colorado Springs printable pdf download

If you are looking for a colorado sales or use tax form that is not listed on this page, please email dor_taxpayerservice@state.co.us. Enter total receipts from all sales and services both. Sales tax returns and payment are due on the 20th of the month following the taxable period. Any retailer that is required to collect colorado sales tax must obtain.

Colorado Dealer Reassignment Form

Enter total receipts from all sales and services both. Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due. Any retailer that is required to collect colorado sales tax must obtain and maintain a colorado sales tax license. Please note the colorado department of.

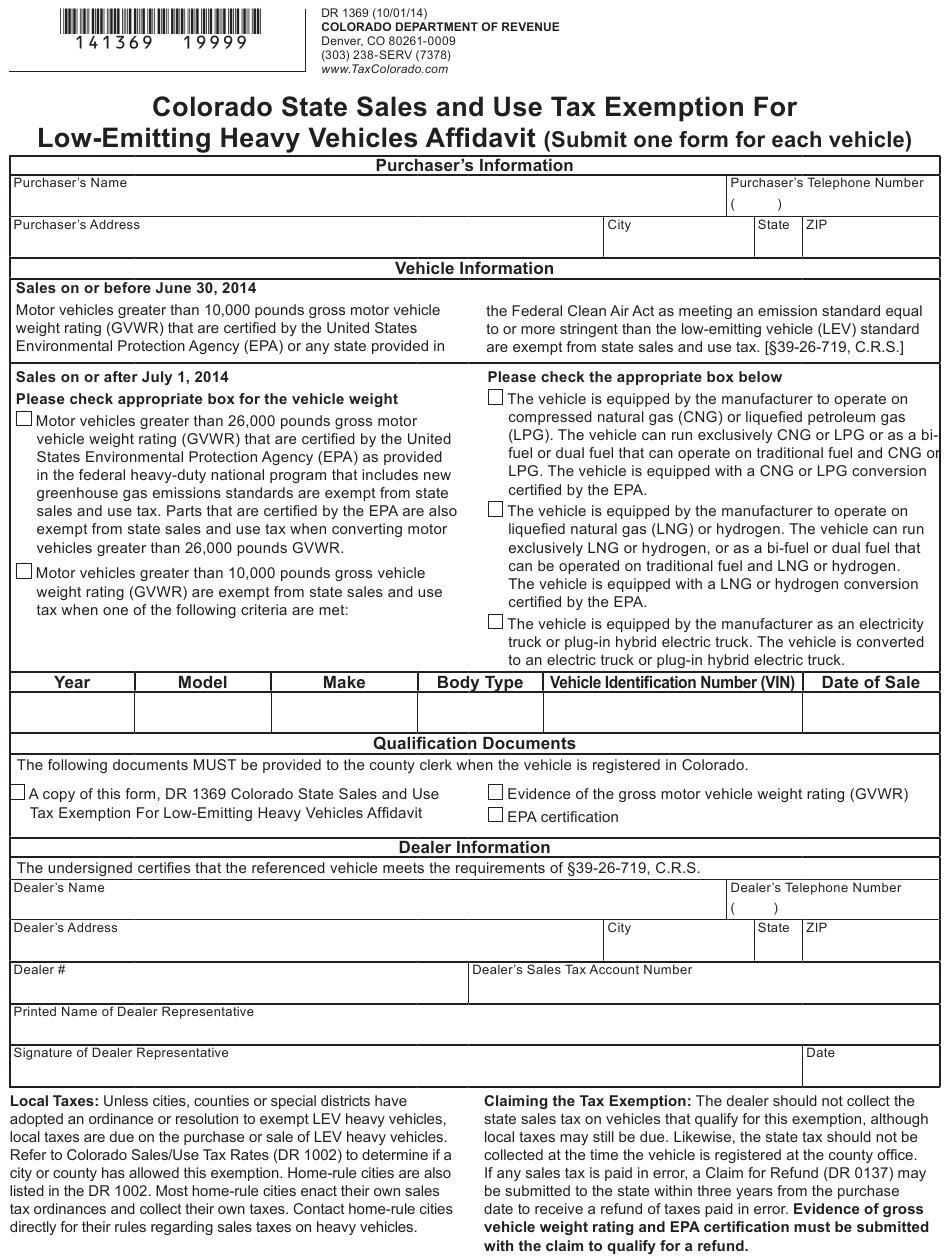

Colorado Sales And Use Tax Exemption Form

Please note the colorado department of revenue will eventually. Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due. Sales tax returns and payment are due on the 20th of the month following the taxable period. Did you know 82% of colorado sales tax.

Colorado Retail Sales Tax Form Fill Out and Sign Printable PDF

Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due. Did you know 82% of colorado sales tax returns are filed electronically? Please note the colorado department of revenue will eventually. If you are looking for a colorado sales or use tax form that.

Blank Colorado Exemption Form Fill Out and Print PDFs

Sales tax returns and payment are due on the 20th of the month following the taxable period. Enter total receipts from all sales and services both. If you are looking for a colorado sales or use tax form that is not listed on this page, please email dor_taxpayerservice@state.co.us. Any retailer that is required to collect colorado sales tax must obtain.

Colorado Form DR 0024 Standard Sales Tax Receipt For Vehicle Sales

They must also file returns. Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due. Please note the colorado department of revenue will eventually. Enter total receipts from all sales and services both. If you are looking for a colorado sales or use tax.

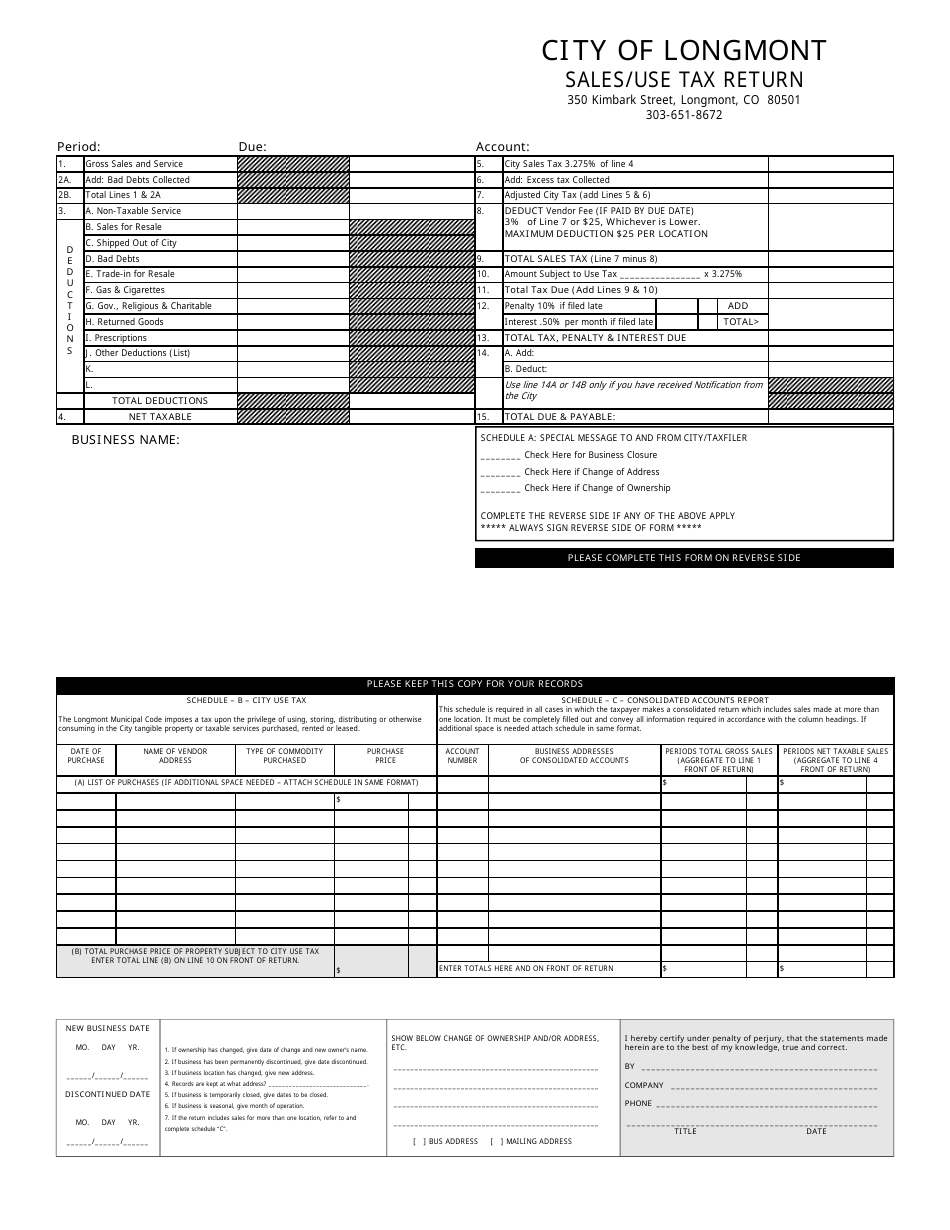

LONGMONT, Colorado Sales/Use Tax Return Form Fill Out, Sign Online

Any retailer that is required to collect colorado sales tax must obtain and maintain a colorado sales tax license. Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due. If you are looking for a colorado sales or use tax form that is not.

Colorado Resale Certificate Dresses Images 2022

Enter total receipts from all sales and services both. Any retailer that is required to collect colorado sales tax must obtain and maintain a colorado sales tax license. They must also file returns. Did you know 82% of colorado sales tax returns are filed electronically? Please note the colorado department of revenue will eventually.

Any Retailer That Is Required To Collect Colorado Sales Tax Must Obtain And Maintain A Colorado Sales Tax License.

If you are looking for a colorado sales or use tax form that is not listed on this page, please email dor_taxpayerservice@state.co.us. Retailers must file a sales tax return for every filing period, even if the retailer made no sales during the period and no tax is due. Enter total receipts from all sales and services both. They must also file returns.

Please Note The Colorado Department Of Revenue Will Eventually.

Sales tax returns and payment are due on the 20th of the month following the taxable period. Did you know 82% of colorado sales tax returns are filed electronically?