Corporation Name Change Irs

Corporation Name Change Irs - Business owners and other authorized individuals can submit a name change for their business. Corporations and llcs can check the name change box while. The specific action required may vary depending on. Include the information when you file your annual taxes. You have two primary options for reporting your business name change to the irs: Changing a business name with the irs can be done in one of two ways.

Corporations and llcs can check the name change box while. You have two primary options for reporting your business name change to the irs: Include the information when you file your annual taxes. The specific action required may vary depending on. Business owners and other authorized individuals can submit a name change for their business. Changing a business name with the irs can be done in one of two ways.

Corporations and llcs can check the name change box while. Include the information when you file your annual taxes. The specific action required may vary depending on. Changing a business name with the irs can be done in one of two ways. Business owners and other authorized individuals can submit a name change for their business. You have two primary options for reporting your business name change to the irs:

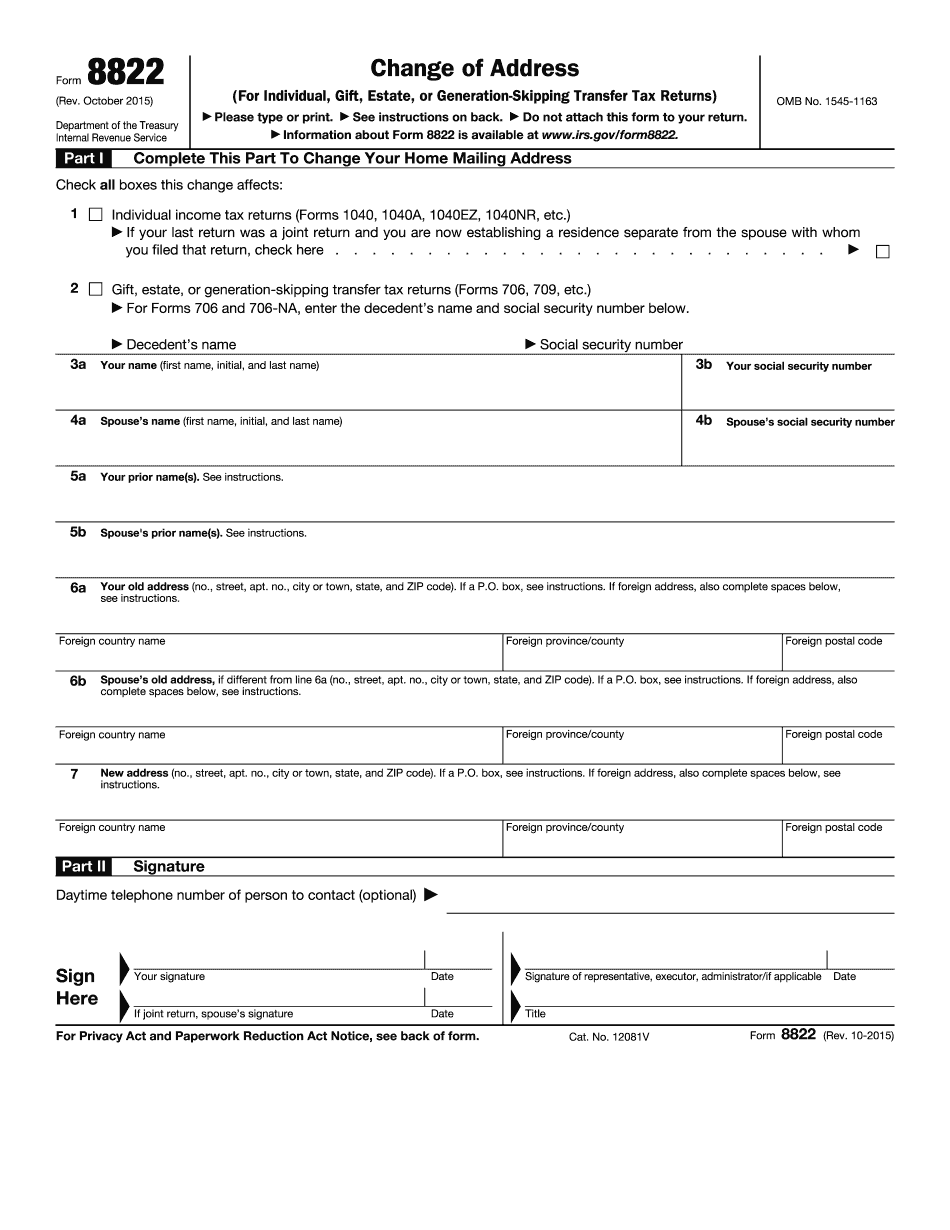

irs name change form Fill Online, Printable, Fillable Blank form

Changing a business name with the irs can be done in one of two ways. Business owners and other authorized individuals can submit a name change for their business. Include the information when you file your annual taxes. Corporations and llcs can check the name change box while. You have two primary options for reporting your business name change to.

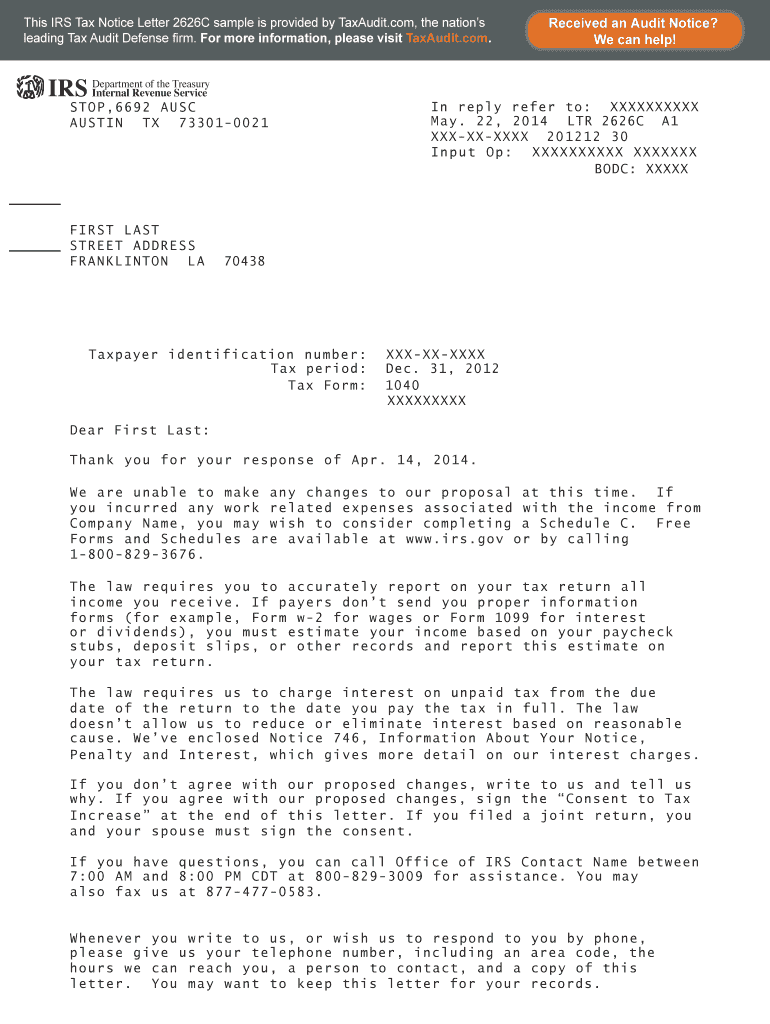

Business Name Change Letter Template To Irs

Business owners and other authorized individuals can submit a name change for their business. Changing a business name with the irs can be done in one of two ways. You have two primary options for reporting your business name change to the irs: Include the information when you file your annual taxes. The specific action required may vary depending on.

IRS Name Change How to file the IRS 8822 MissNowMrs

Include the information when you file your annual taxes. Business owners and other authorized individuals can submit a name change for their business. Corporations and llcs can check the name change box while. You have two primary options for reporting your business name change to the irs: The specific action required may vary depending on.

Irs Business Name Change Letter Template

Include the information when you file your annual taxes. The specific action required may vary depending on. Business owners and other authorized individuals can submit a name change for their business. You have two primary options for reporting your business name change to the irs: Changing a business name with the irs can be done in one of two ways.

Irs Business Name Change Letter Template

You have two primary options for reporting your business name change to the irs: Include the information when you file your annual taxes. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on. Changing a business name with the irs can be done in one of two ways.

Irs Business Name Change Form 8822b Armando Friend's Template

The specific action required may vary depending on. Changing a business name with the irs can be done in one of two ways. Include the information when you file your annual taxes. Corporations and llcs can check the name change box while. You have two primary options for reporting your business name change to the irs:

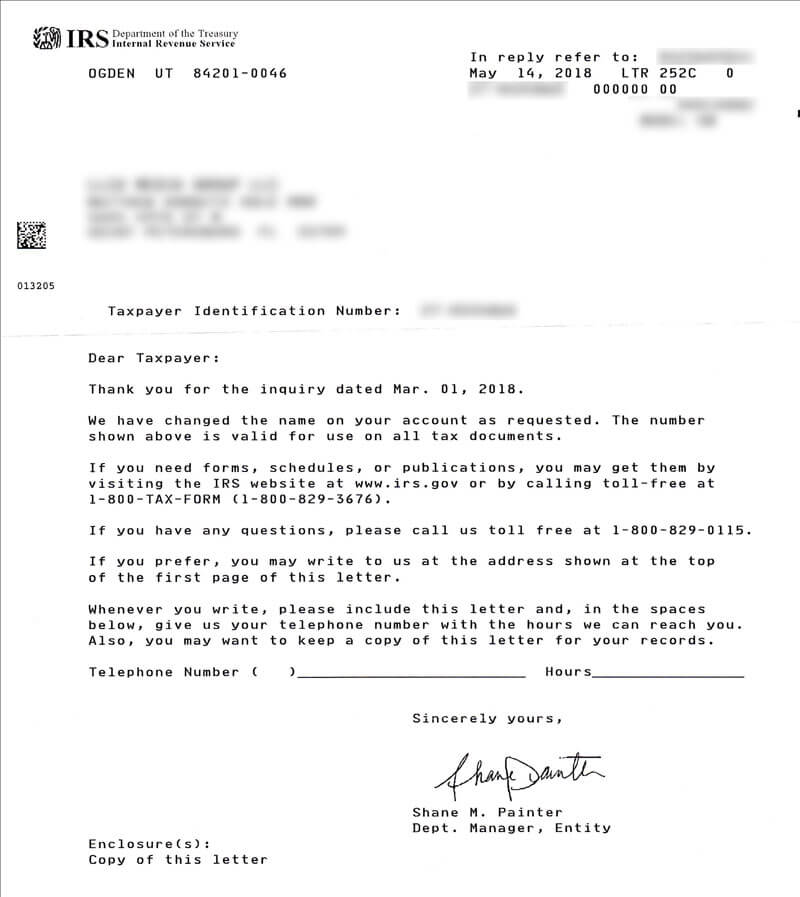

Irs Name Change Letter Sample An irs corporate name change form 8822

You have two primary options for reporting your business name change to the irs: Include the information when you file your annual taxes. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on. Changing a business name with the irs can be done in one of two ways.

Change address with irs

Corporations and llcs can check the name change box while. Business owners and other authorized individuals can submit a name change for their business. Changing a business name with the irs can be done in one of two ways. The specific action required may vary depending on. Include the information when you file your annual taxes.

IRS Business Name Change

You have two primary options for reporting your business name change to the irs: Corporations and llcs can check the name change box while. Changing a business name with the irs can be done in one of two ways. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending.

Irs Name Change Letter Sample 28 Irs form 9465 Fillable in 2020 (With

Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on. Include the information when you file your annual taxes. Changing a business name with the irs can be done in one of two ways. You have two primary options for reporting your business name change to the irs:

Include The Information When You File Your Annual Taxes.

Changing a business name with the irs can be done in one of two ways. Corporations and llcs can check the name change box while. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on.