Denver Local Tax

Denver Local Tax - The most convenient option to register for your tax license is online at denver's ebiz tax center. See below for information about specific taxes, to download forms, or obtain payment information. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Introduction to local payroll taxes different types of local. View sales tax rates applicable to your specific business location(s). View the amount of tax. General tax information for anyone conducting business in the city and county of denver such as collecting and filing sales, use, lodger’s,. 2024 guide to local payroll taxes table of contents section 1: Combined state, local, and special district sales tax rates in metro denver and northern colorado range from 2.9% to 9.25%.

Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. Get ebiz access to your accounts, register as a. Visit the business tax faq page for more. See below for information about specific taxes, to download forms, or obtain payment information. View the amount of tax. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. View sales tax rates applicable to your specific business location(s). General tax information for anyone conducting business in the city and county of denver such as collecting and filing sales, use, lodger’s,. Combined state, local, and special district sales tax rates in metro denver and northern colorado range from 2.9% to 9.25%. 2024 guide to local payroll taxes table of contents section 1:

See below for information about specific taxes, to download forms, or obtain payment information. View the amount of tax. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. The most convenient option to register for your tax license is online at denver's ebiz tax center. Combined state, local, and special district sales tax rates in metro denver and northern colorado range from 2.9% to 9.25%. View sales tax rates by specific city or county. Visit the business tax faq page for more. General tax information for anyone conducting business in the city and county of denver such as collecting and filing sales, use, lodger’s,. View sales tax rates applicable to your specific business location(s).

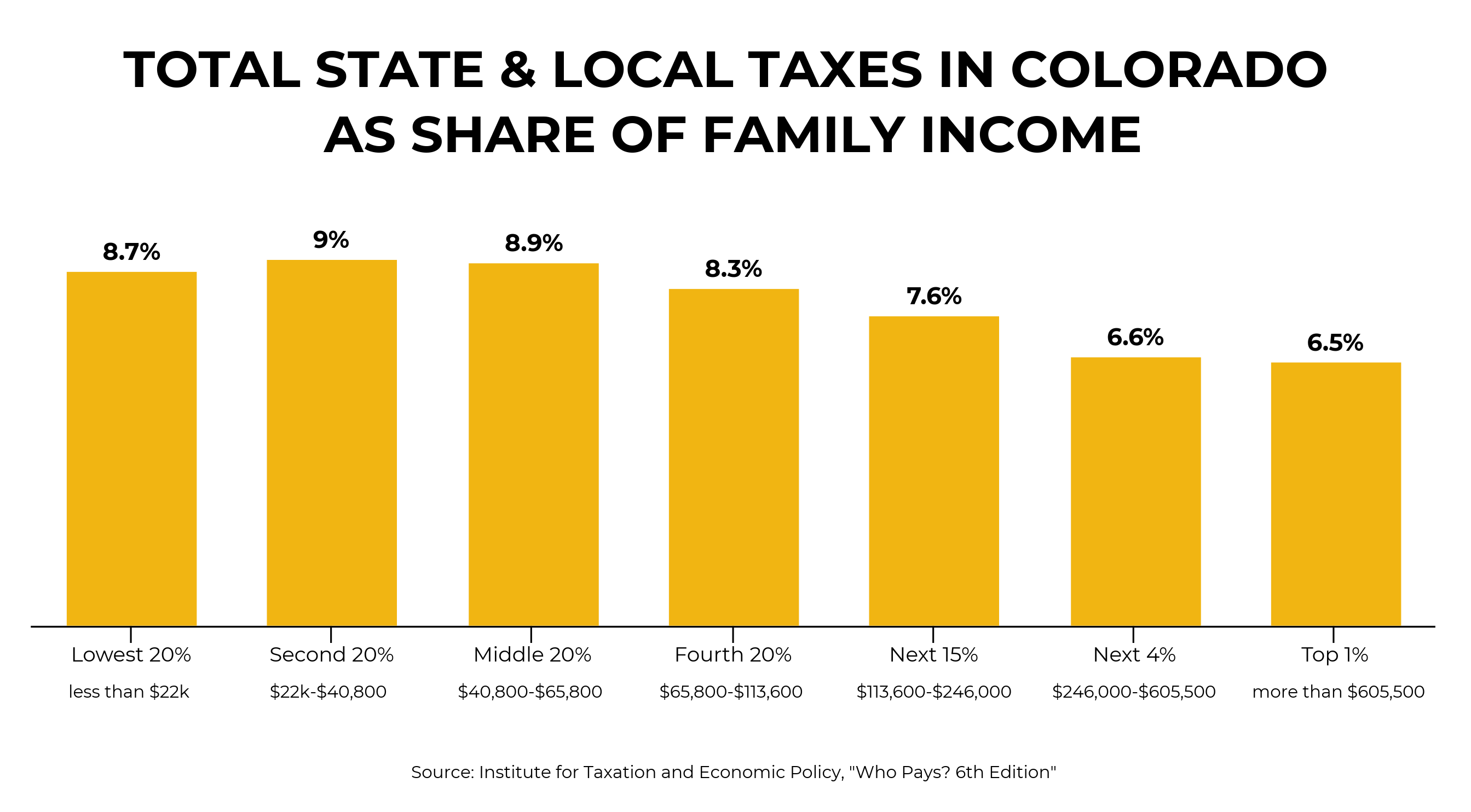

State & Local Taxes Denver South

General tax information for anyone conducting business in the city and county of denver such as collecting and filing sales, use, lodger’s,. View sales tax rates applicable to your specific business location(s). Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. 2024 guide to local payroll taxes table of.

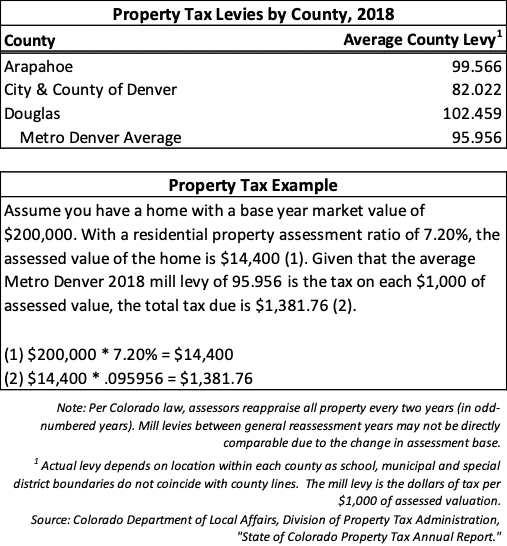

These Denver neighborhoods are getting the biggest property tax hikes

The most convenient option to register for your tax license is online at denver's ebiz tax center. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most.

Metro Denver property taxes are going to go up, and for many, they’re

Introduction to local payroll taxes different types of local. See below for information about specific taxes, to download forms, or obtain payment information. Combined state, local, and special district sales tax rates in metro denver and northern colorado range from 2.9% to 9.25%. View sales tax rates by specific city or county. Visit the business tax faq page for more.

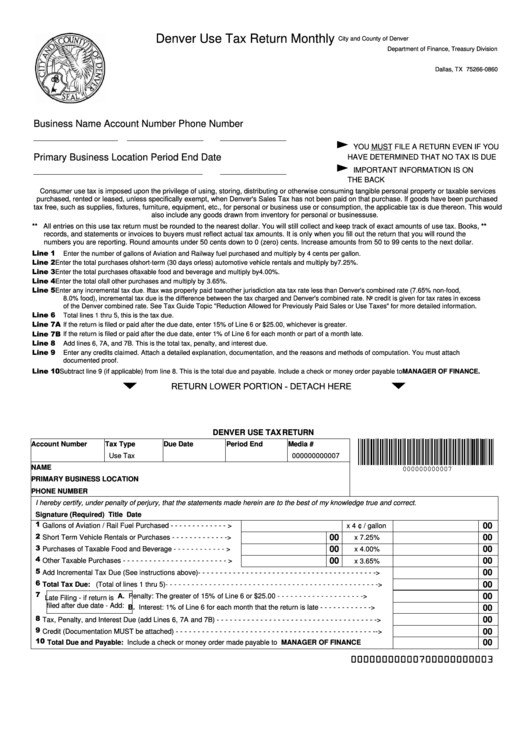

Fillable Denver Use Tax Return Monthly City And County Of Denver

Combined state, local, and special district sales tax rates in metro denver and northern colorado range from 2.9% to 9.25%. See below for information about specific taxes, to download forms, or obtain payment information. View sales tax rates by specific city or county. Introduction to local payroll taxes different types of local. View sales tax rates applicable to your specific.

Denver Property Tax Guide 💰 Assessor, Rate, Payments, Search & More!

View sales tax rates applicable to your specific business location(s). Get ebiz access to your accounts, register as a. General tax information for anyone conducting business in the city and county of denver such as collecting and filing sales, use, lodger’s,. Combined state, local, and special district sales tax rates in metro denver and northern colorado range from 2.9% to.

Denver Property Tax Rates Momentum 360 Tax Rates 2023

2024 guide to local payroll taxes table of contents section 1: Introduction to local payroll taxes different types of local. See below for information about specific taxes, to download forms, or obtain payment information. The most convenient option to register for your tax license is online at denver's ebiz tax center. General tax information for anyone conducting business in the.

Receive FREE Tax Services in Denver with Tax Help Colorado & Mile High

View sales tax rates applicable to your specific business location(s). Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Combined state, local, and special.

When Can You File Taxes 2024 Colorado State Casi Martie

See below for information about specific taxes, to download forms, or obtain payment information. General tax information for anyone conducting business in the city and county of denver such as collecting and filing sales, use, lodger’s,. The most convenient option to register for your tax license is online at denver's ebiz tax center. Visit the business tax faq page for.

State to start processing tax returns this week FOX31 Denver

2024 guide to local payroll taxes table of contents section 1: Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Visit the business tax faq page for more. Visit our information for local government or entities implementing a new tax or changed tax rate.

Learn More Quick Facts on a Fair Tax for Colorado

The most convenient option to register for your tax license is online at denver's ebiz tax center. Get ebiz access to your accounts, register as a. View sales tax rates by specific city or county. View sales tax rates applicable to your specific business location(s). View the amount of tax.

View The Amount Of Tax.

Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Introduction to local payroll taxes different types of local. View sales tax rates by specific city or county. General tax information for anyone conducting business in the city and county of denver such as collecting and filing sales, use, lodger’s,.

See Below For Information About Specific Taxes, To Download Forms, Or Obtain Payment Information.

2024 guide to local payroll taxes table of contents section 1: Combined state, local, and special district sales tax rates in metro denver and northern colorado range from 2.9% to 9.25%. View sales tax rates applicable to your specific business location(s). Visit the business tax faq page for more.

Visit Our Information For Local Government Or Entities Implementing A New Tax Or Changed Tax Rate Page For More Information.

The most convenient option to register for your tax license is online at denver's ebiz tax center. Get ebiz access to your accounts, register as a.