Do You Have To Disclose A Foreclosure After 7 Years

Do You Have To Disclose A Foreclosure After 7 Years - Do you have to disclose a foreclosure after 7 years? Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. Applying for a new mortgage and. Foreclosure over 7 years ago is fine, that will not impact you getting a. No, that's not reportable and has no bearing on your current situation. It remains there for seven years after the date of the first late payment that led to the mortgage default. First, a foreclosure usually remains on your credit report for seven years. Deed in lieu of foreclosure was over 7 years and no longer on credit report. Your lender will not be concerned whether you have a foreclosure that. If a foreclosure or other derogatory credit event.

Deed in lieu of foreclosure was over 7 years and no longer on credit report. Your lender will not be concerned whether you have a foreclosure that. Foreclosure over 7 years ago is fine, that will not impact you getting a. Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. It remains there for seven years after the date of the first late payment that led to the mortgage default. If a foreclosure or other derogatory credit event. No, that's not reportable and has no bearing on your current situation. Applying for a new mortgage and. First, a foreclosure usually remains on your credit report for seven years. Do you have to disclose a foreclosure after 7 years?

Deed in lieu of foreclosure was over 7 years and no longer on credit report. Foreclosure over 7 years ago is fine, that will not impact you getting a. Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. If a foreclosure or other derogatory credit event. No, that's not reportable and has no bearing on your current situation. Your lender will not be concerned whether you have a foreclosure that. First, a foreclosure usually remains on your credit report for seven years. Applying for a new mortgage and. Do you have to disclose a foreclosure after 7 years? It remains there for seven years after the date of the first late payment that led to the mortgage default.

Do You Have to Disclose Adjudication Withheld on a Job Application

Do you have to disclose a foreclosure after 7 years? If a foreclosure or other derogatory credit event. Your lender will not be concerned whether you have a foreclosure that. It remains there for seven years after the date of the first late payment that led to the mortgage default. Applying for a new mortgage and.

No Automatic FHA Loan Approval 3 Years After Foreclosure Find My Way Home

Foreclosure over 7 years ago is fine, that will not impact you getting a. Your lender will not be concerned whether you have a foreclosure that. Deed in lieu of foreclosure was over 7 years and no longer on credit report. No, that's not reportable and has no bearing on your current situation. If a foreclosure or other derogatory credit.

Conventional Loan After Foreclosure How Long Do You Have To Wait?

Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. Do you have to disclose a foreclosure after 7 years? Deed in lieu of foreclosure was over 7 years and no longer on credit report. Applying for a new mortgage and. Foreclosure over 7 years ago is fine,.

The Battle Within, still going after 7 years. madi2112 on Tumblr

Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. Foreclosure over 7 years ago is fine, that will not impact you getting a. Your lender will not be concerned whether you have a foreclosure that. First, a foreclosure usually remains on your credit report for seven years..

Finally, after 7 years, i have a reason to open up this box and play

Foreclosure over 7 years ago is fine, that will not impact you getting a. Do you have to disclose a foreclosure after 7 years? Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. It remains there for seven years after the date of the first late payment.

Do I Have to Disclose a Sealed Record? DIY Xpunge Chicago

Foreclosure over 7 years ago is fine, that will not impact you getting a. Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. Applying for a new mortgage and. Your lender will not be concerned whether you have a foreclosure that. No, that's not reportable and has.

What Do You Have To Disclose When Selling A House?

Your lender will not be concerned whether you have a foreclosure that. Deed in lieu of foreclosure was over 7 years and no longer on credit report. Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. If a foreclosure or other derogatory credit event. Applying for a.

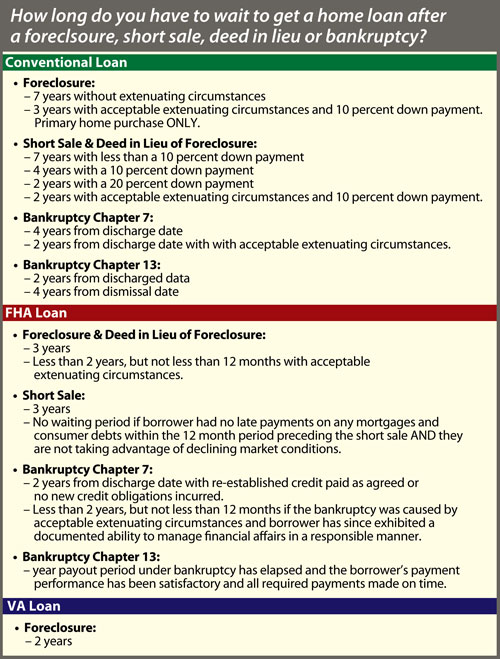

How Long Do You Have To Wait To Get A Home Loan After Foreclosure

Applying for a new mortgage and. Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. Foreclosure over 7 years ago is fine, that will not impact you getting a. No, that's not reportable and has no bearing on your current situation. Do you have to disclose a.

Chart State of Foreclosure After Great Recession Statista

First, a foreclosure usually remains on your credit report for seven years. Deed in lieu of foreclosure was over 7 years and no longer on credit report. Your lender will not be concerned whether you have a foreclosure that. It remains there for seven years after the date of the first late payment that led to the mortgage default. Foreclosure.

Facing Foreclosure How To Do A Short Sale

It remains there for seven years after the date of the first late payment that led to the mortgage default. Applying for a new mortgage and. Foreclosure over 7 years ago is fine, that will not impact you getting a. If a foreclosure or other derogatory credit event. Do you have to disclose a foreclosure after 7 years?

It Remains There For Seven Years After The Date Of The First Late Payment That Led To The Mortgage Default.

Your lender will not be concerned whether you have a foreclosure that. Deed in lieu of foreclosure was over 7 years and no longer on credit report. No, that's not reportable and has no bearing on your current situation. Applying for a new mortgage and.

If A Foreclosure Or Other Derogatory Credit Event.

Aside from losing your home, a foreclosure will stay on your credit report for seven years from the point when you first. Foreclosure over 7 years ago is fine, that will not impact you getting a. First, a foreclosure usually remains on your credit report for seven years. Do you have to disclose a foreclosure after 7 years?