Does Chapter 7 Discharge Irs Debt

Does Chapter 7 Discharge Irs Debt - At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. A discharge releases you (the debtor) from. Will eliminate (discharge) personal liability for tax debts older than three years unless returns filed late. Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the debt—the lien will not go away. Income tax debts are treated differently depending on whether you file a chapter 7 bankruptcy or a chapter 13 case.

Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the debt—the lien will not go away. Income tax debts are treated differently depending on whether you file a chapter 7 bankruptcy or a chapter 13 case. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. A discharge releases you (the debtor) from. Will eliminate (discharge) personal liability for tax debts older than three years unless returns filed late.

At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the debt—the lien will not go away. Will eliminate (discharge) personal liability for tax debts older than three years unless returns filed late. A discharge releases you (the debtor) from. Income tax debts are treated differently depending on whether you file a chapter 7 bankruptcy or a chapter 13 case.

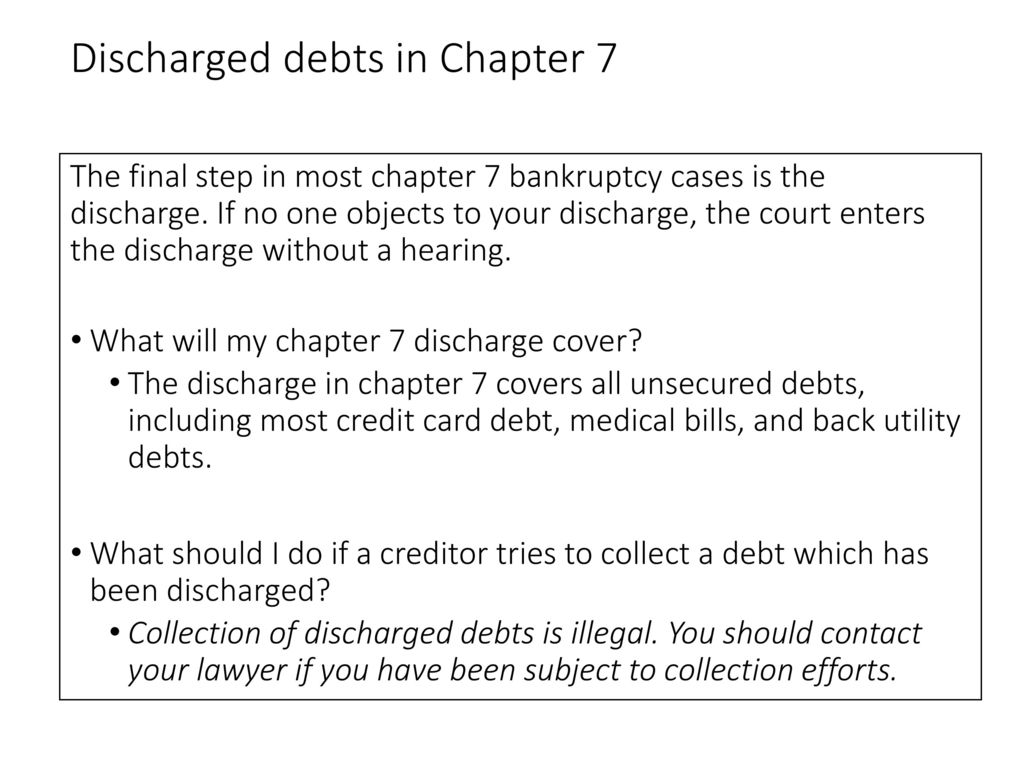

The Chapter 7 Discharge Chapter 7 Bankruptcy Attorneys ARM Lawyers

Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the debt—the lien will not go away. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. A discharge releases you (the debtor) from. Will eliminate (discharge) personal liability for tax debts older than three years unless returns.

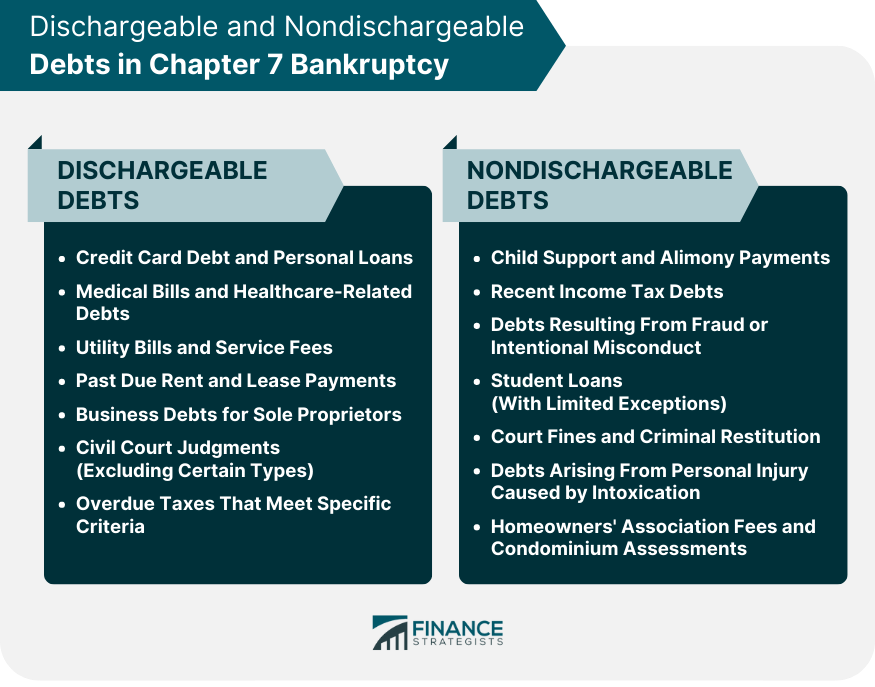

What Debts Are Discharged in Chapter 7 Bankruptcy?

Income tax debts are treated differently depending on whether you file a chapter 7 bankruptcy or a chapter 13 case. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. A discharge releases you (the debtor) from. Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the.

Chapter 20 Bankruptcy. ppt download

Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the debt—the lien will not go away. A discharge releases you (the debtor) from. Will eliminate (discharge) personal liability for tax debts older than three years unless returns filed late. At the conclusion of your chapter 7 bankruptcy you will receive a discharge.

What is a Chapter 7 Discharge and How to Get a Copy Law & Crime News

At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the debt—the lien will not go away. Income tax debts are treated differently depending on whether you file a chapter 7 bankruptcy or a chapter 13 case. Will.

Does Chapter 7 wipe out all debt? Leia aqui What debts are not

Income tax debts are treated differently depending on whether you file a chapter 7 bankruptcy or a chapter 13 case. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Will eliminate (discharge) personal liability for tax debts older than three years unless returns filed late. A discharge releases you (the debtor) from. Even if.

discharge of debtor chapter 7 YouTube

At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Will eliminate (discharge) personal liability for tax debts older than three years unless returns filed late. Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the debt—the lien will not go away. Income tax debts are treated.

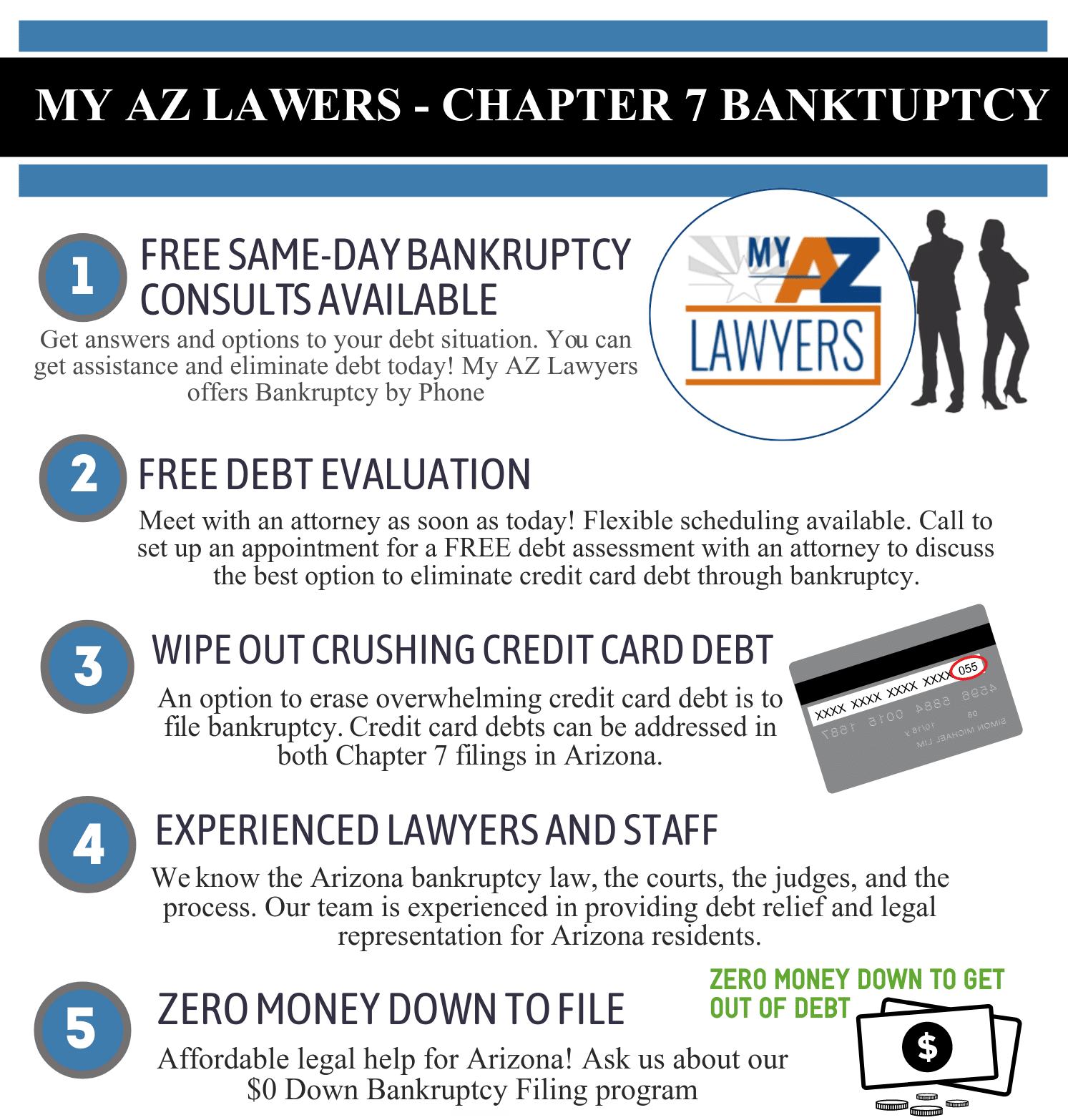

Chapter 7 Bankruptcy 24 Hour Legal Advice Ask A Lawyer Live Chat

Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the debt—the lien will not go away. A discharge releases you (the debtor) from. Will eliminate (discharge) personal liability for tax debts older than three years unless returns filed late. At the conclusion of your chapter 7 bankruptcy you will receive a discharge.

What Debts Are Discharged in Chapter 7 Bankruptcy?

Income tax debts are treated differently depending on whether you file a chapter 7 bankruptcy or a chapter 13 case. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. A discharge releases you (the debtor) from. Will eliminate (discharge) personal liability for tax debts older than three years unless returns filed late. Even if.

The Chapter 7 Discharge Chapter 7 Bankruptcy Attorneys ARM Lawyers

A discharge releases you (the debtor) from. Will eliminate (discharge) personal liability for tax debts older than three years unless returns filed late. Income tax debts are treated differently depending on whether you file a chapter 7 bankruptcy or a chapter 13 case. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Even if.

Understanding Chapter 7 Bankruptcy Discharge and its Exceptions by

A discharge releases you (the debtor) from. Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the debt—the lien will not go away. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Will eliminate (discharge) personal liability for tax debts older than three years unless returns.

At The Conclusion Of Your Chapter 7 Bankruptcy You Will Receive A Discharge Of Debt.

A discharge releases you (the debtor) from. Income tax debts are treated differently depending on whether you file a chapter 7 bankruptcy or a chapter 13 case. Even if you can discharge an income tax obligation, the discharge only wipes out your liability for the debt—the lien will not go away. Will eliminate (discharge) personal liability for tax debts older than three years unless returns filed late.