Federal Government Tax Exempt Form

Federal Government Tax Exempt Form - This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living. Download sf1094 form for federal contractors claiming tax exemption on travel expenses. The form is updated to 04/2015 and. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes.

Download sf1094 form for federal contractors claiming tax exemption on travel expenses. The form is updated to 04/2015 and. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes. This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living.

The form is updated to 04/2015 and. This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes. Download sf1094 form for federal contractors claiming tax exemption on travel expenses.

Tax Exempt Form 20202021 Fill and Sign Printable Template Online

This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living. Download sf1094 form for federal contractors claiming tax exemption on travel expenses. The form is updated to 04/2015 and. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes.

2023 Federal Tax Exemption Form

The form is updated to 04/2015 and. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes. This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living. Download sf1094 form for federal contractors claiming tax exemption on travel expenses.

IRS 3500a Form for California TaxExemption 501(C) Organization

Download sf1094 form for federal contractors claiming tax exemption on travel expenses. This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living. The form is updated to 04/2015 and. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes.

FREE 10 Sample Tax Exemption Forms In PDF

The form is updated to 04/2015 and. This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living. Download sf1094 form for federal contractors claiming tax exemption on travel expenses. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes.

Tax Exempt Form For Ellis County

Download sf1094 form for federal contractors claiming tax exemption on travel expenses. The form is updated to 04/2015 and. This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes.

Governmental Employees Hotel Lodging Sales Use Tax Exemption

Download sf1094 form for federal contractors claiming tax exemption on travel expenses. The form is updated to 04/2015 and. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes. This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living.

California Taxexempt Form 2023

This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes. Download sf1094 form for federal contractors claiming tax exemption on travel expenses. The form is updated to 04/2015 and.

United States Federal Agencies Tax Exempt Form

This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living. The form is updated to 04/2015 and. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes. Download sf1094 form for federal contractors claiming tax exemption on travel expenses.

State Of Utah Tax Exempt Form Form example download

Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes. This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living. The form is updated to 04/2015 and. Download sf1094 form for federal contractors claiming tax exemption on travel expenses.

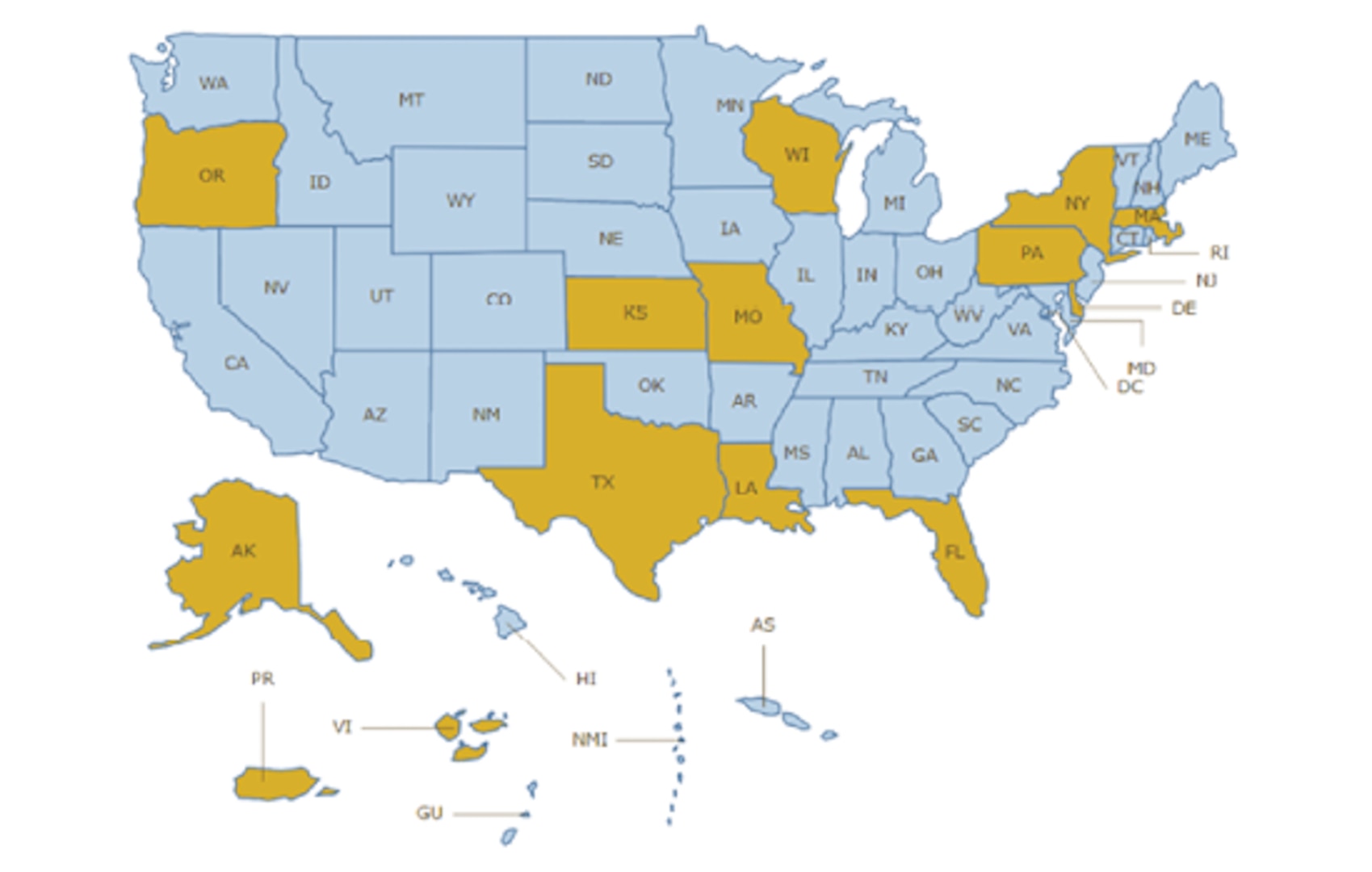

Save on Lodging Taxes in Exempt Locations > Defense Travel Management

The form is updated to 04/2015 and. Download sf1094 form for federal contractors claiming tax exemption on travel expenses. Gsa smartpay gpc accounts are centrally billed accounts (cbas) and, as such, should be exempt from state taxes. This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living.

Gsa Smartpay Gpc Accounts Are Centrally Billed Accounts (Cbas) And, As Such, Should Be Exempt From State Taxes.

Download sf1094 form for federal contractors claiming tax exemption on travel expenses. This certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living. The form is updated to 04/2015 and.