Form 2441 Provider Ssn

Form 2441 Provider Ssn - If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. You must complete and attach form 2441, child and dependent care expenses to your tax return. In this situation, all the lines on line 1 of form 2441 must be. If they still refuse to provide an ein or ssn, send your provider a w. When a childcare provider will not give you a ssn or tax id. Be sure to put your name and social security number (ssn) on the statement. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other.

If they still refuse to provide an ein or ssn, send your provider a w. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. When a childcare provider will not give you a ssn or tax id. In this situation, all the lines on line 1 of form 2441 must be. You must complete and attach form 2441, child and dependent care expenses to your tax return. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. Be sure to put your name and social security number (ssn) on the statement.

When a childcare provider will not give you a ssn or tax id. If they still refuse to provide an ein or ssn, send your provider a w. You must complete and attach form 2441, child and dependent care expenses to your tax return. Be sure to put your name and social security number (ssn) on the statement. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. In this situation, all the lines on line 1 of form 2441 must be. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the.

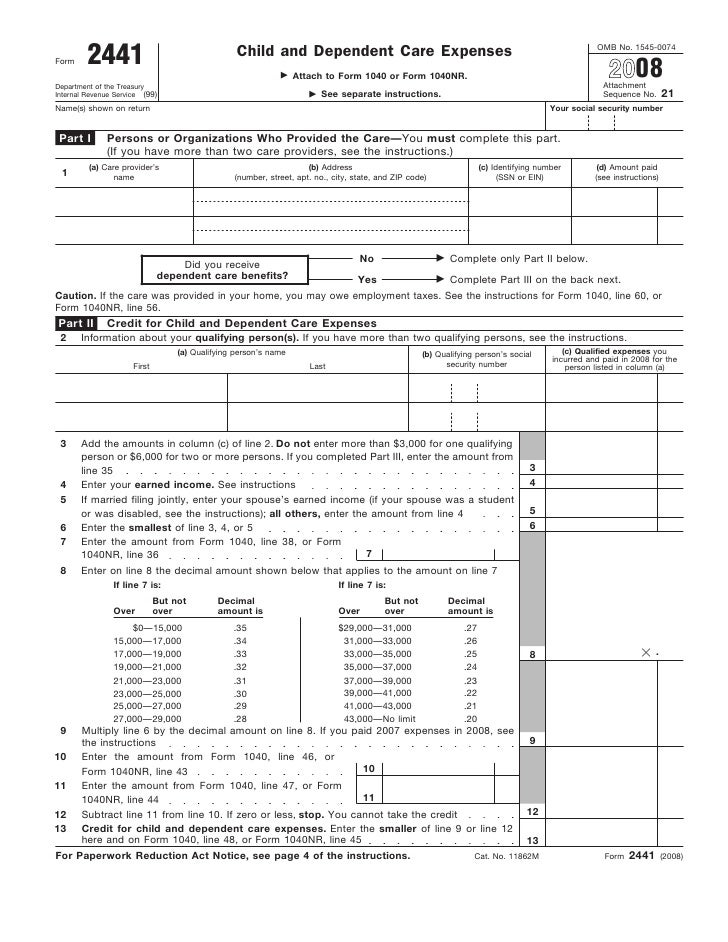

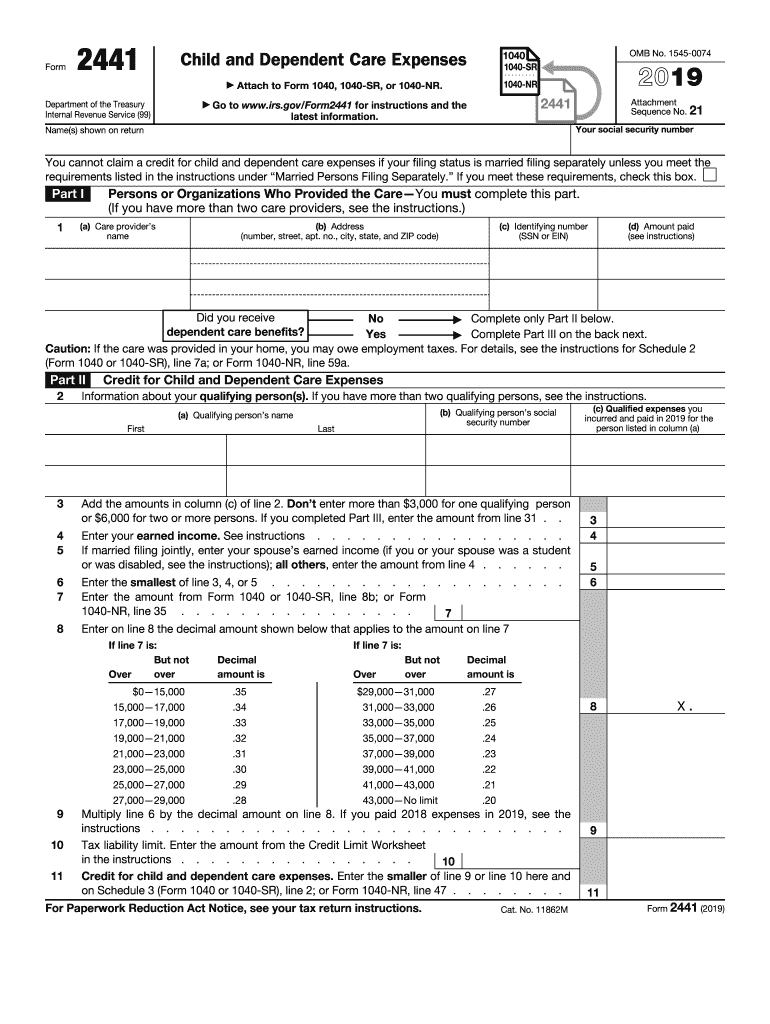

Form 2441Child and Dependent Care Expenses

If they still refuse to provide an ein or ssn, send your provider a w. Be sure to put your name and social security number (ssn) on the statement. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. If the provider refuses to give you their identifying information,.

Filing Tax Form 2441 Child and Dependent Care Expenses Reconcile Books

Be sure to put your name and social security number (ssn) on the statement. If they still refuse to provide an ein or ssn, send your provider a w. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. If the provider refuses to give you their identifying information,.

Filling form 2441 Children & Dependent Care Expenses Lendstart

If they still refuse to provide an ein or ssn, send your provider a w. When a childcare provider will not give you a ssn or tax id. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. In this situation, all the lines on line 1 of form 2441.

All About IRS Form 2441 Nasdaq

When a childcare provider will not give you a ssn or tax id. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. In this situation, all the lines on line 1 of form 2441 must be. If the provider refuses to give you their identifying information, you should.

Form 2441 YouTube

Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. If they still refuse to provide an ein or ssn, send your provider a w. In this situation, all.

Form 2441 20222023 Fill online, Printable, Fillable Blank

If they still refuse to provide an ein or ssn, send your provider a w. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. In this situation, all.

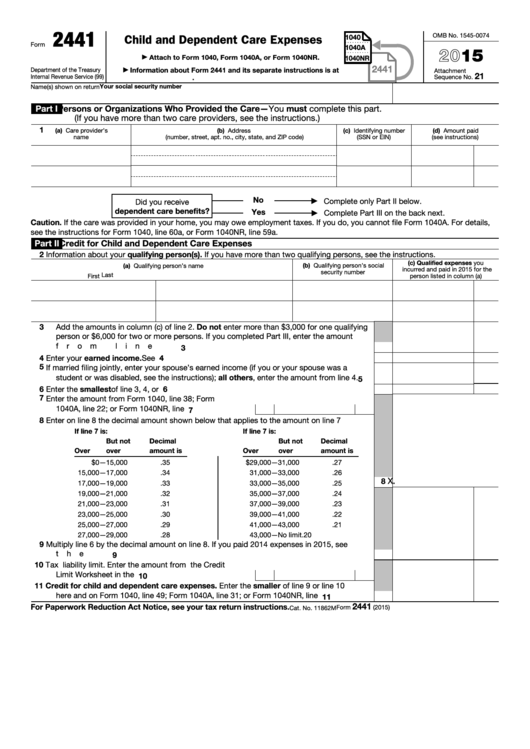

Fillable Form 2441 Child And Dependent Care Expenses 2015 printable

You must complete and attach form 2441, child and dependent care expenses to your tax return. In this situation, all the lines on line 1 of form 2441 must be. If they still refuse to provide an ein or ssn, send your provider a w. If the provider refuses to give you their identifying information, you should report on form.

Filing the form 2441 YouTube

If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. Learn how to claim the child and dependent care credit when you don't have the provider's social.

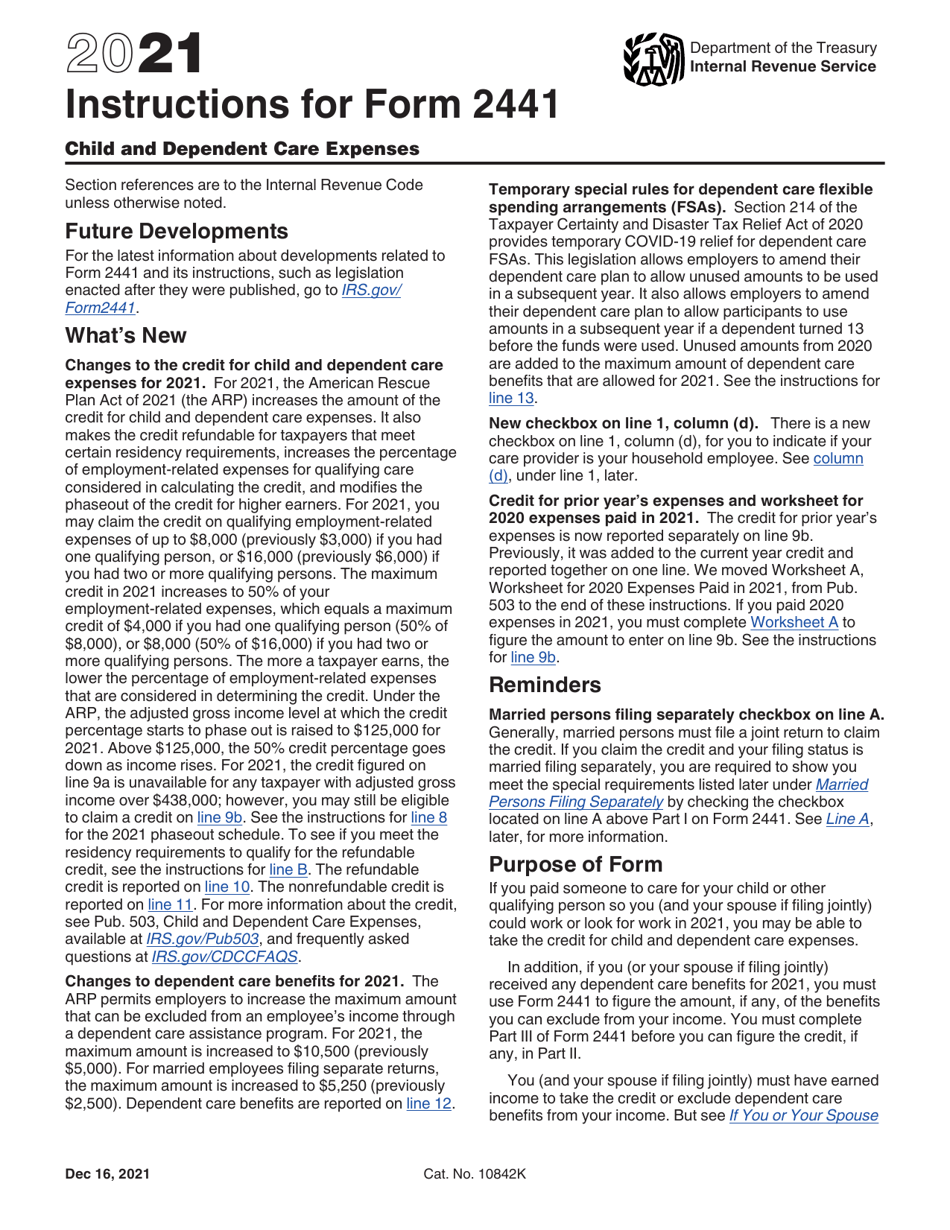

Download Instructions for IRS Form 2441 Child and Dependent Care

Be sure to put your name and social security number (ssn) on the statement. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. If they still.

Form 2441 Fill out & sign online DocHub

You must complete and attach form 2441, child and dependent care expenses to your tax return. Learn how to claim the child and dependent care credit when you don't have the provider's social security number or other. Be sure to put your name and social security number (ssn) on the statement. If the provider refuses to give you their identifying.

When A Childcare Provider Will Not Give You A Ssn Or Tax Id.

Be sure to put your name and social security number (ssn) on the statement. If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have (such as the. In this situation, all the lines on line 1 of form 2441 must be. You must complete and attach form 2441, child and dependent care expenses to your tax return.

Learn How To Claim The Child And Dependent Care Credit When You Don't Have The Provider's Social Security Number Or Other.

If the provider refuses to give you their identifying information, you should report on form 2441 whatever information you have. If they still refuse to provide an ein or ssn, send your provider a w.