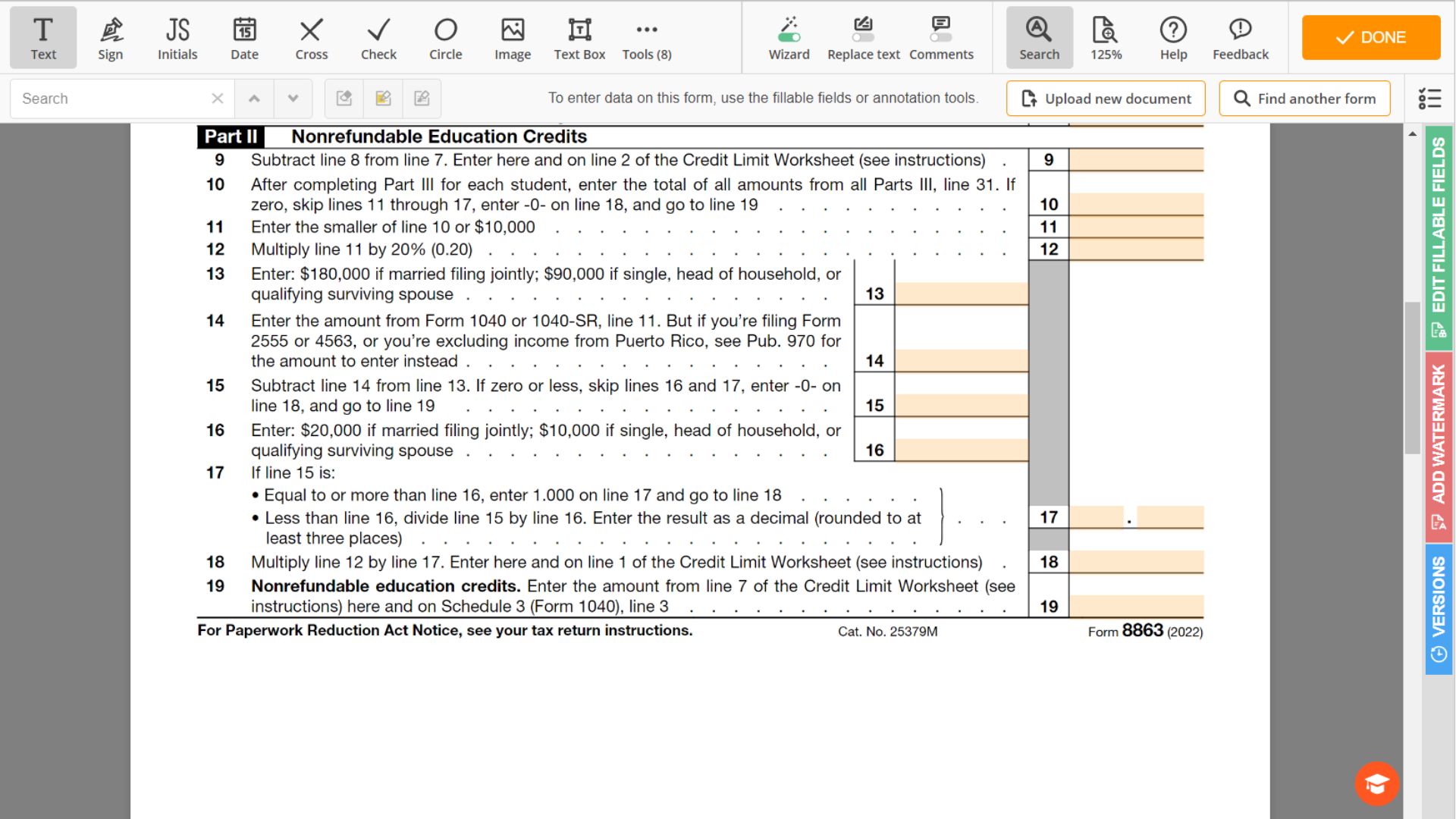

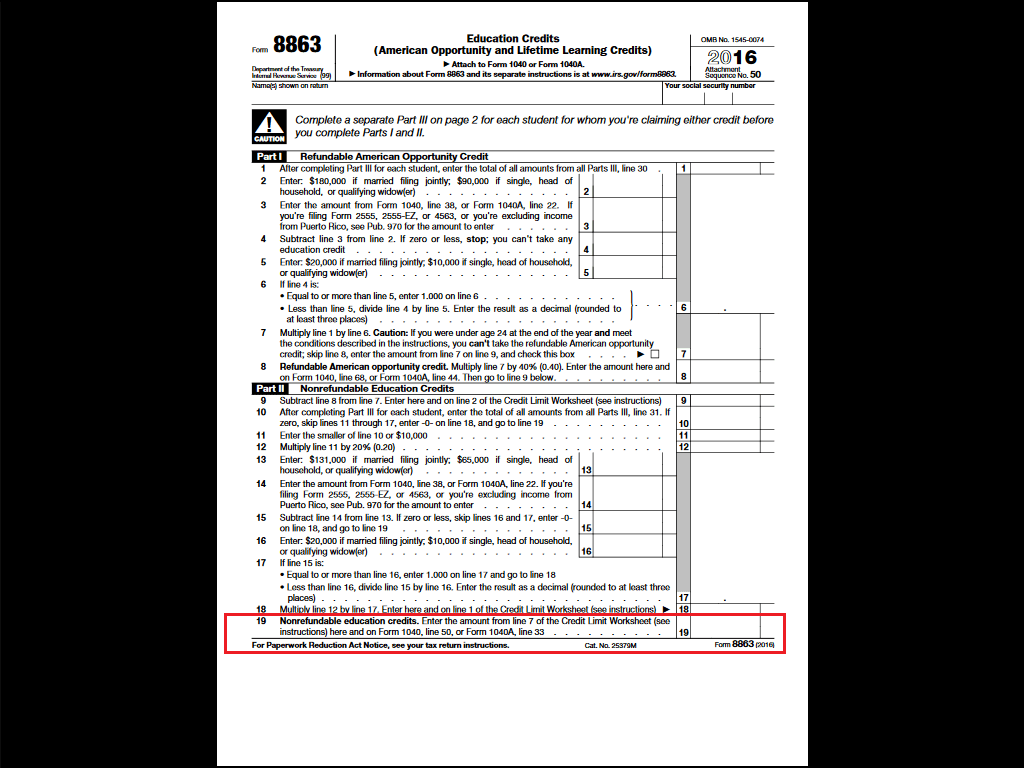

Form 8863 Line 19

Form 8863 Line 19 - Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. Enter the amount from form 8863, line 9 2. Add lines 1 and 2 3. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. I'm trying to file online, but am stuck here on what. The amount you get on line. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms.

Enter the amount from form 8863, line 9 2. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. Add lines 1 and 2 3. I'm trying to file online, but am stuck here on what. The amount you get on line. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms.

Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. I'm trying to file online, but am stuck here on what. The amount you get on line. Enter the amount from form 8863, line 9 2. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. Add lines 1 and 2 3.

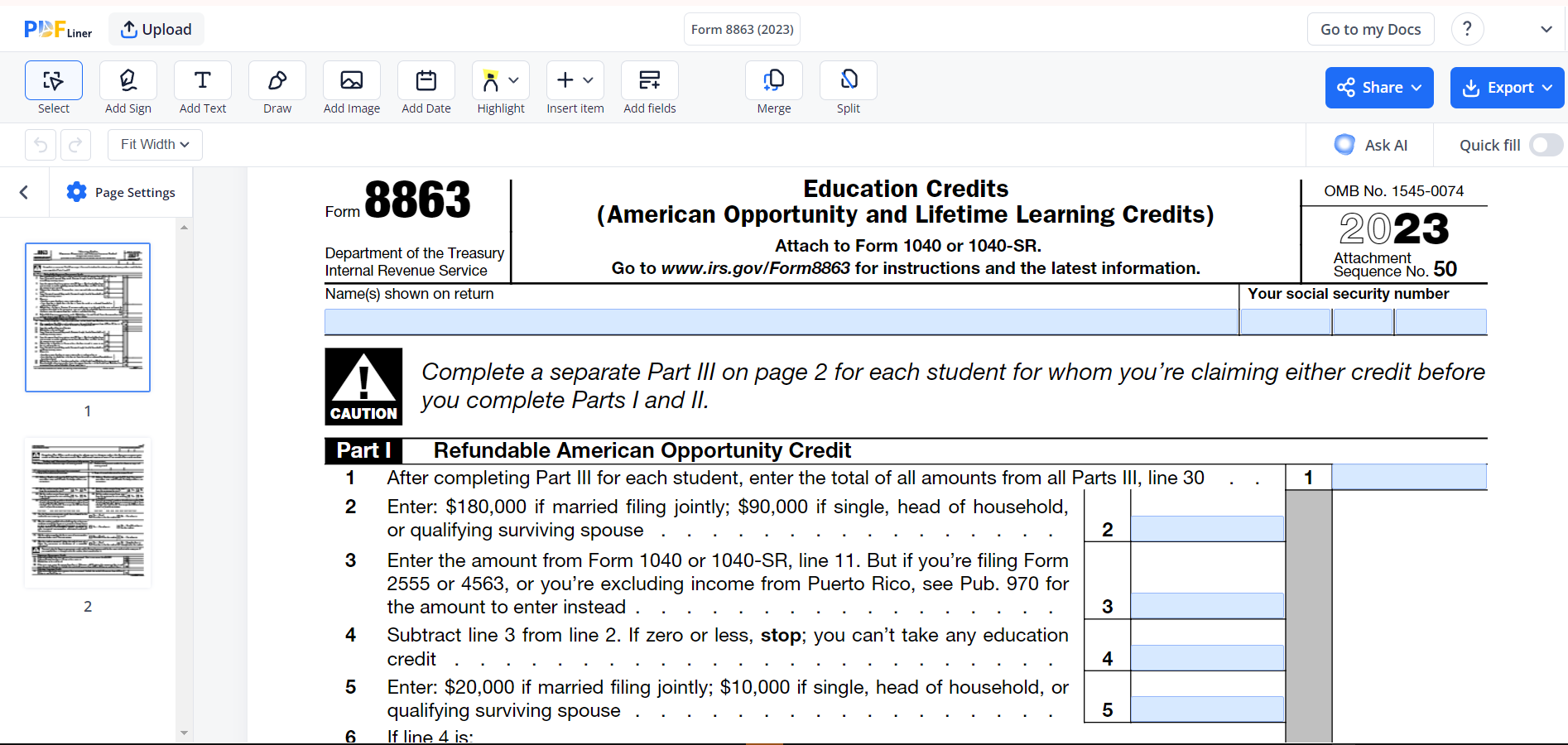

Form 8863 Fillable Pdf Printable Forms Free Online

I'm trying to file online, but am stuck here on what. Enter the amount from form 8863, line 9 2. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses.

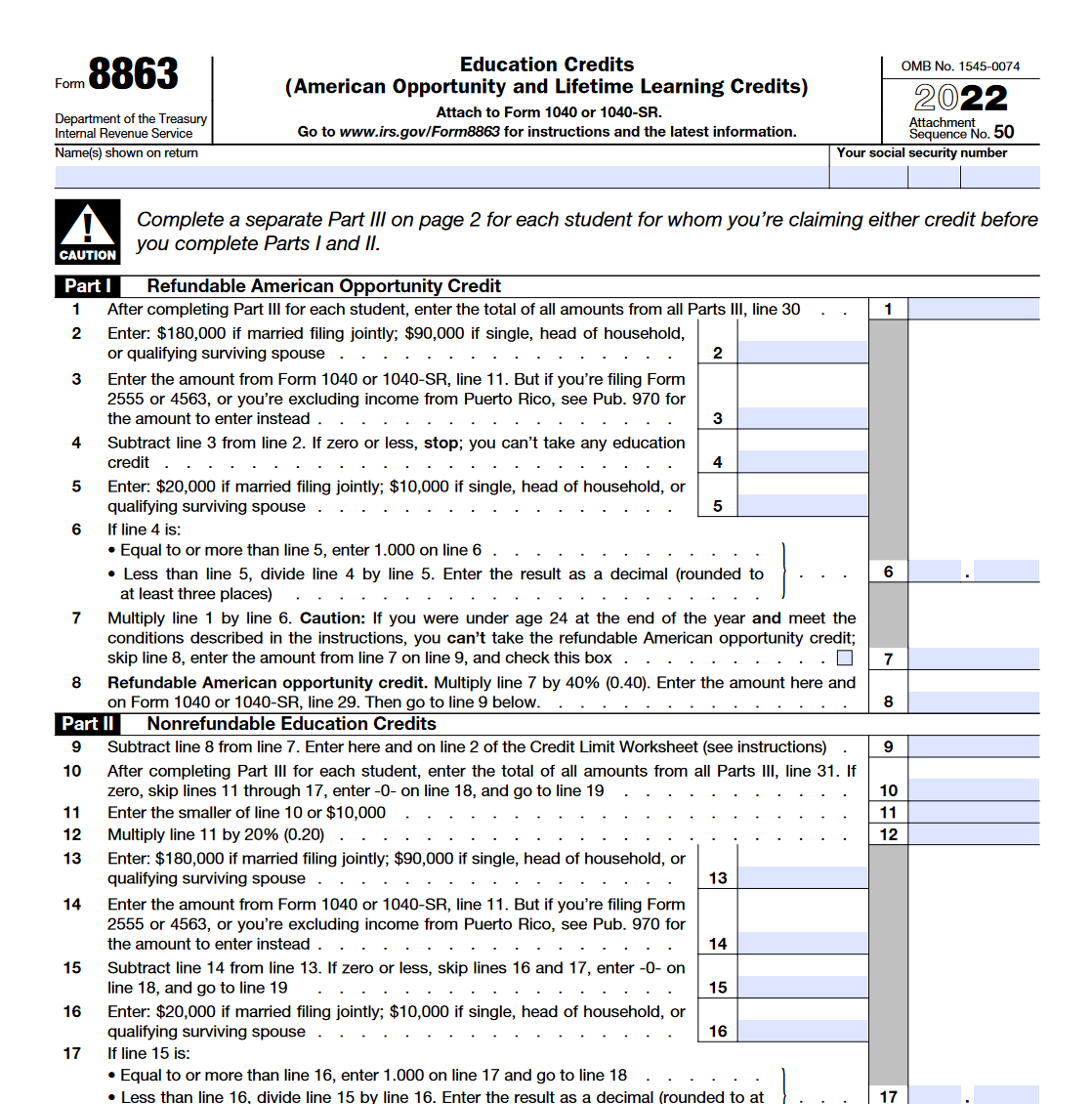

IRS Form 8863 📝 Get Federal Tax Form 8863 for 2022 Instructions

I'm trying to file online, but am stuck here on what. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. Enter the amount from form 8863, line 9.

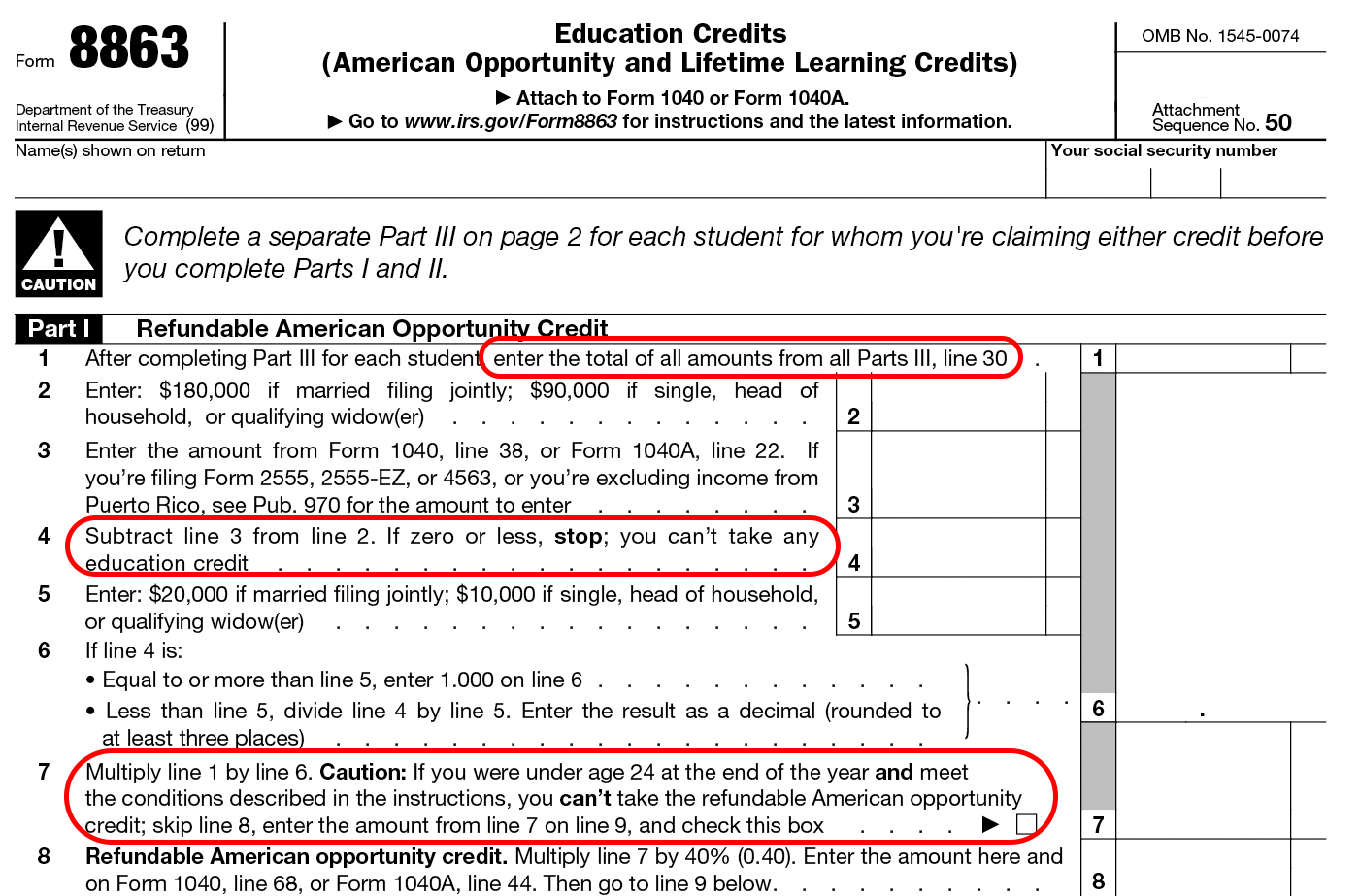

Form 8863 Fillable and Printable blank PDFline

I'm trying to file online, but am stuck here on what. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. Irs form 8863, education credits, is the tax.

Printable Form 8863

I'm trying to file online, but am stuck here on what. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. The amount you get on line. Add lines 1 and 2 3. Enter the amount from form 8863, line 9 2.

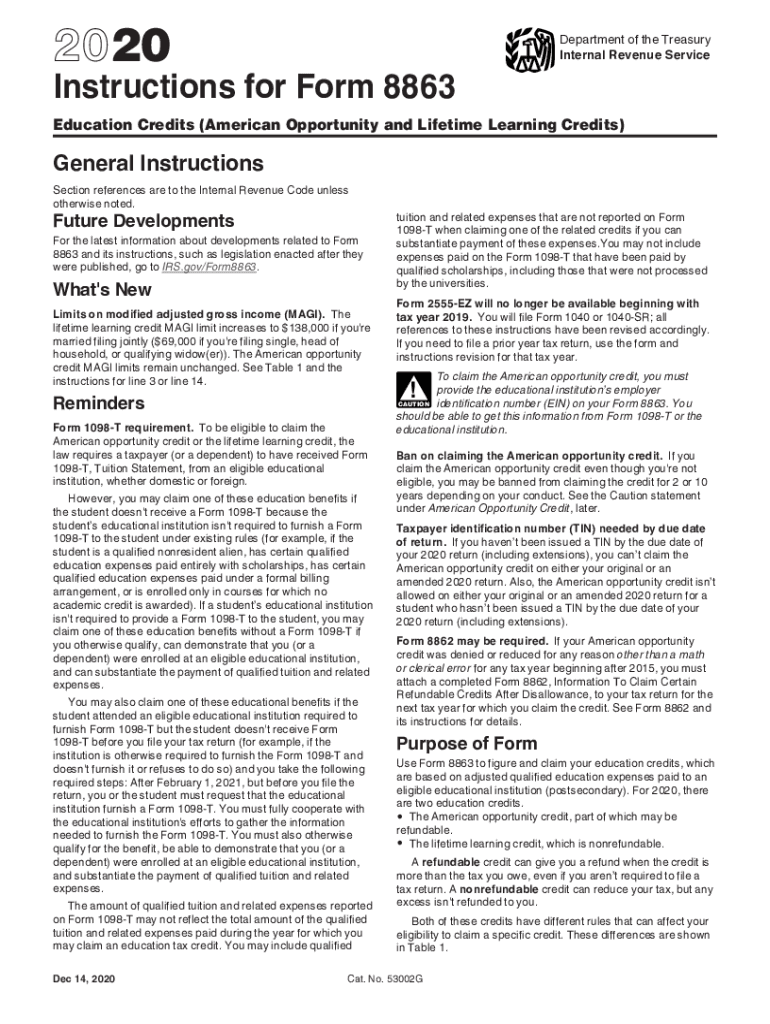

2020 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

The amount you get on line. Enter the amount from form 8863, line 9 2. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. I'm trying to file.

Form 8863 YouTube

Enter the amount from form 8863, line 9 2. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. The amount you get on line. I'm trying to file online, but am stuck here on what. Add lines 1 and 2 3.

IRS Form 8863 Instructions

Enter the amount from form 8863, line 9 2. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. The amount you get on line. Add lines 1 and 2 3. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates,.

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

I'm trying to file online, but am stuck here on what. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. Add lines 1 and 2 3. Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms. Complete the.

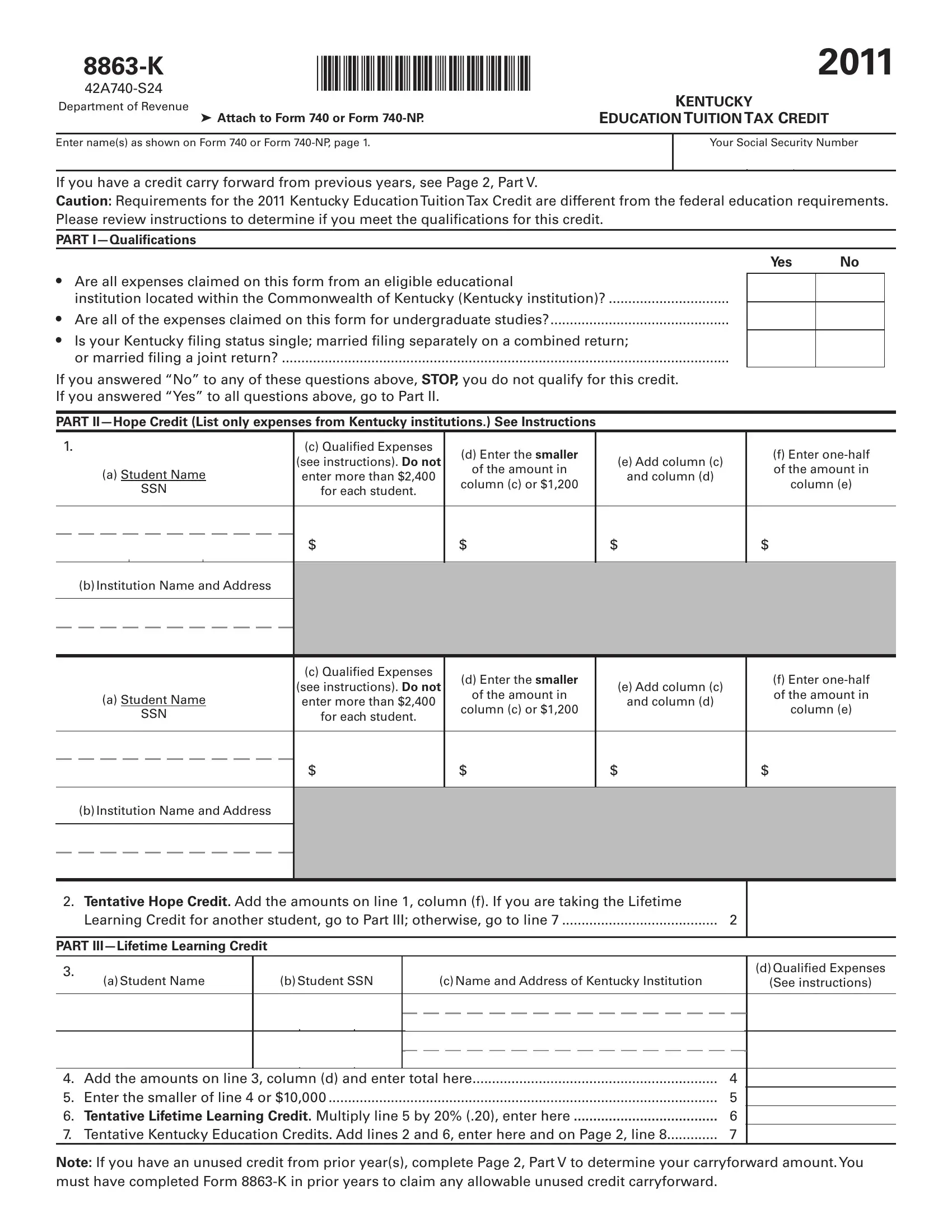

Form 8863 K ≡ Fill Out Printable PDF Forms Online

Information about form 8863, education credits (american opportunity and lifetime learning credits), including recent updates, related forms. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. Enter the amount from form 8863, line 9 2. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a.

Printable Form 8863 Printable Forms Free Online

I'm trying to file online, but am stuck here on what. The amount you get on line. Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you.

Add Lines 1 And 2 3.

Complete a separate part iii on page 2 for each student for whom you’re claiming either credit before you complete parts i and ii. Complete the credit limit worksheet using the amount from line 18, on line 1 of the worksheet. The amount you get on line. I'm trying to file online, but am stuck here on what.

Information About Form 8863, Education Credits (American Opportunity And Lifetime Learning Credits), Including Recent Updates, Related Forms.

Irs form 8863, education credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they. Enter the amount from form 8863, line 9 2.