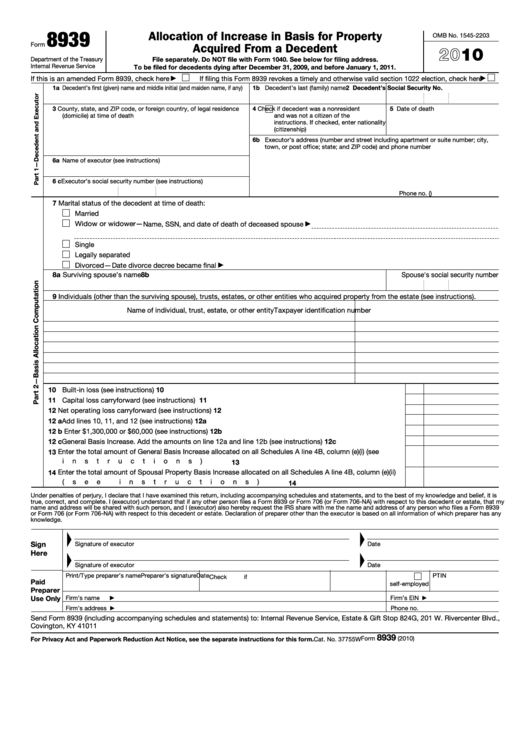

Form 8939 Filing Requirements

Form 8939 Filing Requirements - Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the. Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts. Learn who must file form 8938, statement of specified foreign financial assets, and what assets are included. Form 8939 is due april 15 and attached to the individual’s tax return.

Form 8939 is due april 15 and attached to the individual’s tax return. Learn who must file form 8938, statement of specified foreign financial assets, and what assets are included. Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts. Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the.

Learn who must file form 8938, statement of specified foreign financial assets, and what assets are included. Form 8939 is due april 15 and attached to the individual’s tax return. Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts. Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the.

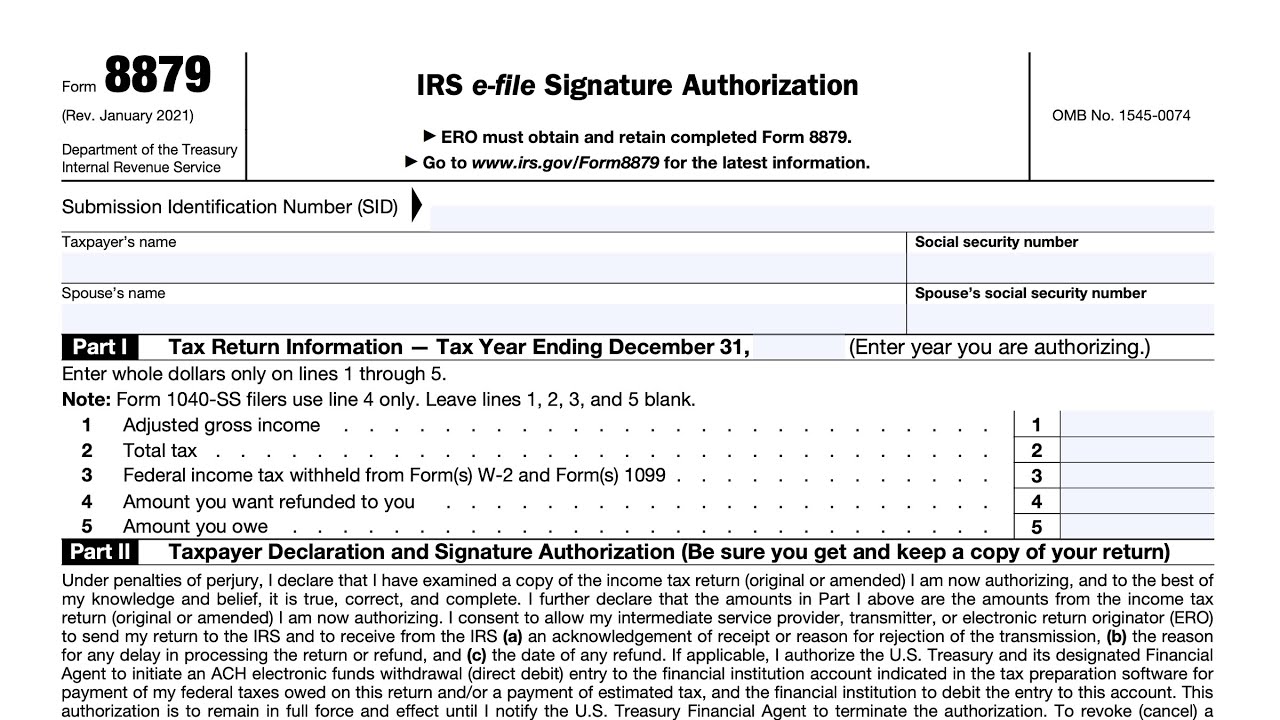

Downloadable Form 8879 IRS EFile Signature Authorization, 42 OFF

Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the. Learn who must file form 8938, statement of specified foreign financial assets, and what assets are included. Form 8939 is due april 15 and attached to the individual’s tax return. Learn the differences between form 8938 and fbar,.

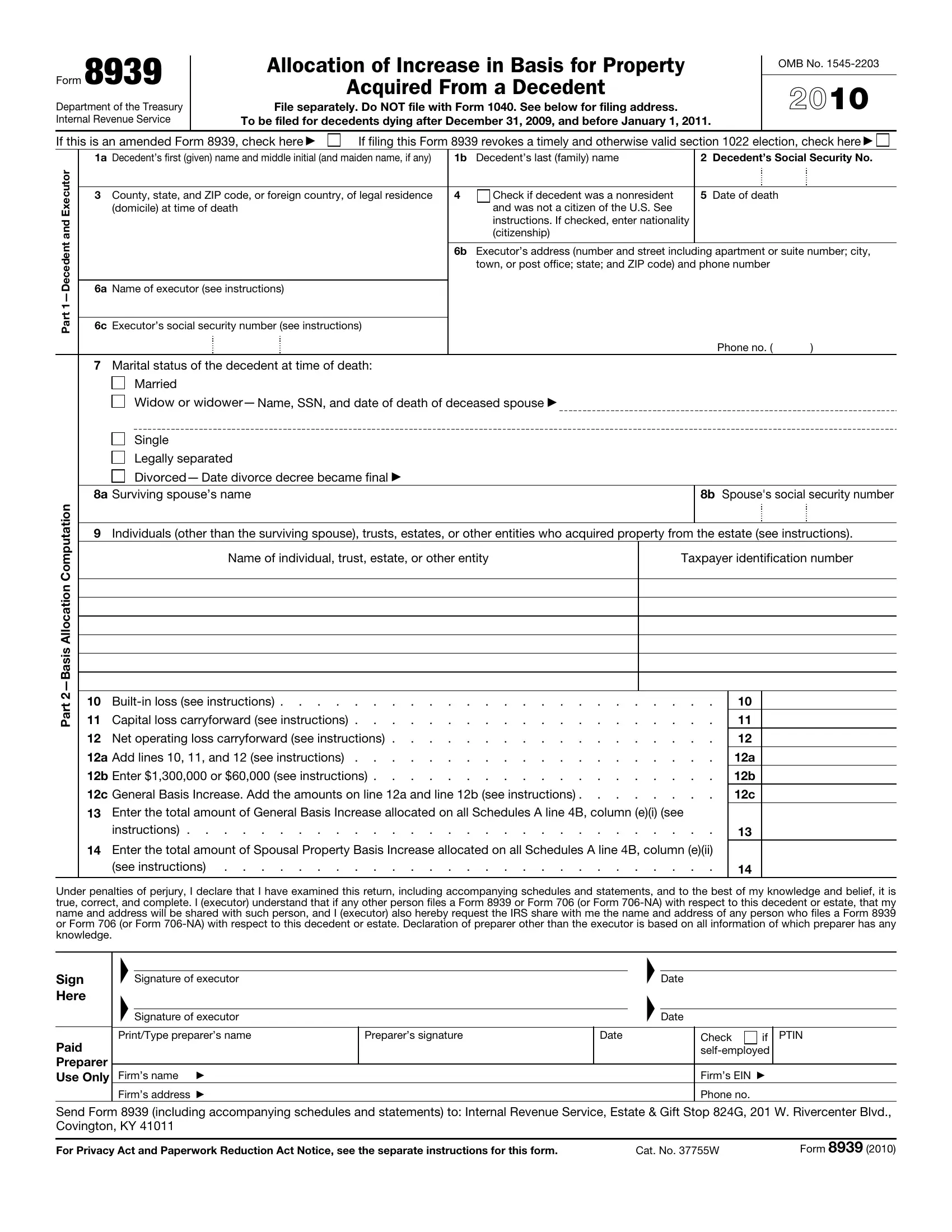

Advance DRAFT Form 8939

Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts. Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the. Form 8939 is due april 15 and attached to the individual’s tax return. Learn who must file form 8938, statement of.

Ultimate Guide to Filing for Nonprofit Tax IRS Form 990 Nonprofits

Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts. Learn who must file form 8938, statement of specified foreign financial assets, and what assets are included. Form 8939 is due april 15 and attached to the individual’s tax return. Yesterday, the irs posted form 8939, allocation of basis increase for property acquired.

Fill Free fillable F8939 Accessible 2010 Form 8939 PDF form

Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts. Learn who must file form 8938, statement of specified foreign financial assets, and what assets are included. Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the. Form 8939 is due.

Form 8939 ≡ Fill Out Printable PDF Forms Online

Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts. Learn who must file form 8938, statement of specified foreign financial assets, and what assets are included. Form 8939 is due april 15 and attached to the individual’s tax return. Yesterday, the irs posted form 8939, allocation of basis increase for property acquired.

Moderator Sidney Kess Panelists ppt download

Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts. Learn who must file form 8938, statement of specified foreign financial assets, and what assets are included. Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the. Form 8939 is due.

Alabama 1099 State Filing Requirements A Complete Guide by

Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the. Form 8939 is due april 15 and attached to the individual’s tax return. Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts. Learn who must file form 8938, statement of.

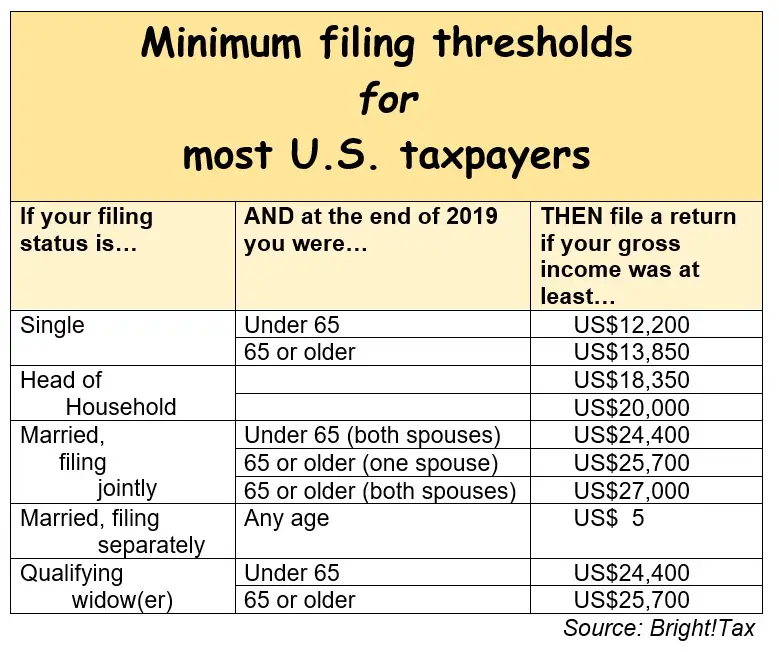

Federal Tax Filing Threshold 2023 Printable Forms Free Online

Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts. Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the. Learn who must file form 8938, statement of specified foreign financial assets, and what assets are included. Form 8939 is due.

Form 8939 ≡ Fill Out Printable PDF Forms Online

Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the. Learn who must file form 8938, statement of specified foreign financial assets, and what assets are included. Form 8939 is due april 15 and attached to the individual’s tax return. Learn the differences between form 8938 and fbar,.

Fillable Form 8939 Allocation Of Increase In Basis For Property

Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts. Learn who must file form 8938, statement of specified foreign financial assets, and what assets are included. Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the. Form 8939 is due.

Learn Who Must File Form 8938, Statement Of Specified Foreign Financial Assets, And What Assets Are Included.

Form 8939 is due april 15 and attached to the individual’s tax return. Yesterday, the irs posted form 8939, allocation of basis increase for property acquired from a decedent, and today, the irs posted the. Learn the differences between form 8938 and fbar, two forms for reporting foreign financial assets and accounts.