Georgia Tax Lien

Georgia Tax Lien - A state tax execution, also known as a tax lien, is a legal claim. It may be used against your property, bank account, or income to collect the amount. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. A georgia state tax lien is a legal claim against your property resulting from unpaid state taxes, such as sales or corporate taxes. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. In georgia, the priority of a tax lien is a fundamental consideration for property owners and potential creditors.

Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. A state tax execution, also known as a tax lien, is a legal claim. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. A georgia state tax lien is a legal claim against your property resulting from unpaid state taxes, such as sales or corporate taxes. In georgia, the priority of a tax lien is a fundamental consideration for property owners and potential creditors. It may be used against your property, bank account, or income to collect the amount.

A georgia state tax lien is a legal claim against your property resulting from unpaid state taxes, such as sales or corporate taxes. A state tax execution, also known as a tax lien, is a legal claim. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. In georgia, the priority of a tax lien is a fundamental consideration for property owners and potential creditors. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. It may be used against your property, bank account, or income to collect the amount.

Tax Lien State Of Tax Lien

A georgia state tax lien is a legal claim against your property resulting from unpaid state taxes, such as sales or corporate taxes. A state tax execution, also known as a tax lien, is a legal claim. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. In.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. A state tax execution, also known as a tax lien, is a legal claim. In georgia, the priority of a tax lien is a fundamental consideration for property owners and potential creditors..

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

A state tax execution, also known as a tax lien, is a legal claim. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a.

Tax Lien Tax Lien Certificates

A state tax execution, also known as a tax lien, is a legal claim. It may be used against your property, bank account, or income to collect the amount. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. In georgia, the.

Changes State Tax Lien Law

Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. In georgia, the priority of a tax lien is a.

Real Estate Tax Lien Investing for Beginners Secrets to Find

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. It may be used against your property, bank account, or income to collect the amount. A state tax execution, also known as a tax lien, is a legal claim. Find state tax.

Tax Lien Sale PDF Tax Lien Taxes

Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. It may be used against your property, bank account, or income to collect the amount. In georgia, the priority of a tax lien is a fundamental consideration for property owners and potential creditors. A state tax execution, also.

EasytoUnderstand Tax Lien Code Certificates Posteezy

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. In georgia, the priority of a tax lien is a fundamental consideration for property owners and potential creditors. It may be used against your property, bank account, or income to collect the.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

A state tax execution, also known as a tax lien, is a legal claim. It may be used against your property, bank account, or income to collect the amount. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. In georgia, the.

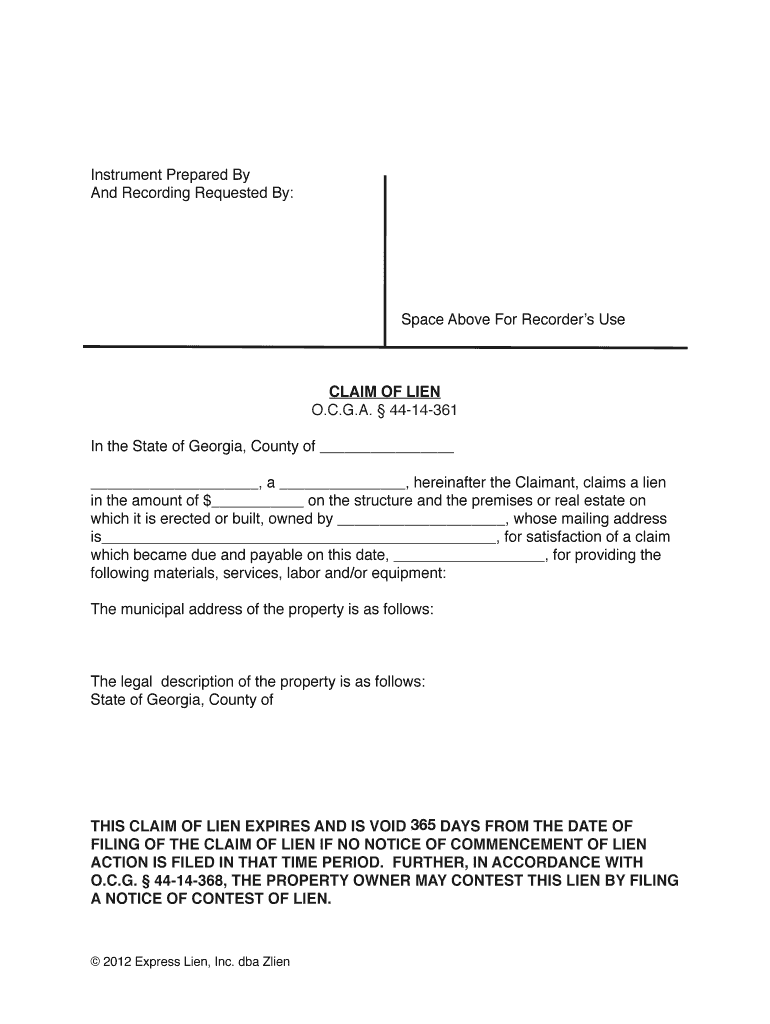

Mechanics Lien Form Fill Online, Printable, Fillable, Blank

It may be used against your property, bank account, or income to collect the amount. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. A state tax execution, also known as a tax lien, is a legal claim. Find state tax.

It May Be Used Against Your Property, Bank Account, Or Income To Collect The Amount.

Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. In georgia, the priority of a tax lien is a fundamental consideration for property owners and potential creditors. A georgia state tax lien is a legal claim against your property resulting from unpaid state taxes, such as sales or corporate taxes.