Harris County Texas Tax Lien Sales

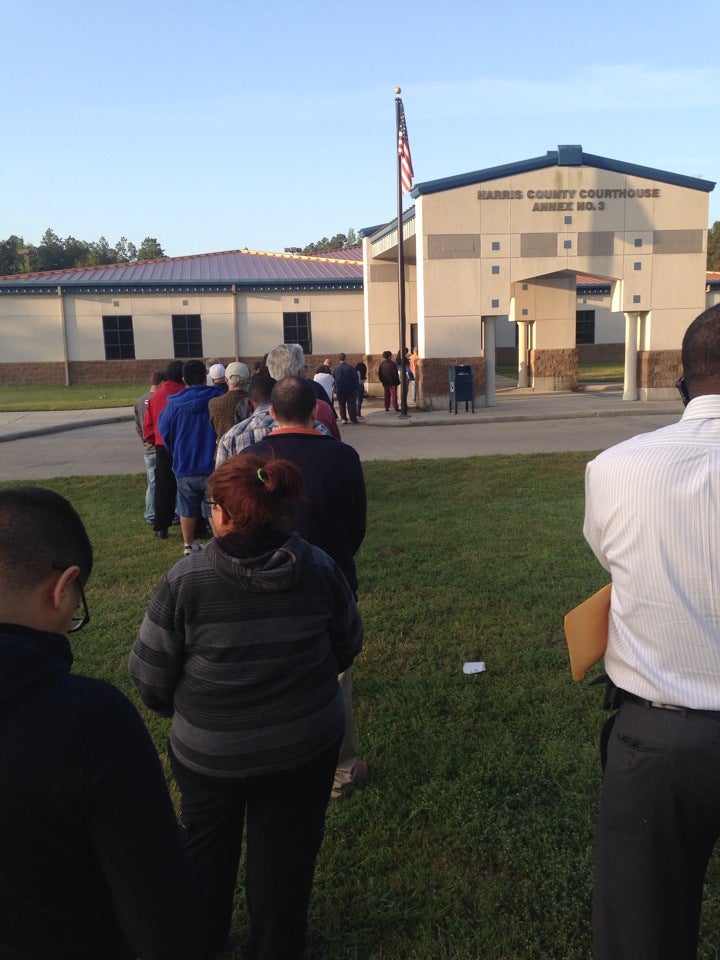

Harris County Texas Tax Lien Sales - The information provided on this website is updated daily from. Registration of bidders begins at 8:30 a.m. The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. You can contact the harris county tax assessor. The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. You can register online prior to the sale or the morning of the sale starting at 8:30am. Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. Harris county delinquent tax sale property listing sale date: You can find registration information here:. Sales must be held from 10:00 a.m.

The following websites contain information on delinquent properties to be sold at tax sale: You can register online prior to the sale or the morning of the sale starting at 8:30am. You can contact the harris county tax assessor. Registration of bidders begins at 8:30 a.m. The information provided on this website is updated daily from. Sales must be held from 10:00 a.m. Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. Harris county delinquent tax sale property listing sale date: Harris county tax sales are held the first tuesday of each month. Yes, you must register with the harris county tax office to bid at the tax sale.

The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. You can contact the harris county tax assessor. You can register online prior to the sale or the morning of the sale starting at 8:30am. Registration of bidders begins at 8:30 a.m. The following websites contain information on delinquent properties to be sold at tax sale: The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. Yes, you must register with the harris county tax office to bid at the tax sale. The information provided on this website is updated daily from. Harris county tax sales are held the first tuesday of each month. Harris county delinquent tax sale property listing sale date:

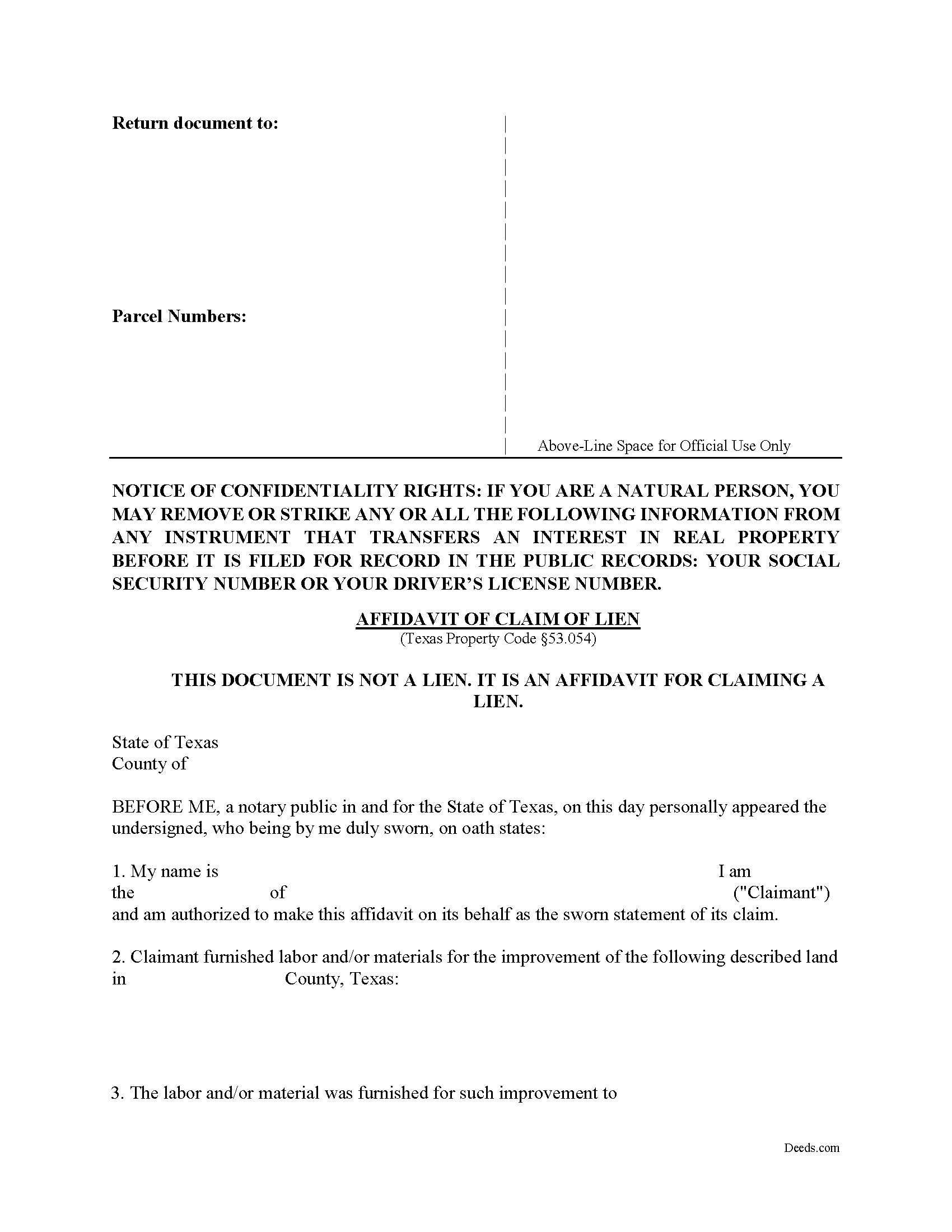

Printable Lien Form Santa Barbara County Printable Forms Free Online

The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. The information provided on this website is updated daily from. Harris county tax sales are held the first tuesday of each.

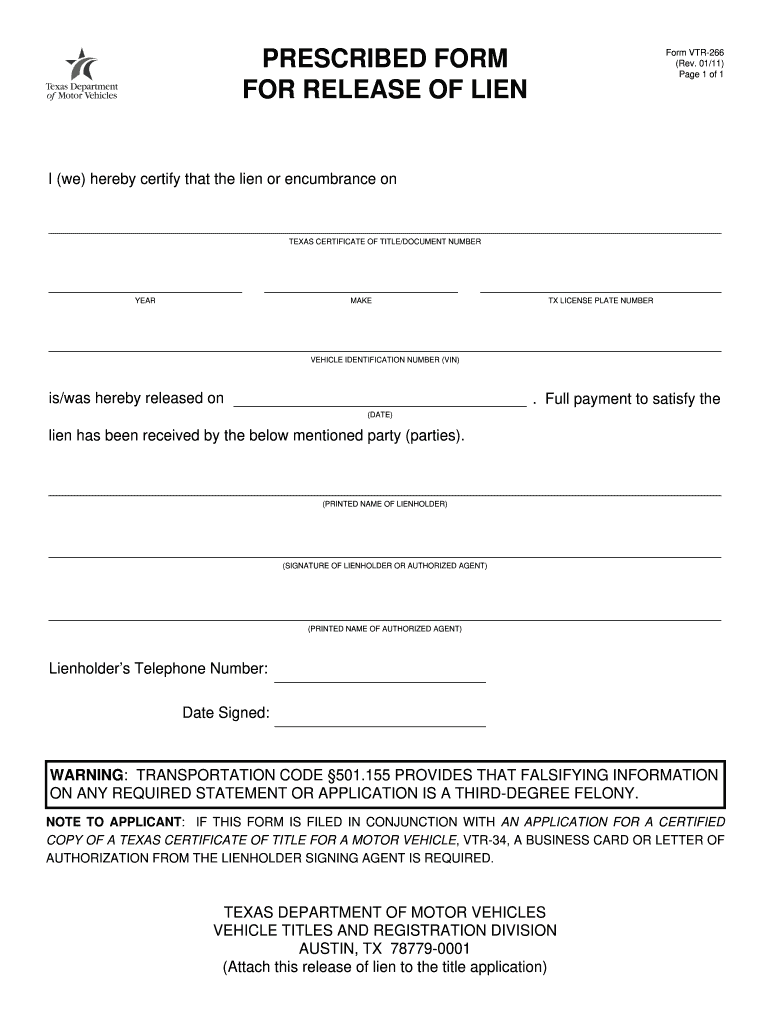

Tax Lien Tax Lien Certificates Texas

Yes, you must register with the harris county tax office to bid at the tax sale. Harris county tax sales are held the first tuesday of each month. You can find registration information here:. The information provided on this website is updated daily from. Registration of bidders begins at 8:30 a.m.

The Other Foreclosure Crisis Property Tax Lien Sales FORECLOSURE FRAUD

Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. The information provided on this website is updated daily from. You can register online prior to the sale or the morning of the sale starting at 8:30am. The following websites contain information on delinquent properties to be sold at tax.

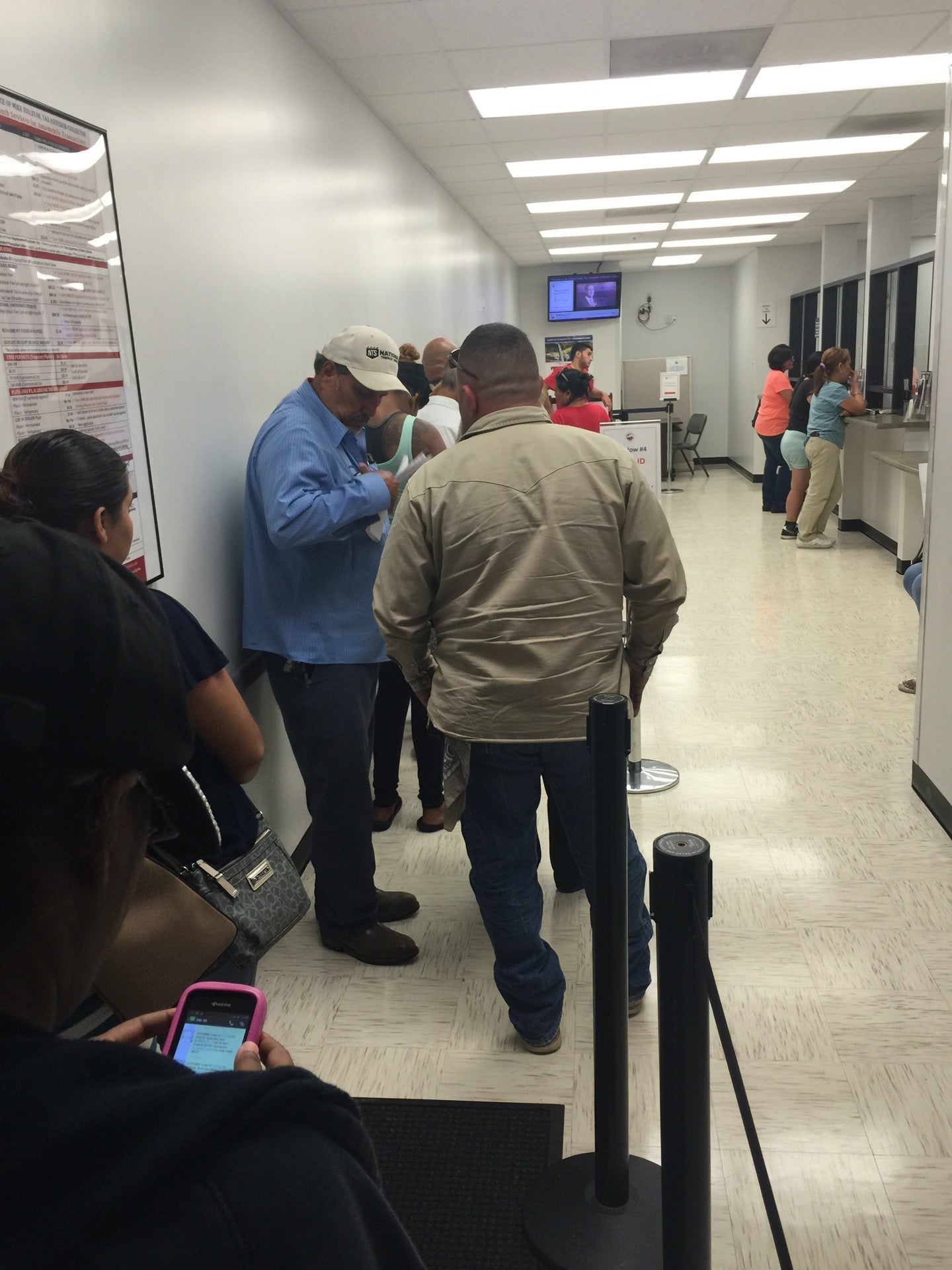

Harris County Tax Collector, 16715 Clay Rd, Ste 4, Houston, TX, Court

You can contact the harris county tax assessor. Sales must be held from 10:00 a.m. You can find registration information here:. Harris county delinquent tax sale property listing sale date: The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm.

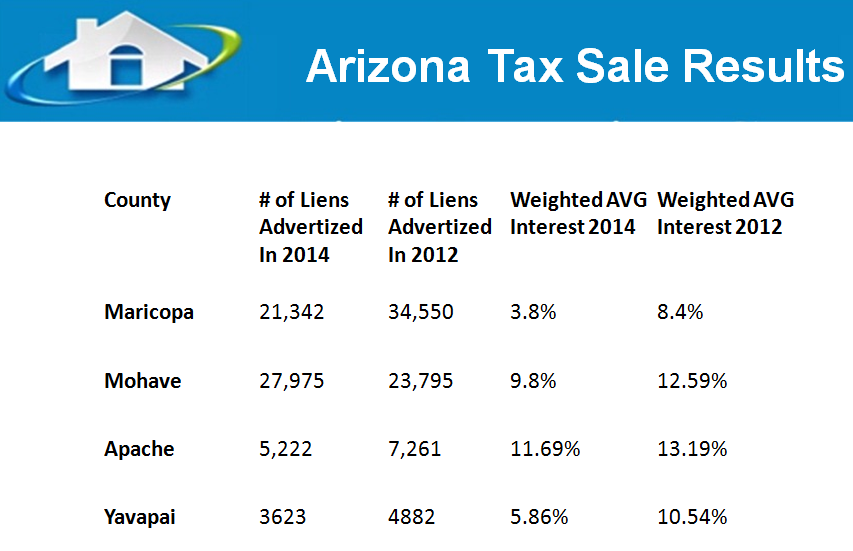

Results From The Arizona Online Tax Lien Sales Tax Lien Investing Tips

You can contact the harris county tax assessor. Harris county delinquent tax sale property listing sale date: Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. You can find registration information here:. The information provided on this website is updated daily from.

Anne Arundel County Tax Lien Certificates prosecution2012

The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. Sales must be held from 10:00 a.m. Harris county delinquent tax sale property listing sale date: Yes, you must register with the harris county tax office to bid at the tax sale. The harris county delinquent.

Harris County Tax Collector, 7900 Will Clayton Pkwy, Humble, TX MapQuest

The following websites contain information on delinquent properties to be sold at tax sale: Sales must be held from 10:00 a.m. Yes, you must register with the harris county tax office to bid at the tax sale. The information provided on this website is updated daily from. You can contact the harris county tax assessor.

Harris County Affidavit of Lien Form Texas

Yes, you must register with the harris county tax office to bid at the tax sale. You can find registration information here:. The following websites contain information on delinquent properties to be sold at tax sale: Harris county delinquent tax sale property listing sale date: Additional information relating to the harris county delinquent tax sale are available from the resources.

Harris County Tax Office, 10851 Scarsdale Blvd, Houston, TX, Court

You can register online prior to the sale or the morning of the sale starting at 8:30am. Yes, you must register with the harris county tax office to bid at the tax sale. Harris county tax sales are held the first tuesday of each month. The information provided on this website is updated daily from. Sales must be held from.

Texas Lien Fill Online, Printable, Fillable, Blank pdfFiller

The following websites contain information on delinquent properties to be sold at tax sale: You can find registration information here:. Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. The information provided on this website is updated daily from. Sales must be held from 10:00 a.m.

The Following Websites Contain Information On Delinquent Properties To Be Sold At Tax Sale:

Registration of bidders begins at 8:30 a.m. The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. Harris county delinquent tax sale property listing sale date:

Sales Must Be Held From 10:00 A.m.

You can contact the harris county tax assessor. You can register online prior to the sale or the morning of the sale starting at 8:30am. The information provided on this website is updated daily from. Harris county tax sales are held the first tuesday of each month.

Additional Information Relating To The Harris County Delinquent Tax Sale Are Available From The Resources And Links Throughout This Website.

You can find registration information here:. Yes, you must register with the harris county tax office to bid at the tax sale.