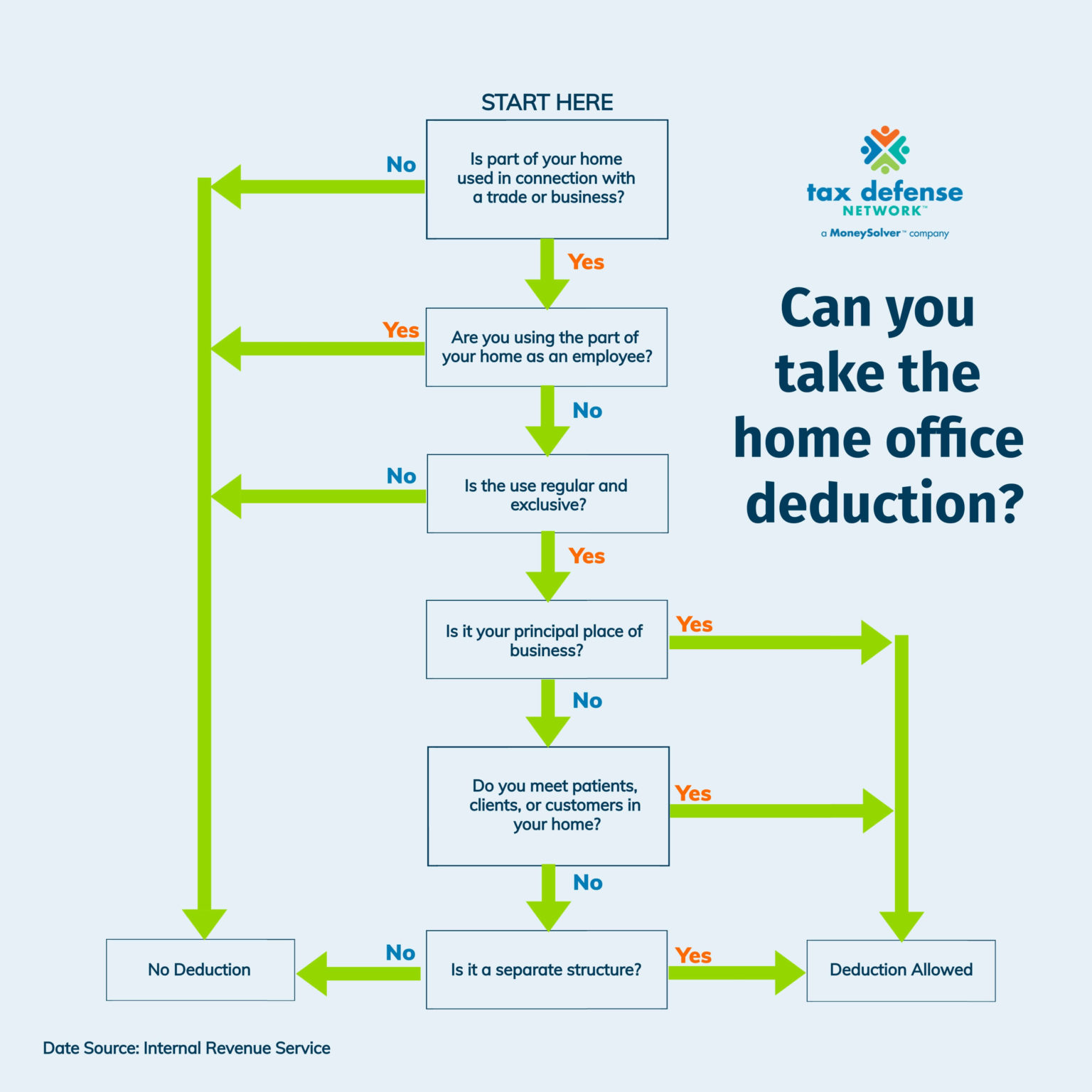

Home Office Deduction Form

Home Office Deduction Form - These may include mortgage interest, insurance, utilities,. There are certain expenses taxpayers can deduct. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not deductible this year. Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). [2] what does exclusive use mean? Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Use a separate form 8829 for each home you used for business during the year. The home office deduction, calculated on form 8829, is available to both homeowners and renters. [3] does my home office still qualify if my mother uses it once a year when. Mortgage interest, real estate taxes).

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not deductible this year. These may include mortgage interest, insurance, utilities,. Office in the home frequently asked questions [1] what are the requirements for deducting expenses for the business use of my home? [2] what does exclusive use mean? The home office deduction, calculated on form 8829, is available to both homeowners and renters. [3] does my home office still qualify if my mother uses it once a year when. There are certain expenses taxpayers can deduct. Use a separate form 8829 for each home you used for business during the year. Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Mortgage interest, real estate taxes).

[3] does my home office still qualify if my mother uses it once a year when. Use a separate form 8829 for each home you used for business during the year. [2] what does exclusive use mean? Mortgage interest, real estate taxes). Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). The home office deduction, calculated on form 8829, is available to both homeowners and renters. These may include mortgage interest, insurance, utilities,. Office in the home frequently asked questions [1] what are the requirements for deducting expenses for the business use of my home? There are certain expenses taxpayers can deduct. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not deductible this year.

Home Office Deduction Breakdown LawInc

Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Mortgage interest, real estate taxes). The home office deduction, calculated on form 8829, is available to both homeowners and renters. Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040)..

An Easy Guide to The Home Office Deduction

[3] does my home office still qualify if my mother uses it once a year when. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not deductible this year. [2] what does exclusive use mean? Standard deduction of $5 per square foot.

What is the Home Office Deduction?

Office in the home frequently asked questions [1] what are the requirements for deducting expenses for the business use of my home? Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Mortgage interest, real estate taxes). The home office deduction, calculated on form 8829, is.

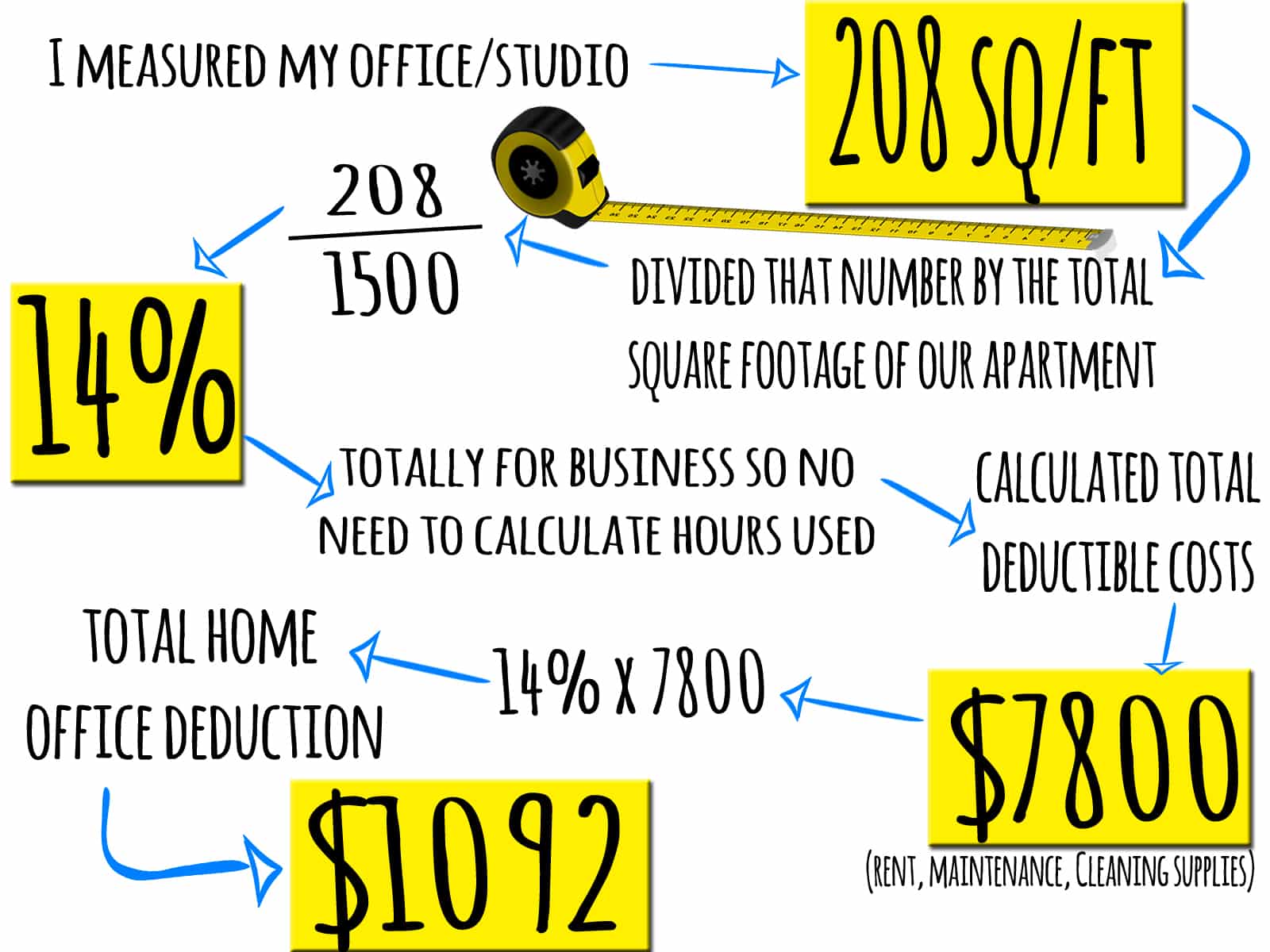

How to Calculate the Home Office Deduction 1099 Expert

[2] what does exclusive use mean? Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). There are certain expenses taxpayers can deduct. Mortgage interest, real estate taxes). These may include mortgage interest, insurance, utilities,.

Irs Home Office Deduction 2024 Hanny Muffin

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not deductible this year. Mortgage interest, real estate taxes). [2] what does exclusive use mean? Use a separate form 8829 for each home you used for business during the year. There are certain.

Your 2023 Home Office Deduction Guide Orchard

[2] what does exclusive use mean? There are certain expenses taxpayers can deduct. Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to.

Home Office Deduction 1099 Expert

[2] what does exclusive use mean? Mortgage interest, real estate taxes). The home office deduction, calculated on form 8829, is available to both homeowners and renters. [3] does my home office still qualify if my mother uses it once a year when. Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file.

Free Business Expense Spreadsheet and Self Employed Business Tax

Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). [2] what does exclusive use mean? The home office deduction, calculated on form 8829, is available to both homeowners and renters. Use a separate form 8829 for each home you used for business during the year..

Fillable Online FAQs Simplified Method for Home Office Deduction Fax

The home office deduction, calculated on form 8829, is available to both homeowners and renters. Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). [2] what does exclusive use mean? Use a separate form 8829 for each home you used for business during the year. Use form 8829 to figure the allowable expenses.

Freelancer Taxes How to deduct your home office From Rags to Reasonable

Use a separate form 8829 for each home you used for business during the year. Mortgage interest, real estate taxes). Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Standard deduction of $5 per square foot of home used for business (maximum 300 square feet)..

Use A Separate Form 8829 For Each Home You Used For Business During The Year.

[2] what does exclusive use mean? The home office deduction, calculated on form 8829, is available to both homeowners and renters. Form 8829 2024 expenses for business use of your home department of the treasury internal revenue service file only with schedule c (form 1040). Office in the home frequently asked questions [1] what are the requirements for deducting expenses for the business use of my home?

These May Include Mortgage Interest, Insurance, Utilities,.

Mortgage interest, real estate taxes). There are certain expenses taxpayers can deduct. Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts not deductible this year.