Indiana Property Tax Lien

Indiana Property Tax Lien - For general information about county property tax sale, please visit the sri website. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. To be removed from a tax sale, payment in full should be. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer.

To be removed from a tax sale, payment in full should be. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. For general information about county property tax sale, please visit the sri website.

The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. To be removed from a tax sale, payment in full should be. For general information about county property tax sale, please visit the sri website.

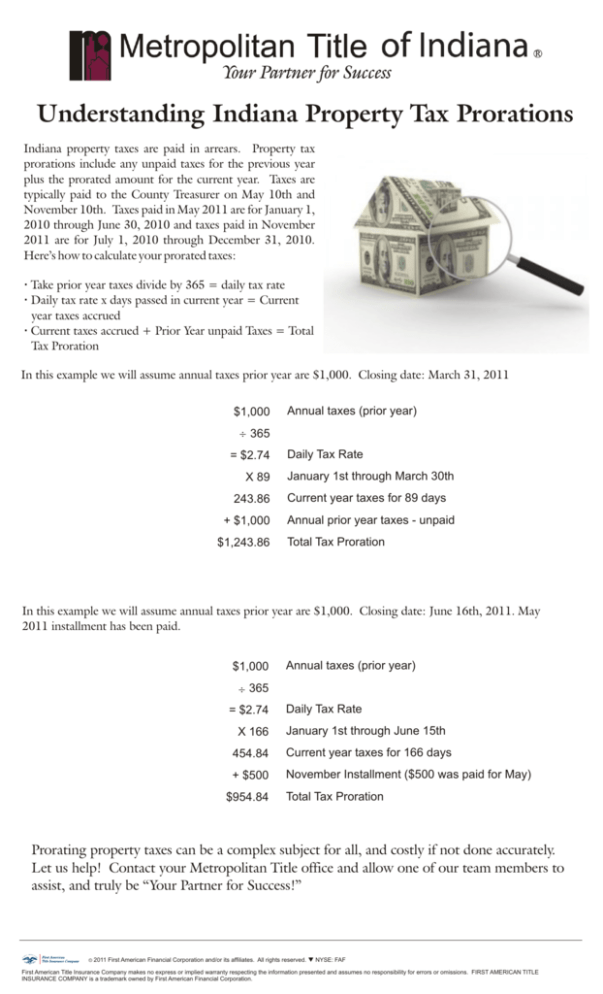

Understanding Indiana Property Tax Prorations

General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. The floyd county treasurer is responsible for the depository of tax obligations,.

Tax Lien Indiana State Tax Lien

During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale.

Tax Lien Sale PDF Tax Lien Taxes

General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. To be removed from a tax sale, payment in full should be. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. The.

Federal tax lien on foreclosed property laderdriver

The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. To be removed from a tax sale, payment in full should be. General.

Tax Lien Indiana State Tax Lien

Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and are ready to help you. General property taxes are payable at any time after the first day of.

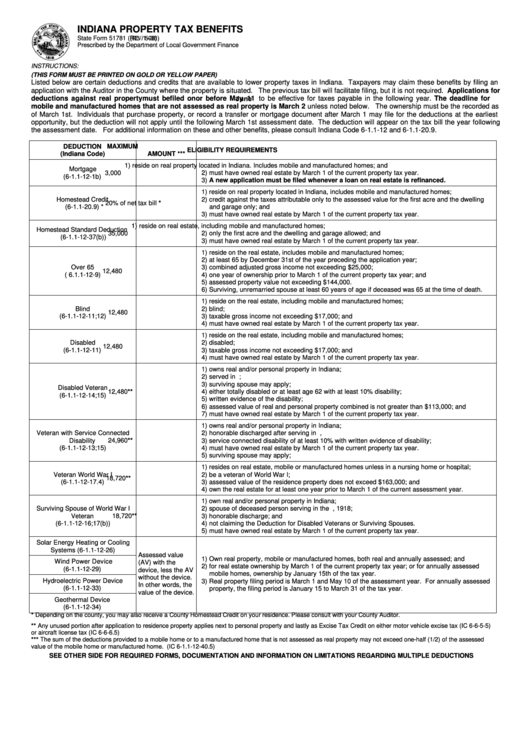

Indiana Property Tax Benefits Form Printable Pdf Download

For general information about county property tax sale, please visit the sri website. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments..

Tax Lien Indiana State Tax Lien

During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. The team of wayne greeson has extensive experience in representing tax lien clients across the state of indiana, and.

EasytoUnderstand Tax Lien Code Certificates Posteezy

General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. For general information about county property tax sale, please visit the sri website. During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for. The team.

What is a property Tax Lien? Real Estate Articles by

Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. General property taxes are payable at any time after the first day of january of each year,.

Real Property Tax Lien Hymson Goldstein Pantiliat & Lohr, PLLC

General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. To be removed from a tax sale, payment in full should be. For general information about county property tax sale, please visit the sri website. The team of wayne greeson has extensive experience in representing tax.

The Team Of Wayne Greeson Has Extensive Experience In Representing Tax Lien Clients Across The State Of Indiana, And Are Ready To Help You.

General property taxes are payable at any time after the first day of january of each year, and are payable in two equal installments. Indiana code provides that real property parcels with delinquent taxes due will be offered for a tax certificate sale by the county treasurer. The floyd county treasurer is responsible for the depository of tax obligations, collection of property taxes, processing of liquor license. For general information about county property tax sale, please visit the sri website.

To Be Removed From A Tax Sale, Payment In Full Should Be.

During the redemption period, lien buyers are strongly encouraged to pay all subsequent taxes and special assessments on the properties for.