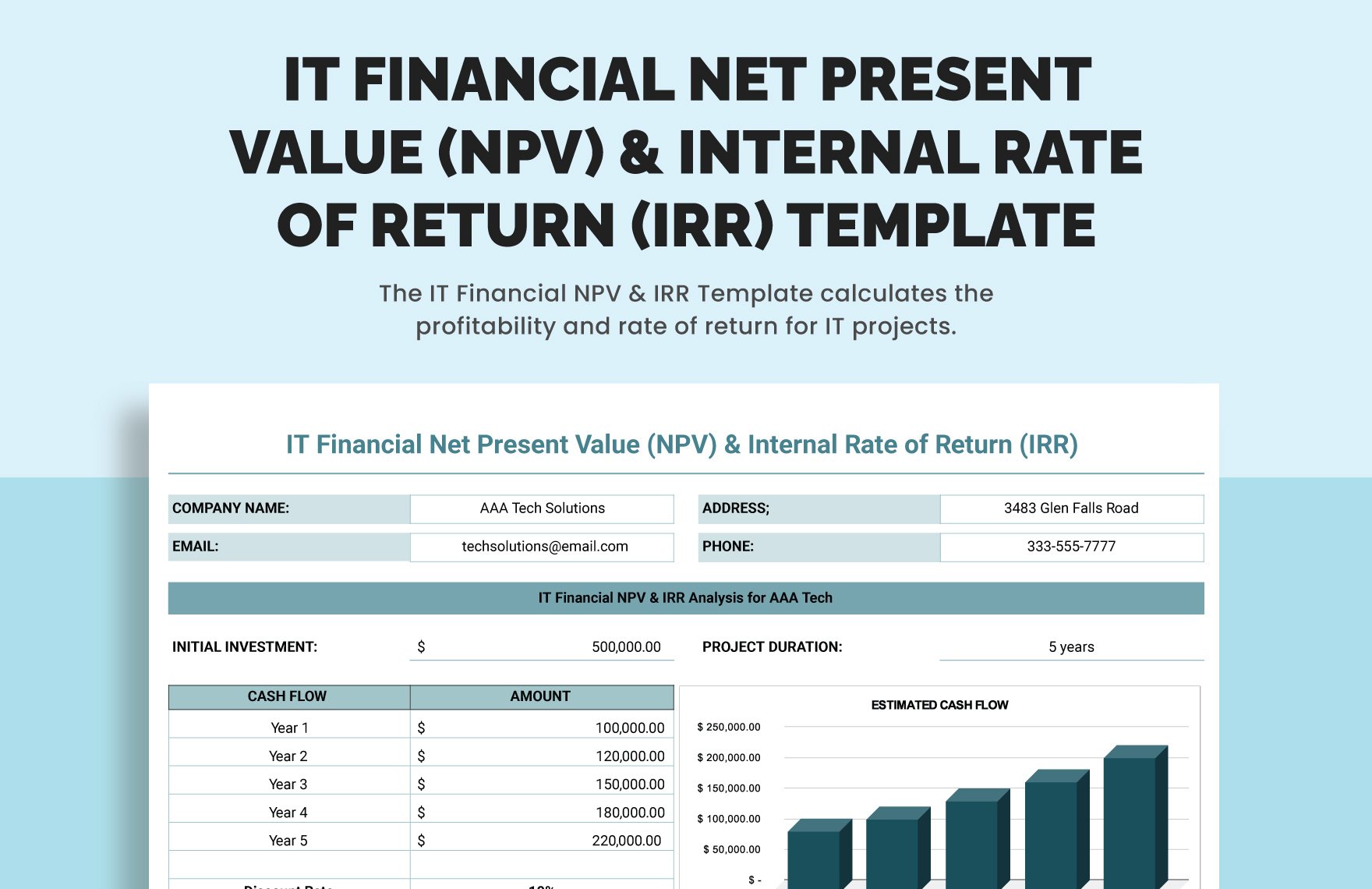

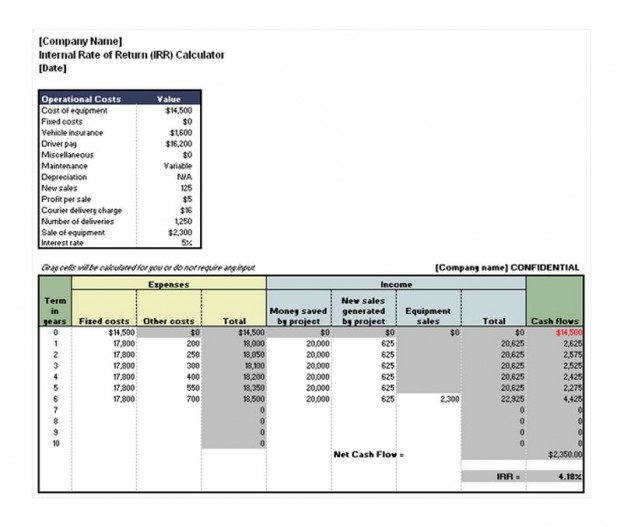

Internal Rate Of Return Excel Template

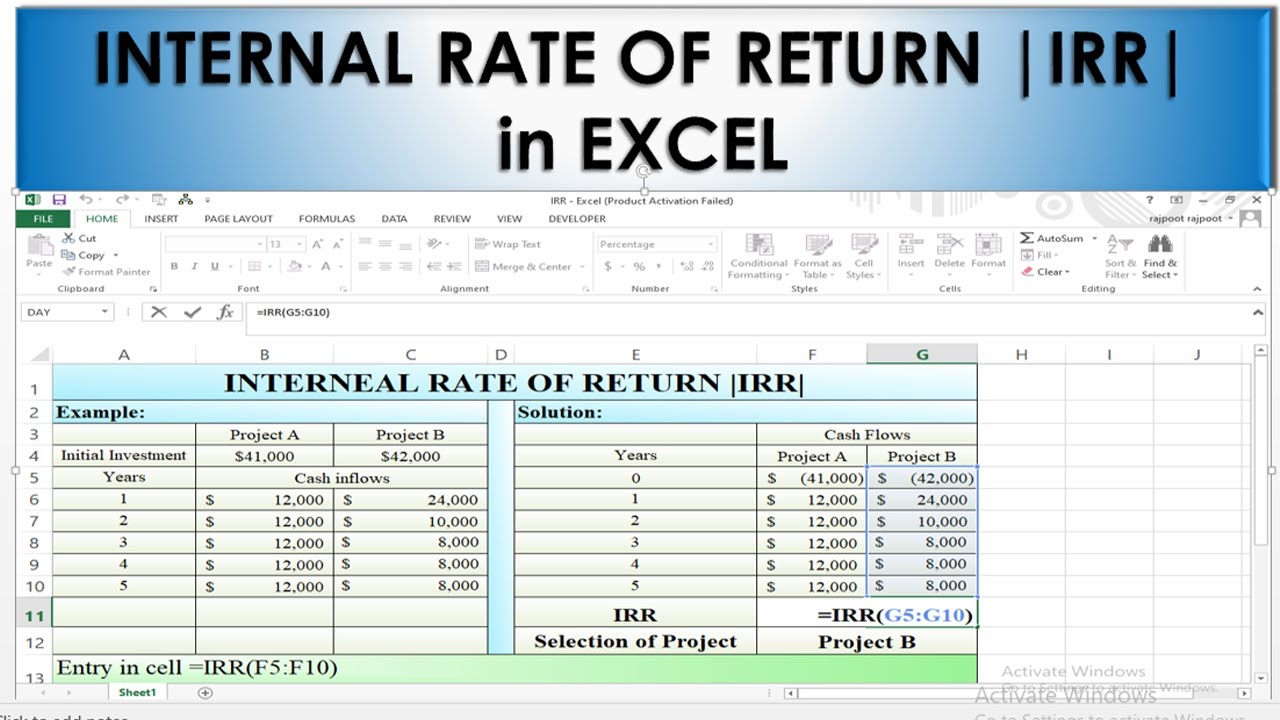

Internal Rate Of Return Excel Template - The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be. Irr, the modified irr (mirr), and irr for different payment periods (xirr). Excel has three functions to calculate the irr:

Irr, the modified irr (mirr), and irr for different payment periods (xirr). Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be. Excel has three functions to calculate the irr: The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero.

Irr, the modified irr (mirr), and irr for different payment periods (xirr). Excel has three functions to calculate the irr: The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be.

How to Calculate IRR in excel Internal Rate of return YouTube

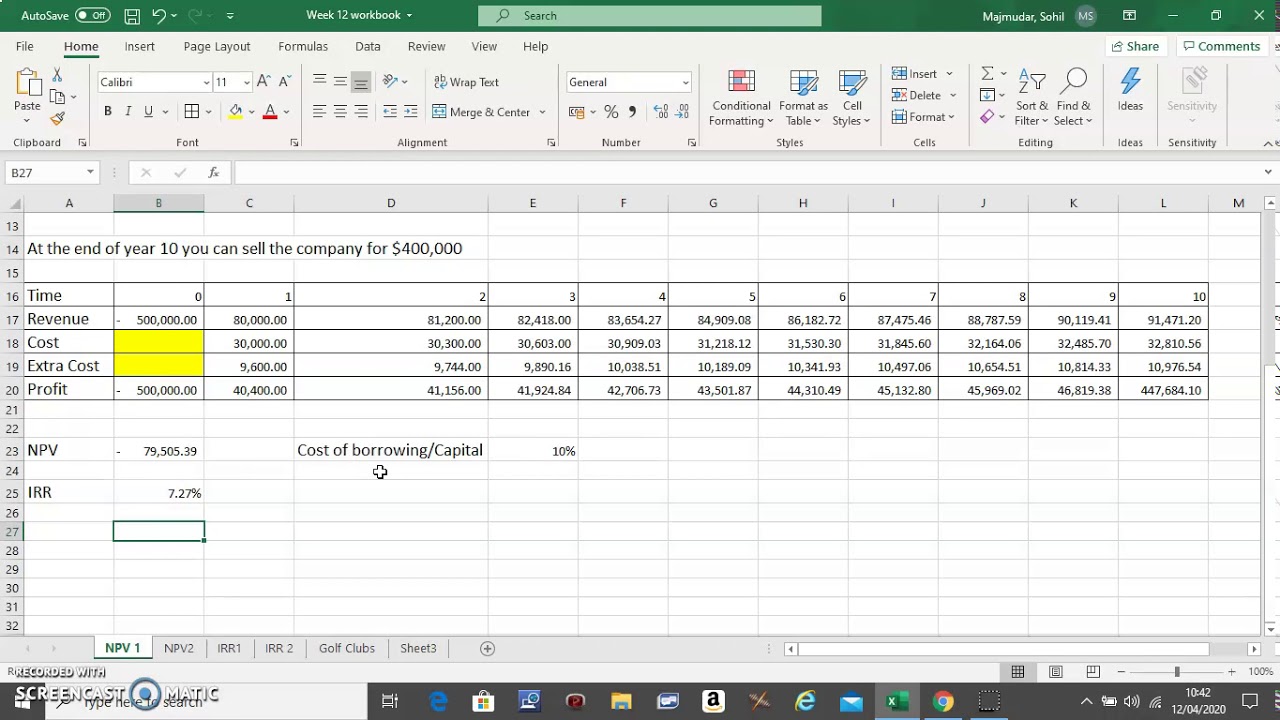

The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be. Excel has three functions to calculate the irr: Irr, the modified irr (mirr), and irr for.

Irr Excel Template

Excel has three functions to calculate the irr: Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be. Irr, the modified irr (mirr), and irr for different payment periods (xirr). The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present.

Internal Rate Of Return Excel Template

The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Irr, the modified irr (mirr), and irr for different payment periods (xirr). Excel has three functions to calculate the irr: Internal rate of return (irr) is a discount rate that is used to identify potential/future.

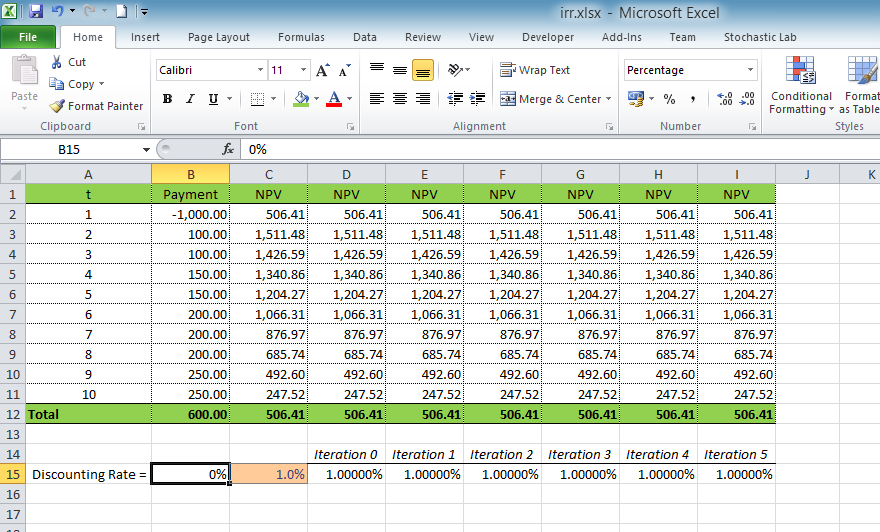

Calculating Internal Rate of Return (IRR) using Excel Excel VBA Templates

Irr, the modified irr (mirr), and irr for different payment periods (xirr). The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Excel has three functions to calculate the irr: Internal rate of return (irr) is a discount rate that is used to identify potential/future.

Understanding The Internal Rate Of Return Method Excel Template And

Irr, the modified irr (mirr), and irr for different payment periods (xirr). Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be. The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Excel has three functions.

Internal Rate Of Return Excel Template

Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be. The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Irr, the modified irr (mirr), and irr for different payment periods (xirr). Excel has three functions.

Internal Rate of Return Calculator Free

Irr, the modified irr (mirr), and irr for different payment periods (xirr). Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be. The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Excel has three functions.

12 Internal Rate Of Return Excel Template Excel Templates Excel

Excel has three functions to calculate the irr: The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Irr, the modified irr (mirr), and irr for different payment periods (xirr). Internal rate of return (irr) is a discount rate that is used to identify potential/future.

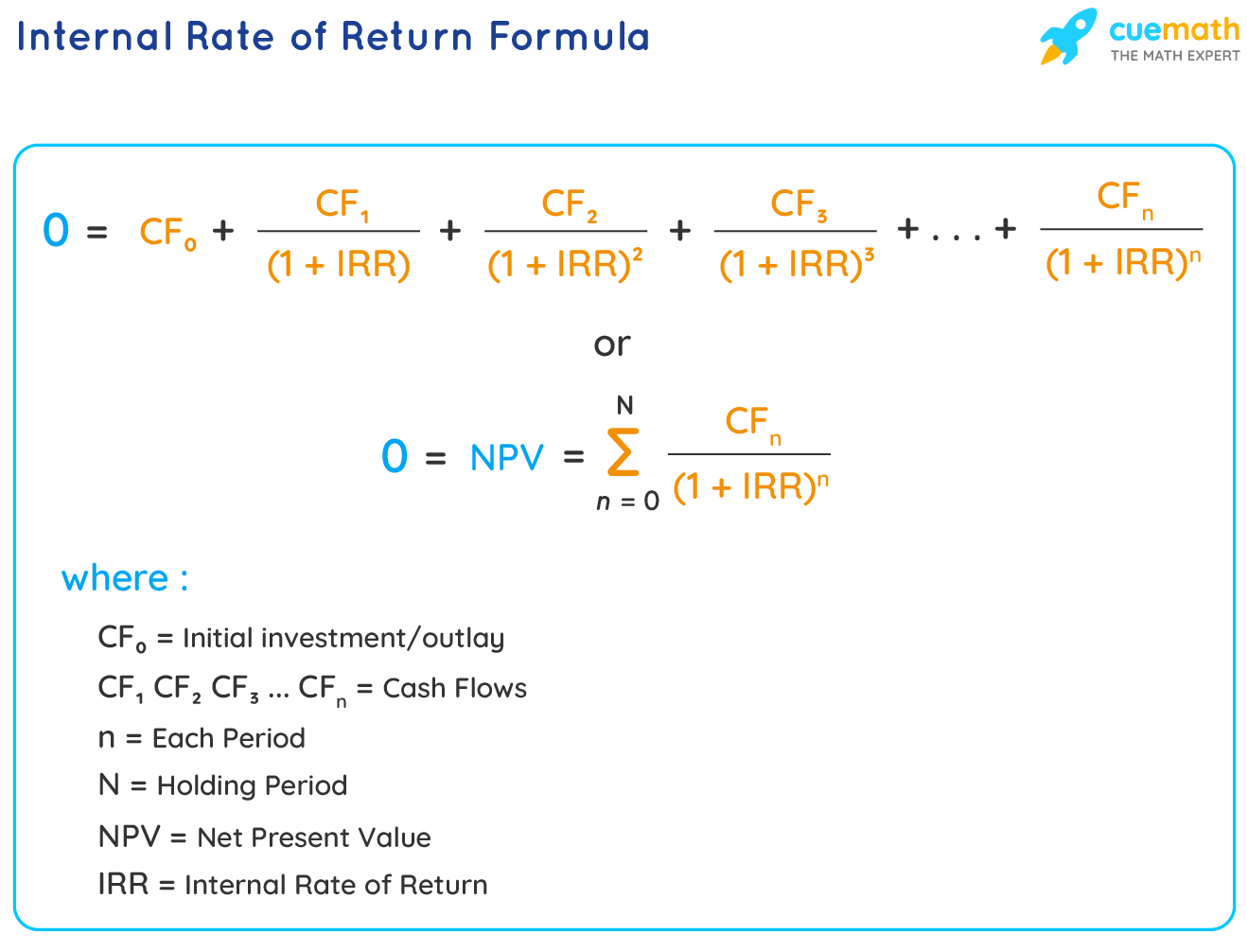

Internal Rate of Return (IRR) Formula and Examples Current Rate

The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Irr, the modified irr (mirr), and irr for different payment periods (xirr). Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be. Excel has three functions.

Internal Rate Of Return

Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be. Irr, the modified irr (mirr), and irr for different payment periods (xirr). The internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero. Excel has three functions.

The Internal Rate Of Return (Irr)—Or The Discounted Cash Flow Rate Of Return—Is The Discount Rate That Makes The Net Present Value Equal To Zero.

Excel has three functions to calculate the irr: Irr, the modified irr (mirr), and irr for different payment periods (xirr). Internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be.

:max_bytes(150000):strip_icc()/IRR_final-9761b2cb70aa42eca108db9f04d3e8c5.png)