Irs Llc Name Change

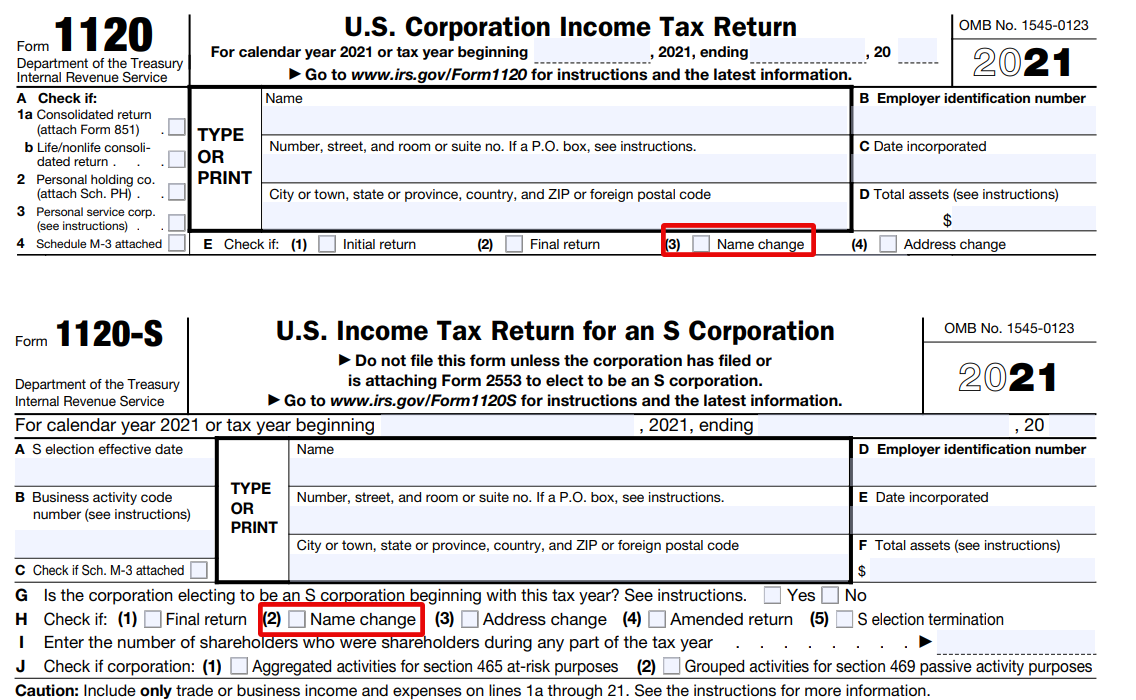

Irs Llc Name Change - The specific action required may vary depending on the type of business. Business owners and other authorized individuals can submit a name change for their business. You need a new ein, in general, when you change your entity’s ownership or structure. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). You don’t need a new ein if you just change your business name or address. If the ein was recently. You can download our irs llc name. Check your entity type to see. Virginia and foreign business entities authorized to do business in virginia can file a name change online. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change.

You can download our irs llc name. Check your entity type to see. Virginia and foreign business entities authorized to do business in virginia can file a name change online. You need a new ein, in general, when you change your entity’s ownership or structure. Business owners and other authorized individuals can submit a name change for their business. You don’t need a new ein if you just change your business name or address. If the ein was recently. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. The specific action required may vary depending on the type of business. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs).

Virginia and foreign business entities authorized to do business in virginia can file a name change online. Business owners and other authorized individuals can submit a name change for their business. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). You don’t need a new ein if you just change your business name or address. The specific action required may vary depending on the type of business. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. You need a new ein, in general, when you change your entity’s ownership or structure. Check your entity type to see. If the ein was recently. You can download our irs llc name.

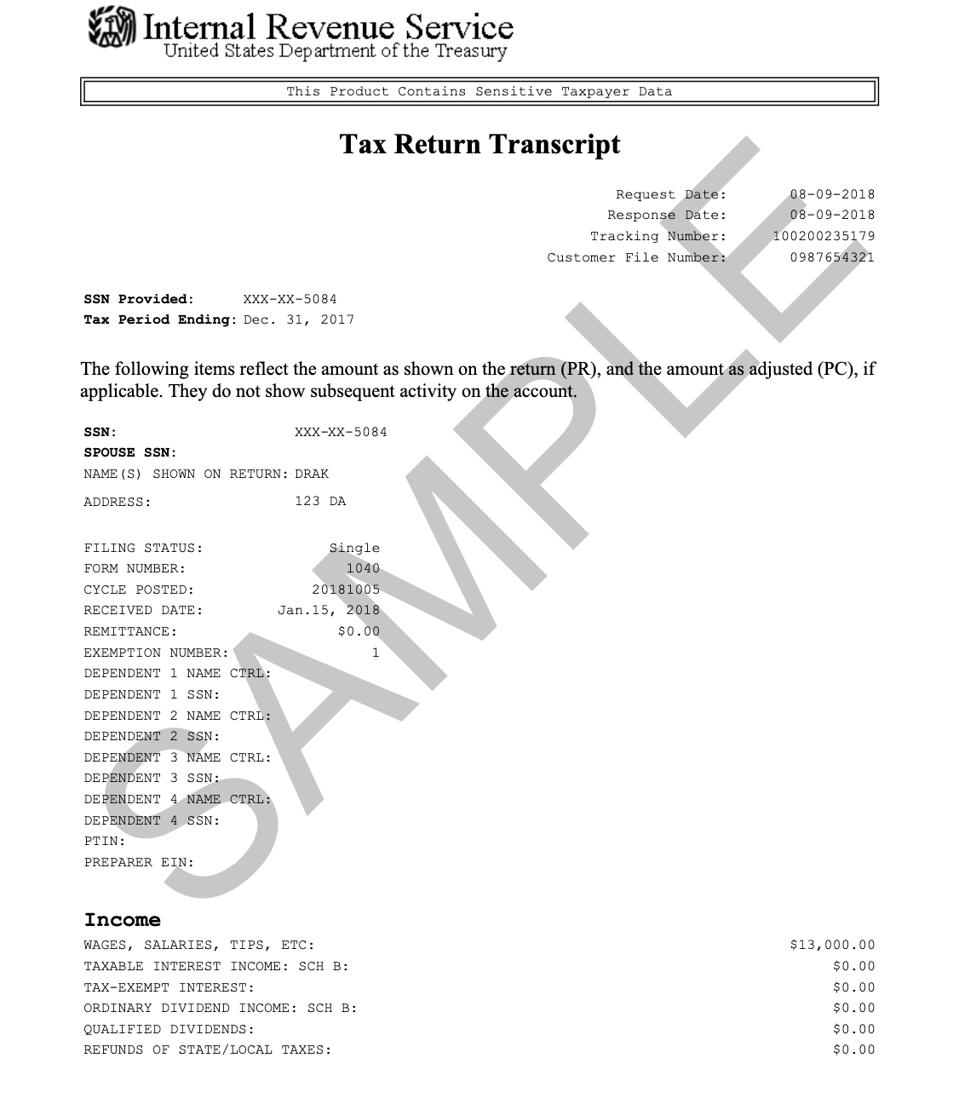

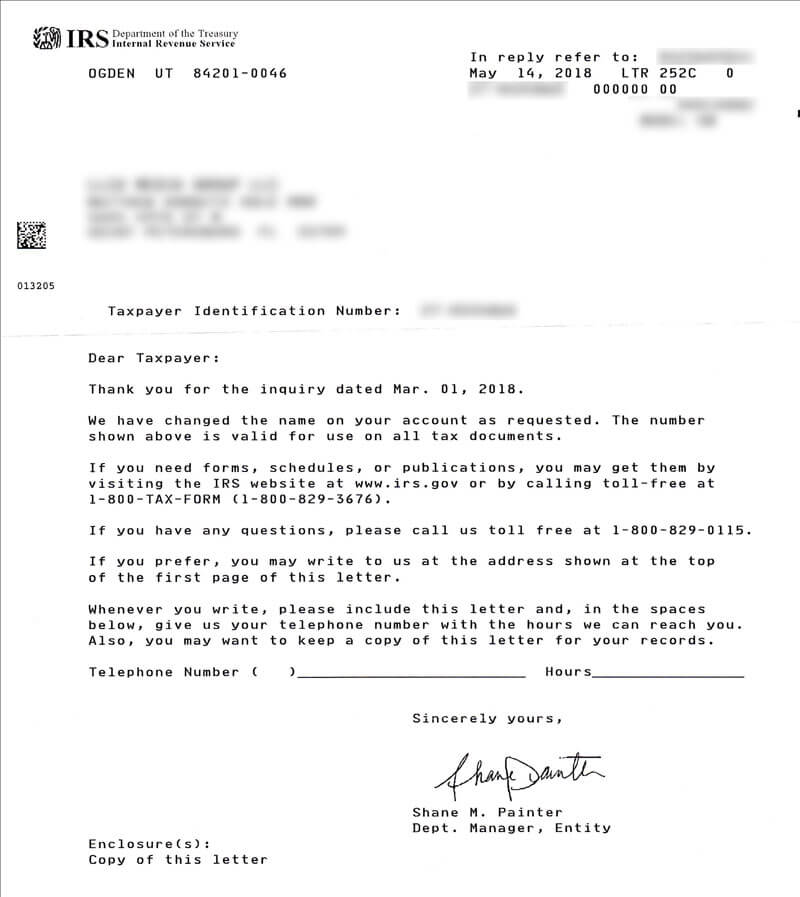

Irs Name Change Letter Sample Change of Beneficiary Form Letter (with

You don’t need a new ein if you just change your business name or address. Business owners and other authorized individuals can submit a name change for their business. You need a new ein, in general, when you change your entity’s ownership or structure. If the ein was recently. Virginia and foreign business entities authorized to do business in virginia.

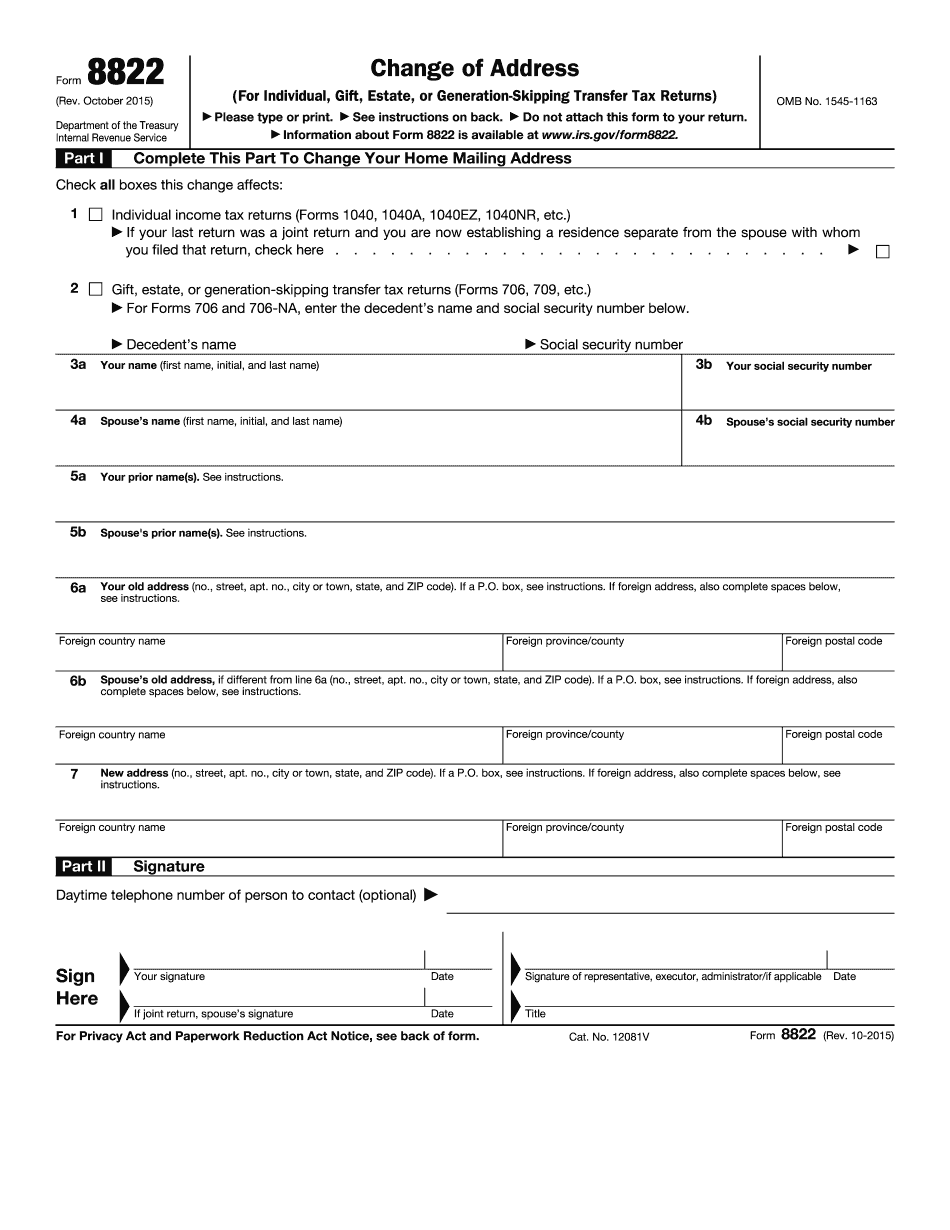

irs name change form Fill Online, Printable, Fillable Blank form

You need a new ein, in general, when you change your entity’s ownership or structure. You can download our irs llc name. The specific action required may vary depending on the type of business. Check your entity type to see. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service.

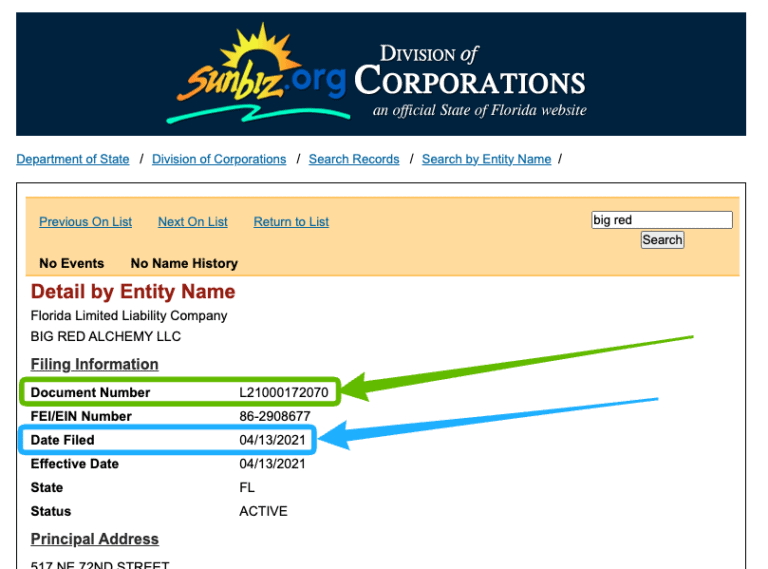

How to Change your LLC Name with the IRS? LLC University®

In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. Check your entity type to see. If the ein was recently. Virginia and foreign business entities authorized to do business in virginia can file a name change online. Corporations and llcs can.

Name Change Letter charlotte clergy coalition

You can download our irs llc name. You don’t need a new ein if you just change your business name or address. Virginia and foreign business entities authorized to do business in virginia can file a name change online. Business owners and other authorized individuals can submit a name change for their business. Corporations and llcs can check the name.

How to Change Your Business Name A Complete Guide

In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. You need a new ein, in general, when you change your entity’s ownership or structure. Corporations and llcs can check the name change box while filing their annual tax return with the.

How to Change the Name of Your LLC [Expert Tutorial] YouTube

Virginia and foreign business entities authorized to do business in virginia can file a name change online. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on the type of business. You don’t need a new ein if you just change your business name or address. If the.

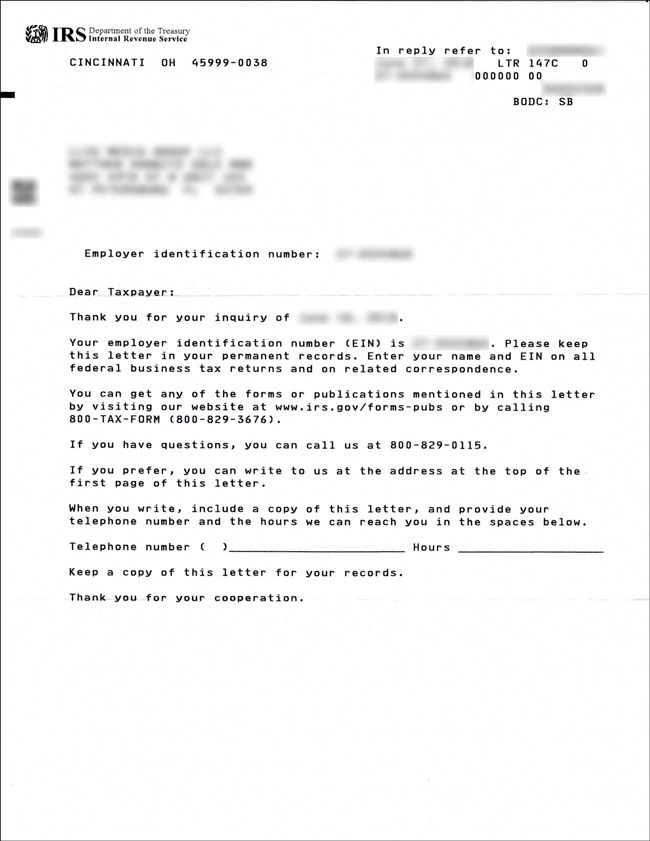

IRS Business Name Change

The specific action required may vary depending on the type of business. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. You need a new ein, in general, when you change your entity’s ownership or structure. Check your entity type to.

How to Change an LLC Name in Florida (Stepbystep) LLCU®

The specific action required may vary depending on the type of business. Check your entity type to see. Business owners and other authorized individuals can submit a name change for their business. In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change..

Irs Business Name Change Letter Template

The specific action required may vary depending on the type of business. You need a new ein, in general, when you change your entity’s ownership or structure. You can download our irs llc name. You don’t need a new ein if you just change your business name or address. Business owners and other authorized individuals can submit a name change.

Business Name Change Irs Sample Letter Irs Ein Name Change Form

Virginia and foreign business entities authorized to do business in virginia can file a name change online. The specific action required may vary depending on the type of business. You need a new ein, in general, when you change your entity’s ownership or structure. If the ein was recently. Business owners and other authorized individuals can submit a name change.

Check Your Entity Type To See.

You can download our irs llc name. You need a new ein, in general, when you change your entity’s ownership or structure. Corporations and llcs can check the name change box while filing their annual tax return with the internal revenue service (irs). Virginia and foreign business entities authorized to do business in virginia can file a name change online.

Business Owners And Other Authorized Individuals Can Submit A Name Change For Their Business.

In order to change your llc name with the irs, you’ll need to mail them a letter and show proof of the state approving your llc name change. You don’t need a new ein if you just change your business name or address. If the ein was recently. The specific action required may vary depending on the type of business.

![How to Change the Name of Your LLC [Expert Tutorial] YouTube](https://i.ytimg.com/vi/dV_ocJN0iJg/maxresdefault.jpg)