Irs Tax Lien Search

Irs Tax Lien Search - Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. To get the total amount due on a tax. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Get tax relief from a tax. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov.

Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. Get tax relief from a tax. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. To get the total amount due on a tax.

To get the total amount due on a tax. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Get tax relief from a tax.

Tax Lien Irs Lien On House House Information Center

Get tax relief from a tax. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. For general lien information, taxpayers may refer to the understanding a federal.

Tax Lien Sale Download Free PDF Tax Lien Taxes

For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. Get tax relief from a tax. To get the total amount due on a tax. If a property owner fails to pay federal taxes,.

How to Tackle IRS Tax Lien or Levy Notice? Internal Revenue Code

Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state.

IRS Liens Archives IRS Office Near Me

For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Search logic mandated by the ucc statute and locates exact matches excluding noise words and abbreviations as provided below. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to.

Tax Lien Records Search Online Background Check Services a la Carte

For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for.

When Does The Irs File A Tax Lien?

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. To get the total amount due on a tax. Get tax relief from.

Notice of Tax Lien IRS RJS LAW Best Tax Attorney San Diego

Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. To get the total amount due on a tax. Get tax relief from a tax. If a property owner fails to.

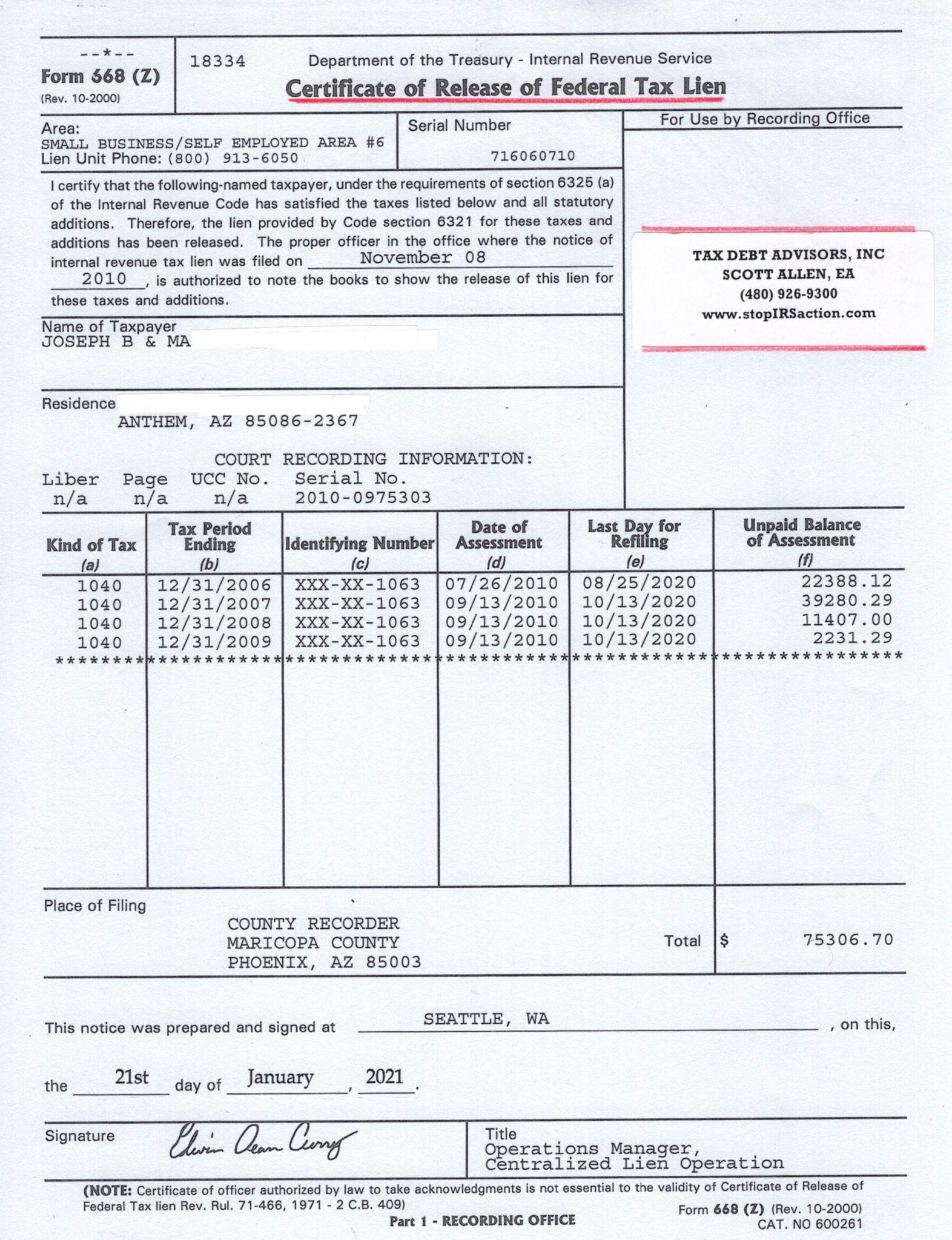

IRS Tax Lien in Arizona IRS help from Tax Debt Advisors, Inc Tax

Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. To get the total amount due on a tax. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Search logic mandated by the ucc.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Get tax relief from a tax. Search logic mandated by the ucc statute and locates exact matches excluding noise words.

What Is IRS Tax Lien? Serving Food That Rocks

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov. Get tax relief from a tax. Search logic mandated by the ucc statute and locates exact matches excluding noise words.

Learn What A Federal Tax Lien Is, How It Affects Your Credit And Assets, And How To Find Out If You Have One.

Get tax relief from a tax. To get the total amount due on a tax. Results include the debtor’s name, address, corporate fein (optional), the lien’s status and the type of filing (flr lien) for each record. For general lien information, taxpayers may refer to the understanding a federal tax lien page on irs.gov.

Search Logic Mandated By The Ucc Statute And Locates Exact Matches Excluding Noise Words And Abbreviations As Provided Below.

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure.