Irs Tax Liens Search

Irs Tax Liens Search - Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Get tax relief from a tax. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Notices of federal tax lien.

For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Get tax relief from a tax. Notices of federal tax lien. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private.

For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Get tax relief from a tax. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Notices of federal tax lien. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois.

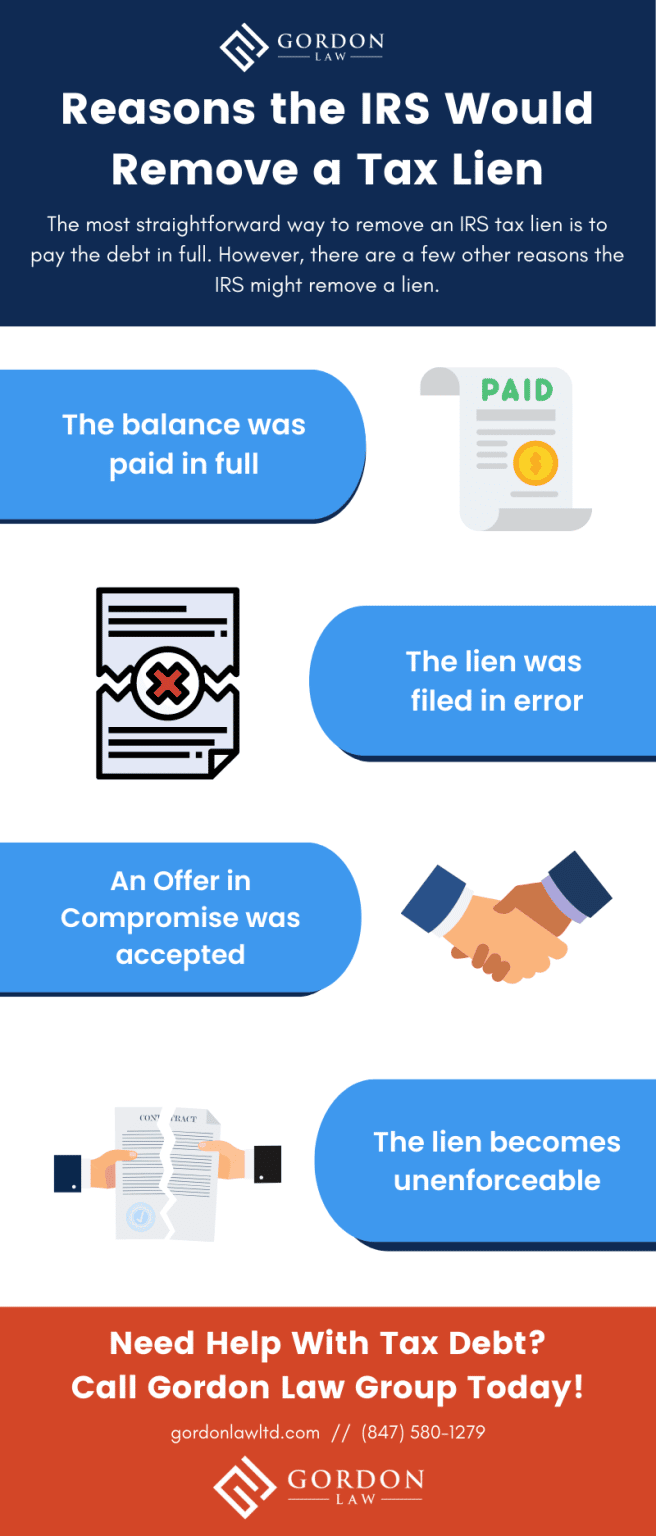

What Are IRS Tax Liens? Gordon Law Group

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Get tax relief from a tax. If a property owner fails to pay federal taxes, the irs files a.

IRS funding repeal would be big gift to tax cheats report

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Notices of federal tax lien. The state tax lien registry is an.

What Are IRS Tax Liens? Gordon Law Group

Get tax relief from a tax. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Learn what a federal tax lien is, how it affects your credit and.

Freaking Out About a Tax Lien? The Expert Can Help!

Get tax relief from a tax. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Learn what a federal tax lien is, how it affects your credit and.

Freaking Out About a Tax Lien? The Expert Can Help!

For general lien information, taxpayers may refer to the understanding a federal tax lien page on. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released.

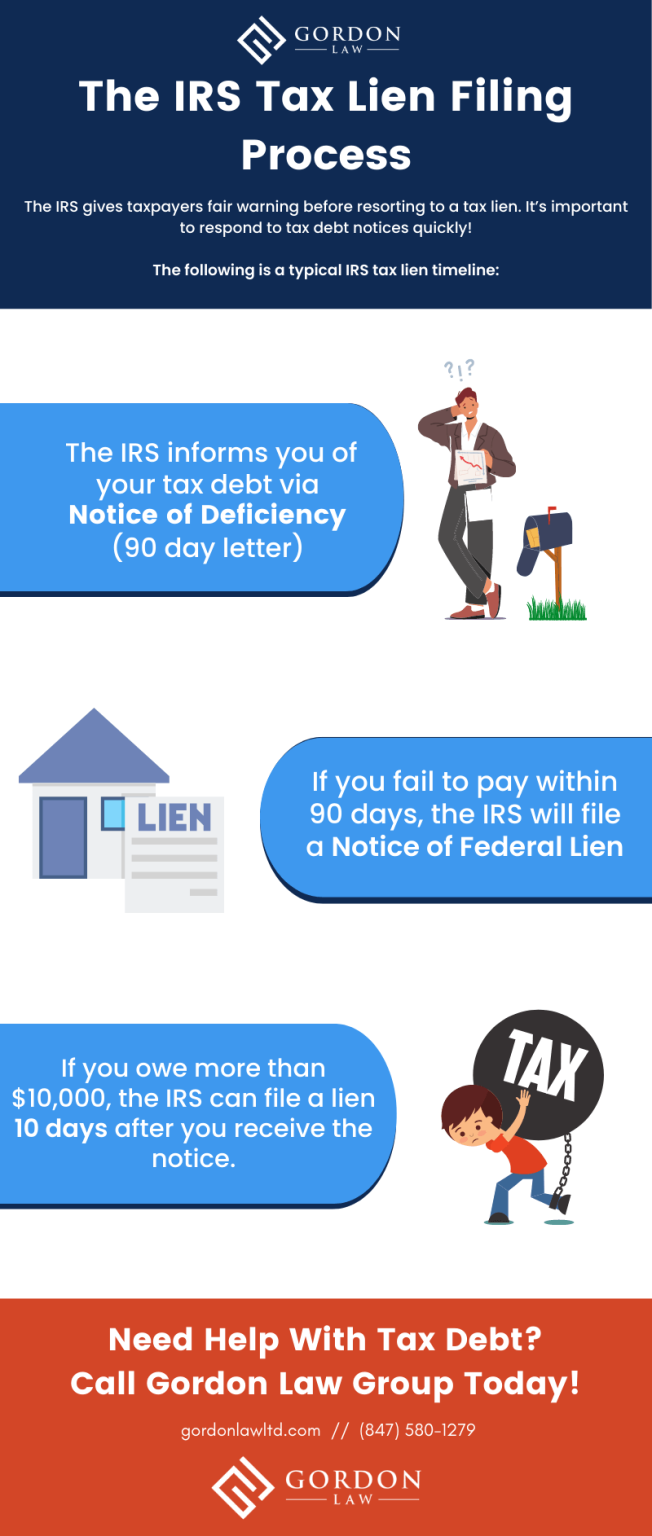

When Are IRS Tax Liens Filed? How Can I Avoid Them? Tax Resolution

Get tax relief from a tax. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. If a property owner fails to pay federal taxes, the irs files a notice of.

IRS Federal Tax Liens Prevention and Removal Processevention and remo…

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. The state tax lien registry is an online, statewide system for maintaining.

IRS Federal Tax Liens Prevention and Removal Process

Get tax relief from a tax. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. If a property owner fails to pay federal taxes, the irs files a notice of.

IRS Liens Archives IRS Office Near Me

You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. For general lien information, taxpayers may refer to the understanding.

What Are IRS Tax Liens? Gordon Law Group

Notices of federal tax lien. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Get tax relief from a tax. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a.

The State Tax Lien Registry Is An Online, Statewide System For Maintaining Notices Of Tax Liens Filed Or Released That Are Enforced By The Illinois.

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Get tax relief from a tax. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Notices of federal tax lien.

You Can Search For A Federal Tax Lien At The Recorder's Office In The Taxpayer's Home County And State, Or You Can Use A Private.

For general lien information, taxpayers may refer to the understanding a federal tax lien page on.