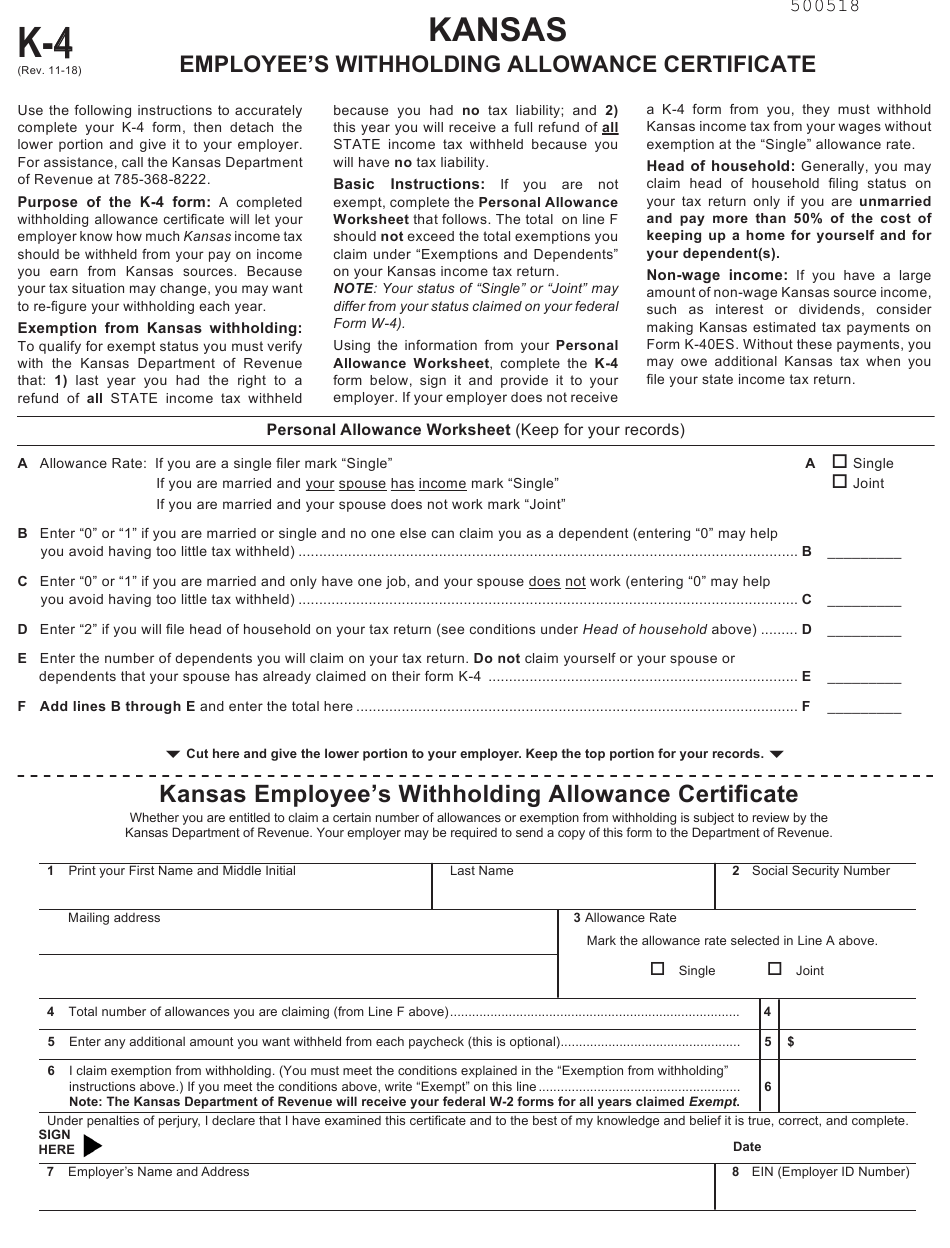

Kansas Tax Withholding Form

Kansas Tax Withholding Form - For assistance, call kdor (kansas department of. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law.

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. For assistance, call kdor (kansas department of. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income.

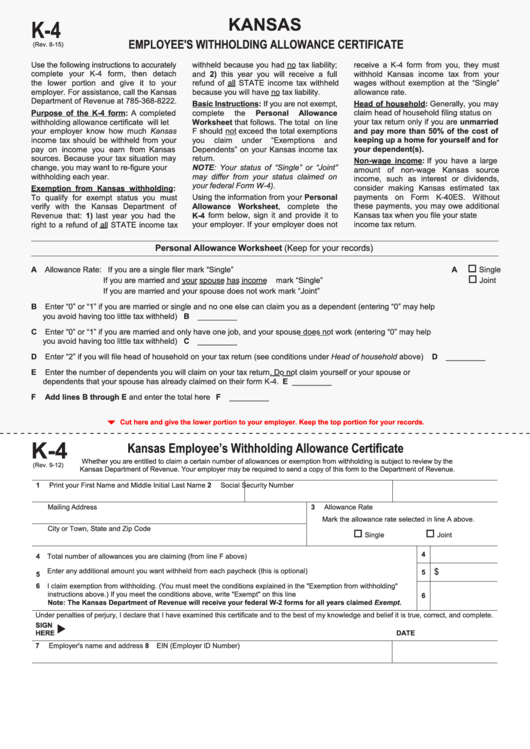

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. For assistance, call kdor (kansas department of. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a.

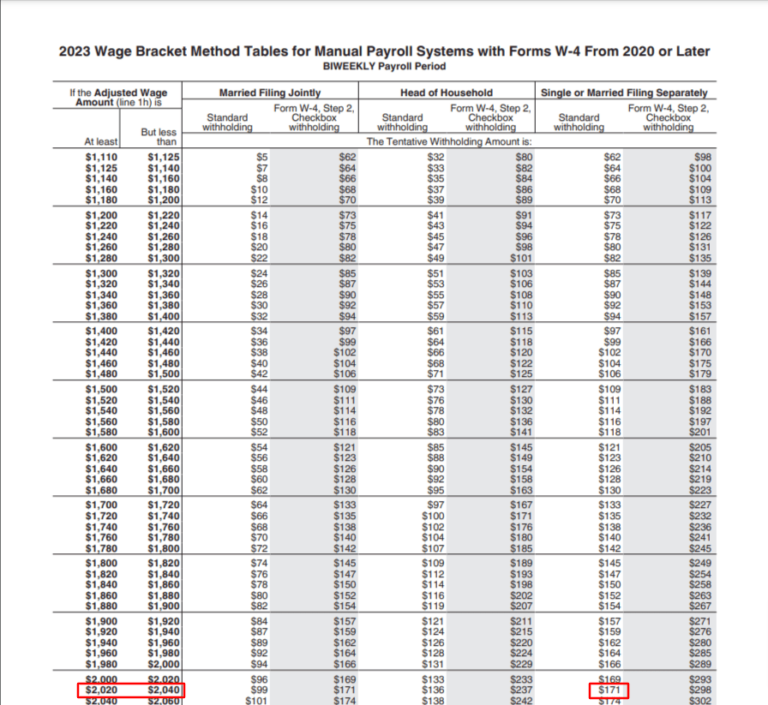

How Much Withholding You Should Claim and How to Change It

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. For assistance, call.

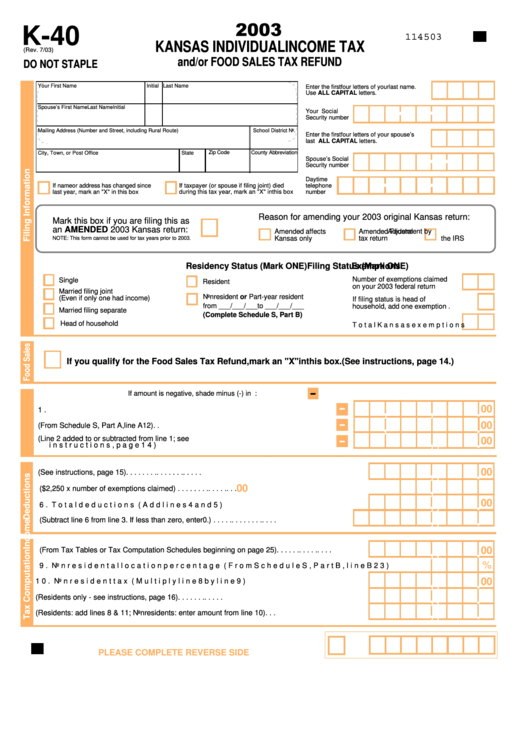

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. An employer must withhold kansas tax.

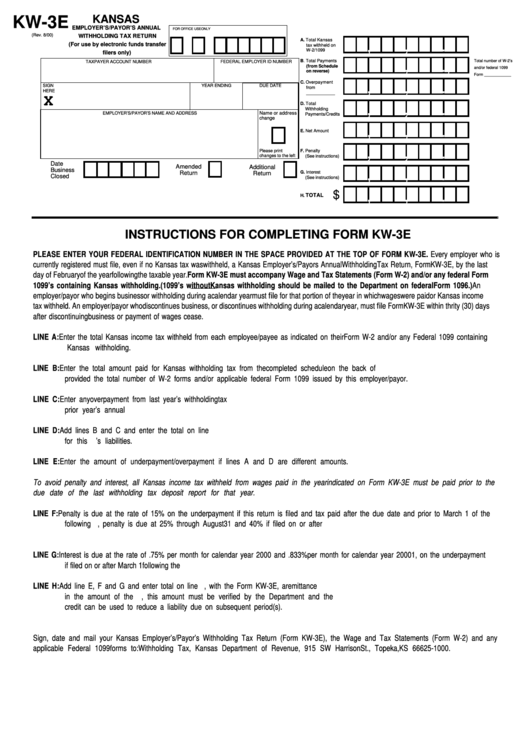

Form Kw3e Kansas Employer'S/payor'S Annual Withholding Tax Return

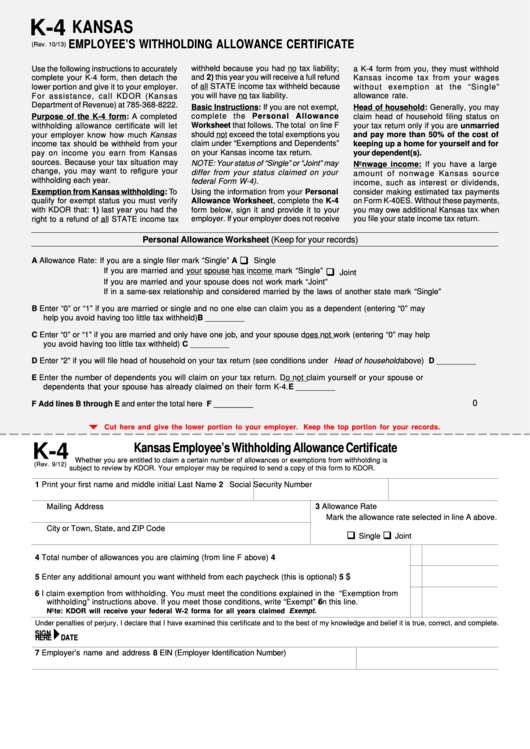

An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required.

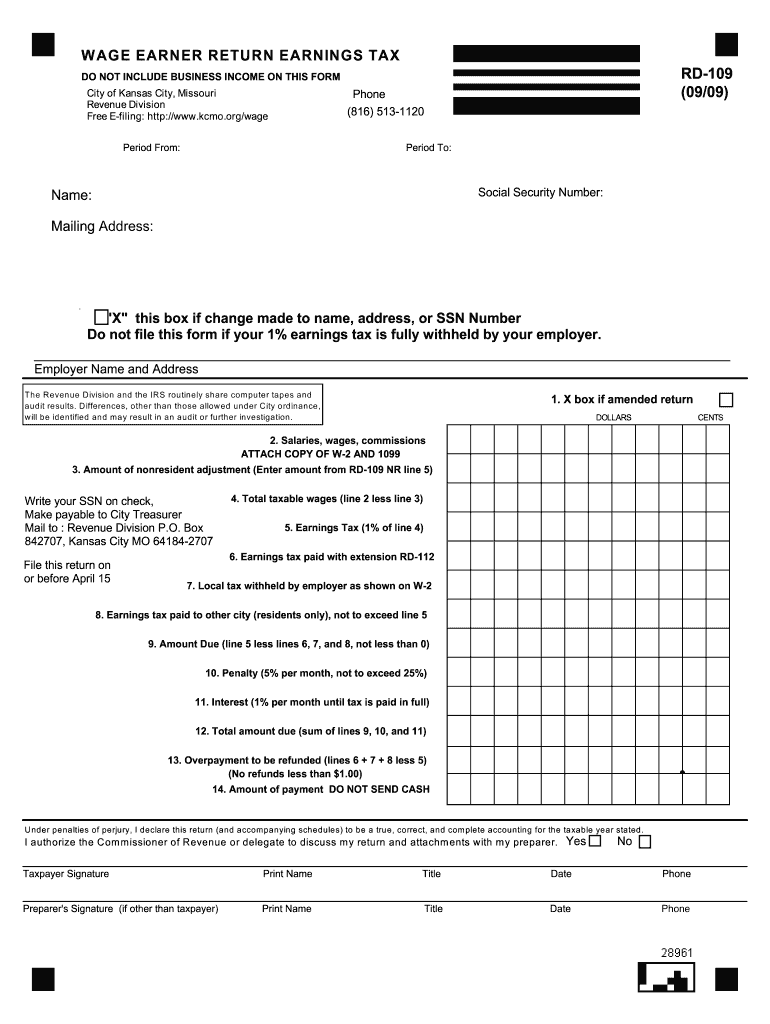

Kansas City Earnings Tax Form Rd 109 Fill Out and Sign Printable PDF

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Since july 1,.

Kansas State Tax 2024 Prudi Regine

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. For assistance, call kdor (kansas department of. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. Use this form to report the kansas income tax withheld from wages and/or.

Kansas Unemployment Tax Withholding Form

Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required.

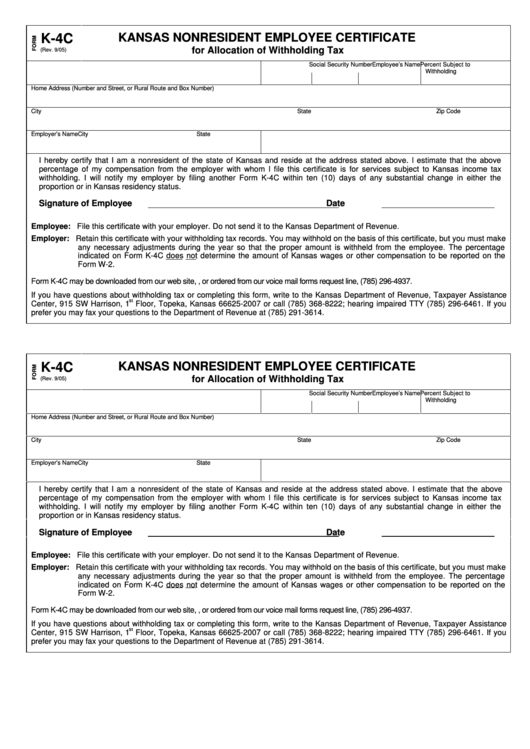

Fillable Form K4c Kansas Nonresident Employee Certificate For

Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. For assistance, call kdor (kansas department of. An employer must withhold kansas tax if the employee is a resident of kansas, performing services.

Kansas Withholding Form 2024 Pepi Trisha

For assistance, call kdor (kansas department of. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside.

Kansas Tax Exempt Form Lodging

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income. A completed withholding allowance certificate will let your employer know how much kansas income tax should be. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law. Since july.

Kansas W4 Form 2024

A completed withholding allowance certificate will let your employer know how much kansas income tax should be. An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

A Completed Withholding Allowance Certificate Will Let Your Employer Know How Much Kansas Income Tax Should Be.

An employer must withhold kansas tax if the employee is a resident of kansas, performing services inside or outside of kansas, or a. Since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax returns electronically. For assistance, call kdor (kansas department of. Use this form to report the kansas income tax withheld from wages and/or other taxable payments as required by law.

Withholding Allowance Certificate Will Let Your Employer Know How Much Kansas Income Tax Should Be Withheld From Your Pay On Income.

A completed withholding allowance certificate will let your employer know how much kansas income tax should be.