Kentucky Locality Tax

Kentucky Locality Tax - Click here for more information. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. We have information on the local income tax rates in 218 localities in kentucky. Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms. File your current year return electronically ky file allows everyone to. You can click on any city or county for more details, including the. Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Keeping you updated on tax law changes.

Click here for more information. We have information on the local income tax rates in 218 localities in kentucky. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. You can click on any city or county for more details, including the. Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms. File your current year return electronically ky file allows everyone to. Keeping you updated on tax law changes.

Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. File your current year return electronically ky file allows everyone to. You can click on any city or county for more details, including the. We have information on the local income tax rates in 218 localities in kentucky. Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Keeping you updated on tax law changes. Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms. Click here for more information. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically.

Sparks Tax and Accounting Services Topeka KS

You can click on any city or county for more details, including the. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties.

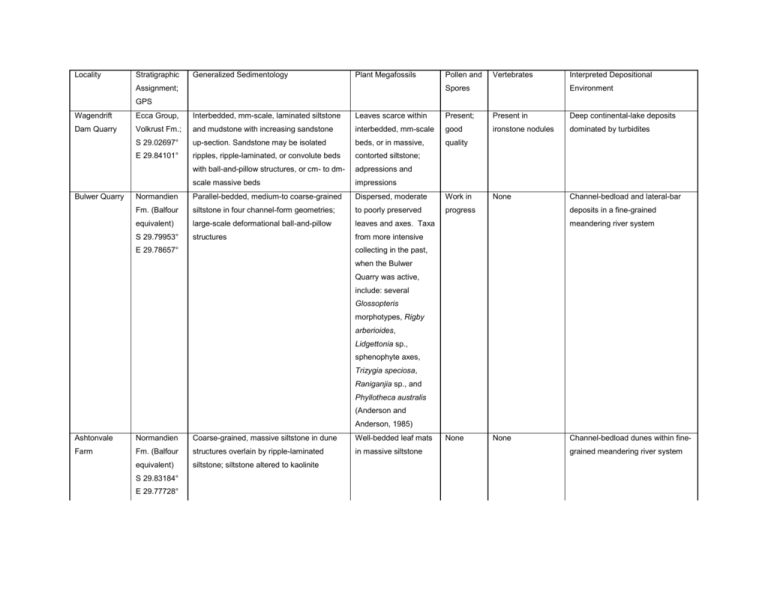

Locality

We have information on the local income tax rates in 218 localities in kentucky. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically..

TAX Consultancy Firm Gurugram

Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. File your current year return electronically ky file allows everyone to. Keeping you updated on tax law changes. Click here for more information. We have information on the local income tax rates in 218 localities.

How to Get Kentucky Sales Tax Permit A Comprehensive Guide

Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. Keeping you updated on tax law changes. You can click on any city or.

2025 NonLocality BAH Rates

Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms. Click here for more information. Keeping you updated on tax law changes. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income..

Locality Homes

Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms. Ky constitution and krs 92.280 require every city to annually tax all.

News Locality Bank

Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. You can click on any city or county for more details, including the. Keeping you updated on tax law changes. Residents of louisville pay a flat city income tax of 2.20% on earned income, in.

35+ Thrilling Locality Quotes That Will Unlock Your True Potential

Keeping you updated on tax law changes. Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income. We have information.

Ultimate Kentucky Sales Tax Guide Zamp

Keeping you updated on tax law changes. File your current year return electronically ky file allows everyone to. Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction.

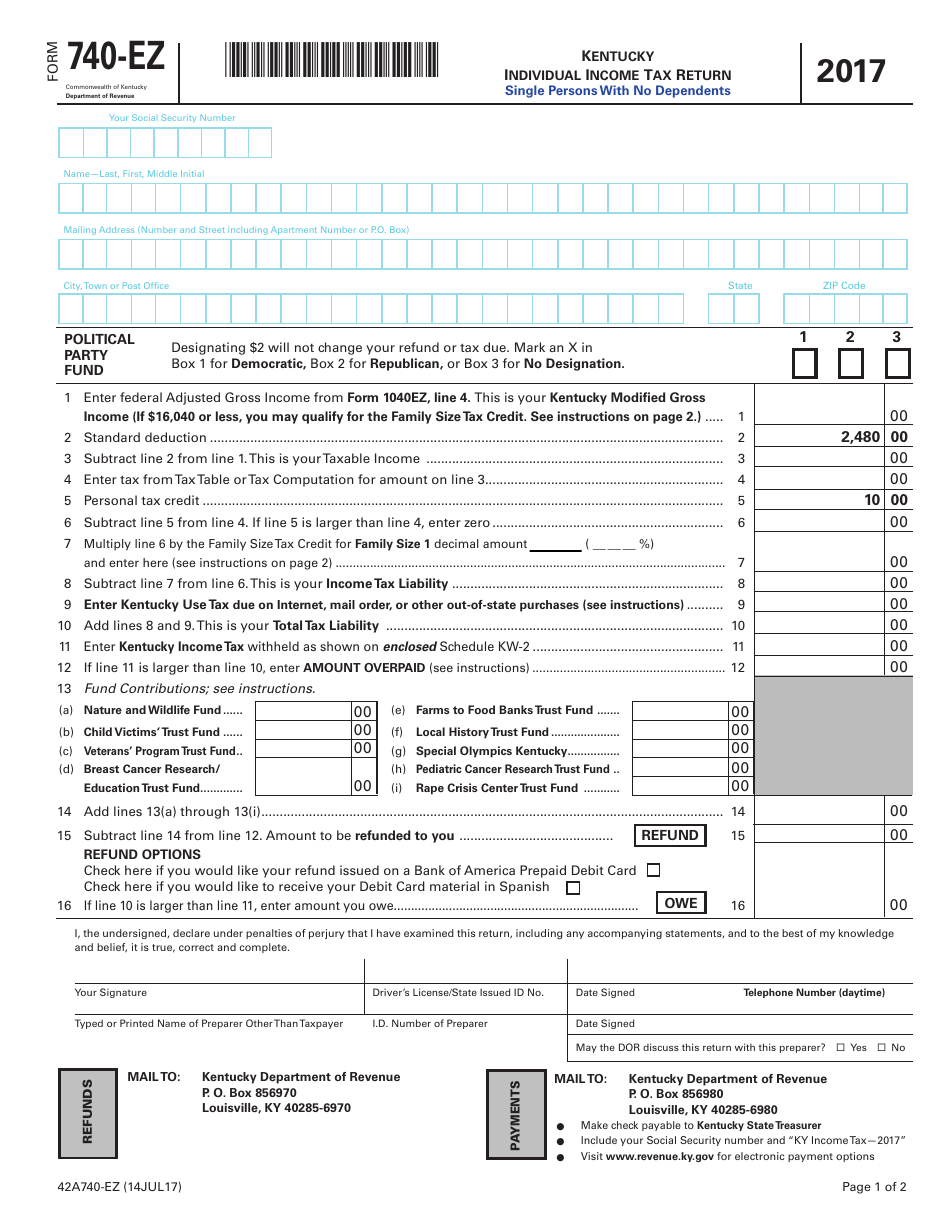

Form 740EZ 2017 Fill Out, Sign Online and Download Fillable PDF

File your current year return electronically ky file allows everyone to. Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. Keeping you updated.

You Can Click On Any City Or County For More Details, Including The.

Kentucky local income tax rates on top of kentucky’s state flat income tax rate of 4.0 in 2024, some of its counties and cities also. Many cities and counties require a local business license and/or impose an occupational tax or other type of tax on individuals and firms. File your current year return electronically ky file allows everyone to. We have information on the local income tax rates in 218 localities in kentucky.

Click Here For More Information.

Keeping you updated on tax law changes. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically. Residents of louisville pay a flat city income tax of 2.20% on earned income, in addition to the kentucky income tax and the federal income.