Local Business Tax Receipt Florida

Local Business Tax Receipt Florida - When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30. The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to.

When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30. The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to.

The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to. When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30.

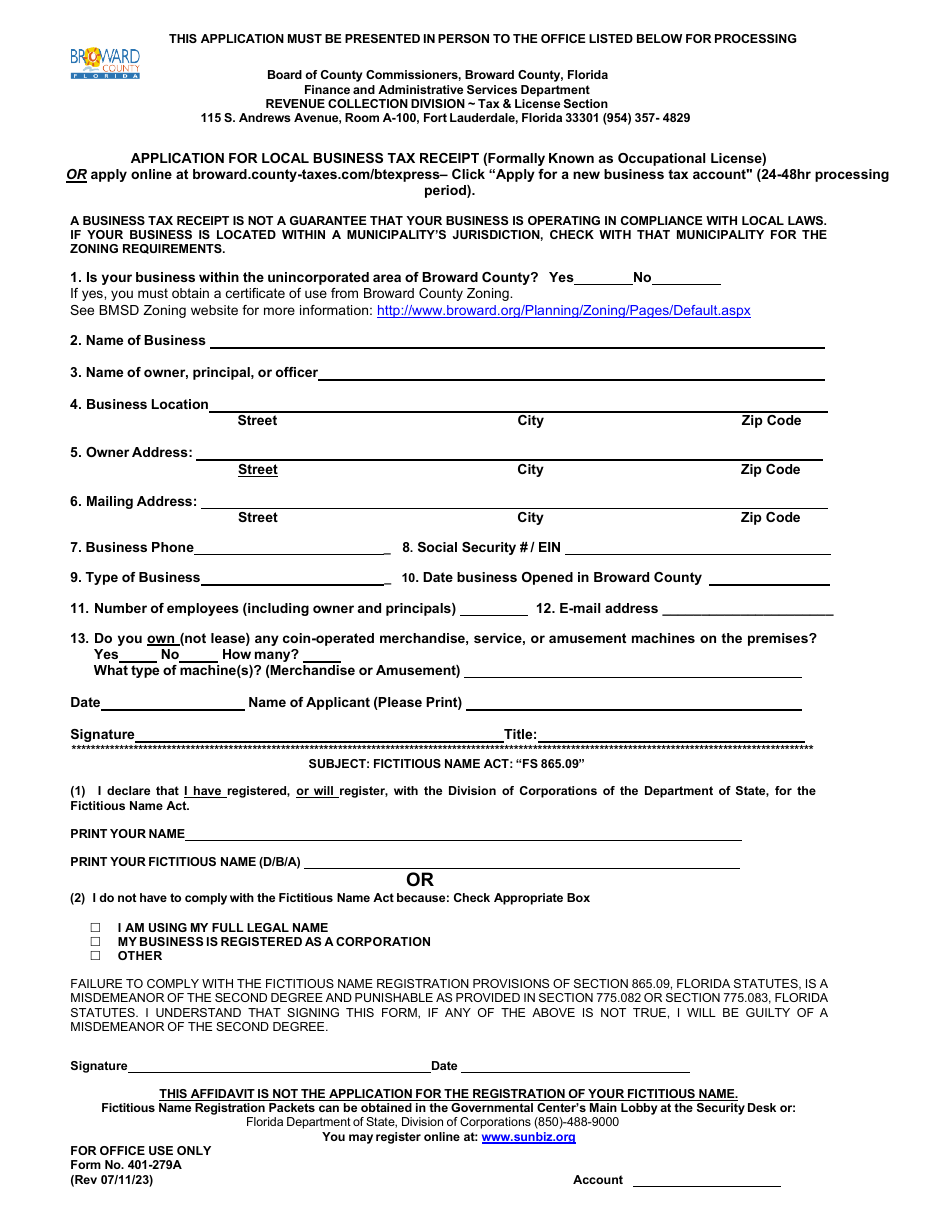

Form 401279A Download Printable PDF or Fill Online Application for

When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30. The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to.

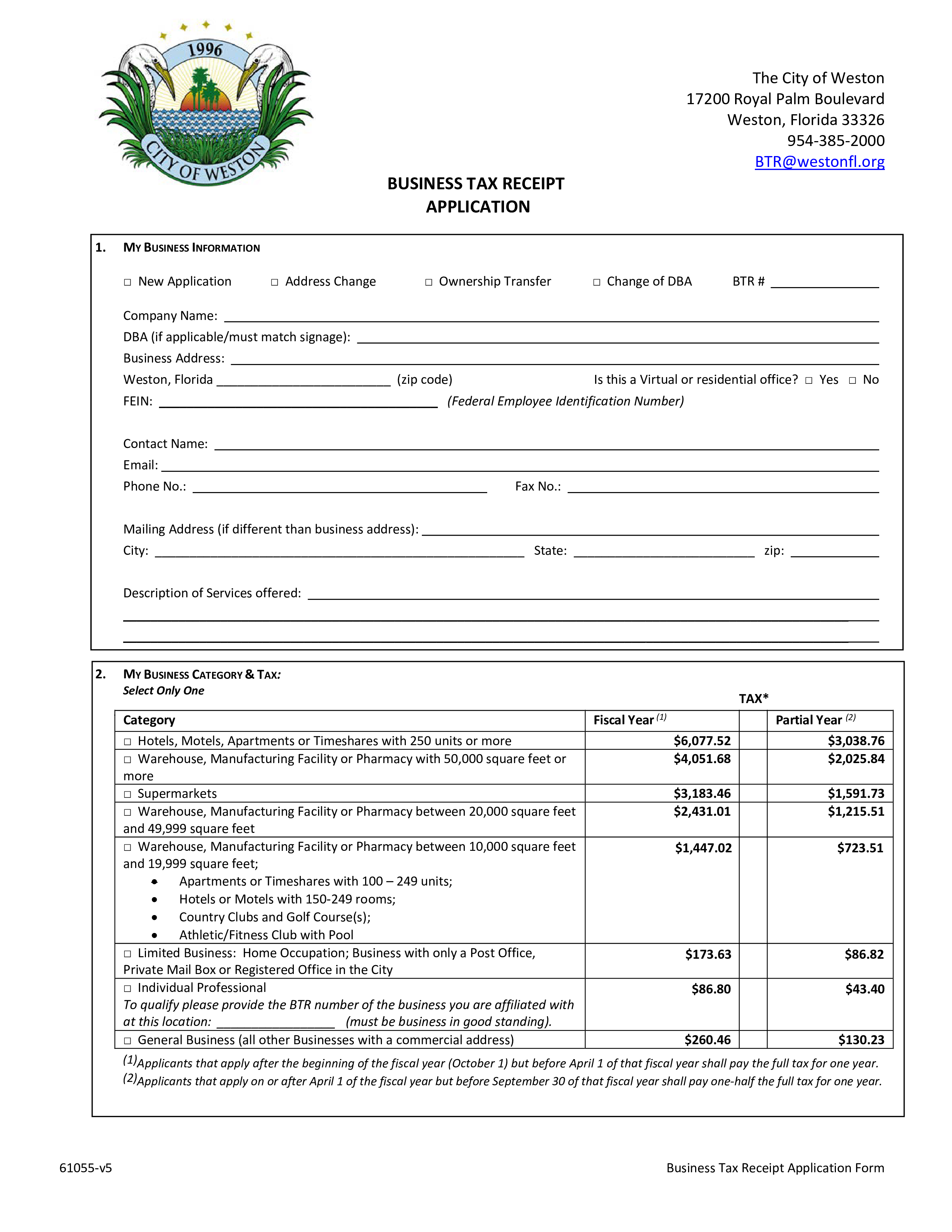

Kostenloses Printable Business Tax Receipt Application

The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to. When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30.

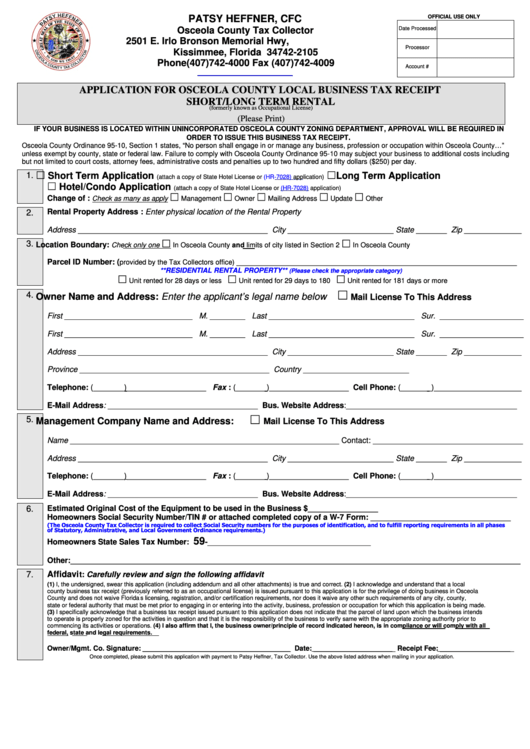

Fillable Application For Osceola County Local Business Tax Receipt Form

When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30. The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to.

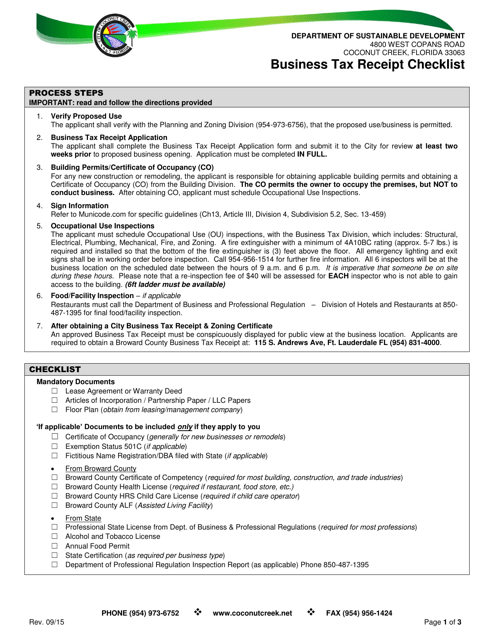

Application For Local Business Tax Receipt Application For Local

When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30. The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to.

City of Coconut Creek, Florida Business Tax Receipt Application Fill

When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30. The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to.

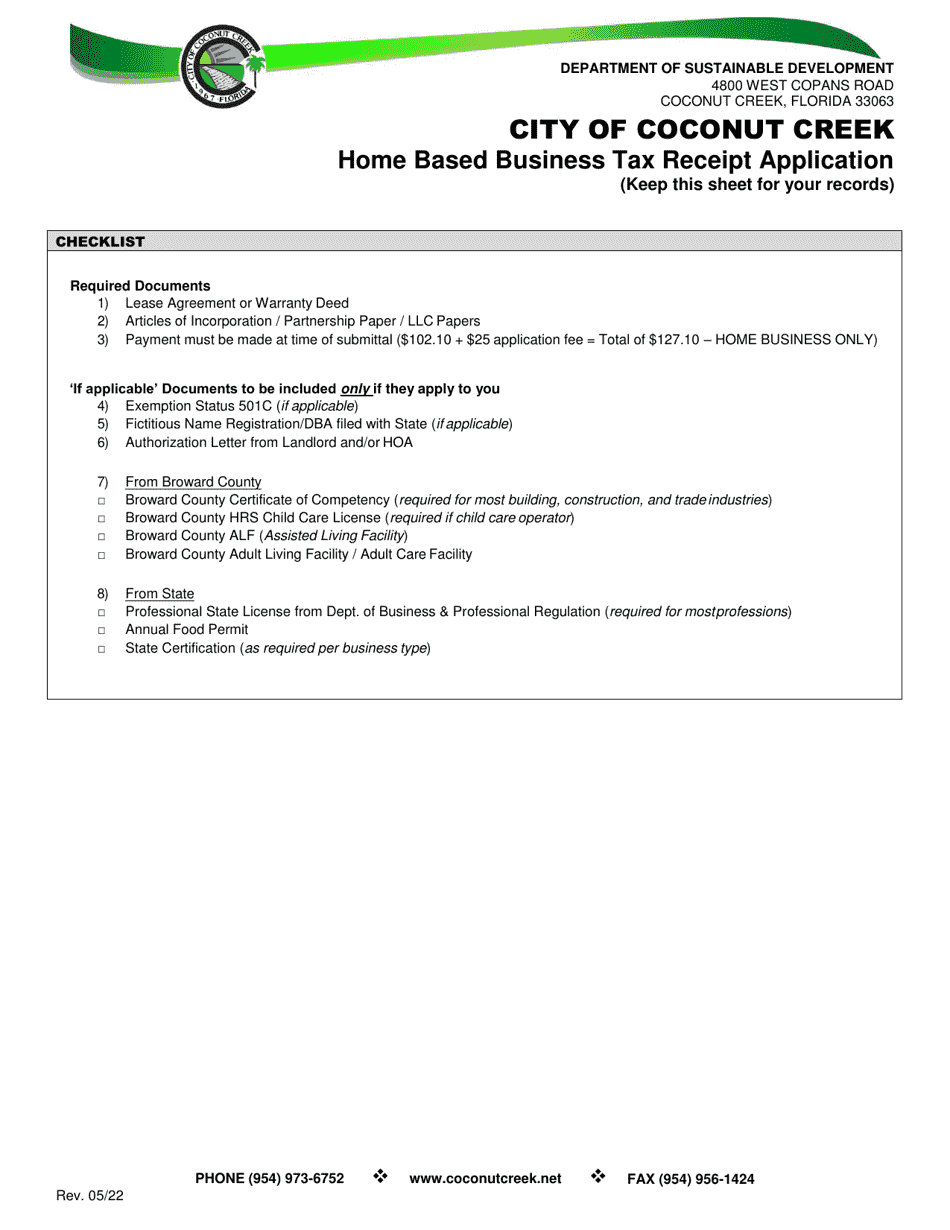

City of Coconut Creek, Florida Home Based Business Tax Receipt

When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30. The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to.

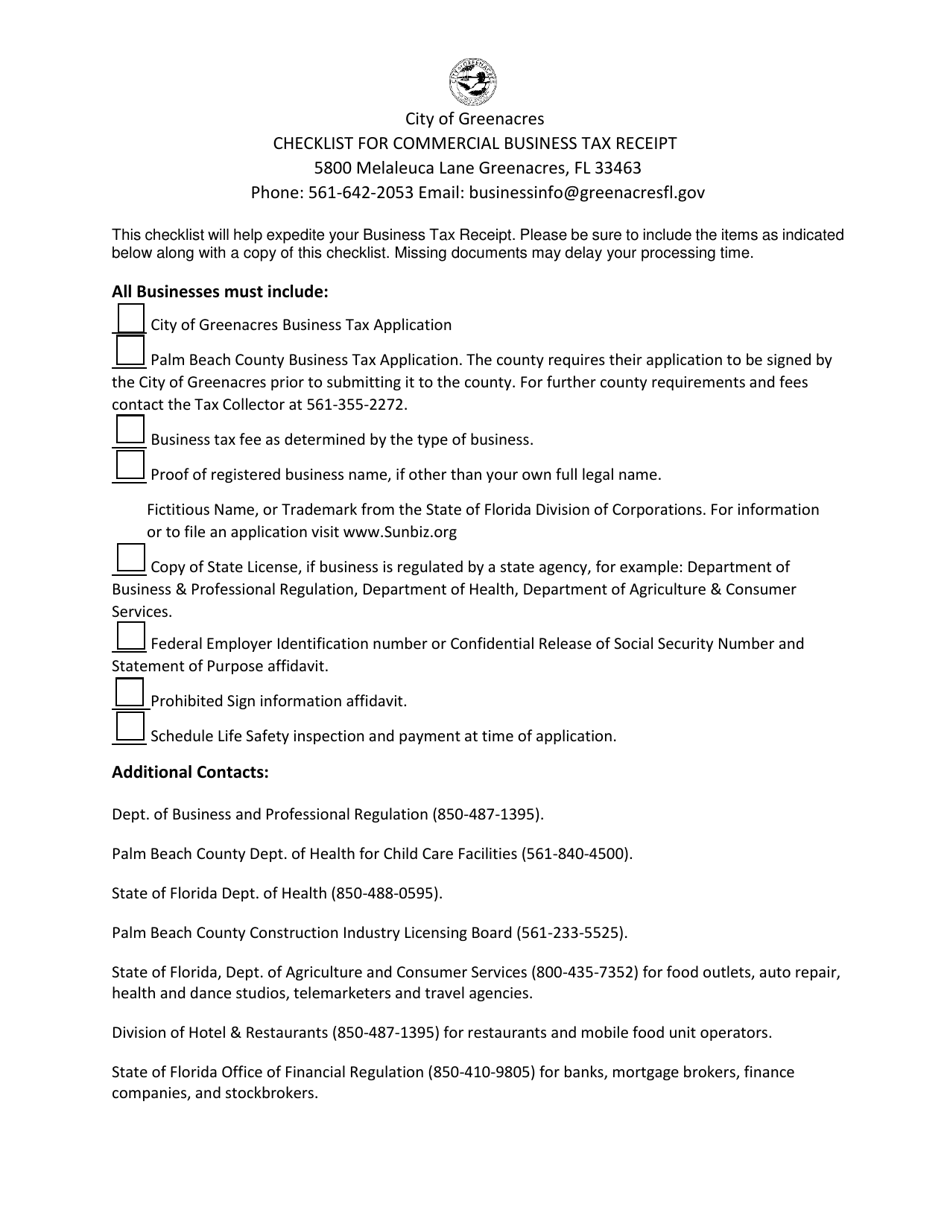

City of Greenacres, Florida Checklist for Commercial Business Tax

When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30. The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to.

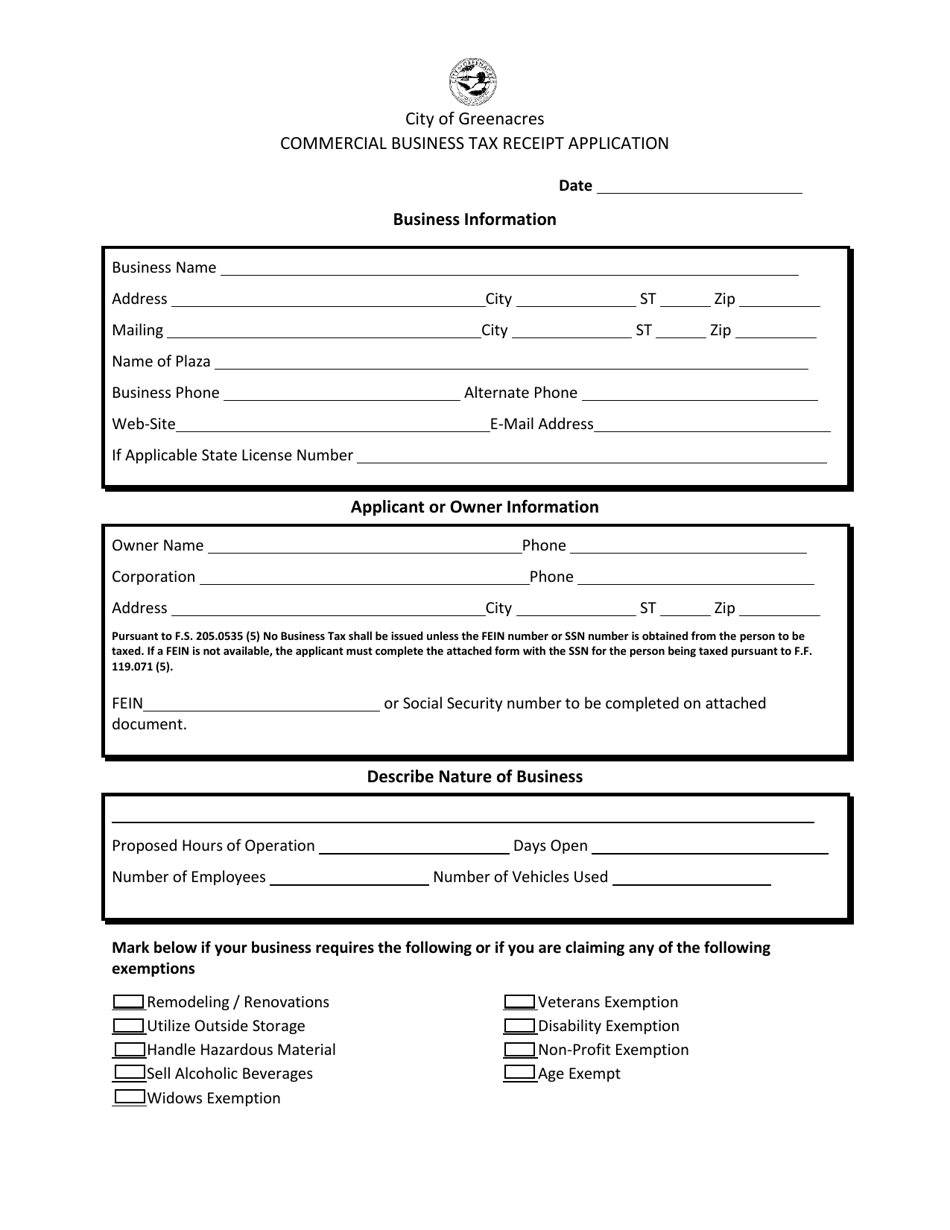

City of Greenacres, Florida Commercial Business Tax Receipt Application

The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to. When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30.

How to Register for Your Florida County's Annual Local Business Tax Receipt

When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30. The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to.

Broward County Business Tax Receipt Master of Documents

When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30. The registration and payment for the local business tax receipt can be completed at the tax collector main office or sent via mail to.

The Registration And Payment For The Local Business Tax Receipt Can Be Completed At The Tax Collector Main Office Or Sent Via Mail To.

When you pay a local business tax, you receive a local business tax receipt, which is valid for one year, from october 1 through september 30.