Local Tax Rates Pa

Local Tax Rates Pa - We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. The first two (2) digits of a psd code represent the tax. You can click on any city or county for more details, including. Municipality and school district tax rates. For detailed and historic tax information, please see the tax compendium. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). View and sort psd codes & eit rates by county, municipality, and school district. Common level ratio factor (clr) for real estate valuation. Here is a link where you can enter the name of the municipality where you live and it will give you a list of taxes and rates for that. Municipalities in pennsylvania by county and class.

For detailed and historic tax information, please see the tax compendium. View and sort psd codes & eit rates by county, municipality, and school district. The first two (2) digits of a psd code represent the tax. Municipality and school district tax rates. You can click on any city or county for more details, including. Here is a link where you can enter the name of the municipality where you live and it will give you a list of taxes and rates for that. We have information on the local income tax rates in 12 localities in pennsylvania. Municipalities in pennsylvania by county and class. Common level ratio factor (clr) for real estate valuation. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst).

The first two (2) digits of a psd code represent the tax. Municipality and school district tax rates. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). For detailed and historic tax information, please see the tax compendium. Common level ratio factor (clr) for real estate valuation. Municipalities in pennsylvania by county and class. View and sort psd codes & eit rates by county, municipality, and school district. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. You can click on any city or county for more details, including. Here is a link where you can enter the name of the municipality where you live and it will give you a list of taxes and rates for that.

Trust tax rates KTS Chartered Accountants

The first two (2) digits of a psd code represent the tax. Municipalities in pennsylvania by county and class. Common level ratio factor (clr) for real estate valuation. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). For detailed and historic tax information, please see the.

The World's Highest Corporate Tax Rates 2010

View and sort psd codes & eit rates by county, municipality, and school district. Common level ratio factor (clr) for real estate valuation. For detailed and historic tax information, please see the tax compendium. Municipality and school district tax rates. You can click on any city or county for more details, including.

Combined State and Average Local Sales Tax Rates Tax Foundation

Municipality and school district tax rates. We have information on the local income tax rates in 12 localities in pennsylvania. For detailed and historic tax information, please see the tax compendium. You can click on any city or county for more details, including. Here is a link where you can enter the name of the municipality where you live and.

State and Local Sales Tax Rates Sales Taxes Tax Foundation

Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). The first two (2) digits of a psd code represent the tax. We have information on the local income tax rates in 12 localities in pennsylvania. Here is a link where you can enter the name of.

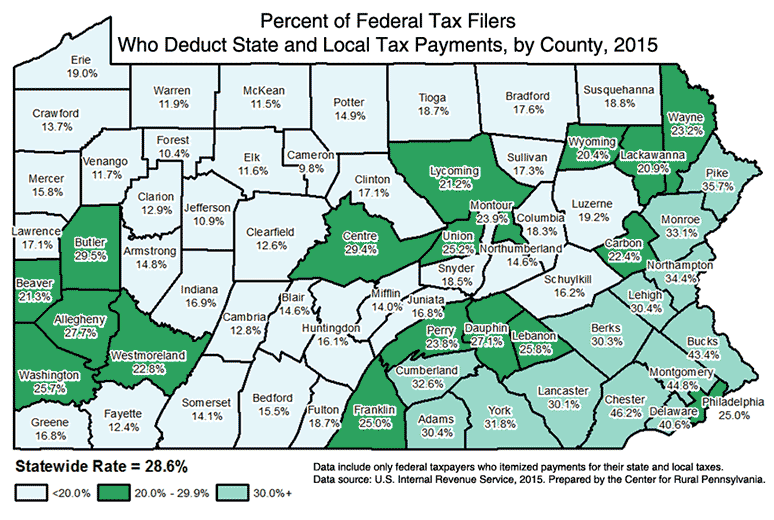

DataGrams Center for Rural PA

The first two (2) digits of a psd code represent the tax. Municipality and school district tax rates. View and sort psd codes & eit rates by county, municipality, and school district. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). Common level ratio factor (clr).

Monday Map State and Local Sales Tax Rates, 2011 Tax Foundation

You can click on any city or county for more details, including. Here is a link where you can enter the name of the municipality where you live and it will give you a list of taxes and rates for that. Common level ratio factor (clr) for real estate valuation. Municipality and school district tax rates. For detailed and historic.

State and Local Sales Tax Rates Midyear 2013 Tax Foundation

Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). You can click on any city or county for more details, including. We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. View and sort psd.

TAX AND SOCIAL SECURITY IN BELGIUM Law Right

The first two (2) digits of a psd code represent the tax. Municipality and school district tax rates. We have information on the local income tax rates in 12 localities in pennsylvania. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). For detailed and historic tax.

Where Could Interest and Tax Rates Be Headed? SouthPark Capital Tax

Municipalities in pennsylvania by county and class. View and sort psd codes & eit rates by county, municipality, and school district. Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). We recommend you contact the county, municipality and/or school district provided as a match for the.

State local effective tax rates map Infogram

We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. Municipality and school district tax rates. Municipalities in pennsylvania by county and class. Common level ratio factor (clr) for real estate valuation. View and sort psd codes & eit rates by county, municipality, and school district.

Common Level Ratio Factor (Clr) For Real Estate Valuation.

We recommend you contact the county, municipality and/or school district provided as a match for the address you entered to confirm. The first two (2) digits of a psd code represent the tax. Municipalities in pennsylvania by county and class. We have information on the local income tax rates in 12 localities in pennsylvania.

Municipality And School District Tax Rates.

Employers with worksites located in pennsylvania are required to withhold and remit the local earned income tax (eit) and local services tax (lst). View and sort psd codes & eit rates by county, municipality, and school district. Here is a link where you can enter the name of the municipality where you live and it will give you a list of taxes and rates for that. For detailed and historic tax information, please see the tax compendium.

.png)

.png)