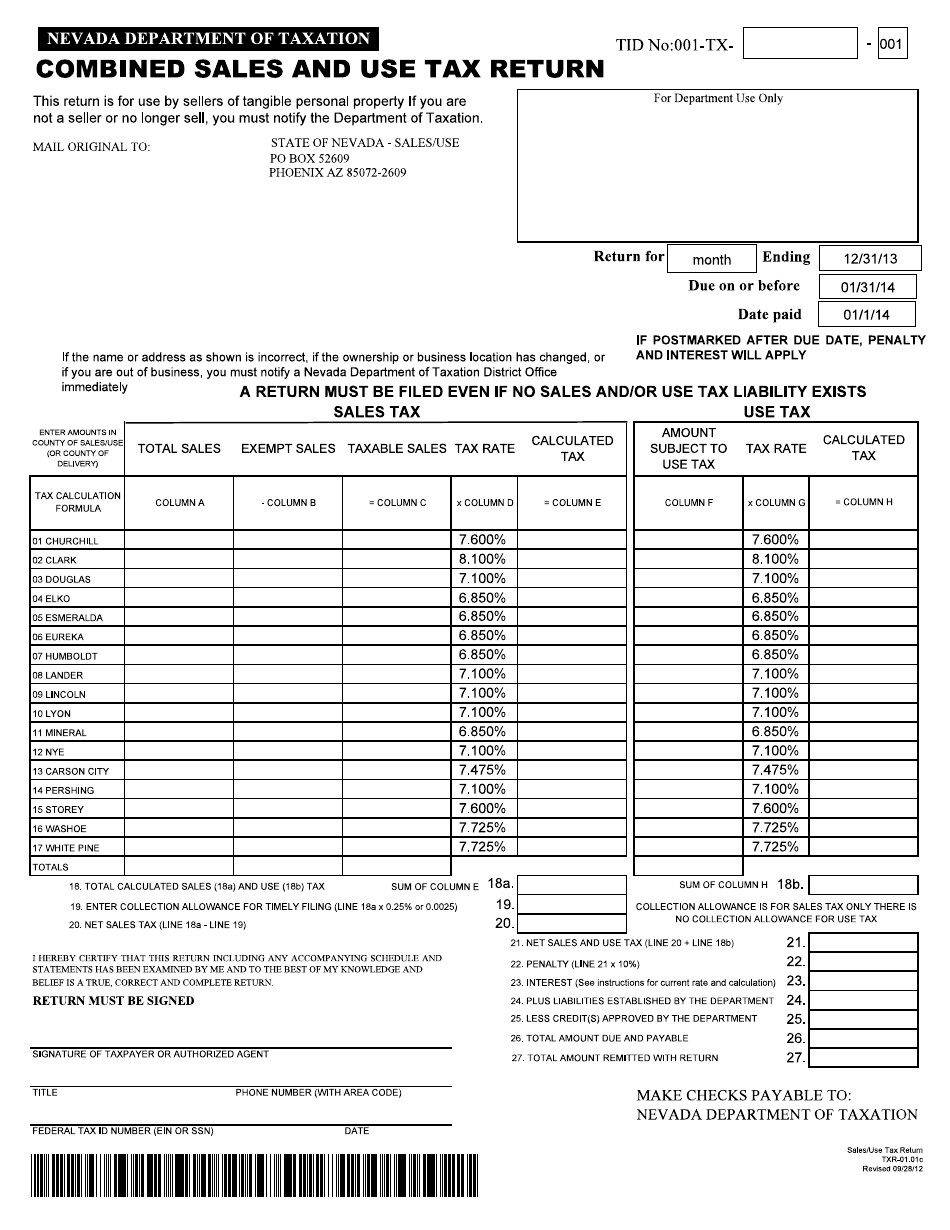

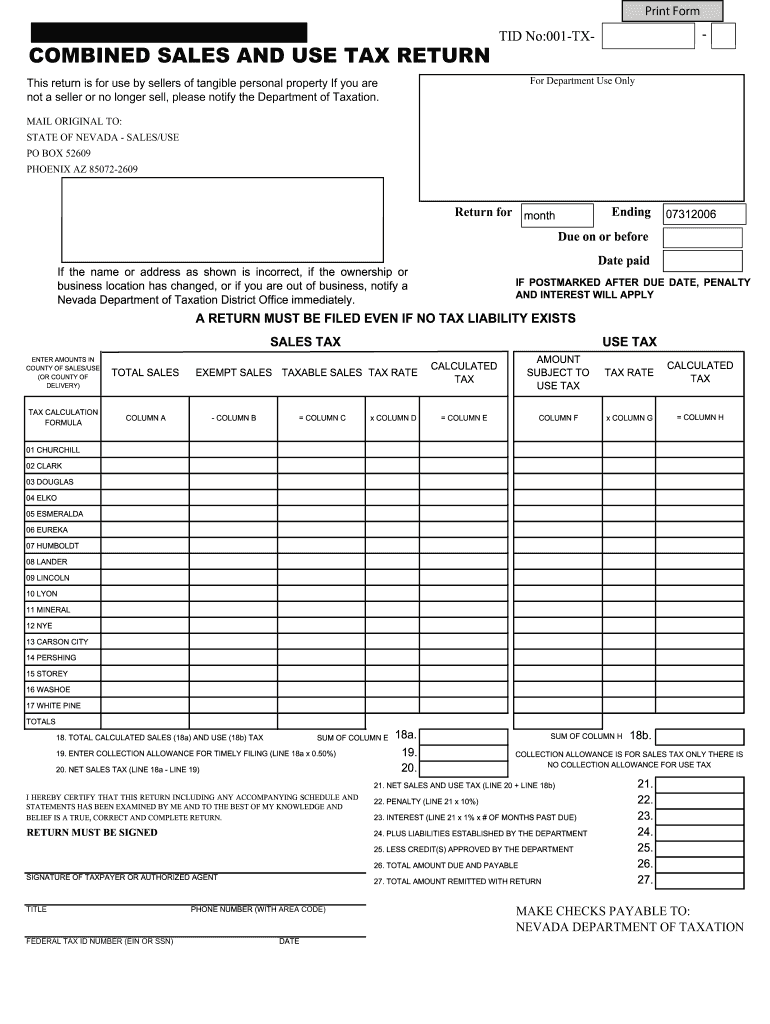

Nv Sales And Use Tax Form

Nv Sales And Use Tax Form - Click below to start over. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax forms. Sales & use tax return. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Starting over will clear your session if you have another window open. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Businesses can also download the sales and use tax return form. Sales and use tax return. The best way to pay nevada sales tax is to register online.

Click below to start over. Businesses can also download the sales and use tax return form. The best way to pay nevada sales tax is to register online. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales and use tax return. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales & use tax forms. Sales & use tax return. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Starting over will clear your session if you have another window open.

Starting over will clear your session if you have another window open. The best way to pay nevada sales tax is to register online. Sales and use tax return. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales & use tax return. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Click below to start over. Sales & use tax forms. Businesses can also download the sales and use tax return form.

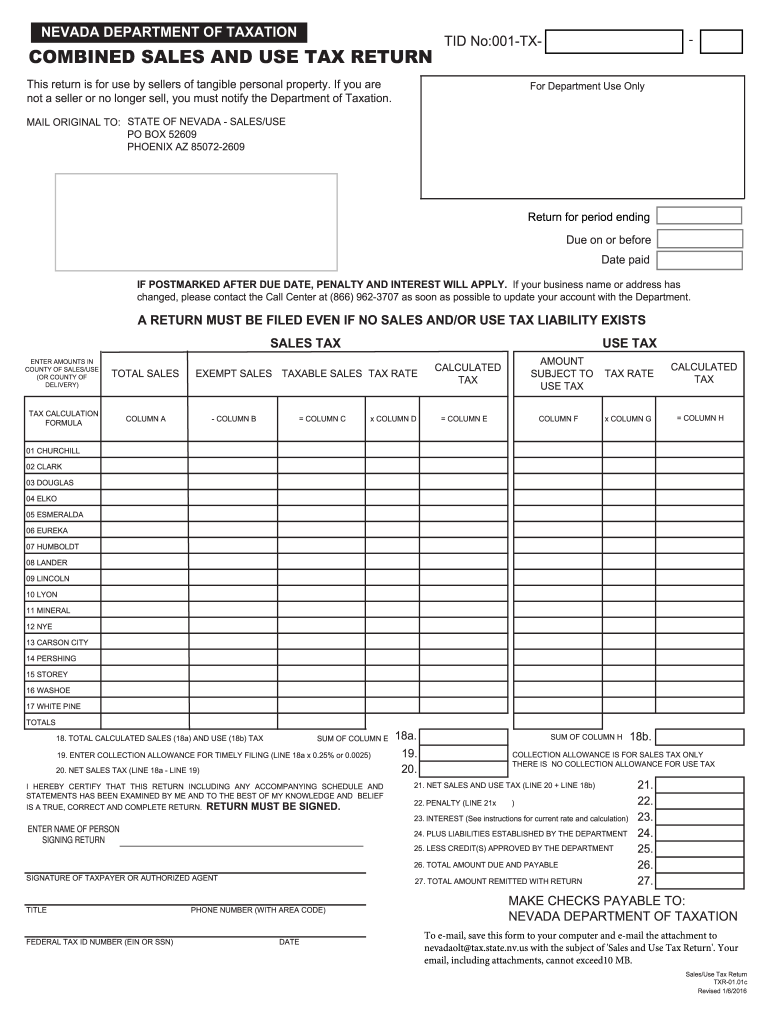

Form TXR01.01c Fill Out, Sign Online and Download Printable PDF

Sales & use tax return. Starting over will clear your session if you have another window open. Sales and use tax return. Sales & use tax forms. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible.

Nevada State Withholding Tax Form

Sales & use tax forms. Starting over will clear your session if you have another window open. Sales and use tax return. Click below to start over. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible.

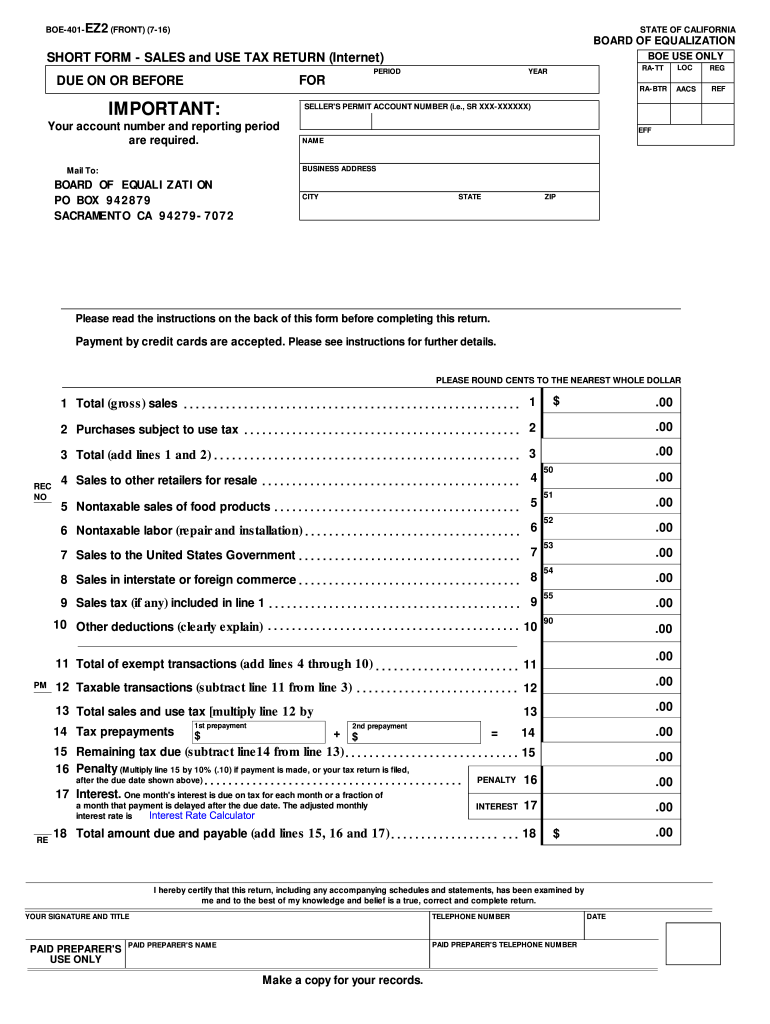

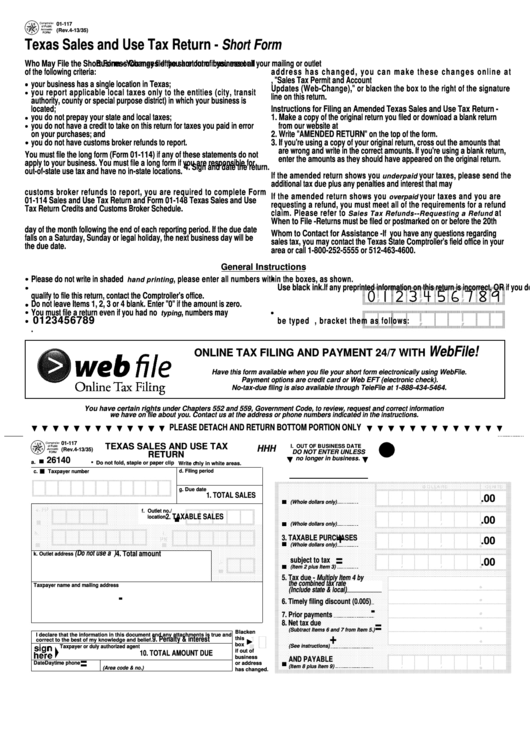

Ca Form Sales Tax Return Fill Online, Printable, Fillable, Blank

Click below to start over. The best way to pay nevada sales tax is to register online. Sales and use tax return. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax forms.

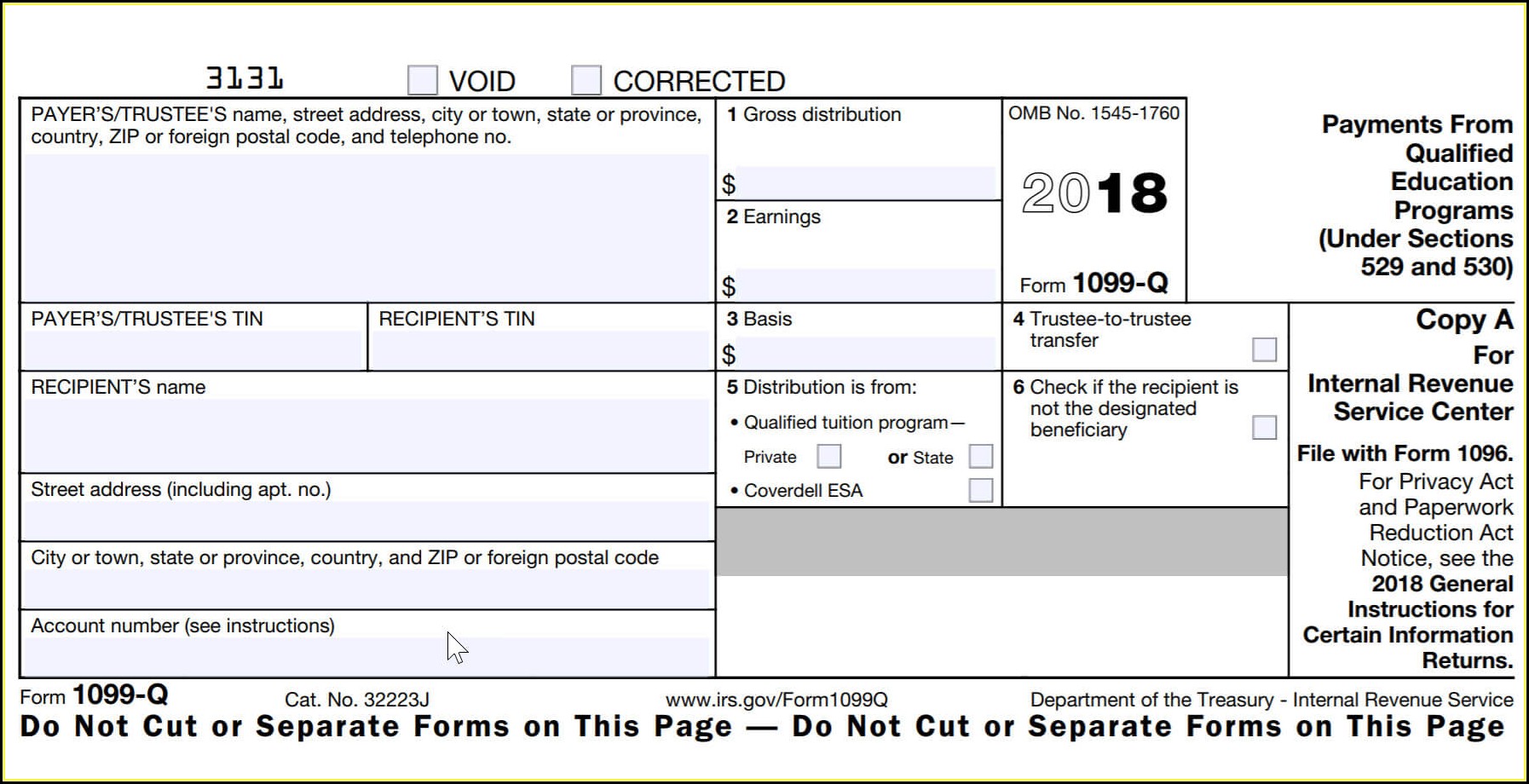

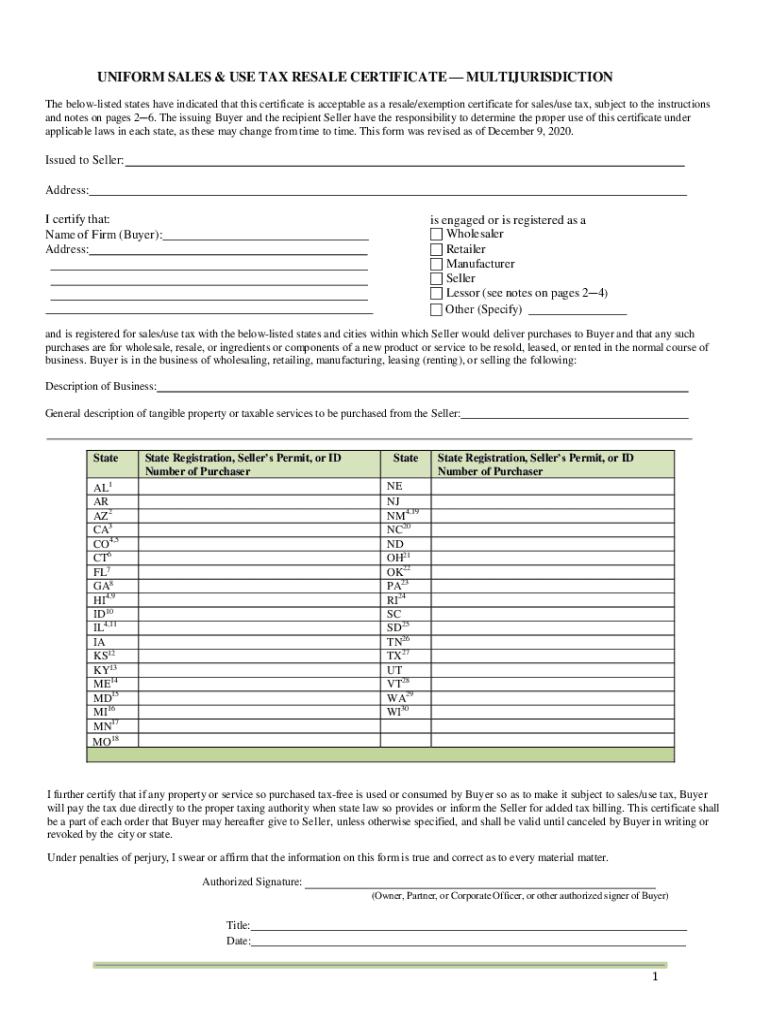

Blank Nv Sales And Use Tax Form Uniform Sales Use Tax Certificate

Click below to start over. Sales & use tax return. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. The best way to pay nevada sales tax is to register online. Sales & use tax forms.

Blank Nv Sales And Use Tax Form E 595e Web Fill 12 09 Fill Online

Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax return. Sales and use tax return. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Click below to start over.

Nevada Sales and Use Tax 20062024 Form Fill Out and Sign Printable

Sales and use tax return. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Businesses can also download the sales and use tax return form. Click below to start over. Total calculated sales (18a) and use (18b) tax 16 washoe 19.

Blank Nv Sales And Use Tax Form Blank Nv Sales And Use Tax Form

Total calculated sales (18a) and use (18b) tax 16 washoe 19. Starting over will clear your session if you have another window open. Sales & use tax forms. The best way to pay nevada sales tax is to register online. Click below to start over.

Nevada Sales Tax Exemption Pdf Fill Online, Printable, Fillable

Businesses can also download the sales and use tax return form. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Starting over will clear your session if you have another.

MTC Uniform Sales & Use Tax Certificate Multijurisdiction 20202022

The best way to pay nevada sales tax is to register online. Sales & use tax forms. Starting over will clear your session if you have another window open. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Businesses can also download the sales and use tax return form.

Blank Nv Sales And Use Tax Form / Form MBTFI Fillable Modified

Businesses can also download the sales and use tax return form. Sales and use tax return. Sales & use tax forms. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax.

The Best Way To Pay Nevada Sales Tax Is To Register Online.

Total calculated sales (18a) and use (18b) tax 16 washoe 19. Starting over will clear your session if you have another window open. Businesses can also download the sales and use tax return form. Sales and use tax return.

Enter Collection Allowance For Timely Filing (Line 18A X 0.25%) Net Sales Tax.

Click below to start over. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax forms. Sales & use tax return.