Oregon Highway Use Tax Bond Form

Oregon Highway Use Tax Bond Form - Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the previous 12 months. This bond is executed under ors chapter 825 to assure payment of fees, taxes, interest and penalties. Highway use tax bond date bond: An or highway use tax bond is a requirement of motor carriers enrolled in oregon's weight mile tax program. Transportation carriers who wish to operate within oregon are required by the department of transportation motor carrier transportation. The bond requirement is a guarantee.

Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the previous 12 months. This bond is executed under ors chapter 825 to assure payment of fees, taxes, interest and penalties. Highway use tax bond date bond: An or highway use tax bond is a requirement of motor carriers enrolled in oregon's weight mile tax program. Transportation carriers who wish to operate within oregon are required by the department of transportation motor carrier transportation. The bond requirement is a guarantee.

The bond requirement is a guarantee. This bond is executed under ors chapter 825 to assure payment of fees, taxes, interest and penalties. Transportation carriers who wish to operate within oregon are required by the department of transportation motor carrier transportation. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the previous 12 months. Highway use tax bond date bond: An or highway use tax bond is a requirement of motor carriers enrolled in oregon's weight mile tax program.

Highway Tax HVUT 2290 Total Truck Permits

Transportation carriers who wish to operate within oregon are required by the department of transportation motor carrier transportation. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the previous 12 months. An or highway use tax bond is a requirement of motor carriers enrolled in oregon's weight mile tax program. Highway use tax.

Remember those less fortunate than yourselves and those suffering from

An or highway use tax bond is a requirement of motor carriers enrolled in oregon's weight mile tax program. Highway use tax bond date bond: The bond requirement is a guarantee. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the previous 12 months. Transportation carriers who wish to operate within oregon are.

Oregon Highway Use Tax Bond Jet Insurance Company

An or highway use tax bond is a requirement of motor carriers enrolled in oregon's weight mile tax program. Highway use tax bond date bond: Transportation carriers who wish to operate within oregon are required by the department of transportation motor carrier transportation. This bond is executed under ors chapter 825 to assure payment of fees, taxes, interest and penalties..

2020 Form OR 7359002 Fill Online, Printable, Fillable, Blank pdfFiller

Highway use tax bond date bond: The bond requirement is a guarantee. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the previous 12 months. Transportation carriers who wish to operate within oregon are required by the department of transportation motor carrier transportation. This bond is executed under ors chapter 825 to assure.

Oregon Highway Use Tax Bond Surety Bond Authority

Highway use tax bond date bond: Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the previous 12 months. The bond requirement is a guarantee. This bond is executed under ors chapter 825 to assure payment of fees, taxes, interest and penalties. An or highway use tax bond is a requirement of motor.

Form CST282 Fill Out, Sign Online and Download Printable PDF, West

Highway use tax bond date bond: The bond requirement is a guarantee. An or highway use tax bond is a requirement of motor carriers enrolled in oregon's weight mile tax program. Transportation carriers who wish to operate within oregon are required by the department of transportation motor carrier transportation. This bond is executed under ors chapter 825 to assure payment.

Essential Guide to Oregon Highway Use Tax Bonds for Truck Owners and

Transportation carriers who wish to operate within oregon are required by the department of transportation motor carrier transportation. The bond requirement is a guarantee. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the previous 12 months. This bond is executed under ors chapter 825 to assure payment of fees, taxes, interest and.

New York Highway Use Tax Registration RLLC

Highway use tax bond date bond: Transportation carriers who wish to operate within oregon are required by the department of transportation motor carrier transportation. An or highway use tax bond is a requirement of motor carriers enrolled in oregon's weight mile tax program. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the.

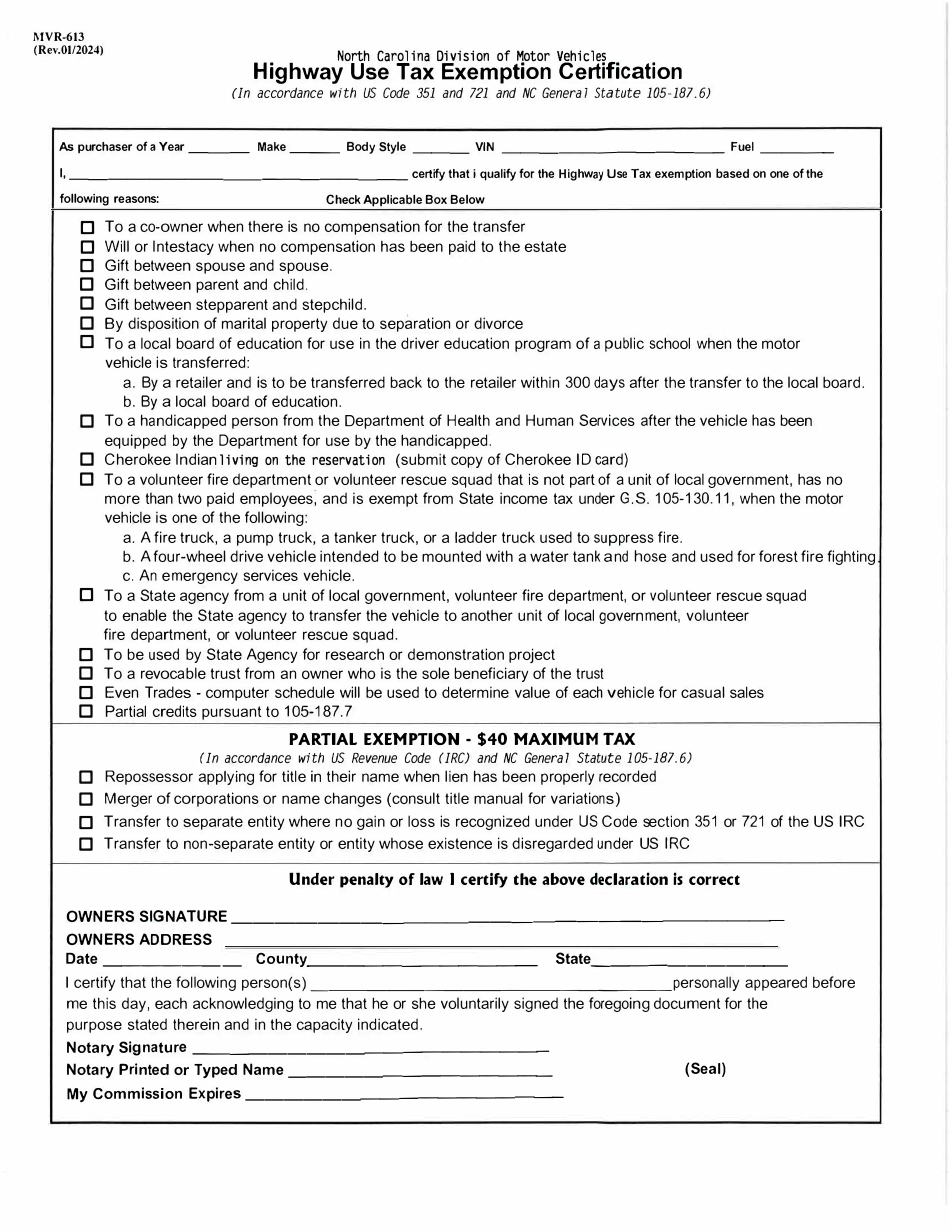

Form MVR613 Download Printable PDF or Fill Online Highway Use Tax

This bond is executed under ors chapter 825 to assure payment of fees, taxes, interest and penalties. An or highway use tax bond is a requirement of motor carriers enrolled in oregon's weight mile tax program. Highway use tax bond date bond: Transportation carriers who wish to operate within oregon are required by the department of transportation motor carrier transportation..

Oregon Highway Use Tax Bond • Surety One, Inc.

The bond requirement is a guarantee. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the previous 12 months. This bond is executed under ors chapter 825 to assure payment of fees, taxes, interest and penalties. Transportation carriers who wish to operate within oregon are required by the department of transportation motor carrier.

Transportation Carriers Who Wish To Operate Within Oregon Are Required By The Department Of Transportation Motor Carrier Transportation.

An or highway use tax bond is a requirement of motor carriers enrolled in oregon's weight mile tax program. The bond requirement is a guarantee. This bond is executed under ors chapter 825 to assure payment of fees, taxes, interest and penalties. Initial bond requests are based on the number of vehicles enrolled or operated in oregon in the previous 12 months.