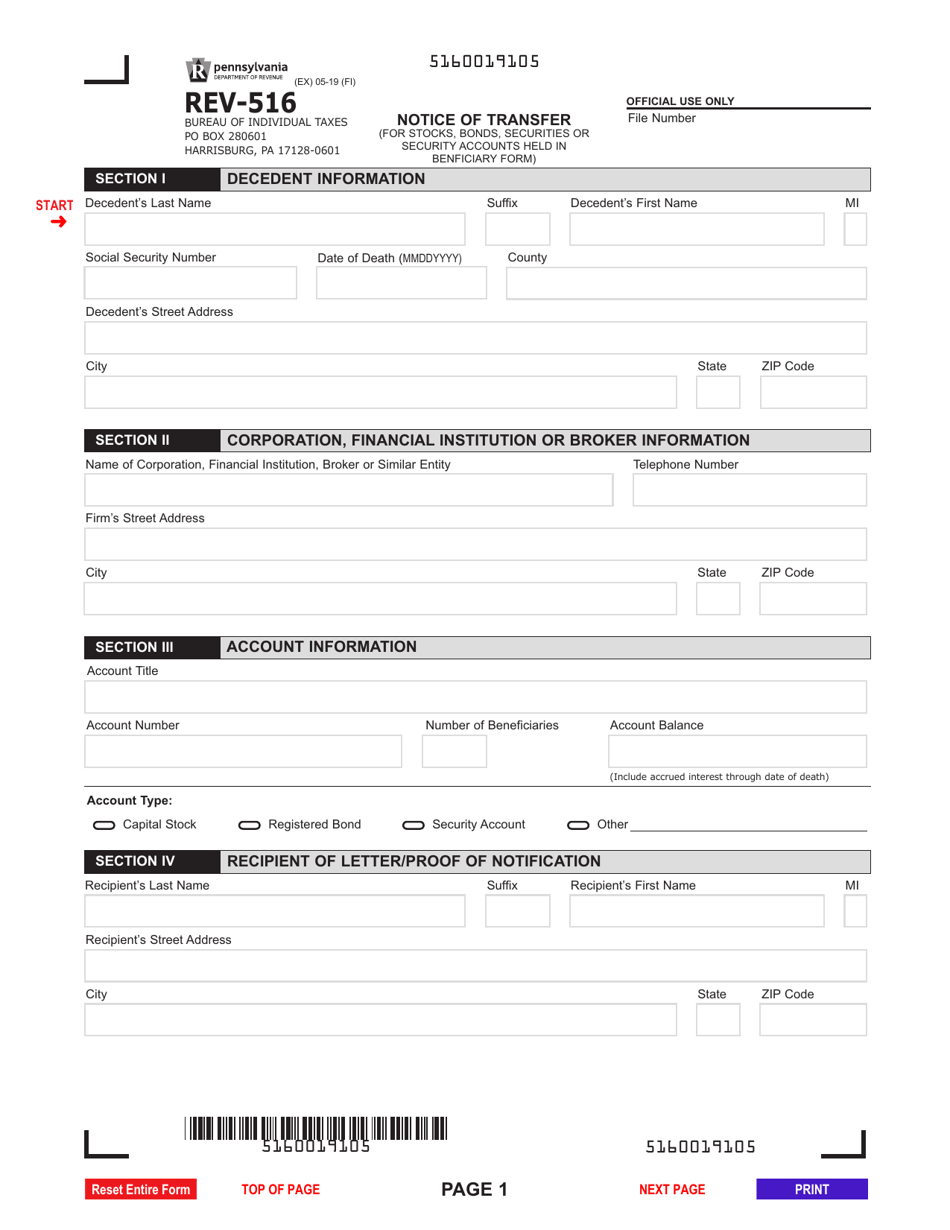

Pa Inheritance Tax Waiver Form

Pa Inheritance Tax Waiver Form - If three beneficiaries, each gets 33.3%, etc. A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. 1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). The inheritance tax return has to be prepared to ascertain the tax after all assets. Oakmark says the waiver form is not required. The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. It is important to check with an.

The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. If three beneficiaries, each gets 33.3%, etc. Oakmark says the waiver form is not required. If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. 1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. It is important to check with an. The inheritance tax return has to be prepared to ascertain the tax after all assets.

If three beneficiaries, each gets 33.3%, etc. The inheritance tax return has to be prepared to ascertain the tax after all assets. Oakmark says the waiver form is not required. The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. 1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). It is important to check with an.

Pa Inheritance Tax Waiver Form Rev 516 Tax Preparation Classes

The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. It is important to check with an. Oakmark says the waiver form is not required. The inheritance tax return has to be prepared to ascertain the tax after all assets. If three beneficiaries, each gets 33.3%,.

Edris Wisniewski

If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. It is important to check with an. Vanguard.

Pa Inheritance Tax Waiver Form Rev 516 Tax Preparation Classes

The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. A mutual fund company is saying they need.

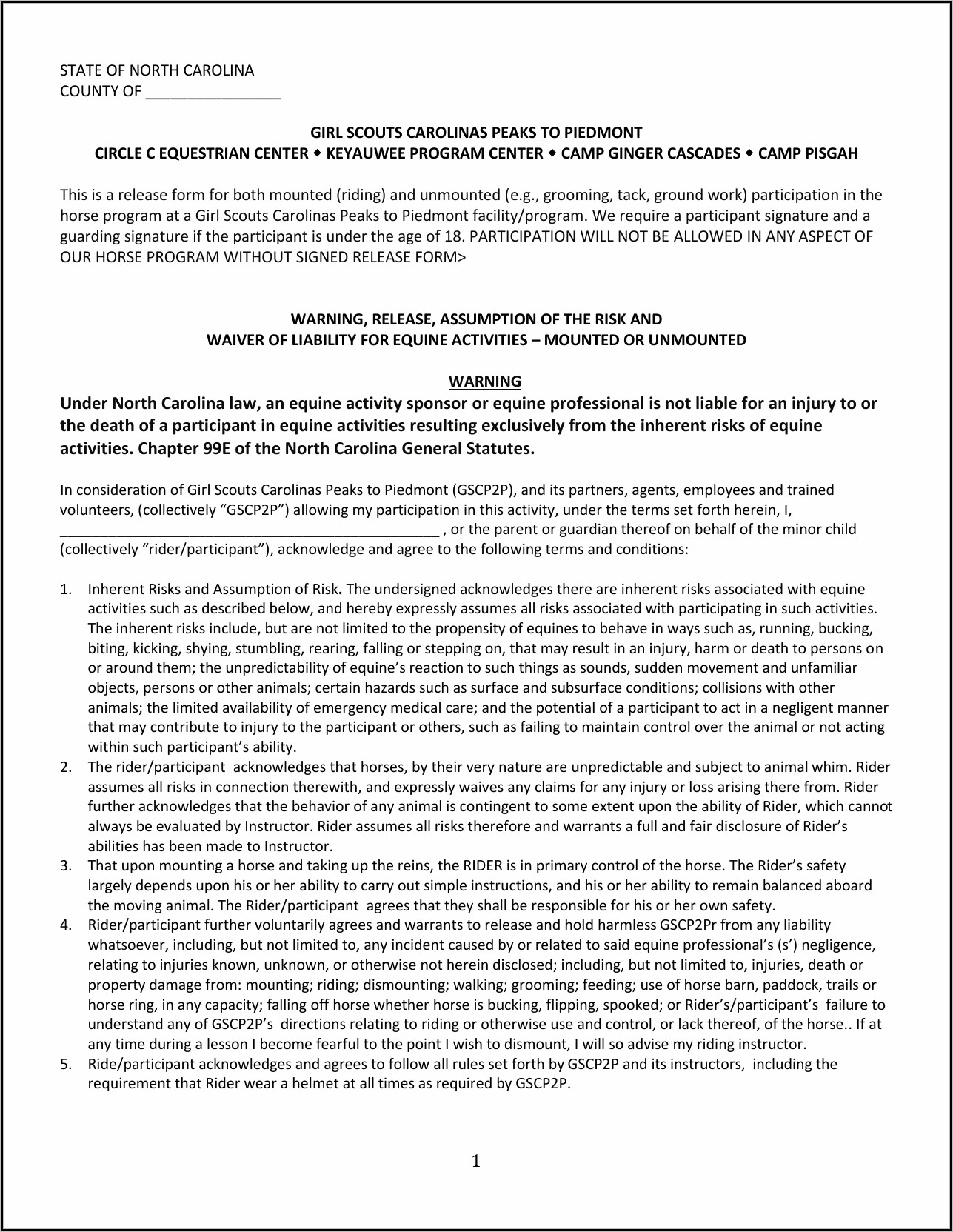

Horseback Riding Waiver Form Template 1 Resume Examples 76YGex432o

If three beneficiaries, each gets 33.3%, etc. Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. The inheritance tax return has to be.

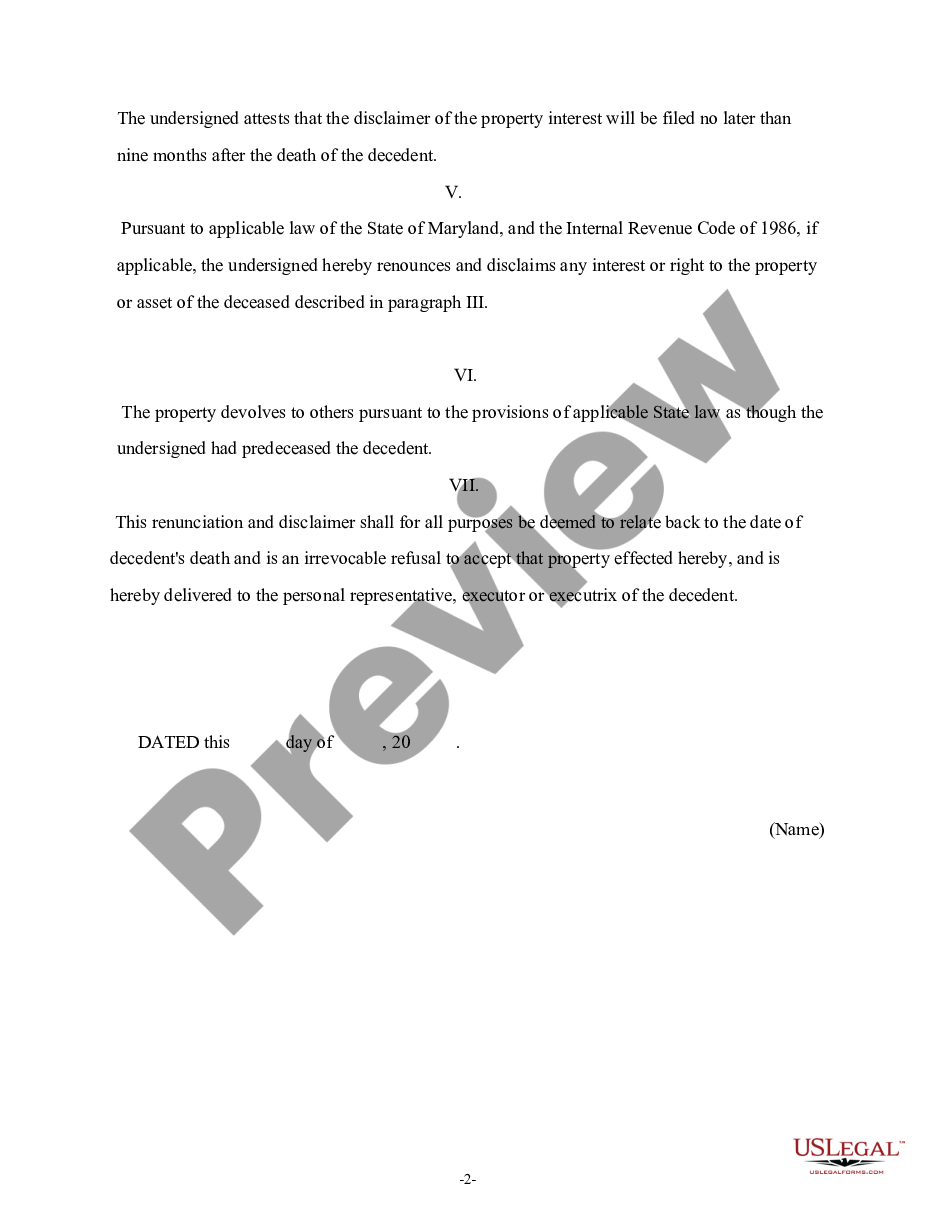

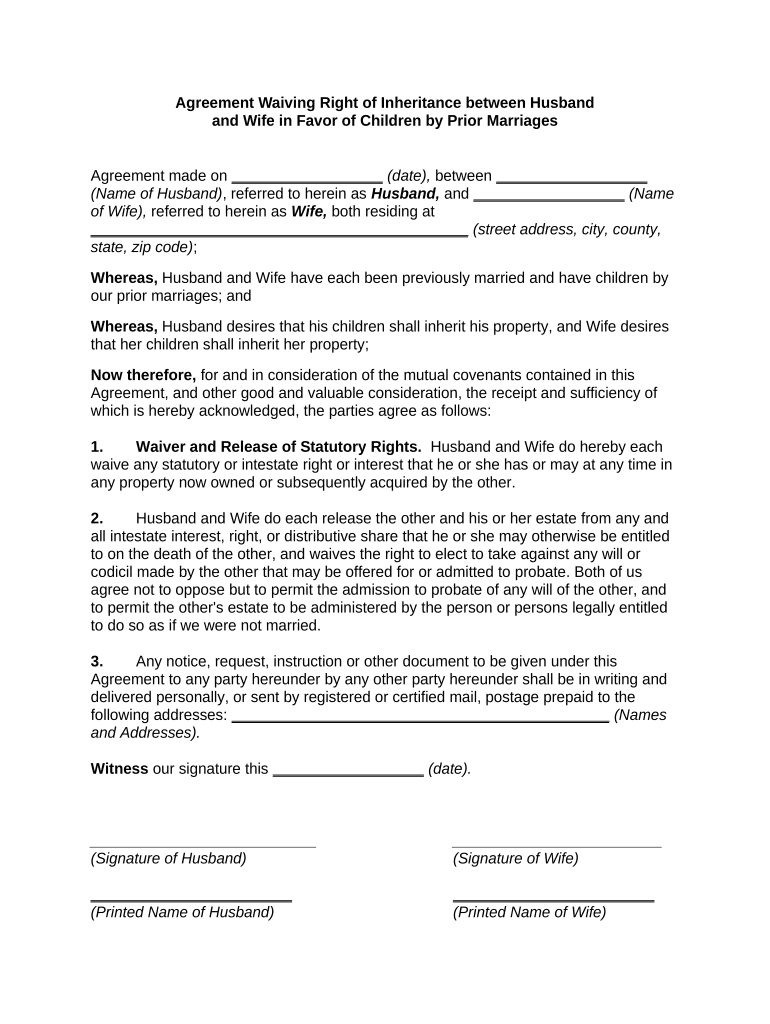

Waiver Of Inheritance Form For Probate US Legal Forms

1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. Oakmark says the waiver form is not required. Vanguard and byn mellon.

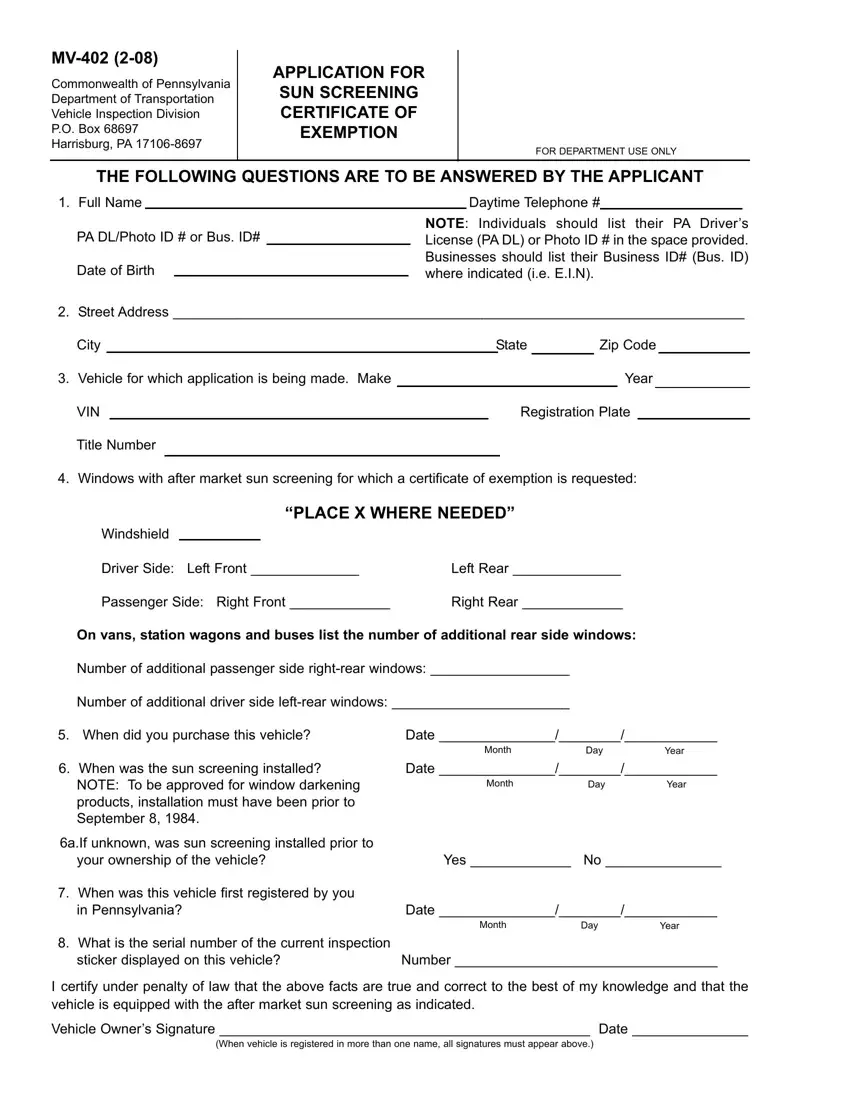

pa inheritance tax waiver request Derailing Site Photos

A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. If three beneficiaries, each gets 33.3%,.

Inheritance Tax Waiver Form Nebraska

Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. It is important to check with an. Oakmark says the.

Inheritance Declaration Form For Pa US Legal Forms

A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. If three beneficiaries, each gets 33.3%,.

inheritance agreement template Doc Template pdfFiller

It is important to check with an. If three beneficiaries, each gets 33.3%, etc. The inheritance tax return has to be prepared to ascertain the tax after all assets. Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. A mutual fund company is saying they need an.

Inheritance Tax Waiver Form Missouri Form Resume Examples Ze12OJAKjx

A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. 1.) if.

If Three Beneficiaries, Each Gets 33.3%, Etc.

1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. It is important to check with an.

A Mutual Fund Company Is Saying They Need An Inheritance Tax Waiver Before They Can Transfer Ownership Of The Ira Of A Deceased Person, Who Had Specified Payable On Death.

Oakmark says the waiver form is not required. The inheritance tax return has to be prepared to ascertain the tax after all assets. If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will.