Sales Tax Exemption Form Ohio

Sales Tax Exemption Form Ohio - There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. What purchases are exempt from the ohio sales tax? While the ohio sales tax of 5.75% applies to most transactions, there are certain items that.

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. What purchases are exempt from the ohio sales tax? To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio.

What purchases are exempt from the ohio sales tax? Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio.

Texas Sales And Use Tax Resale Certificate Example / 01 315 Form Fill

What purchases are exempt from the ohio sales tax? Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. To provide this exemption certificate (or the data elements.

Ohio Farm Sales Tax Exemption Form Tax New tax Available, Act Fast

This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. What purchases are exempt from the ohio sales tax? There is a special contractor's exemption certificate and a construction.

ohio sales tax exemption form example Fighting Column Photo Galleries

What purchases are exempt from the ohio sales tax? To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. Ohio accepts the uniform sales and use tax certificate created by.

Sales Tax Exemption Certificate Sc

There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. Download and fill out this form to claim exception or exemption on purchases of tangible personal property.

Icc Mc Sales Tax Exemption Form Ohio

Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on.

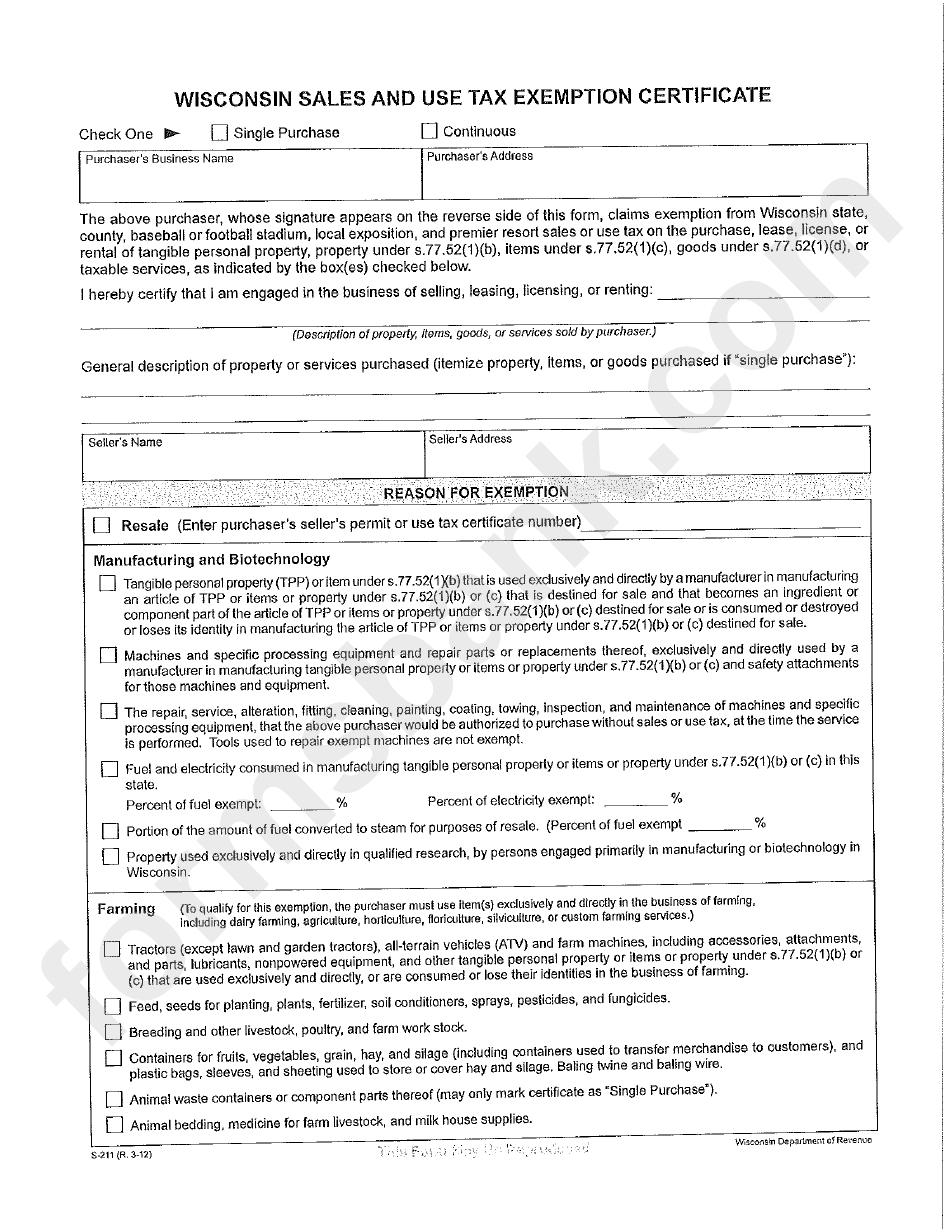

Wi Sales Tax Exemption Form

What purchases are exempt from the ohio sales tax? There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. While the ohio sales tax of 5.75% applies.

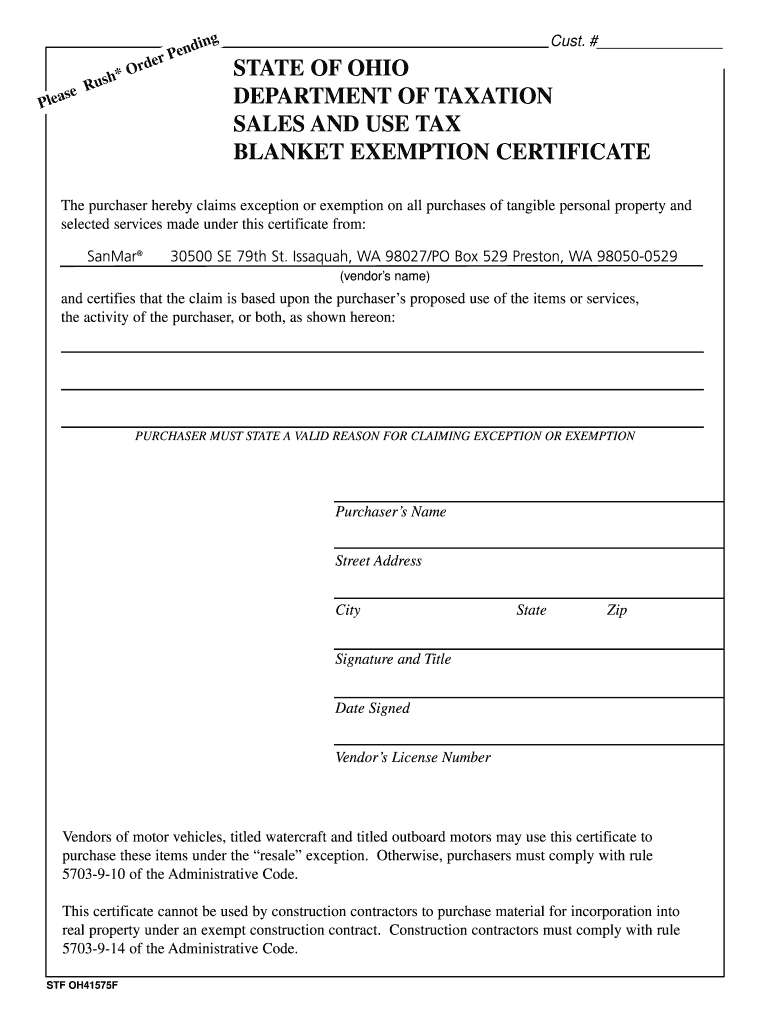

Ohio Sales Tax Blanket Exemption Form 2021

To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. What purchases are exempt.

Sample Certificate Tax Exempt Certificate Form

This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a.

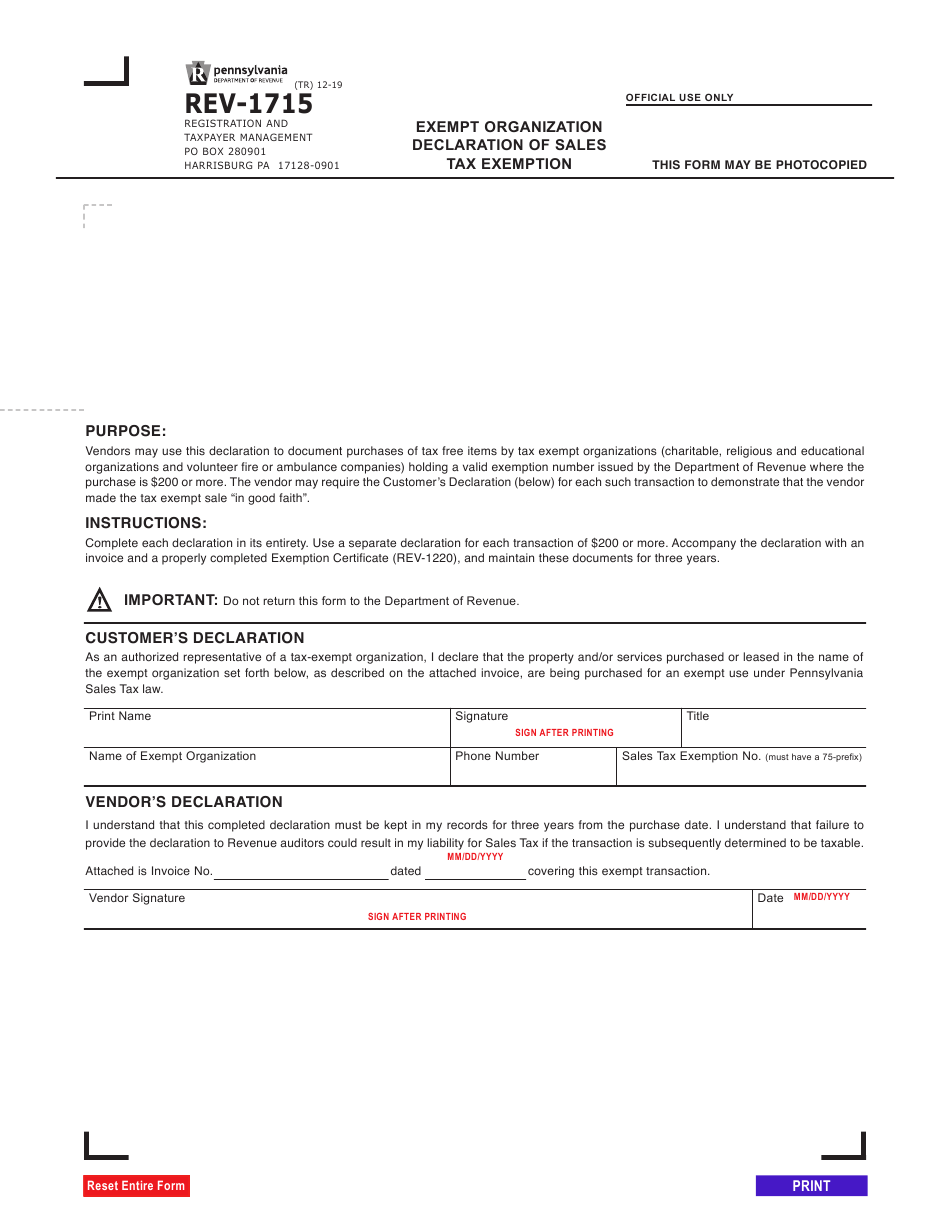

Pa Sales Taxe Exemption Form

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. What purchases are exempt from the ohio sales tax? This form allows purchasers to claim exception or exemption on all.

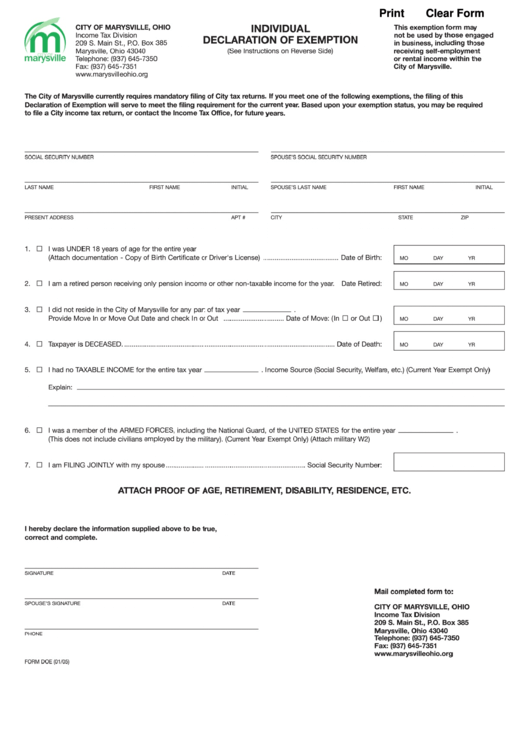

Tax Exemption Form Printable Ohio Printable Forms Free Online

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. To provide this.

Ohio Accepts The Uniform Sales And Use Tax Certificate Created By The Multistate Tax Commission As A Valid Exemption Certificate.

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner.

What Purchases Are Exempt From The Ohio Sales Tax?

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio.