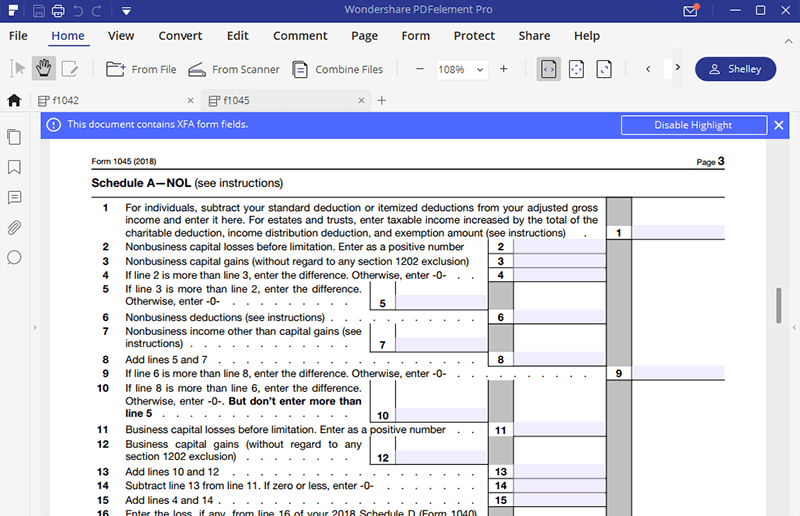

Schedule A Of Form 1045

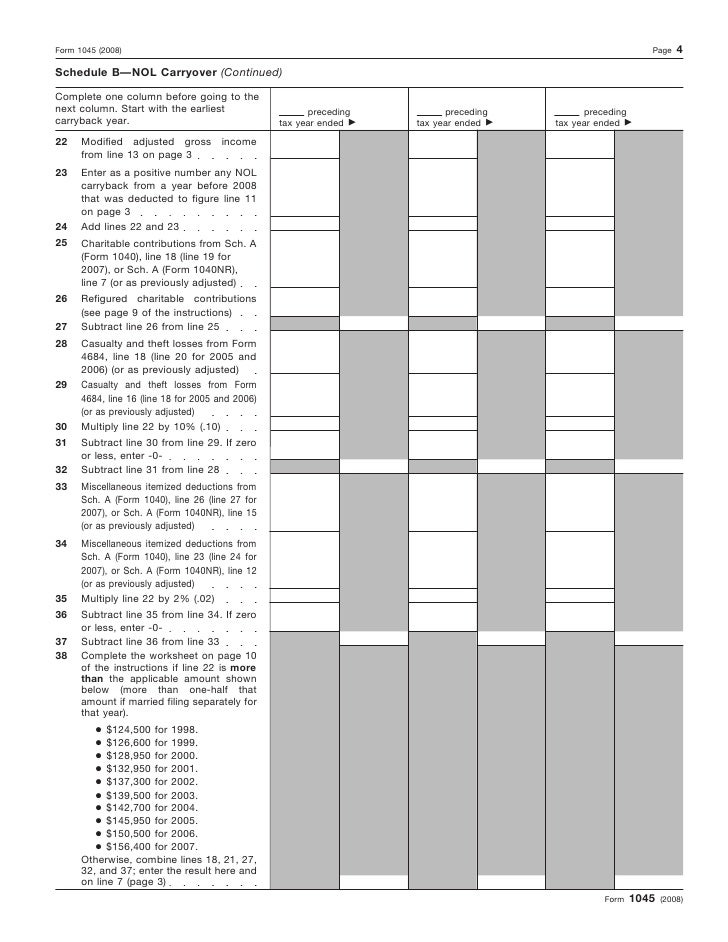

Schedule A Of Form 1045 - Form 1045 will generally not produce if there is no current year net operating loss to carry back. The software produces form 1045. The carryback of an nol. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward.

Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. The software produces form 1045. Form 1045 will generally not produce if there is no current year net operating loss to carry back. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: The carryback of an nol. Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year;

Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: The carryback of an nol. The software produces form 1045. Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Form 1045 will generally not produce if there is no current year net operating loss to carry back.

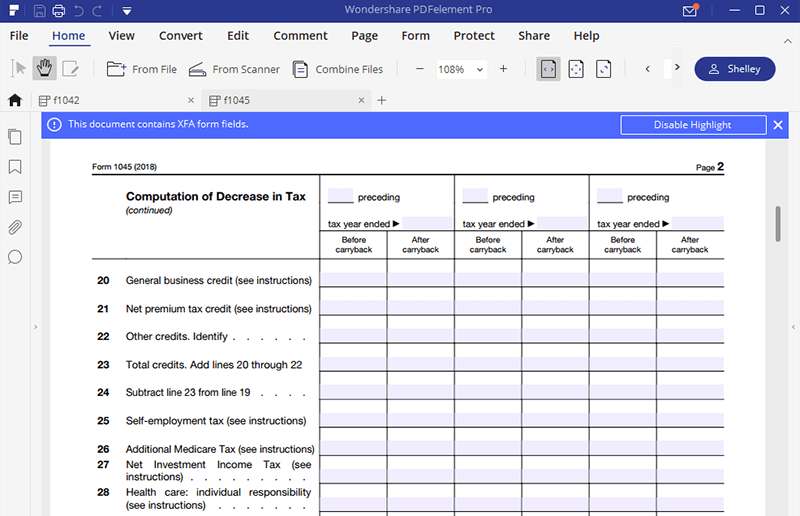

IRS Form 1045 Fill it as You Want

Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: The software produces form 1045. An individual, estate, or trust files form 1045 to apply.

Payment Schedule Form

Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: Form 1045 will generally not produce if there is no current year net.

IRS Form 1045 Fill it as You Want

An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: The software produces form 1045. If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: The carryback of an nol. Form 1045 schedule a is used to compute.

IRS Form 1045 Fill it as You Want

Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. The software produces form 1045. Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; Form 1045 will generally not produce if there is no current year net.

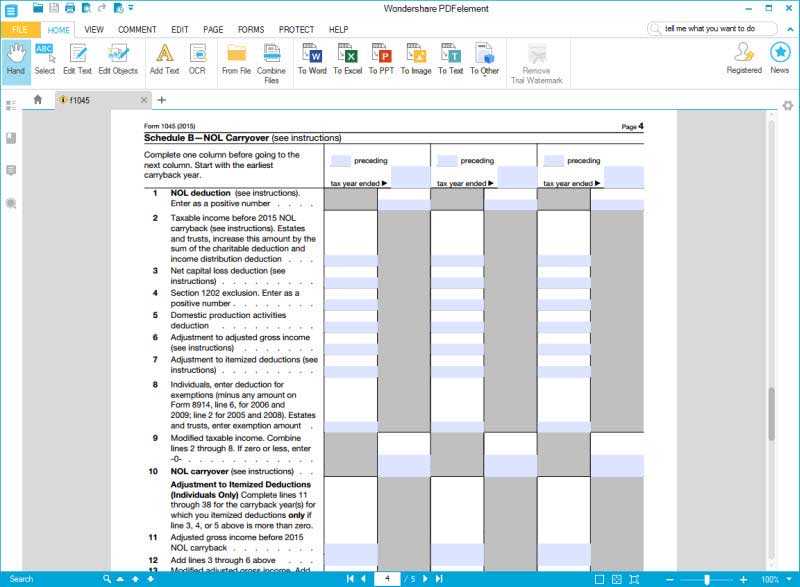

2020 Form 1045 2020 Blank Sample to Fill out Online in PDF

Form 1045 will generally not produce if there is no current year net operating loss to carry back. Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. The carryback of an nol. Enter the appropriate amount from your calculations on form 1045 that is to be carried.

Fillable Online Irs form 1045 schedule a. Irs form 1045 schedule a.Do

The carryback of an nol. The software produces form 1045. Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Form 1045 will generally not produce if there is no current.

Form 1045 Fill Out And Sign Printable Pdf Template Signnow Free

Form 1045 schedule a is used to compute a net operating loss (nol) and determine the amount available for carryback or carryforward. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: The carryback of an nol. If a return has generated a net operating loss (nol) in the current year, there will.

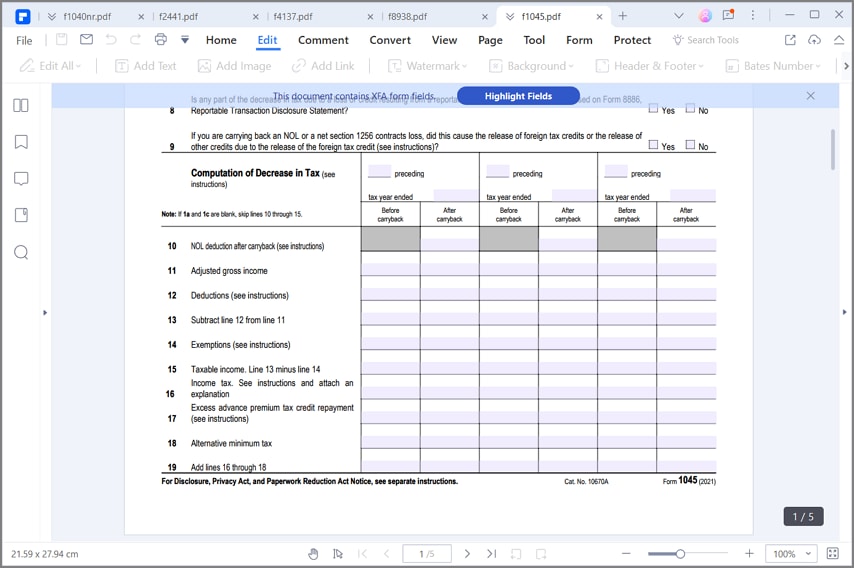

Form 1045 Application for Tentative Refund (2014) Free Download

Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; The software produces form 1045. Form 1045 will generally not produce if there is no current year net operating loss to carry back. If a return has generated a net operating loss (nol) in the current year, there will be.

Instructions pour remplir le formulaire 1045 de l'IRS

Form 1045 will generally not produce if there is no current year net operating loss to carry back. If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: The carryback of an nol. Enter the appropriate amount from your calculations on form 1045 that is.

Form 1045 Application for Tentative Refund

The carryback of an nol. If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: The software produces form 1045. Form 1045 will generally not produce if there is no current year net operating loss to carry back. Form 1045 schedule a is used to.

The Software Produces Form 1045.

If a return has generated a net operating loss (nol) in the current year, there will be a green alert in the return titled explanation: The carryback of an nol. Enter the appropriate amount from your calculations on form 1045 that is to be carried forward to the current year; An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from:

Form 1045 Schedule A Is Used To Compute A Net Operating Loss (Nol) And Determine The Amount Available For Carryback Or Carryforward.

Form 1045 will generally not produce if there is no current year net operating loss to carry back.