Standard Deduction Calculator

Standard Deduction Calculator - Beginning january 1, 2025, the standard mileage rates for the use of a car, van, pickup, or panel truck will be: The irs has announced its 2025 standard mileage rates. This interview will help you determine the amount of your standard deduction. Standard deduction calculator use the calculator below to estimate your 2024 standard deduction, which applies to tax returns due in april 2025. 4.5/5 (13k) Calculate your federal, state and local taxes for the current filing year with our free income tax calculator. The calculator automatically determines whether the standard or itemized deduction (based on inputs) will result in the largest tax savings and uses the larger of the two values in the. The income tax return calculator estimates your refund or taxes owed based on income, deductions, and credits. The standard deduction in 2024 is $14,600 for individuals, $29,200 for joint filers, and $21,900 for heads of households. Your date of birth, your spouse's date of birth, and filing.

The income tax return calculator estimates your refund or taxes owed based on income, deductions, and credits. Standard deduction calculator use the calculator below to estimate your 2024 standard deduction, which applies to tax returns due in april 2025. Beginning january 1, 2025, the standard mileage rates for the use of a car, van, pickup, or panel truck will be: When to claim the standard. This interview will help you determine the amount of your standard deduction. Your date of birth, your spouse's date of birth, and filing. In just five quick screens, you’ll understand the changes in the standard deduction and itemized deductions, and you’ll get an estimate of your deductions based on inputs. 4.5/5 (13k) The calculator automatically determines whether the standard or itemized deduction (based on inputs) will result in the largest tax savings and uses the larger of the two values in the. The irs adjusts the standard deduction each year for inflation.

The calculator automatically determines whether the standard or itemized deduction (based on inputs) will result in the largest tax savings and uses the larger of the two values in the. Enter your income and location to estimate your tax burden. The irs adjusts the standard deduction each year for inflation. When to claim the standard. Find the new rates and information on extra benefits for people over 65. This calculator takes the gross income entered into the income field and then subtracts applicable deductions and adjustments, such as 401(k) contributions, hsa contributions,. How much is my standard deduction? 4.5/5 (13k) The irs has announced its 2025 standard mileage rates. This interview will help you determine the amount of your standard deduction.

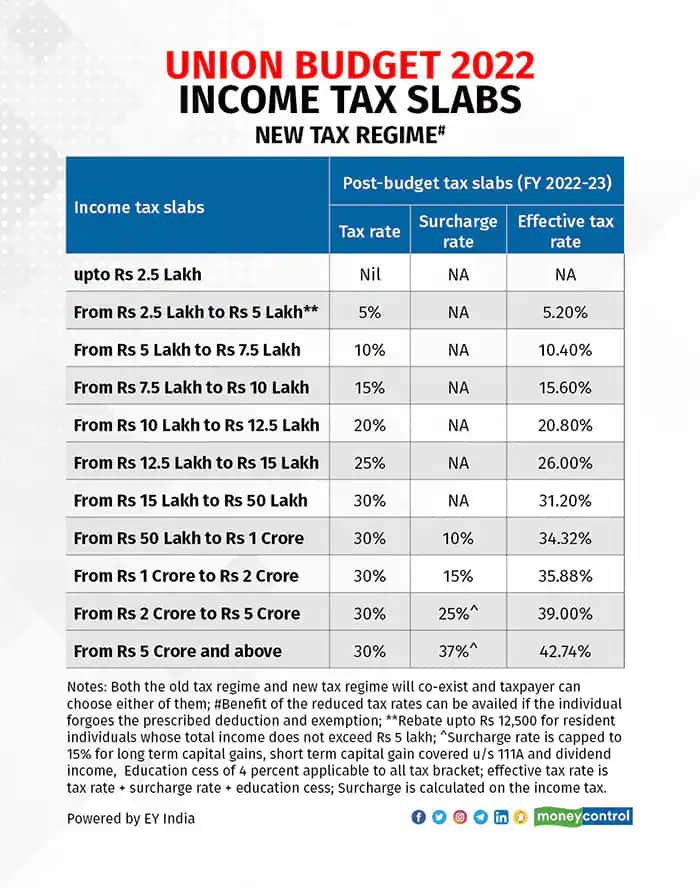

New Tax Regime 2024 Standard Deduction Calculator Odele Aridatha

Beginning january 1, 2025, the standard mileage rates for the use of a car, van, pickup, or panel truck will be: 4.5/5 (13k) When to claim the standard. In just five quick screens, you’ll understand the changes in the standard deduction and itemized deductions, and you’ll get an estimate of your deductions based on inputs. This calculator takes the.

Standard vs. Itemized Deduction Calculator Which Should You Take? Blog

The irs adjusts the standard deduction each year for inflation. The standard deduction in 2024 is $14,600 for individuals, $29,200 for joint filers, and $21,900 for heads of households. Your date of birth, your spouse's date of birth, and filing. How much is my standard deduction? This interview will help you determine the amount of your standard deduction.

Compare Before Deciding on the Standard Deduction Martha May North

How much is my standard deduction? Standard deduction calculator use the calculator below to estimate your 2024 standard deduction, which applies to tax returns due in april 2025. In just five quick screens, you’ll understand the changes in the standard deduction and itemized deductions, and you’ll get an estimate of your deductions based on inputs. The income tax return calculator.

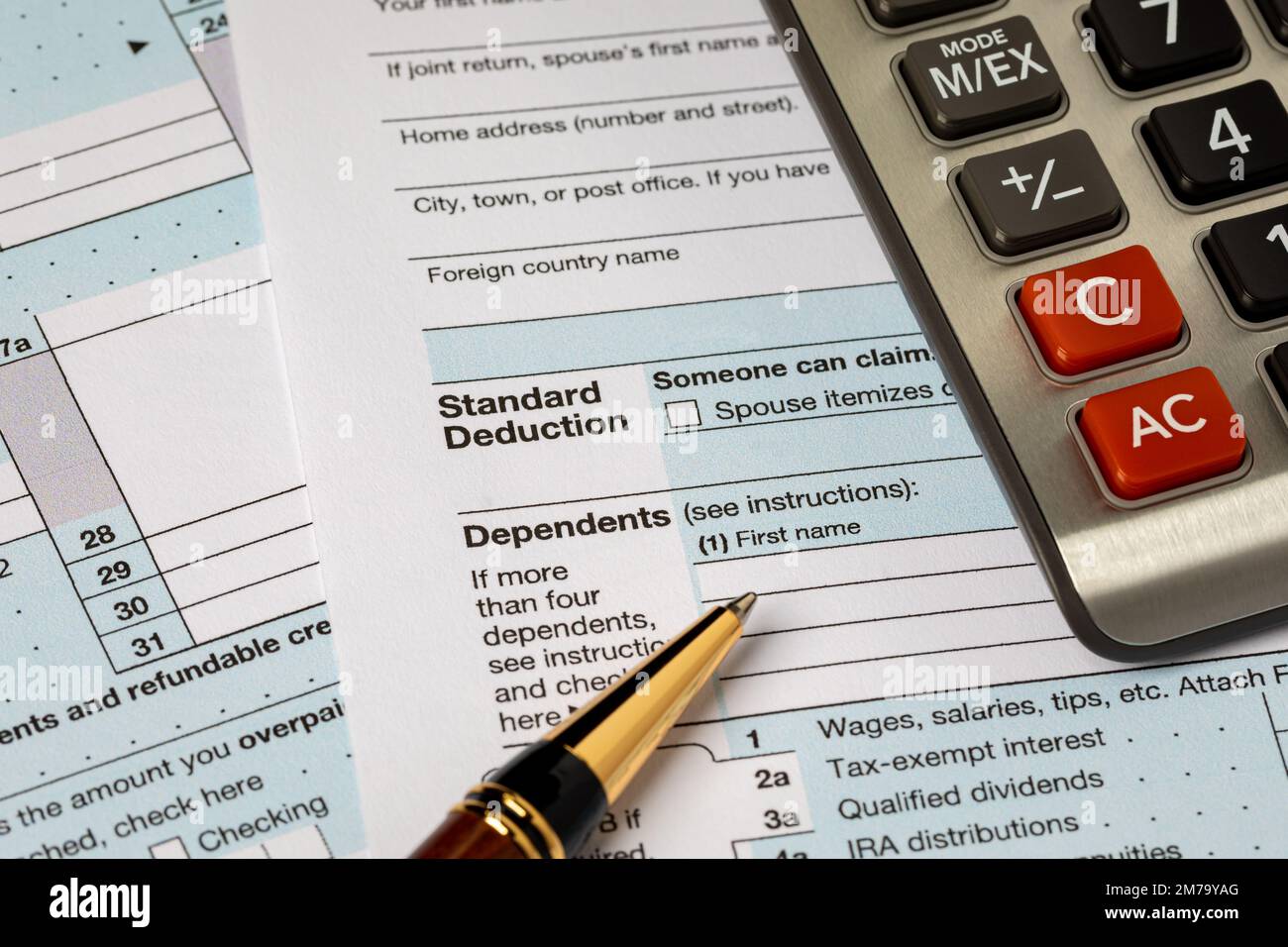

Standard deduction on federal tax return forms and calculator

The standard deduction in 2024 is $14,600 for individuals, $29,200 for joint filers, and $21,900 for heads of households. This interview will help you determine the amount of your standard deduction. Standard deduction calculator use the calculator below to estimate your 2024 standard deduction, which applies to tax returns due in april 2025. In just five quick screens, you’ll understand.

The Standard Deduction and Itemized Deductions After Tax Reform

Your date of birth, your spouse's date of birth, and filing. By inputting relevant data, it uses tax brackets and rules to provide an. 4.5/5 (13k) This interview will help you determine the amount of your standard deduction. Standard deduction calculator use the calculator below to estimate your 2024 standard deduction, which applies to tax returns due in april.

Itemized Deduction Calculator 2024 Emmi Norine

The irs has announced its 2025 standard mileage rates. The irs adjusts the standard deduction each year for inflation. This interview will help you determine the amount of your standard deduction. The income tax return calculator estimates your refund or taxes owed based on income, deductions, and credits. 4.5/5 (13k)

Irs Standard Deduction For 2024 Aleda Aundrea

Your date of birth, your spouse's date of birth, and filing. The irs has announced its 2025 standard mileage rates. Beginning january 1, 2025, the standard mileage rates for the use of a car, van, pickup, or panel truck will be: This calculator takes the gross income entered into the income field and then subtracts applicable deductions and adjustments, such.

Should I itemize or take the standard deduction? Calculators by

The standard deduction in 2024 is $14,600 for individuals, $29,200 for joint filers, and $21,900 for heads of households. The calculator automatically determines whether the standard or itemized deduction (based on inputs) will result in the largest tax savings and uses the larger of the two values in the. In just five quick screens, you’ll understand the changes in the.

Mortgage Interest Tax Deduction Calculator MLS Mortgage

When to claim the standard. In just five quick screens, you’ll understand the changes in the standard deduction and itemized deductions, and you’ll get an estimate of your deductions based on inputs. The irs adjusts the standard deduction each year for inflation. The income tax return calculator estimates your refund or taxes owed based on income, deductions, and credits. How.

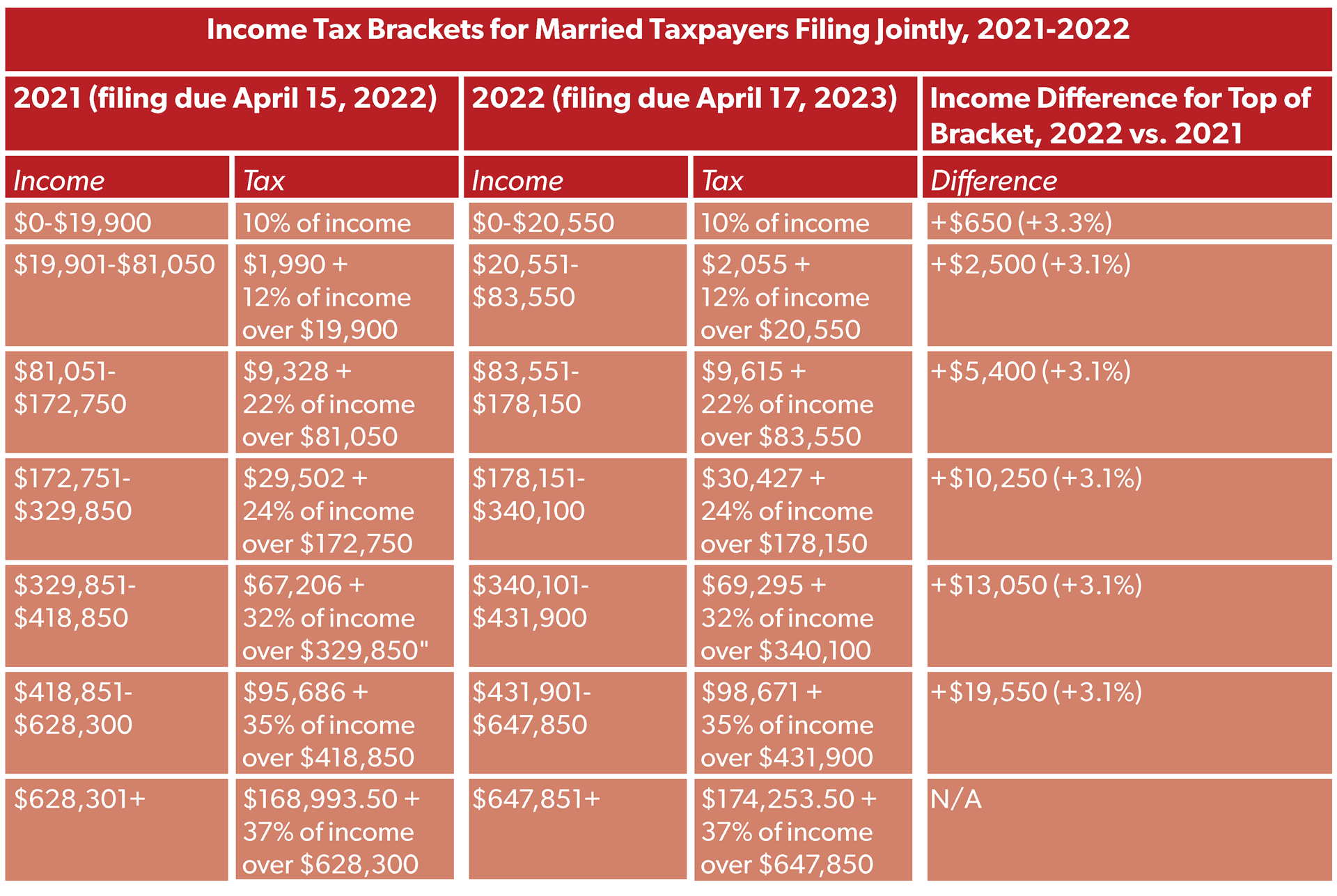

Tax Brackets for 2021 and 2022 Publications National

Beginning january 1, 2025, the standard mileage rates for the use of a car, van, pickup, or panel truck will be: Find the new rates and information on extra benefits for people over 65. The income tax return calculator estimates your refund or taxes owed based on income, deductions, and credits. This calculator takes the gross income entered into the.

Enter Your Income And Location To Estimate Your Tax Burden.

Beginning january 1, 2025, the standard mileage rates for the use of a car, van, pickup, or panel truck will be: Your date of birth, your spouse's date of birth, and filing. By inputting relevant data, it uses tax brackets and rules to provide an. Find the new rates and information on extra benefits for people over 65.

In Just Five Quick Screens, You’ll Understand The Changes In The Standard Deduction And Itemized Deductions, And You’ll Get An Estimate Of Your Deductions Based On Inputs.

The irs has announced its 2025 standard mileage rates. This calculator takes the gross income entered into the income field and then subtracts applicable deductions and adjustments, such as 401(k) contributions, hsa contributions,. Standard deduction calculator use the calculator below to estimate your 2024 standard deduction, which applies to tax returns due in april 2025. This interview will help you determine the amount of your standard deduction.

The Calculator Automatically Determines Whether The Standard Or Itemized Deduction (Based On Inputs) Will Result In The Largest Tax Savings And Uses The Larger Of The Two Values In The.

How much is my standard deduction? The irs adjusts the standard deduction each year for inflation. The income tax return calculator estimates your refund or taxes owed based on income, deductions, and credits. 4.5/5 (13k)

The Standard Deduction In 2024 Is $14,600 For Individuals, $29,200 For Joint Filers, And $21,900 For Heads Of Households.

Calculate your federal, state and local taxes for the current filing year with our free income tax calculator. When to claim the standard.