State Of Michigan Sales Tax Exempt Form

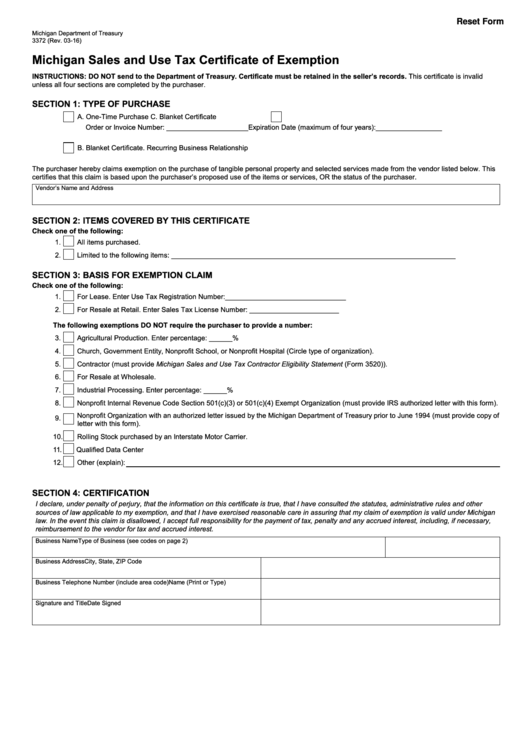

State Of Michigan Sales Tax Exempt Form - Do not send to the department of treasury. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Learn how to complete the form,. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. It is the purchaser’s responsibility. Michigan sales and use tax certificate of exemption instructions: A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from.

Michigan sales and use tax certificate of exemption instructions: This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. It is the purchaser’s responsibility. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. Learn how to complete the form,. Do not send to the department of treasury.

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Learn how to complete the form,. It is the purchaser’s responsibility. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. Michigan sales and use tax certificate of exemption instructions: This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Do not send to the department of treasury. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from.

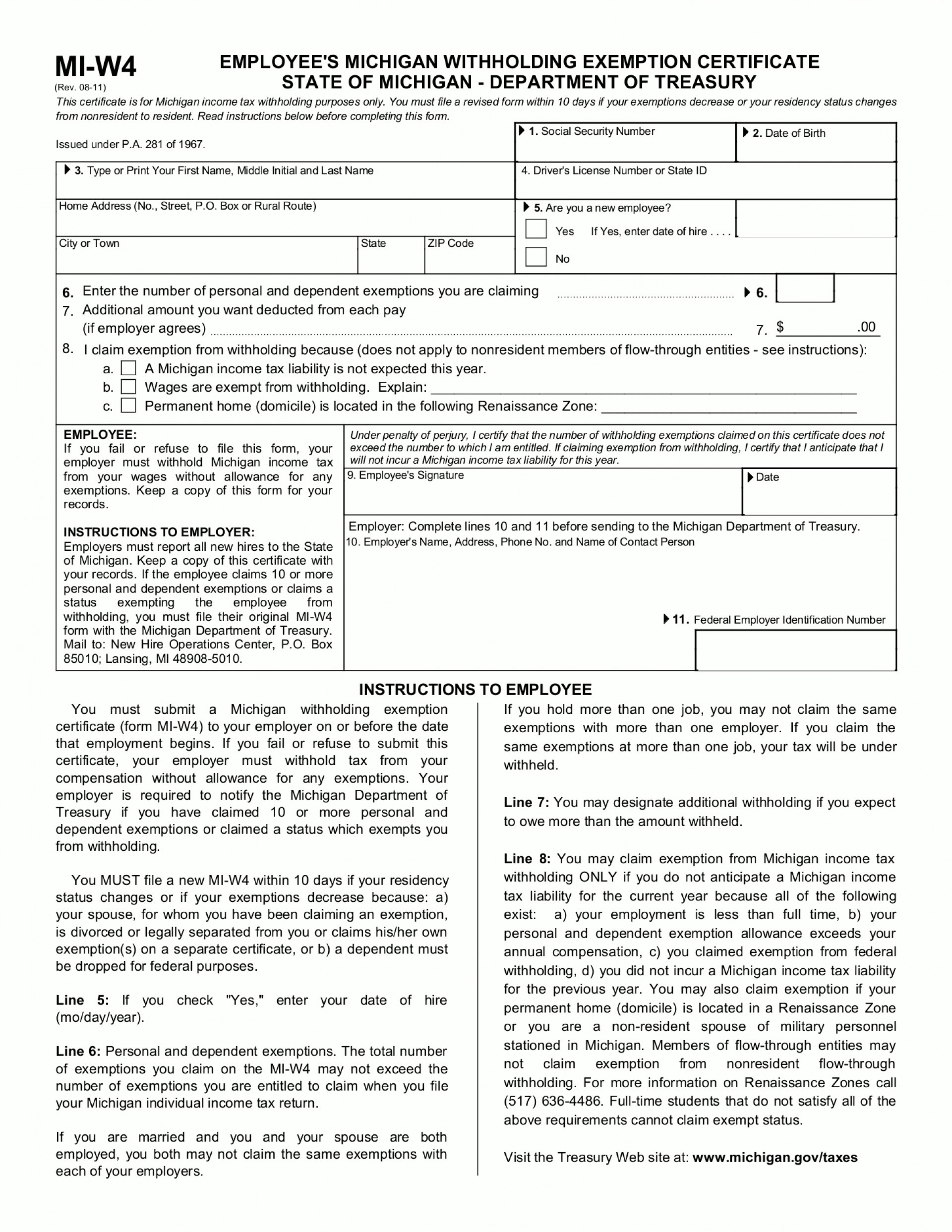

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Michigan sales.

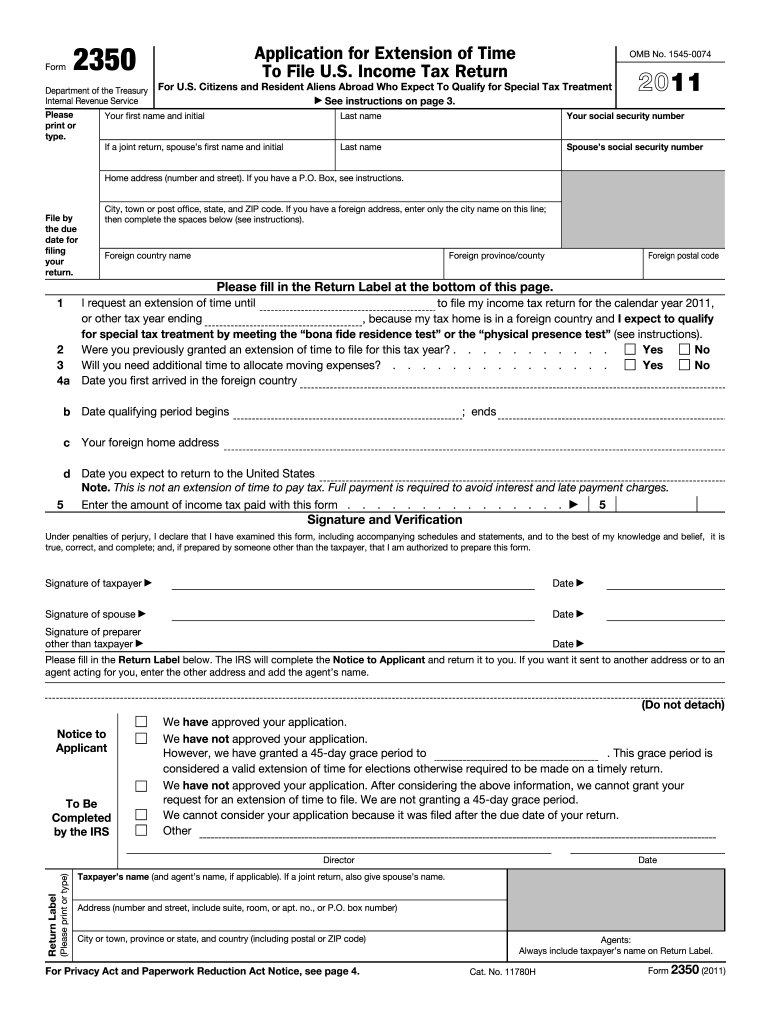

Tax Exempt Form 2350 Fillable Fill Out and Sign Printable PDF

It is the purchaser’s responsibility. Michigan sales and use tax certificate of exemption instructions: Do not send to the department of treasury. Learn how to complete the form,. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax.

Michigan Sales Tax Exempt Form Fillable

Do not send to the department of treasury. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from. Michigan sales and use tax certificate of exemption instructions: It is the purchaser’s responsibility. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with.

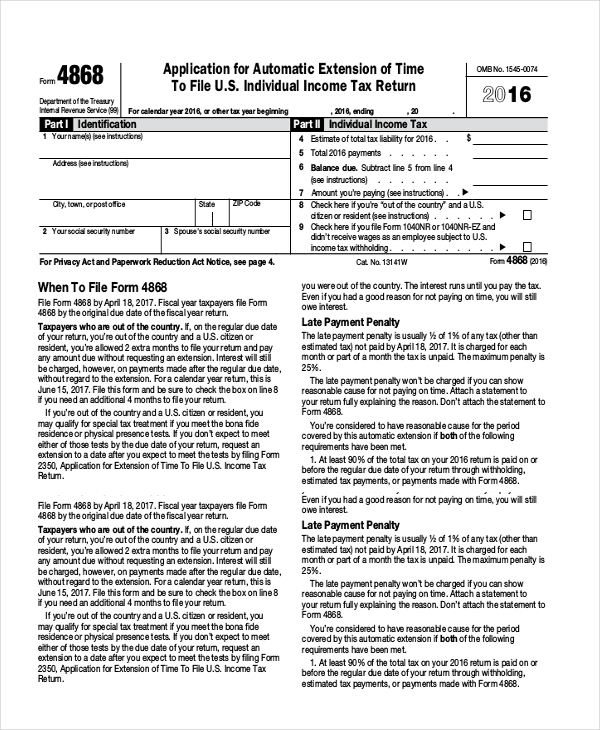

2023 Federal Tax Exemption Form

Learn how to complete the form,. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. Download and print form 3372 to claim exemption from michigan sales and.

Michigan Sales Tax Exemption Form 2024 Page Tricia

This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. Michigan sales and use tax certificate of exemption instructions: Download and print form 3372 to claim exemption from michigan sales.

Mi State Tax Exemption Form

Do not send to the department of treasury. Michigan sales and use tax certificate of exemption instructions: Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Learn how to complete the form,. A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption.

Michigan tax exempt form Fill out & sign online DocHub

It is the purchaser’s responsibility. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions. Michigan sales and use tax certificate of exemption instructions: The purchaser completing this form hereby claims exemption from tax on the purchase.

Mi Tax Exempt Form 2023 Printable Forms Free Online

A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. It is the purchaser’s responsibility. Learn how to complete the form,. Do not send to the department of treasury. Download and print form 3372 to claim exemption from michigan sales and use tax on qualified transactions.

006 Page1 1200Px State And Local Sales Tax Rates Pdf Michigan Form

It is the purchaser’s responsibility. Do not send to the department of treasury. Michigan sales and use tax certificate of exemption instructions: Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased.

Arkansas Sales And Use Tax Exemption

A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions. Do not send to the department of treasury. The purchaser completing this form hereby claims exemption from tax on the.

Download And Print Form 3372 To Claim Exemption From Michigan Sales And Use Tax On Qualified Transactions.

Michigan sales and use tax certificate of exemption instructions: A purchaser who claims exemption for “resale at retail” or “for lease” must provide the seller with an exemption certificate and their sales tax. Purchasers may use this form to claim exemption from michigan sales and use tax on qualifi ed transactions. Learn how to complete the form,.

The Purchaser Completing This Form Hereby Claims Exemption From Tax On The Purchase Of Tangible Personal Property Or Services Purchased From.

Do not send to the department of treasury. It is the purchaser’s responsibility. This form allows purchasers to claim exemption from michigan sales and use tax on qualified transactions.