Tax Consequences Of Foreclosure To Lender

Tax Consequences Of Foreclosure To Lender - (1) the amount the lender. Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,. Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the.

Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the. Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,. (1) the amount the lender.

Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the. Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,. (1) the amount the lender.

Causes and Consequences of the foreclosure Crisis.

Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,. Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the. (1) the amount the lender.

Consequences of Foreclosure Dana AshMcGinty

(1) the amount the lender. Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the. Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,.

Tips on How to Prevent Foreclosure With Your Lender

Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,. (1) the amount the lender. Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the.

Foreclosure Consequences MERS

(1) the amount the lender. Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,. Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the.

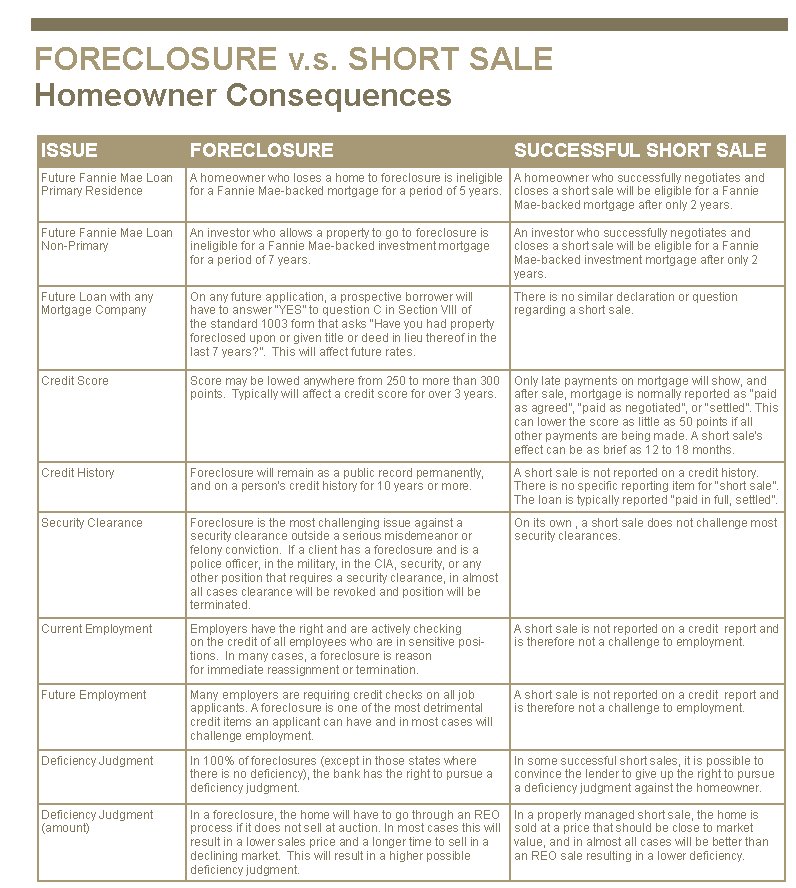

Homeowner Consequences Foreclosure vs. Short Sale Charlie Dresen

Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the. (1) the amount the lender. Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,.

Potential LongTerm Consequences of Foreclosure — RISMedia

(1) the amount the lender. Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,. Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the.

How to Stop Property Tax Foreclosure Jarrett Law Firm

Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the. (1) the amount the lender. Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,.

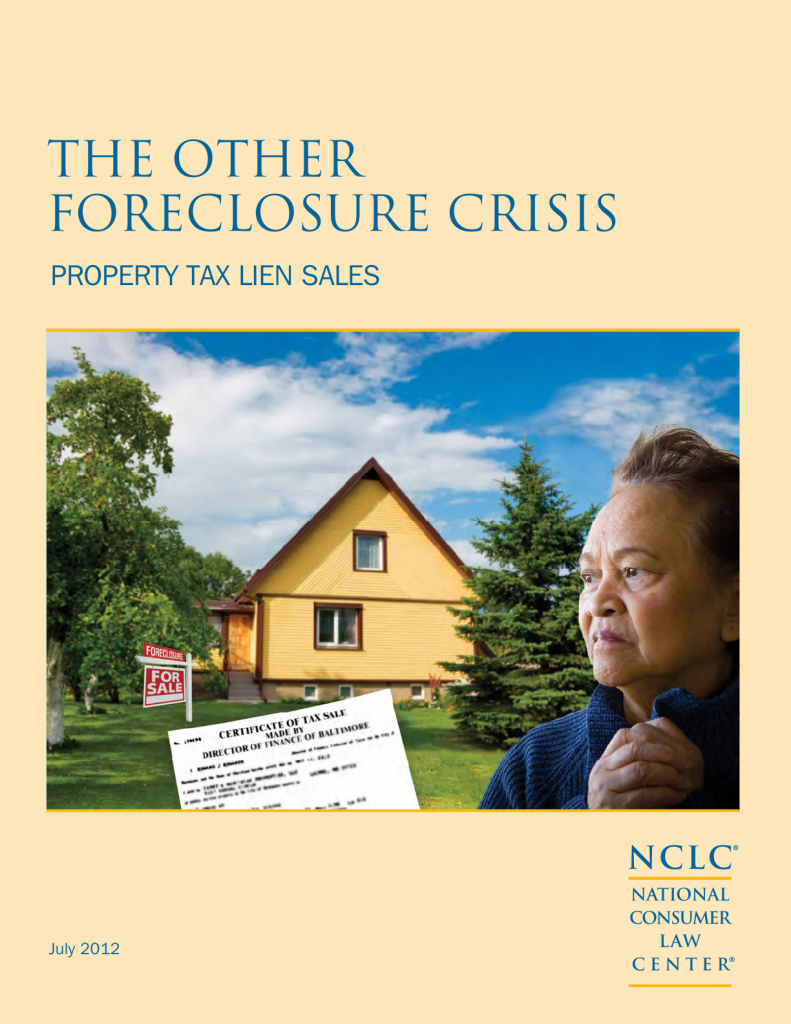

The Other Foreclosure Crisis Property Tax Lien Sales FORECLOSURE FRAUD

Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,. Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the. (1) the amount the lender.

Homeowners, in foreclosure, face tax implications. What you should know

Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the. Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,. (1) the amount the lender.

Foreclosure Processing Washington Total Lender Solutions

Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the. (1) the amount the lender. Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,.

(1) The Amount The Lender.

Foreclosure can result in unexpected tax consequences to the debtor, with the precise impact depending on the type of debt involved,. Foreclosures, repossessions, voluntary conveyances, and bad debts have tax consequences to both the lender and the.