Tax Lien Investment Companies

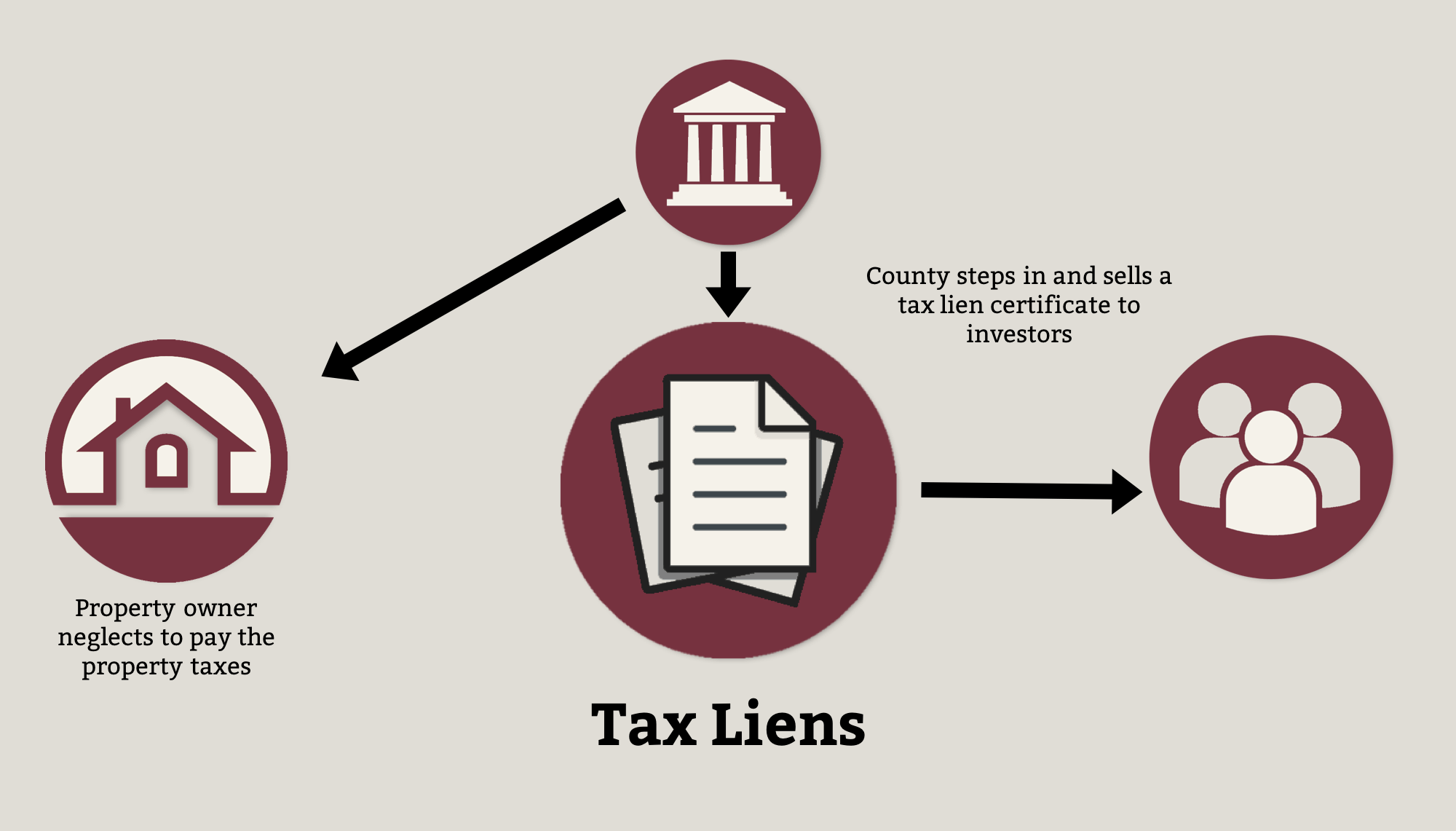

Tax Lien Investment Companies - Kite capital partners is a private equity firm with over $150 million in committed capital across. When property owners fail to pay their property. Tax lien investing is an indirect approach to investing in real estate. Tax lien investing involves an investor buys the claim that a local government makes on. Tax lien investing is a type of real estate investment that involves purchasing these liens from the.

Kite capital partners is a private equity firm with over $150 million in committed capital across. Tax lien investing is an indirect approach to investing in real estate. When property owners fail to pay their property. Tax lien investing involves an investor buys the claim that a local government makes on. Tax lien investing is a type of real estate investment that involves purchasing these liens from the.

Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Kite capital partners is a private equity firm with over $150 million in committed capital across. Tax lien investing is an indirect approach to investing in real estate. When property owners fail to pay their property. Tax lien investing involves an investor buys the claim that a local government makes on.

Investing In Tax Liens Alts.co

Tax lien investing involves an investor buys the claim that a local government makes on. When property owners fail to pay their property. Tax lien investing is an indirect approach to investing in real estate. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Kite capital partners is a private equity firm.

All You Need to Know About Investing in Tax Liens Latest Infographics

Kite capital partners is a private equity firm with over $150 million in committed capital across. When property owners fail to pay their property. Tax lien investing involves an investor buys the claim that a local government makes on. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Tax lien investing is.

Know How Tax Lien Investing Works and How to Make It A Profitable

When property owners fail to pay their property. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Kite capital partners is a private equity firm with over $150 million in committed capital across. Tax lien investing involves an investor buys the claim that a local government makes on. Tax lien investing is.

Steps to invest in tax liens to make profit Latest Infographics

When property owners fail to pay their property. Tax lien investing is an indirect approach to investing in real estate. Tax lien investing involves an investor buys the claim that a local government makes on. Kite capital partners is a private equity firm with over $150 million in committed capital across. Tax lien investing is a type of real estate.

10 Tax Lien Investing Pros and Cons Impact Marketer

Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Kite capital partners is a private equity firm with over $150 million in committed capital across. Tax lien investing is an indirect approach to investing in real estate. Tax lien investing involves an investor buys the claim that a local government makes on..

Tax Lien Investing What to Know CheckBook IRA LLC

Tax lien investing is an indirect approach to investing in real estate. Tax lien investing involves an investor buys the claim that a local government makes on. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Kite capital partners is a private equity firm with over $150 million in committed capital across..

Tax Lien Investing 101 Everything You Need to Know PropertyOnion

Tax lien investing involves an investor buys the claim that a local government makes on. Kite capital partners is a private equity firm with over $150 million in committed capital across. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. When property owners fail to pay their property. Tax lien investing is.

Everything You Need To Know About Tax Lien Investing (And Why It’s So

Kite capital partners is a private equity firm with over $150 million in committed capital across. Tax lien investing involves an investor buys the claim that a local government makes on. When property owners fail to pay their property. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Tax lien investing is.

How to Successful in Tax Lien Investment? Latest Infographics

Kite capital partners is a private equity firm with over $150 million in committed capital across. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. When property owners fail to pay their property. Tax lien investing is an indirect approach to investing in real estate. Tax lien investing involves an investor buys.

Why Tax Lien Investing A Good Business? Tax Lien Certificate School

Tax lien investing involves an investor buys the claim that a local government makes on. Kite capital partners is a private equity firm with over $150 million in committed capital across. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Tax lien investing is an indirect approach to investing in real estate..

Kite Capital Partners Is A Private Equity Firm With Over $150 Million In Committed Capital Across.

When property owners fail to pay their property. Tax lien investing is a type of real estate investment that involves purchasing these liens from the. Tax lien investing is an indirect approach to investing in real estate. Tax lien investing involves an investor buys the claim that a local government makes on.