Tax Lien Sales Nebraska

Tax Lien Sales Nebraska - How tax sales work in nebraska nebraska tax payers who fail to pay the delinquent taxes can lose their property, or some portion of it, to a. Nebraska delinquent tax sale details to help direct and inform tax sale investors of returns, redemption periods, and other details. Taxpayers who are on the delinquent taxpayer list have been sent multiple notices from dor regarding their delinquent tax. All delinquent real property taxes will be offered for sale on the first monday in march at the public tax lien sale. The private tax lien sale is a random draw conducted privately in the treasurer's office (investors are not present). The lists of delinquent real property taxes are based on the. Tax list will be updated each friday until the tax sale. The tax liens not purchased at. 48 rows delinquent lists february 12, 2024. Tax list prints are available at treasurer's office for a $20 print fee.

The tax liens not purchased at. Tax list will be updated each friday until the tax sale. Taxpayers who are on the delinquent taxpayer list have been sent multiple notices from dor regarding their delinquent tax. The lists of delinquent real property taxes are based on the. Tax list prints are available at treasurer's office for a $20 print fee. How tax sales work in nebraska nebraska tax payers who fail to pay the delinquent taxes can lose their property, or some portion of it, to a. 48 rows delinquent lists february 12, 2024. Nebraska delinquent tax sale details to help direct and inform tax sale investors of returns, redemption periods, and other details. The private tax lien sale is a random draw conducted privately in the treasurer's office (investors are not present). All delinquent real property taxes will be offered for sale on the first monday in march at the public tax lien sale.

48 rows delinquent lists february 12, 2024. How tax sales work in nebraska nebraska tax payers who fail to pay the delinquent taxes can lose their property, or some portion of it, to a. The lists of delinquent real property taxes are based on the. Nebraska delinquent tax sale details to help direct and inform tax sale investors of returns, redemption periods, and other details. The tax liens not purchased at. All delinquent real property taxes will be offered for sale on the first monday in march at the public tax lien sale. Tax list will be updated each friday until the tax sale. Taxpayers who are on the delinquent taxpayer list have been sent multiple notices from dor regarding their delinquent tax. The private tax lien sale is a random draw conducted privately in the treasurer's office (investors are not present). Tax list prints are available at treasurer's office for a $20 print fee.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

Taxpayers who are on the delinquent taxpayer list have been sent multiple notices from dor regarding their delinquent tax. All delinquent real property taxes will be offered for sale on the first monday in march at the public tax lien sale. Tax list will be updated each friday until the tax sale. The tax liens not purchased at. Nebraska delinquent.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

How tax sales work in nebraska nebraska tax payers who fail to pay the delinquent taxes can lose their property, or some portion of it, to a. Nebraska delinquent tax sale details to help direct and inform tax sale investors of returns, redemption periods, and other details. Tax list will be updated each friday until the tax sale. 48 rows.

The Other Foreclosure Crisis Property Tax Lien Sales FORECLOSURE FRAUD

48 rows delinquent lists february 12, 2024. Taxpayers who are on the delinquent taxpayer list have been sent multiple notices from dor regarding their delinquent tax. The lists of delinquent real property taxes are based on the. Nebraska delinquent tax sale details to help direct and inform tax sale investors of returns, redemption periods, and other details. All delinquent real.

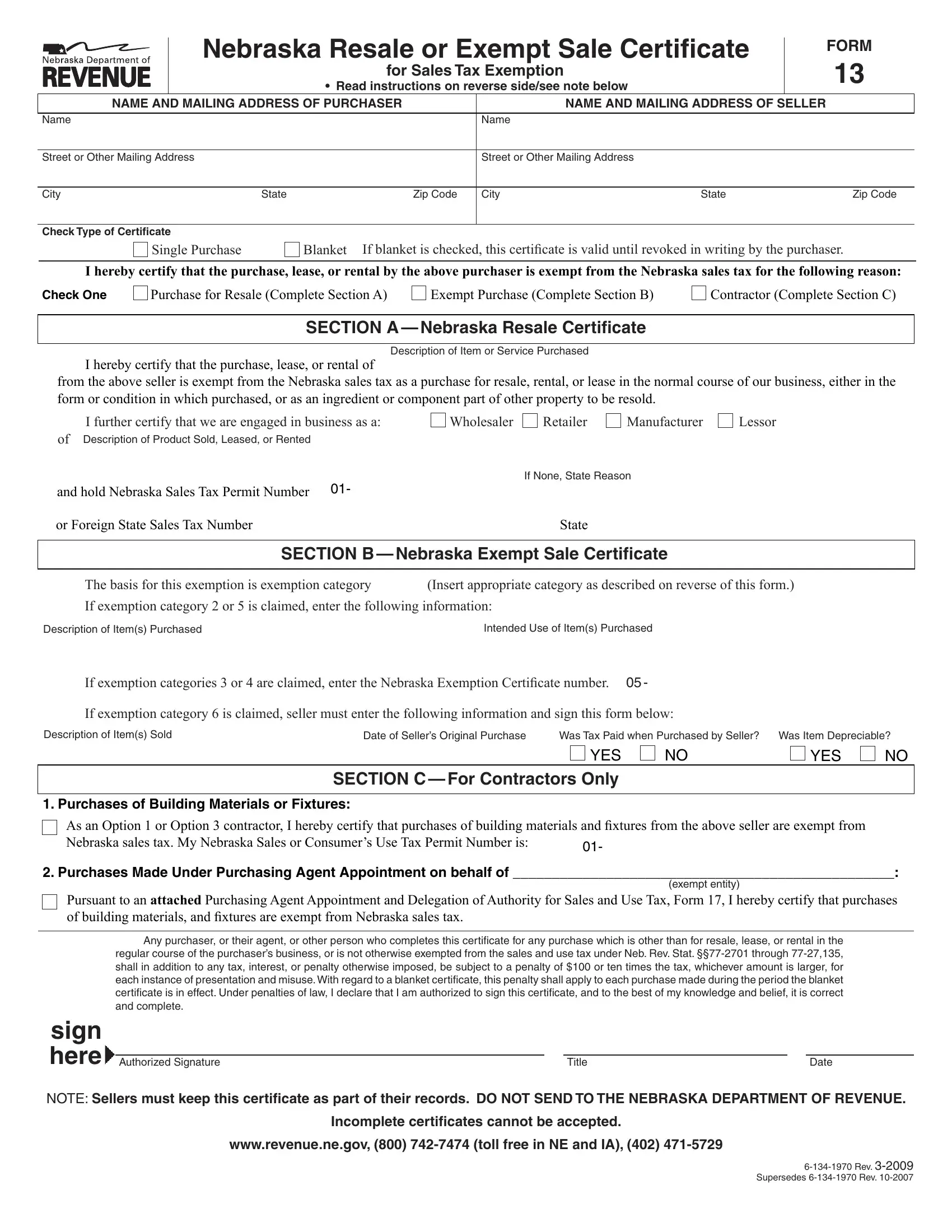

Nebraska Sales Tax Form ≡ Fill Out Printable PDF Forms Online

Tax list will be updated each friday until the tax sale. The tax liens not purchased at. The private tax lien sale is a random draw conducted privately in the treasurer's office (investors are not present). Nebraska delinquent tax sale details to help direct and inform tax sale investors of returns, redemption periods, and other details. All delinquent real property.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

The lists of delinquent real property taxes are based on the. Taxpayers who are on the delinquent taxpayer list have been sent multiple notices from dor regarding their delinquent tax. 48 rows delinquent lists february 12, 2024. Tax list will be updated each friday until the tax sale. All delinquent real property taxes will be offered for sale on the.

Tax Lien Investing Tips Which States have tax sales in the next 30

How tax sales work in nebraska nebraska tax payers who fail to pay the delinquent taxes can lose their property, or some portion of it, to a. 48 rows delinquent lists february 12, 2024. The private tax lien sale is a random draw conducted privately in the treasurer's office (investors are not present). Taxpayers who are on the delinquent taxpayer.

Tax Lien Sale PDF Tax Lien Taxes

Nebraska delinquent tax sale details to help direct and inform tax sale investors of returns, redemption periods, and other details. Tax list prints are available at treasurer's office for a $20 print fee. 48 rows delinquent lists february 12, 2024. Tax list will be updated each friday until the tax sale. The lists of delinquent real property taxes are based.

Tax Lien Training Special Expired — Financial Freedom University

All delinquent real property taxes will be offered for sale on the first monday in march at the public tax lien sale. Taxpayers who are on the delinquent taxpayer list have been sent multiple notices from dor regarding their delinquent tax. Nebraska delinquent tax sale details to help direct and inform tax sale investors of returns, redemption periods, and other.

EasytoUnderstand Tax Lien Code Certificates Posteezy

The lists of delinquent real property taxes are based on the. The tax liens not purchased at. How tax sales work in nebraska nebraska tax payers who fail to pay the delinquent taxes can lose their property, or some portion of it, to a. All delinquent real property taxes will be offered for sale on the first monday in march.

What is a tax lien? TaxJar

Tax list will be updated each friday until the tax sale. How tax sales work in nebraska nebraska tax payers who fail to pay the delinquent taxes can lose their property, or some portion of it, to a. Taxpayers who are on the delinquent taxpayer list have been sent multiple notices from dor regarding their delinquent tax. All delinquent real.

All Delinquent Real Property Taxes Will Be Offered For Sale On The First Monday In March At The Public Tax Lien Sale.

The private tax lien sale is a random draw conducted privately in the treasurer's office (investors are not present). How tax sales work in nebraska nebraska tax payers who fail to pay the delinquent taxes can lose their property, or some portion of it, to a. Tax list prints are available at treasurer's office for a $20 print fee. Tax list will be updated each friday until the tax sale.

Nebraska Delinquent Tax Sale Details To Help Direct And Inform Tax Sale Investors Of Returns, Redemption Periods, And Other Details.

Taxpayers who are on the delinquent taxpayer list have been sent multiple notices from dor regarding their delinquent tax. The tax liens not purchased at. The lists of delinquent real property taxes are based on the. 48 rows delinquent lists february 12, 2024.