Texas Tax Lien Sale

Texas Tax Lien Sale - Sales results by month are posted on the delinquent tax sales link at the bottom of this page. The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. Further guidelines discussing other aspects of. Cause numbers are noted as. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. These are the basic fundamentals of the sales process of all texas tax lien sales.

These are the basic fundamentals of the sales process of all texas tax lien sales. Cause numbers are noted as. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. Further guidelines discussing other aspects of. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes.

Sales results by month are posted on the delinquent tax sales link at the bottom of this page. These are the basic fundamentals of the sales process of all texas tax lien sales. The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. Cause numbers are noted as. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Further guidelines discussing other aspects of. Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website.

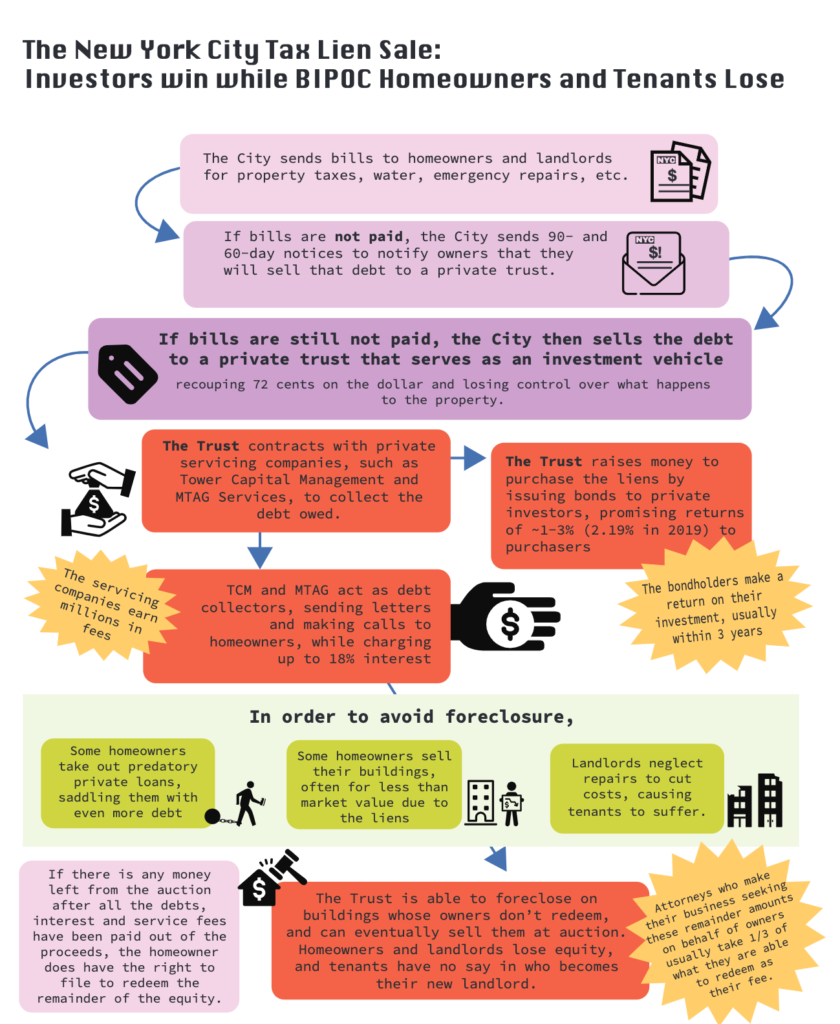

Property Tax Lien Sale Program Extended by City Council CityLand CityLand

A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Further guidelines discussing other aspects of. These are the basic fundamentals of the sales process of all texas tax lien sales. Additional information relating to the harris county delinquent tax.

NYC Tax Lien Sale Reform Conference EastNewYorkCLT

These are the basic fundamentals of the sales process of all texas tax lien sales. Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. The harris county delinquent tax sale is.

Tax Lien Tax Lien Certificates Texas

Sales results by month are posted on the delinquent tax sales link at the bottom of this page. These are the basic fundamentals of the sales process of all texas tax lien sales. Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. Further guidelines discussing other aspects of. A.

Investing in Tax Lien Seminars and Courses

A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. These are the basic fundamentals of the sales process of all.

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Cause numbers are.

Tax Lien Sale San Juan County

Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. Further guidelines discussing other aspects of. Cause numbers are noted as. The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. Sales results by month are posted on the delinquent tax.

tax lien PDF Free Download

A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Cause numbers are noted as. Further guidelines discussing other aspects of. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Additional.

Nyc Tax Lien Sale 2024 Jill Rozalin

The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. Further guidelines discussing other aspects of. Sales results by month are posted on the delinquent tax sales link at the bottom.

TEXAS TAX LIEN SALES GUIDE

Further guidelines discussing other aspects of. These are the basic fundamentals of the sales process of all texas tax lien sales. The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Cause numbers.

Informational Brochure About the Tax Lien Sale EastNewYorkCLT

Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. The harris county delinquent tax sale is the monthly public auction of real estate for past due property taxes. These are the basic fundamentals of the sales process of all texas tax lien sales. Sales results by month are posted.

The Harris County Delinquent Tax Sale Is The Monthly Public Auction Of Real Estate For Past Due Property Taxes.

These are the basic fundamentals of the sales process of all texas tax lien sales. Additional information relating to the harris county delinquent tax sale are available from the resources and links throughout this website. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Further guidelines discussing other aspects of.

Cause Numbers Are Noted As.

A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay.