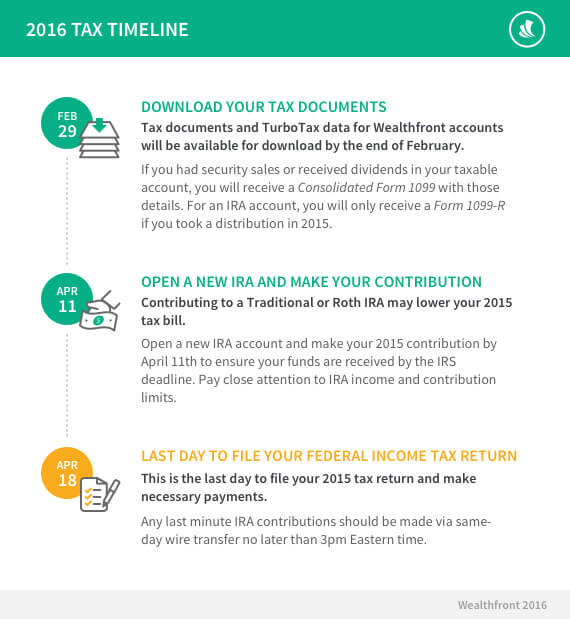

Wealthfront Tax Forms

Wealthfront Tax Forms - For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including. You can just access your account and click your profile | documents. What is a series 480 tax form? For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. Wealthfront will send you a form to report your interest. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. We’ve partnered with green dot bank, member fdic, to bring you. If you’re a wealthfront client and you earned more than $10 of interest (or $600 in awards) during the previous year, we’ll send. Our support team has your back.

Our support team has your back. Wealthfront will send you a form to report your interest. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. If you’re a wealthfront client and you earned more than $10 of interest (or $600 in awards) during the previous year, we’ll send. What is a series 480 tax form? You can just access your account and click your profile | documents. We’ve partnered with green dot bank, member fdic, to bring you. For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including. For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january.

We’ve partnered with green dot bank, member fdic, to bring you. What is a series 480 tax form? For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including. If you’re a wealthfront client and you earned more than $10 of interest (or $600 in awards) during the previous year, we’ll send. Wealthfront will send you a form to report your interest. Our support team has your back. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. You can just access your account and click your profile | documents.

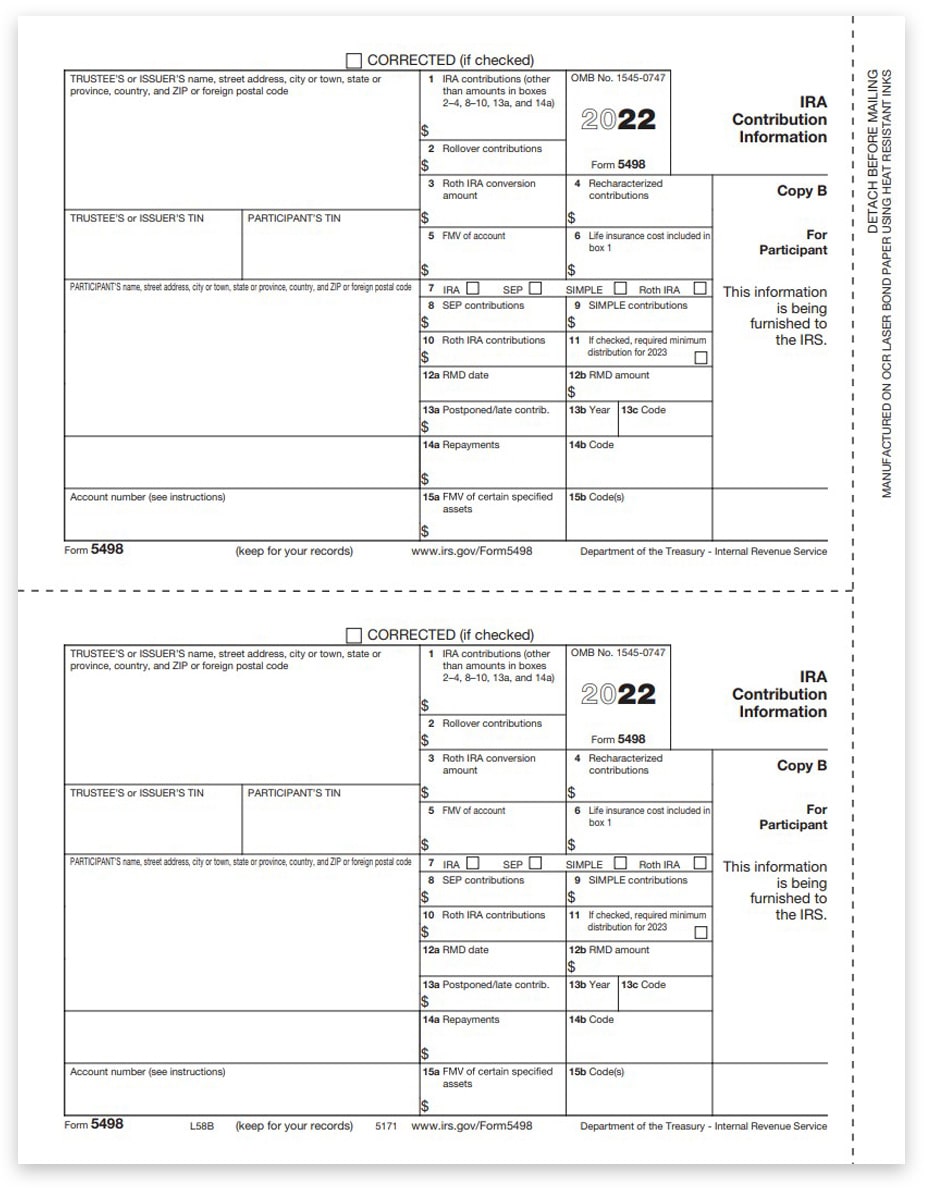

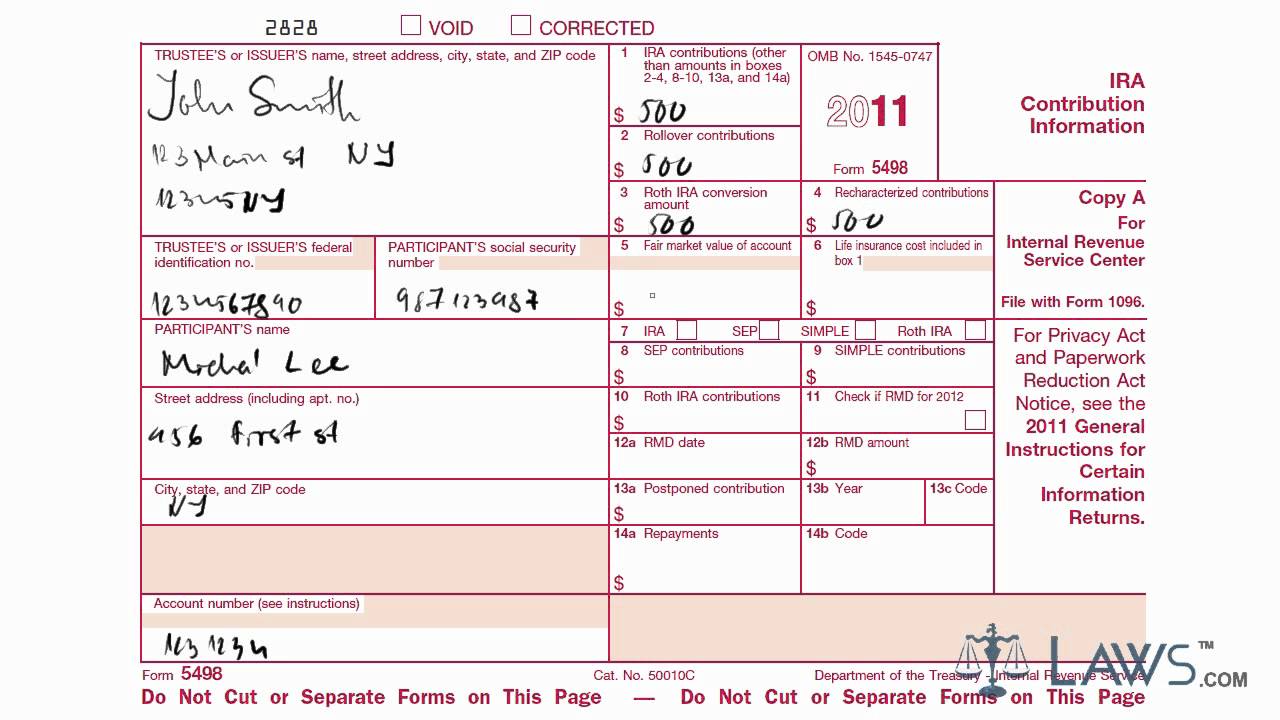

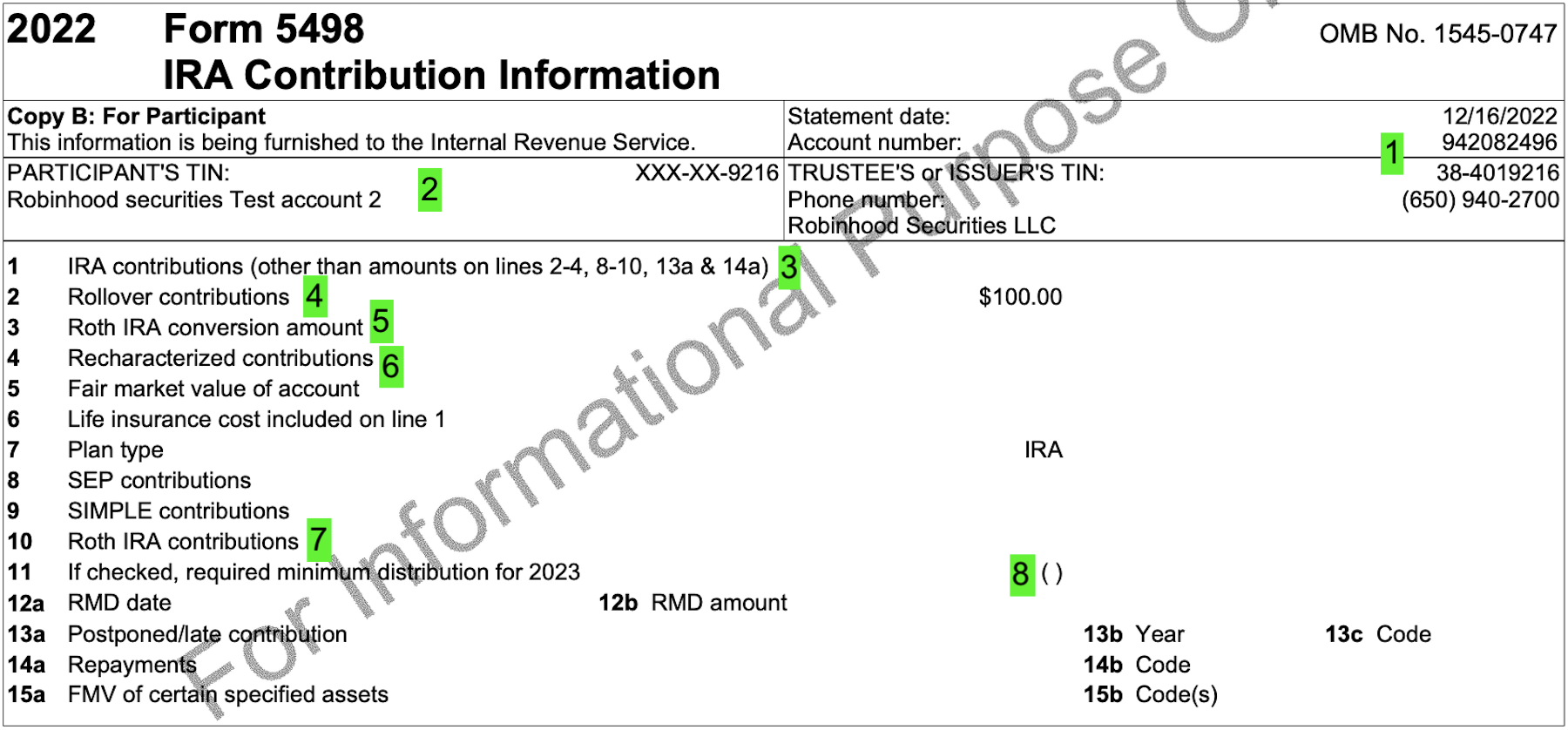

5498 Tax Forms for IRA Contributions, Participant Copy B

We’ve partnered with green dot bank, member fdic, to bring you. What is a series 480 tax form? You can just access your account and click your profile | documents. Our support team has your back. For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including.

Wealthfront TaxLoss Harvesting Explained Is It Worth It? YouTube

Wealthfront will send you a form to report your interest. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. What is a series 480 tax form? Our support team has your back. For individual, joint, and trust automated and stock investing accounts, you.

Wealthfront's TurboTax Integration Makes Tax Time Easy

What is a series 480 tax form? For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. Wealthfront will send you a form to report your interest. Our support team has your back. We’ve partnered with green dot bank, member fdic, to bring you.

Beginner's guide to filing tax in Canada MoneyTalk

What is a series 480 tax form? For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. You can just access your account and click your profile | documents. Wealthfront will send you a form to report your interest. Our support team has your.

Learn How to Fill the Form 5498 Individual Retirement Account

For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. We’ve partnered with green dot bank, member fdic, to bring you. What is a series 480 tax form? You can just access your account and click your profile | documents. For individual, joint, and.

How to read your 1099R and 5498 Robinhood

For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. We’ve partnered with green dot bank, member fdic, to bring you. Wealthfront will send you a form to report your interest. What is a series 480 tax form? For individual, joint, and trust automated.

Wealthfront Eliminates 100k Minimum For TaxLoss Harvesting Wealth

For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. Wealthfront will send you a form to report your interest. We’ve partnered with green dot bank, member fdic, to bring you. If you’re a wealthfront client and you earned more than $10 of interest.

Wealthfront Review

For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. Our support team has your back. If you’re.

How to Read Your Brokerage 1099 Form YouTube

We’ve partnered with green dot bank, member fdic, to bring you. What is a series 480 tax form? For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form.

Top 9 Reviews and Complaints about Wealthfront

For individual, joint, and trust automated and stock investing accounts, you will receive a consolidated form 1099 including. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. We’ve partnered with green dot bank, member fdic, to bring you. If you’re a wealthfront client.

Our Support Team Has Your Back.

You can just access your account and click your profile | documents. For individual, joint, and trust cash accounts, you will receive a 1099 tax form if your cash account generated more than $10 of interest in the. If you’re a wealthfront client and you earned more than $10 of interest (or $600 in awards) during the previous year, we’ll send. Wealthfront will send you a form to report your interest.

For Individual, Joint, And Trust Automated And Stock Investing Accounts, You Will Receive A Consolidated Form 1099 Including.

For cash accounts that generated more than $10 of interest or received $600 or more in awards, you will receive a tax form 1099 by january. We’ve partnered with green dot bank, member fdic, to bring you. What is a series 480 tax form?