What Is Rsu In Box 14 Of W2

What Is Rsu In Box 14 Of W2 - Company provides rsu and psu and converts the amount into stock. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Taxpayers will simply translate the figure listed in. How do i report my rsu? Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu).

Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Company provides rsu and psu and converts the amount into stock. How do i report my rsu? Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Taxpayers will simply translate the figure listed in.

Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Taxpayers will simply translate the figure listed in. Company provides rsu and psu and converts the amount into stock. How do i report my rsu?

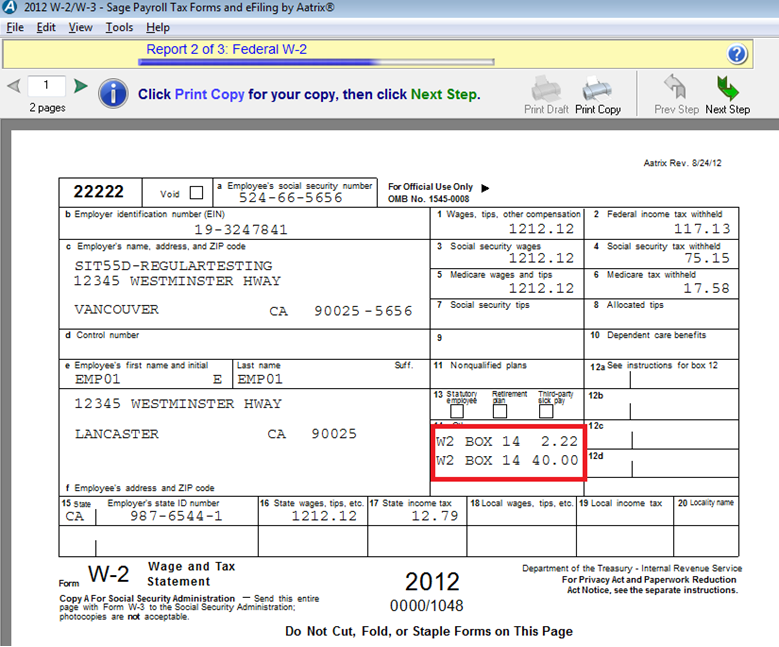

Jahrestag ägyptisch häufig box 14 w2 habe Selbstvertrauen Gastgeber von

Company provides rsu and psu and converts the amount into stock. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. How do i report my rsu? Companies often offer employees stock options that are issued to them or purchased through restricted stock units.

Stock Options vs RSU Understanding the key differences

Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Taxpayers will simply translate the figure listed in. How do i report my rsu? Company provides.

RSU路测单元,你知道多少? 哔哩哔哩

How do i report my rsu? Taxpayers will simply translate the figure listed in. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Company provides.

Jahrestag ägyptisch häufig box 14 w2 habe Selbstvertrauen Gastgeber von

Taxpayers will simply translate the figure listed in. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Company provides rsu and psu and converts the.

Your Complete Guide to Employee Stock Options and Tax Reporting Forms

Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. How do i report my rsu? Taxpayers will simply translate the figure listed in. Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Company provides.

Embedded AI Edge System in RSU Architecture for Traffic Enforcement

Taxpayers will simply translate the figure listed in. Company provides rsu and psu and converts the amount into stock. Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). How do i report my rsu? Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on.

box d w2 Blog TaxBandits

How do i report my rsu? Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Taxpayers will simply translate the figure listed in. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Company provides.

RSU Taxes How are RSUs taxed? Financial

Company provides rsu and psu and converts the amount into stock. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. How do i report my rsu? Companies often offer employees stock options that are issued to them or purchased through restricted stock units.

Community Connections Feb. 2024 RSU 34

Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Taxpayers will simply translate the figure listed in. Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). How do i report my rsu? Company provides.

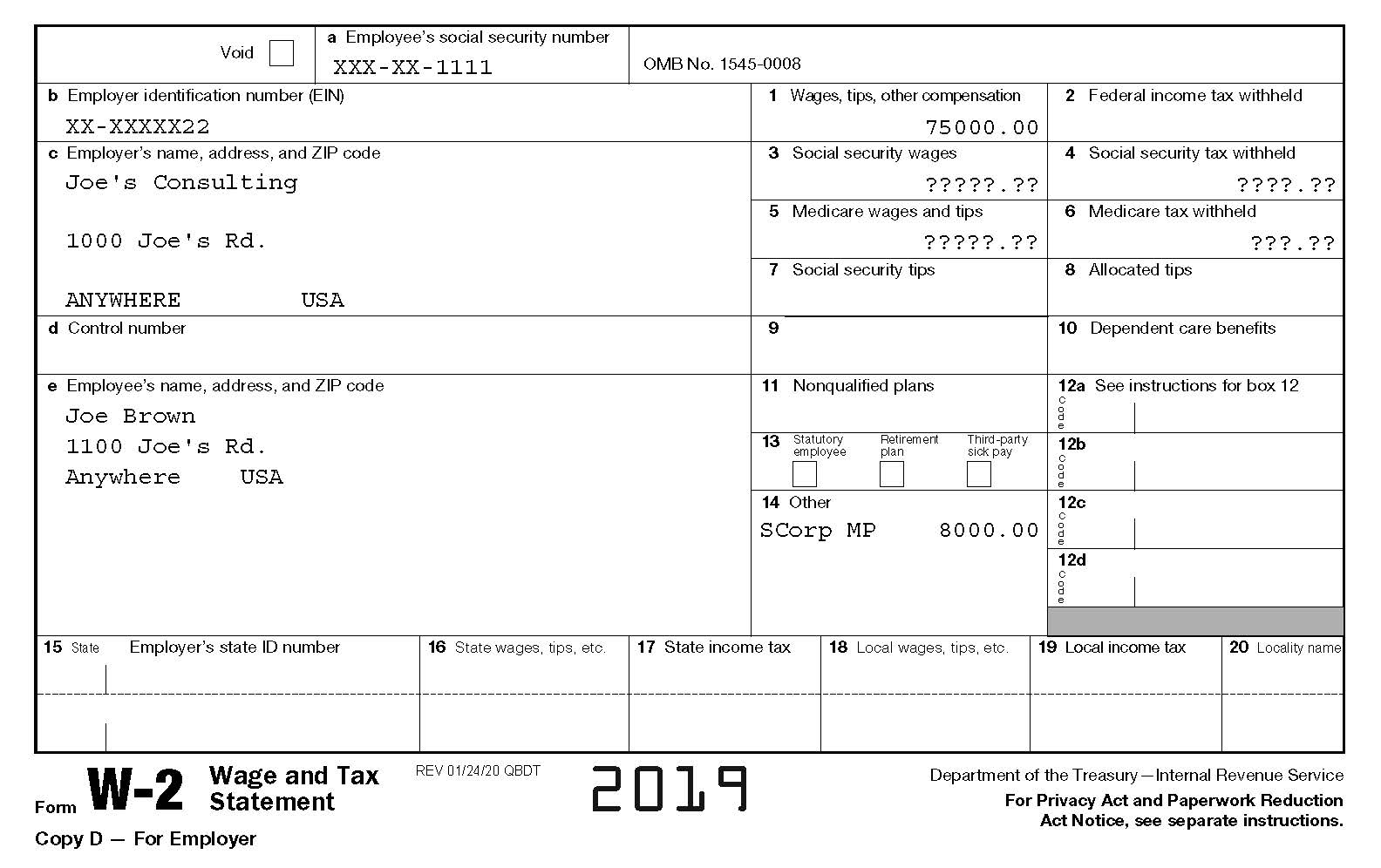

W2 Form Example

Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Taxpayers will simply translate the figure listed in. How do i report my rsu? Company provides rsu and psu and converts the amount into stock. Companies often offer employees stock options that are issued.

How Do I Report My Rsu?

Company provides rsu and psu and converts the amount into stock. Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Taxpayers will simply translate the figure listed in.