When Are 2290 Forms Due

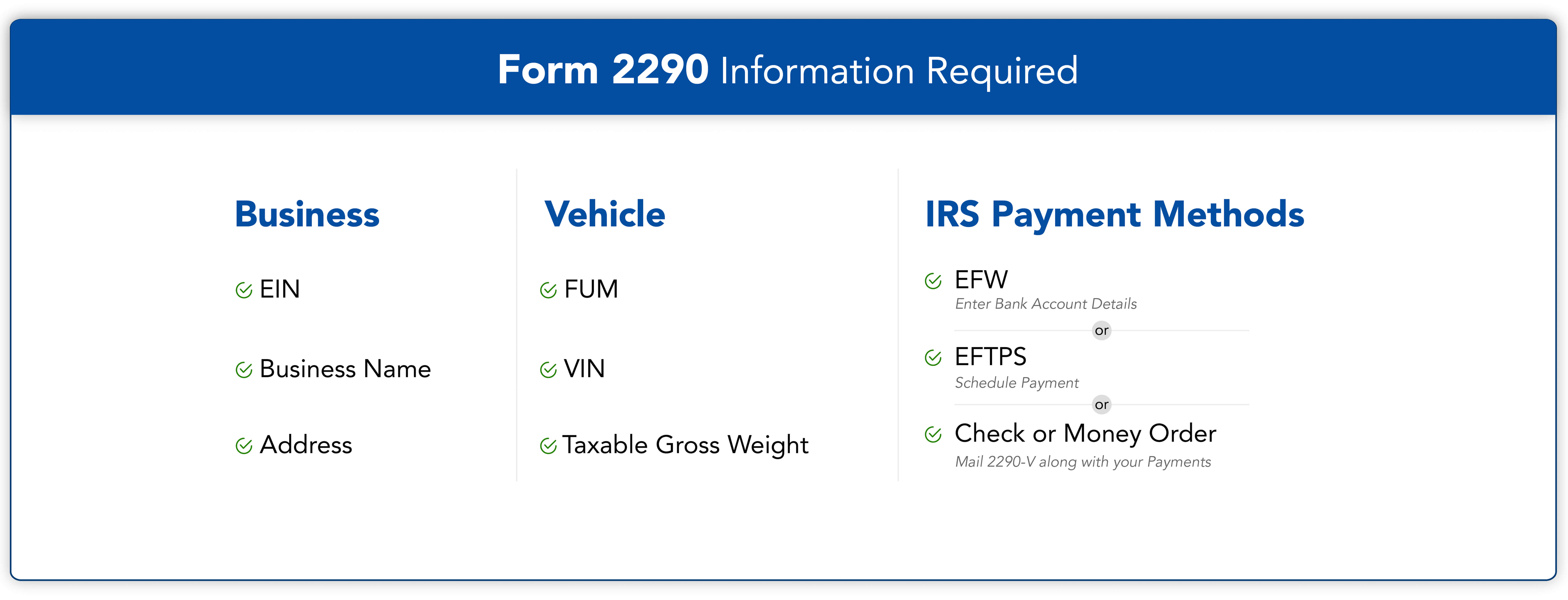

When Are 2290 Forms Due - In short, the 2290 due date is august 31 st (unless the irs extends it due to the 31st falling on weekends, and/or labor day) for. Information about form 2290, heavy. Note that as with all irs tax returns, if the due date. Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. In this case, the answer to the question, ‘when is the 2290 due’ is august 31st.

Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. In short, the 2290 due date is august 31 st (unless the irs extends it due to the 31st falling on weekends, and/or labor day) for. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Information about form 2290, heavy. In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. Note that as with all irs tax returns, if the due date.

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. In short, the 2290 due date is august 31 st (unless the irs extends it due to the 31st falling on weekends, and/or labor day) for. Information about form 2290, heavy. Note that as with all irs tax returns, if the due date. In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways.

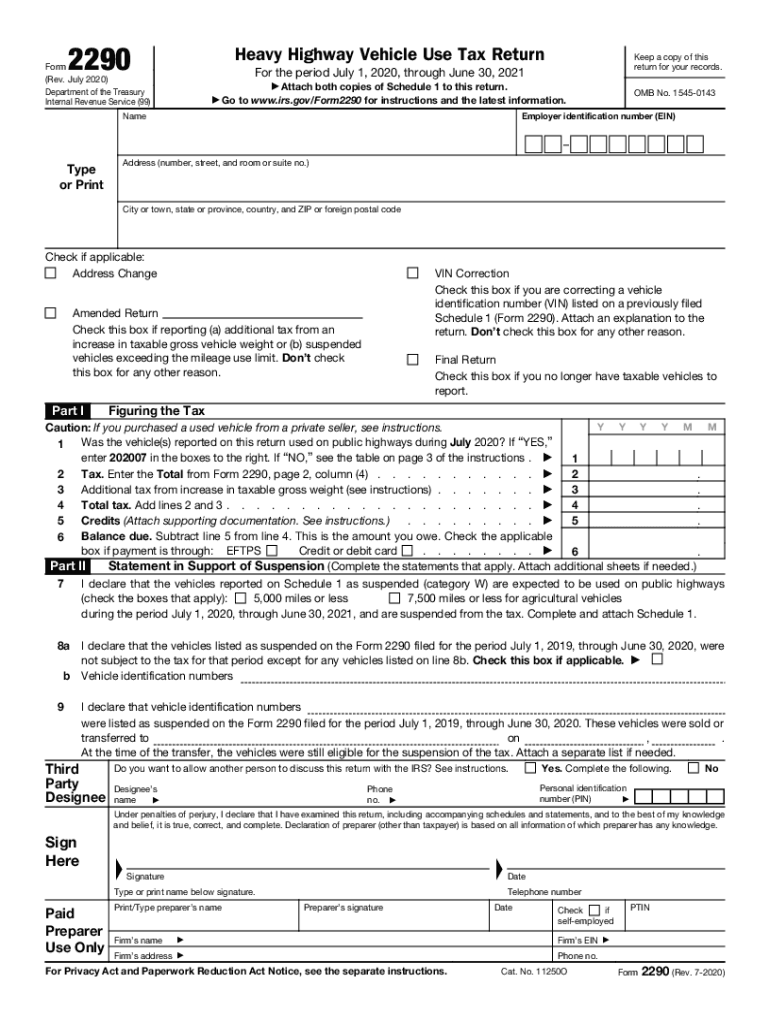

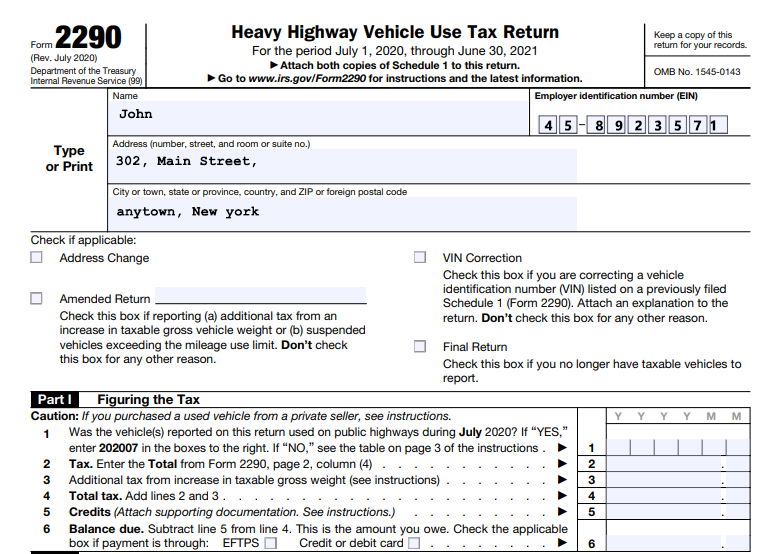

2020 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Form 2290 must be filed for the month the taxable vehicle is first used on public highways.

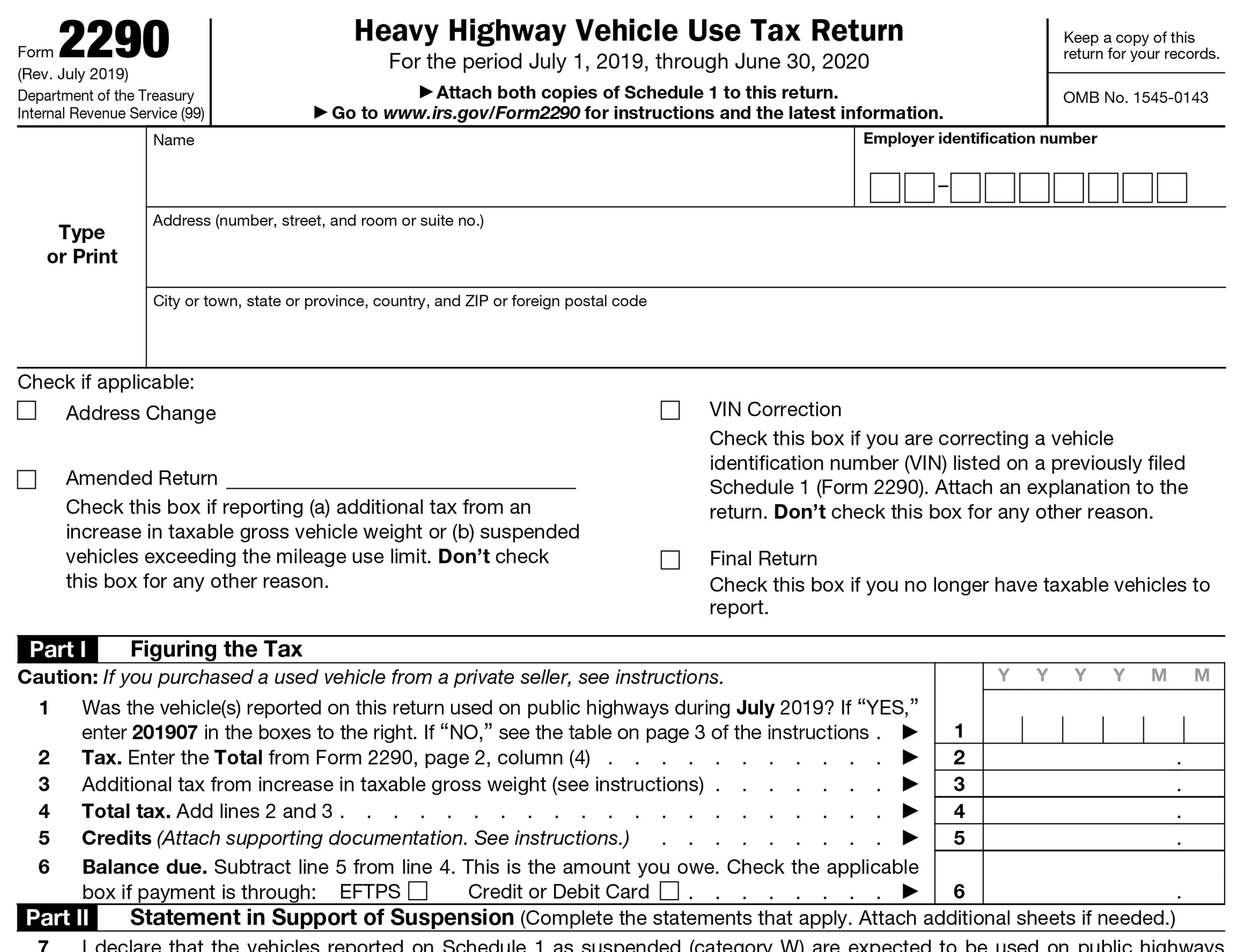

Printable IRS Form 2290 for 2020 Download 2290 Form

You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. In.

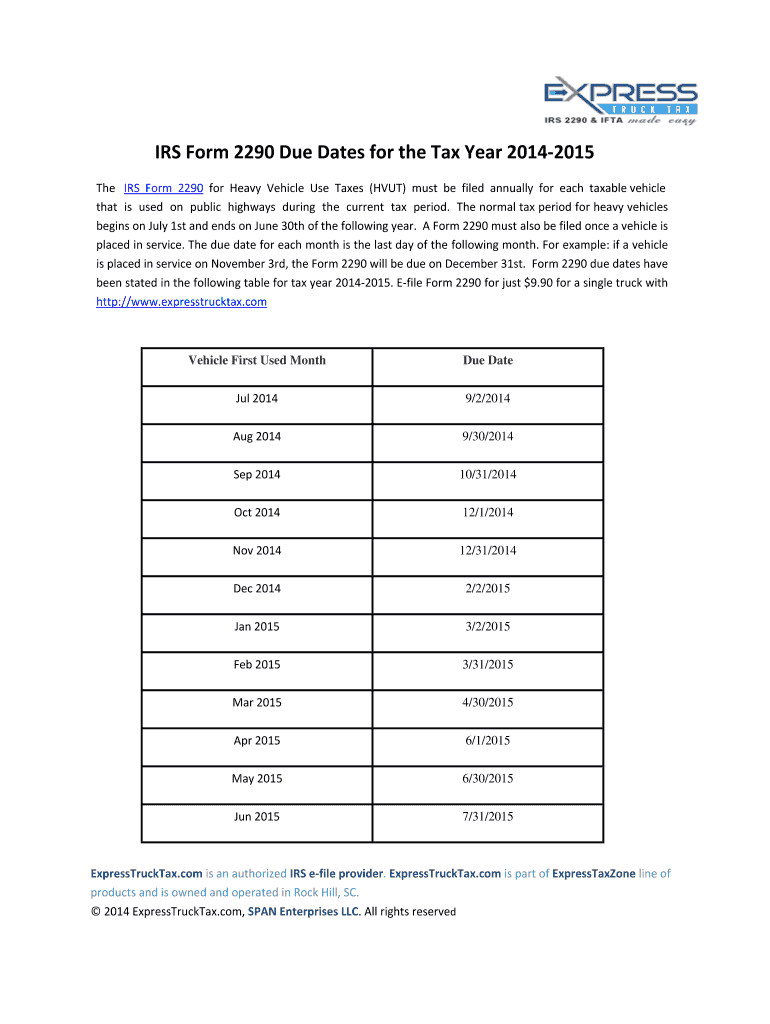

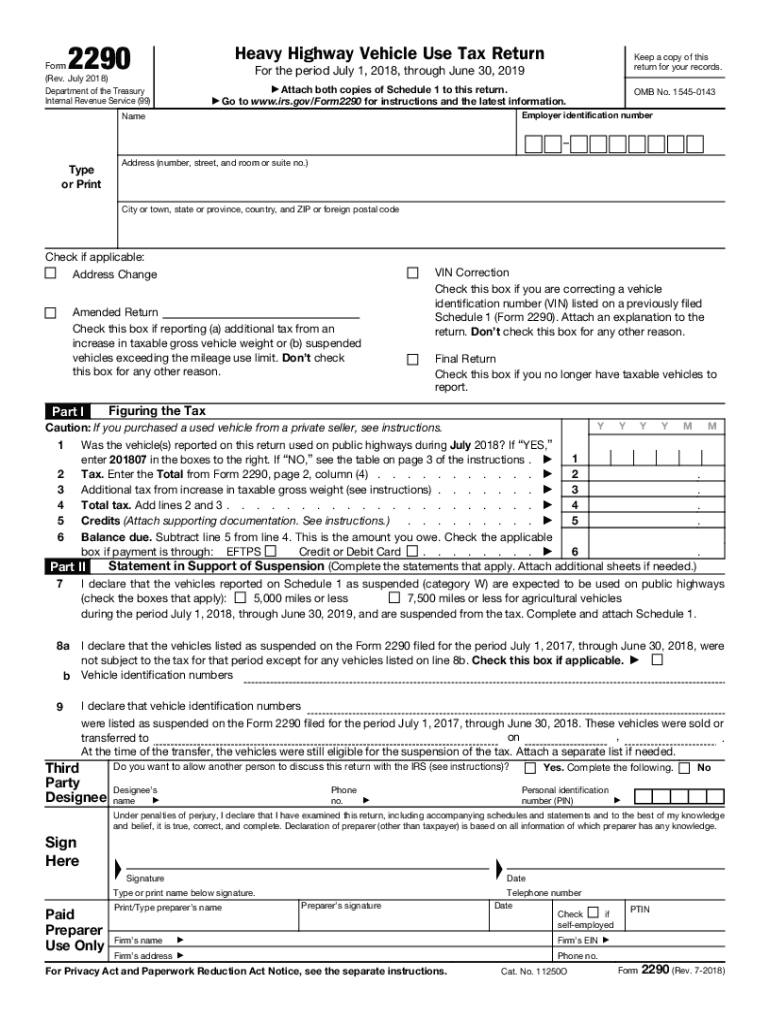

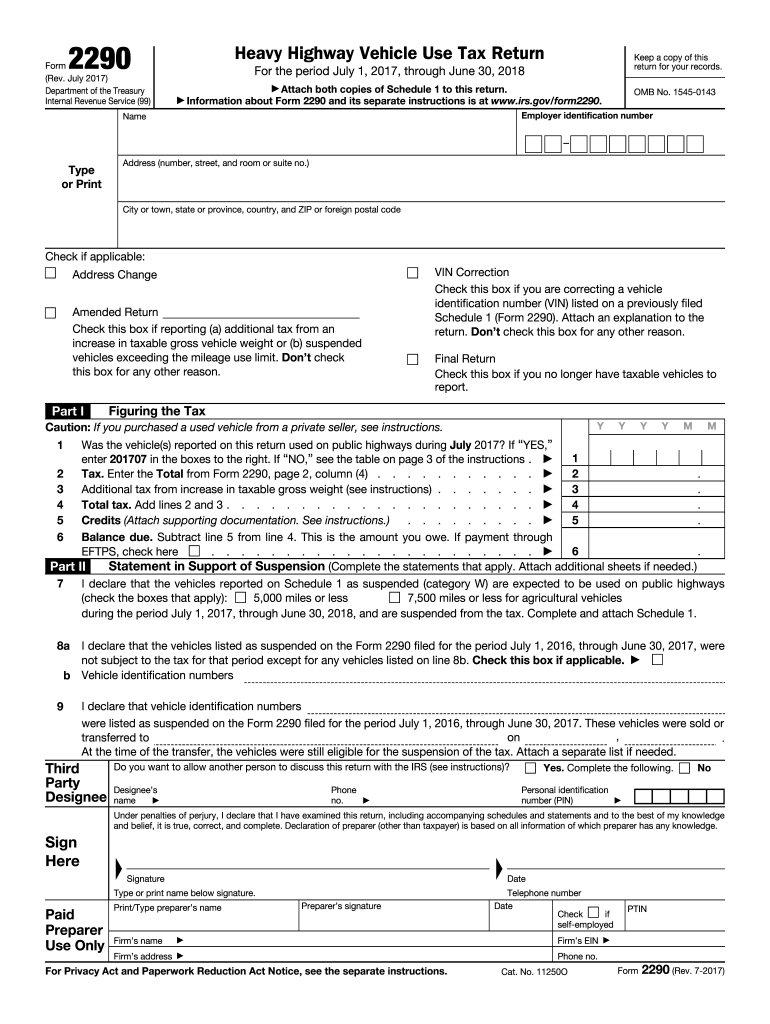

IRS 2290 Due Dates 2014 Fill and Sign Printable Template Online US

Information about form 2290, heavy. Note that as with all irs tax returns, if the due date. In short, the 2290 due date is august 31 st (unless the irs extends it due to the 31st falling on weekends, and/or labor day) for. In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. You.

IRS Form 2290 Due Date For 20232024 Tax Period

Information about form 2290, heavy. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Note that as with all irs tax returns, if the due date. Form 2290 must be filed for the month the taxable vehicle is first used on public highways.

What Is The Form 2290 Due Date? YouTube

Information about form 2290, heavy. Note that as with all irs tax returns, if the due date. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. In short, the 2290 due date is august 31 st (unless the irs extends it due to the 31st falling on weekends, and/or labor day) for..

Irs Form 2290 Printable

In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. In short, the 2290 due date is august 31 st (unless the irs extends it due to the 31st falling on weekends, and/or.

Irs Gov 2290 20182024 Form Fill Out and Sign Printable PDF Template

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Form 2290 must be filed for the month the taxable vehicle is first used on public highways.

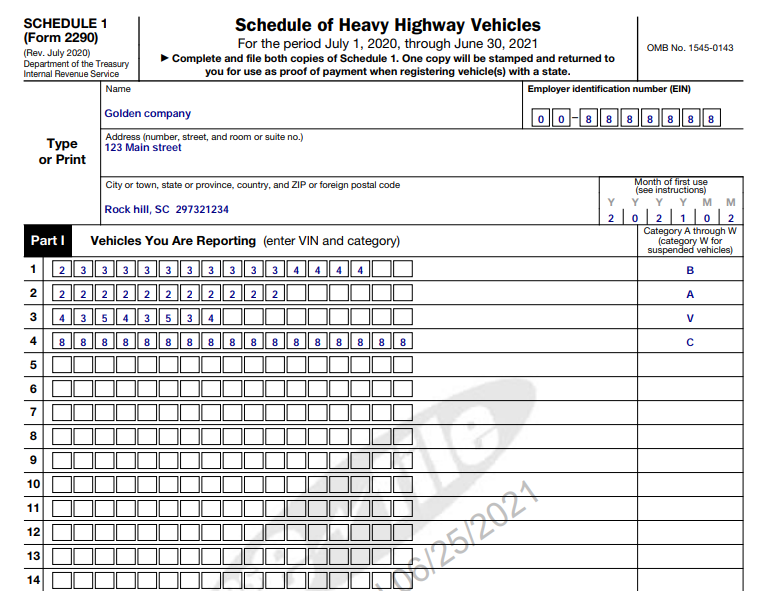

Printable Schedule 1 Form 2290 Printable Form 2024

Information about form 2290, heavy. In short, the 2290 due date is august 31 st (unless the irs extends it due to the 31st falling on weekends, and/or labor day) for. Note that as with all irs tax returns, if the due date. Form 2290 must be filed for the month the taxable vehicle is first used on public highways.

2290 Form Fill Out and Sign Printable PDF Template airSlate SignNow

You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Information about form 2290, heavy. In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. In short, the 2290 due date is august 31 st (unless the irs.

Printable 2290 Form

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Note that as with all irs tax returns, if the due date. In short, the 2290 due date is august 31 st (unless the irs extends it due to the 31st falling on weekends, and/or labor day) for. Form 2290 must be filed.

You Must File Form 2290 For These Trucks By The Last Day Of The Month Following The Month The Vehicle Was First Used On Public Highways.

Information about form 2290, heavy. In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. Note that as with all irs tax returns, if the due date. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

Form 2290 Must Be Filed For The Month The Taxable Vehicle Is First Used On Public Highways During The Current Period.

In short, the 2290 due date is august 31 st (unless the irs extends it due to the 31st falling on weekends, and/or labor day) for.