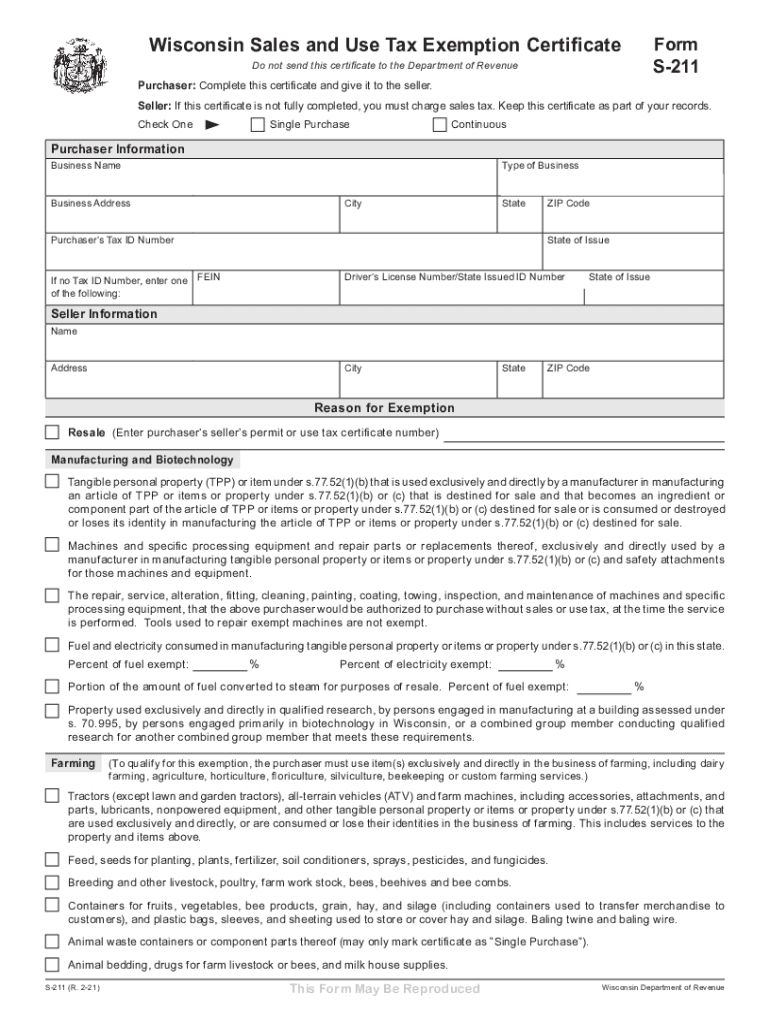

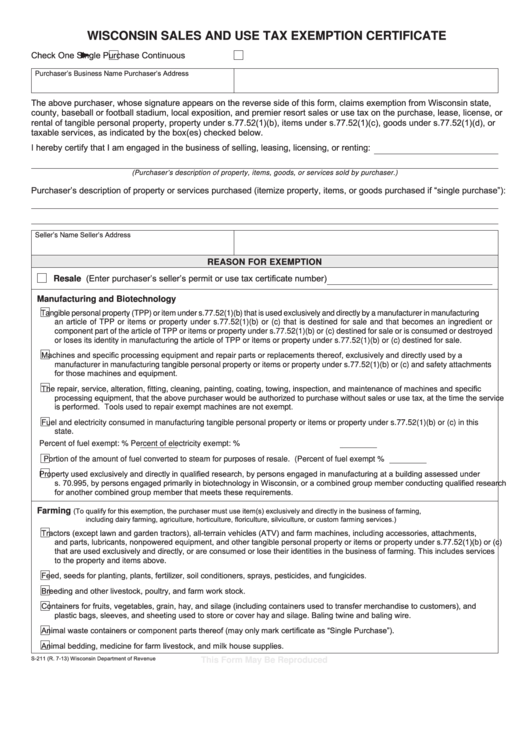

Wisconsin Sales And Use Tax Exemption Form

Wisconsin Sales And Use Tax Exemption Form - Under the sales and use tax law, all receipts from sales of tangible personal property or taxable services are subject to the tax until the contrary. Find out when and how to obtain an exemption. This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture,.

(to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture,. Find out when and how to obtain an exemption. Under the sales and use tax law, all receipts from sales of tangible personal property or taxable services are subject to the tax until the contrary. This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort.

This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture,. Under the sales and use tax law, all receipts from sales of tangible personal property or taxable services are subject to the tax until the contrary. Find out when and how to obtain an exemption.

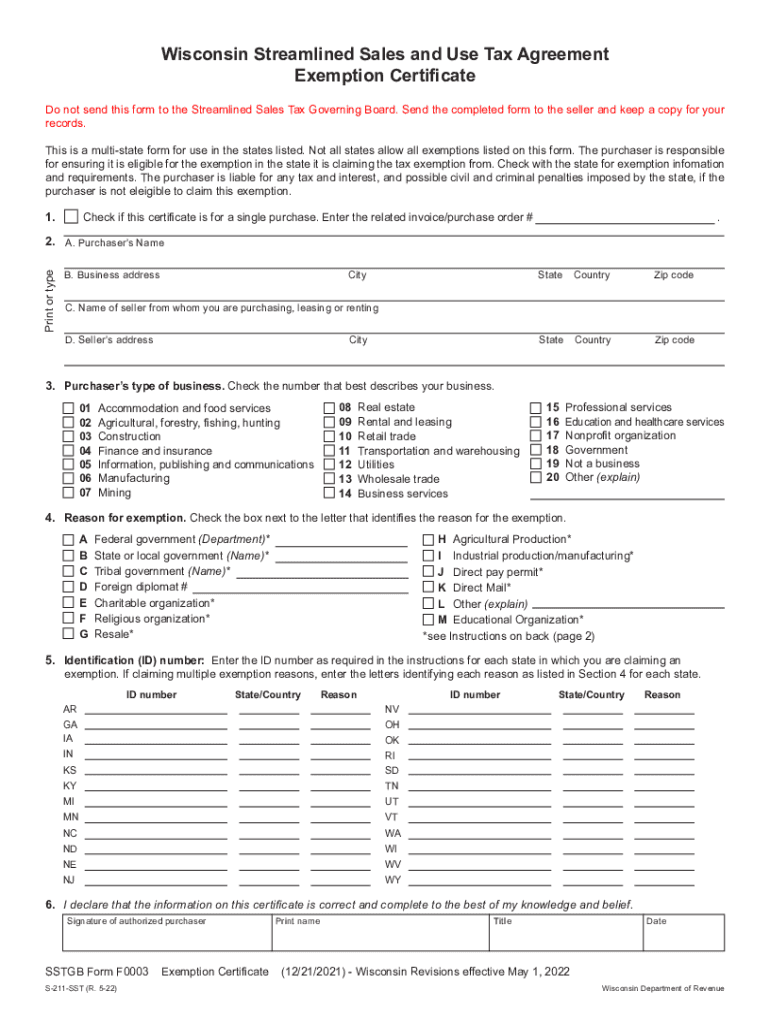

Wi S 211 Sst 20222024 Form Fill Out and Sign Printable PDF Template

This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture,. Under the sales and use tax law, all receipts from sales of tangible personal property or taxable.

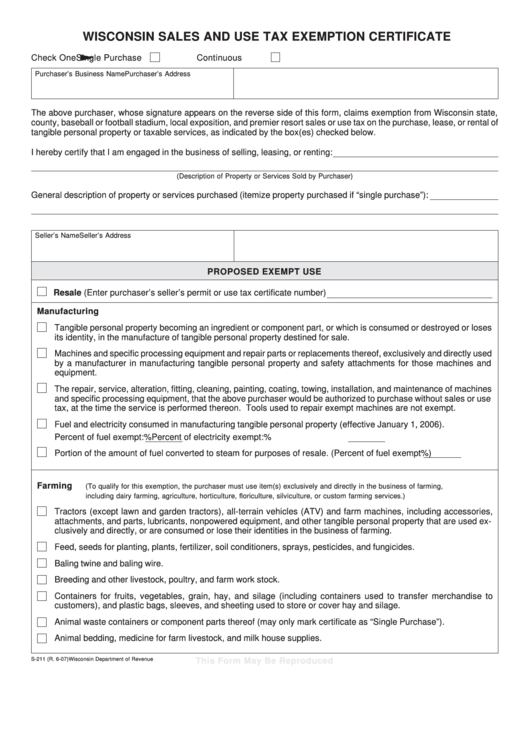

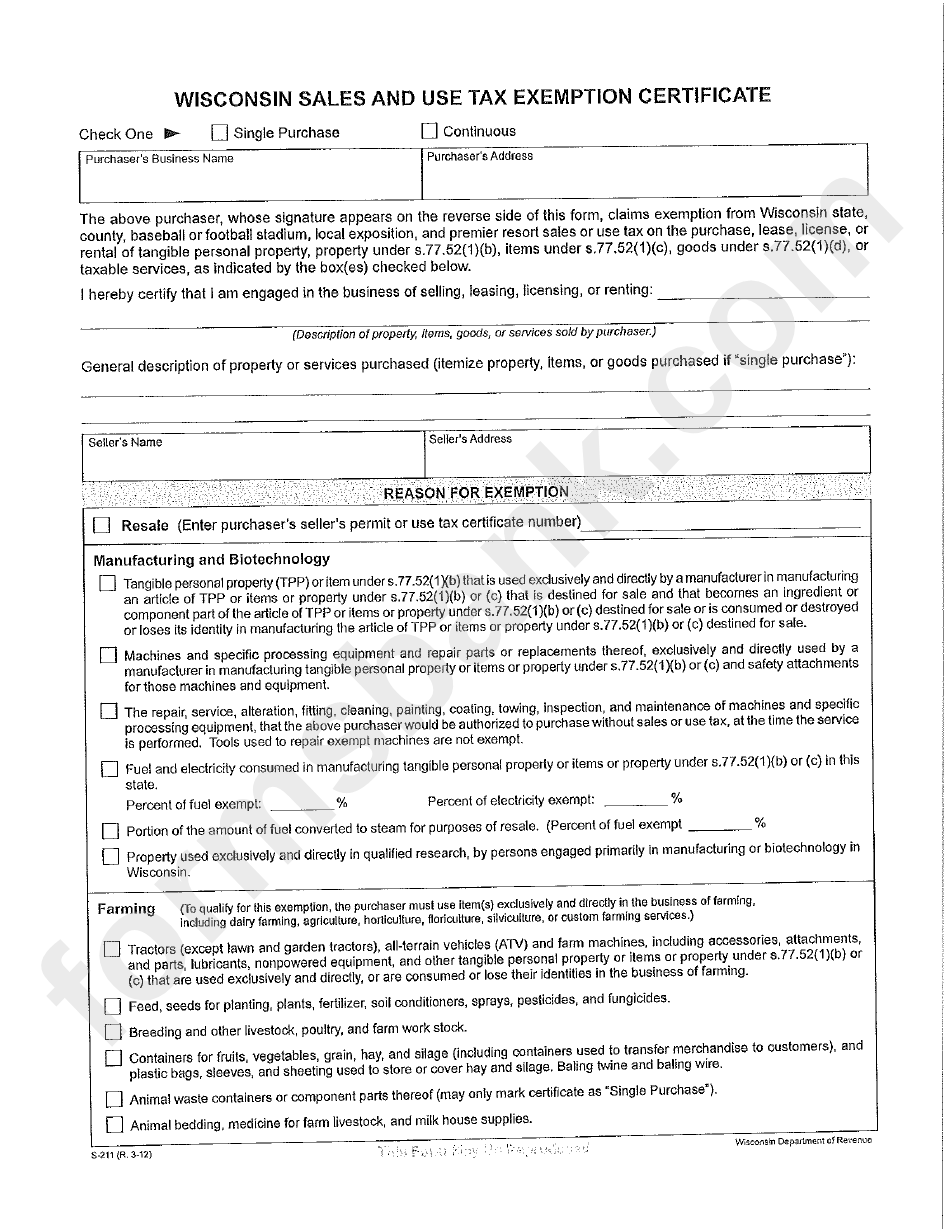

June 2007 S211 Wisconsin Sales And Use Tax Exemption Certificate

This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture,. Find out when and how to obtain an exemption. Under the sales and use tax law, all.

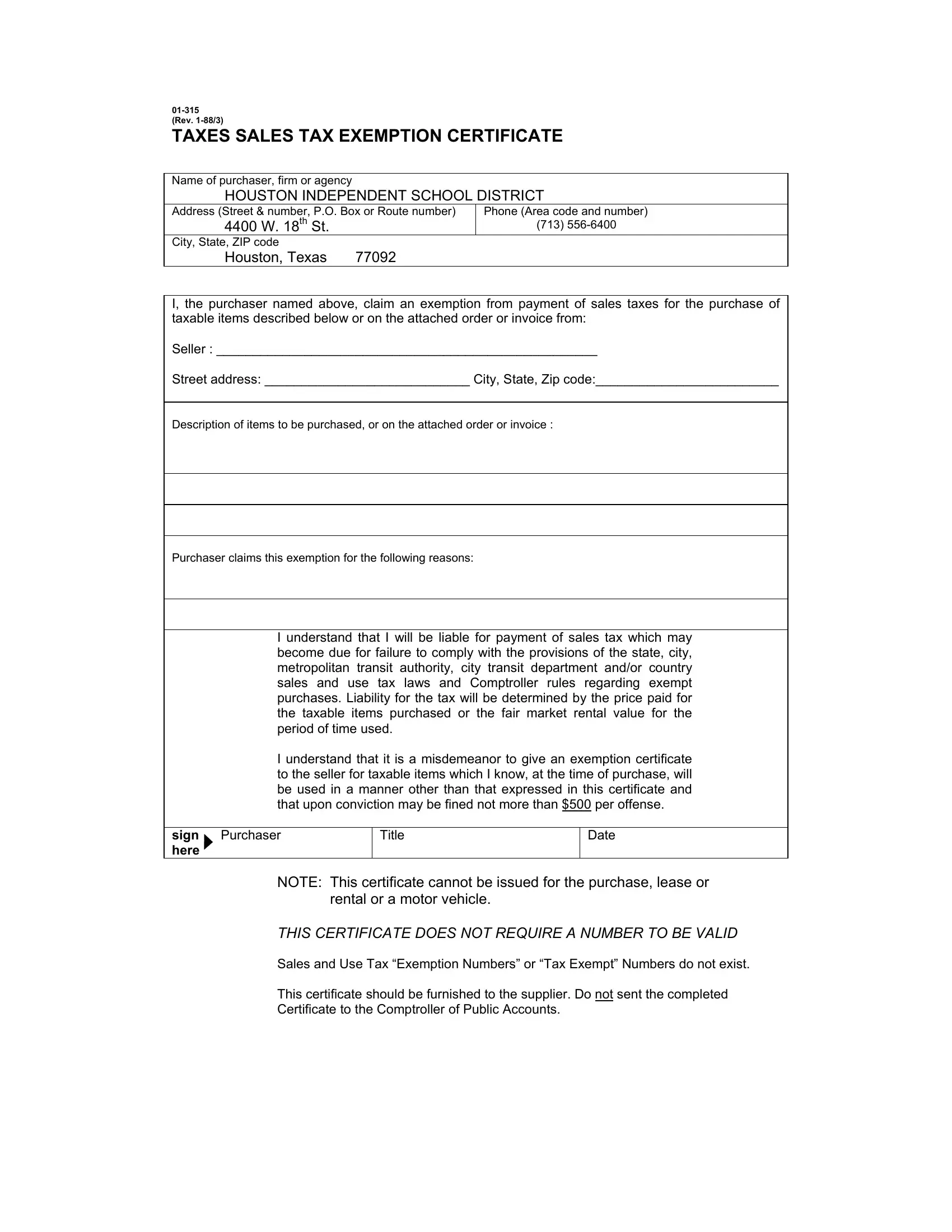

Texas Sales Tax Exemption Certificate PDF Form FormsPal

Find out when and how to obtain an exemption. This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture,. Under the sales and use tax law, all.

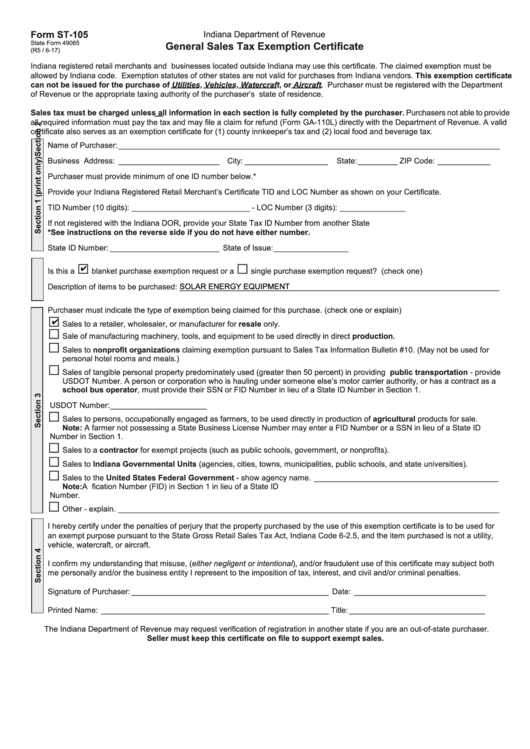

Indiana Sales And Use Tax Exemption Form

(to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture,. This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. Under the sales and use tax law, all receipts from sales of tangible personal property or taxable.

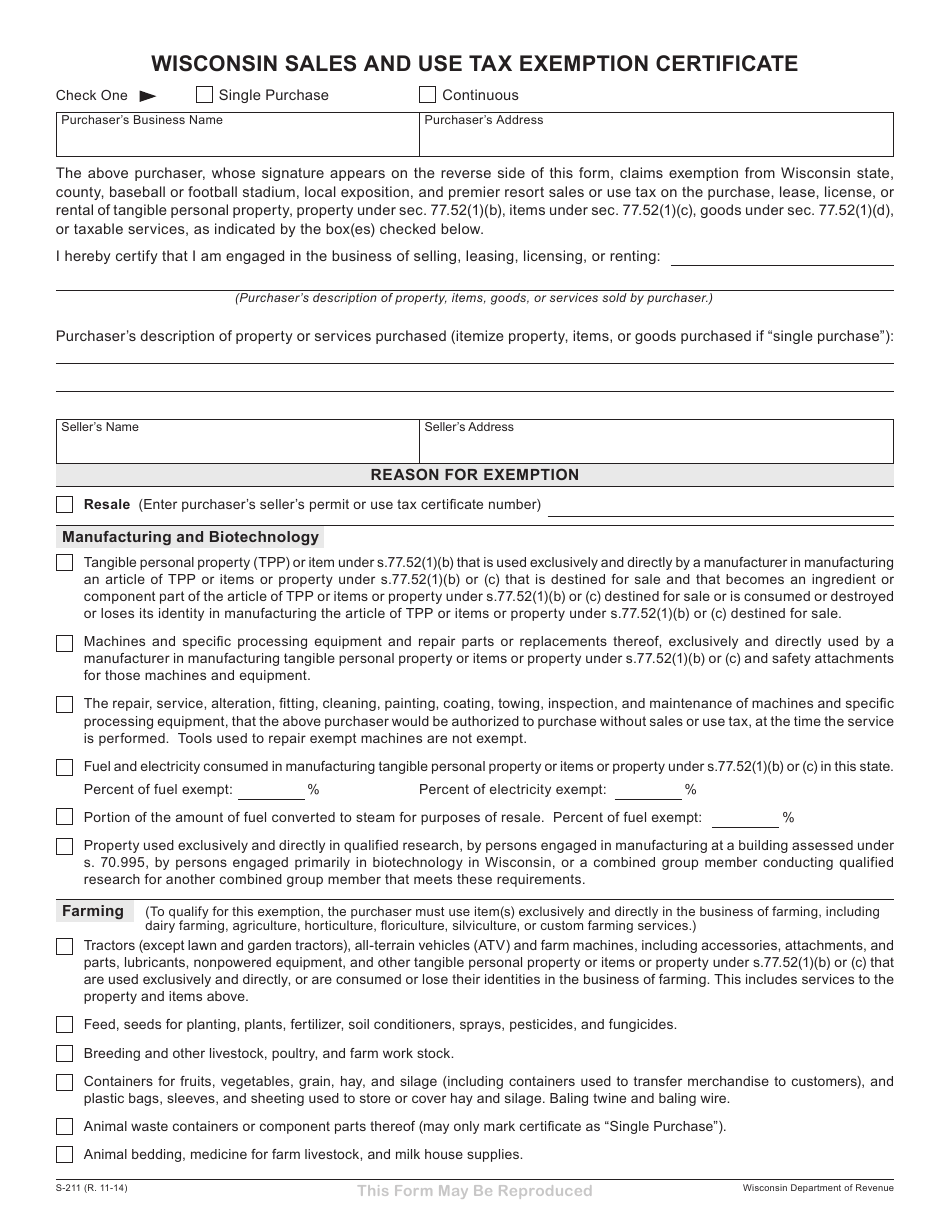

S Revenue Wi 20212024 Form Fill Out and Sign Printable PDF Template

Find out when and how to obtain an exemption. Under the sales and use tax law, all receipts from sales of tangible personal property or taxable services are subject to the tax until the contrary. This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. (to qualify for this.

Wisconsin Sales And Use Tax Exemption Certificate Fill In Form

This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture,. Under the sales and use tax law, all receipts from sales of tangible personal property or taxable.

Form S211 Fill Out, Sign Online and Download Printable PDF

Find out when and how to obtain an exemption. Under the sales and use tax law, all receipts from sales of tangible personal property or taxable services are subject to the tax until the contrary. This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. (to qualify for this.

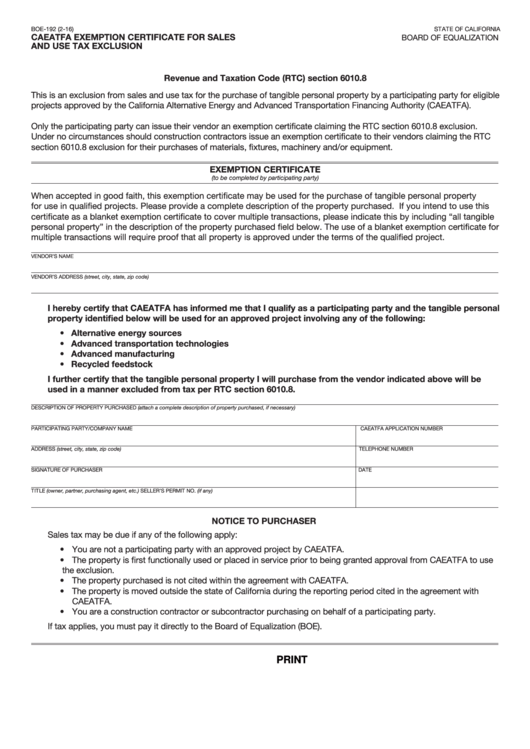

Fillable Caeatfa Exemption Certificate For Sales And Use Tax Exclusion

Find out when and how to obtain an exemption. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture,. Under the sales and use tax law, all receipts from sales of tangible personal property or taxable services are subject to the tax until the contrary. This certificate may.

Wisconsin Sales And Use Tax Exemption Certificate Form S 211

Under the sales and use tax law, all receipts from sales of tangible personal property or taxable services are subject to the tax until the contrary. Find out when and how to obtain an exemption. This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. (to qualify for this.

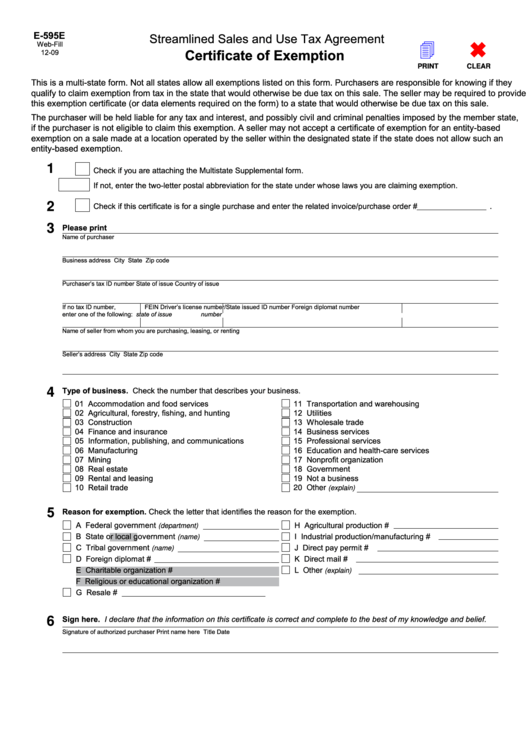

Streamlined Sales & Use Tax Certificate Of Exemption Form

Under the sales and use tax law, all receipts from sales of tangible personal property or taxable services are subject to the tax until the contrary. This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. Find out when and how to obtain an exemption. (to qualify for this.

Under The Sales And Use Tax Law, All Receipts From Sales Of Tangible Personal Property Or Taxable Services Are Subject To The Tax Until The Contrary.

Find out when and how to obtain an exemption. This certificate may be used to claim exemption from wisconsin state, county, baseball and football stadium, local exposition, and premier resort. (to qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture,.