95014 Local Sales Tax Rate

95014 Local Sales Tax Rate - The sales tax rate in cupertino is 9%, and consists of 6% california state sales tax, 0.25% santa clara county sales tax and 2.75% special district tax. Simply enter your zipcode to instantly find local tax rates and calculate sales tax. The 95014, cupertino, california, general sales tax rate is 9.375%. The cupertino, california sales tax rate of 9.375% applies in the zip code 95014. The combined rate used in this calculator (9.375%) is the result of the california. Your total sales tax rate is the sum of the california state tax (6.25%), the santa clara. The current sales tax rate in 95014, ca is 9.38%. Our calculator helps you determine exact tax amounts for any. Look up the current sales and use tax. The combined sales tax rate for cupertino, california is 9.13%.

Simply enter your zipcode to instantly find local tax rates and calculate sales tax. Click for sales tax rates, 95014 sales tax calculator, and printable sales tax table from sales. Our calculator helps you determine exact tax amounts for any. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. An alternative sales tax rate of 9.125% applies in the tax region. Your total sales tax rate is the sum of the california state tax (6.25%), the santa clara. The current sales tax rate in 95014, ca is 9.38%. The combined sales tax rate for cupertino, california is 9.13%. Look up the current sales and use tax. The sales tax rate in cupertino is 9%, and consists of 6% california state sales tax, 0.25% santa clara county sales tax and 2.75% special district tax.

Your total sales tax rate is the sum of the california state tax (6.25%), the santa clara. The current sales tax rate in 95014, ca is 9.38%. Our calculator helps you determine exact tax amounts for any. Look up the current sales and use tax. The cupertino, california sales tax rate of 9.375% applies in the zip code 95014. The combined rate used in this calculator (9.375%) is the result of the california. An alternative sales tax rate of 9.125% applies in the tax region. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The combined sales tax rate for cupertino, california is 9.13%. Simply enter your zipcode to instantly find local tax rates and calculate sales tax.

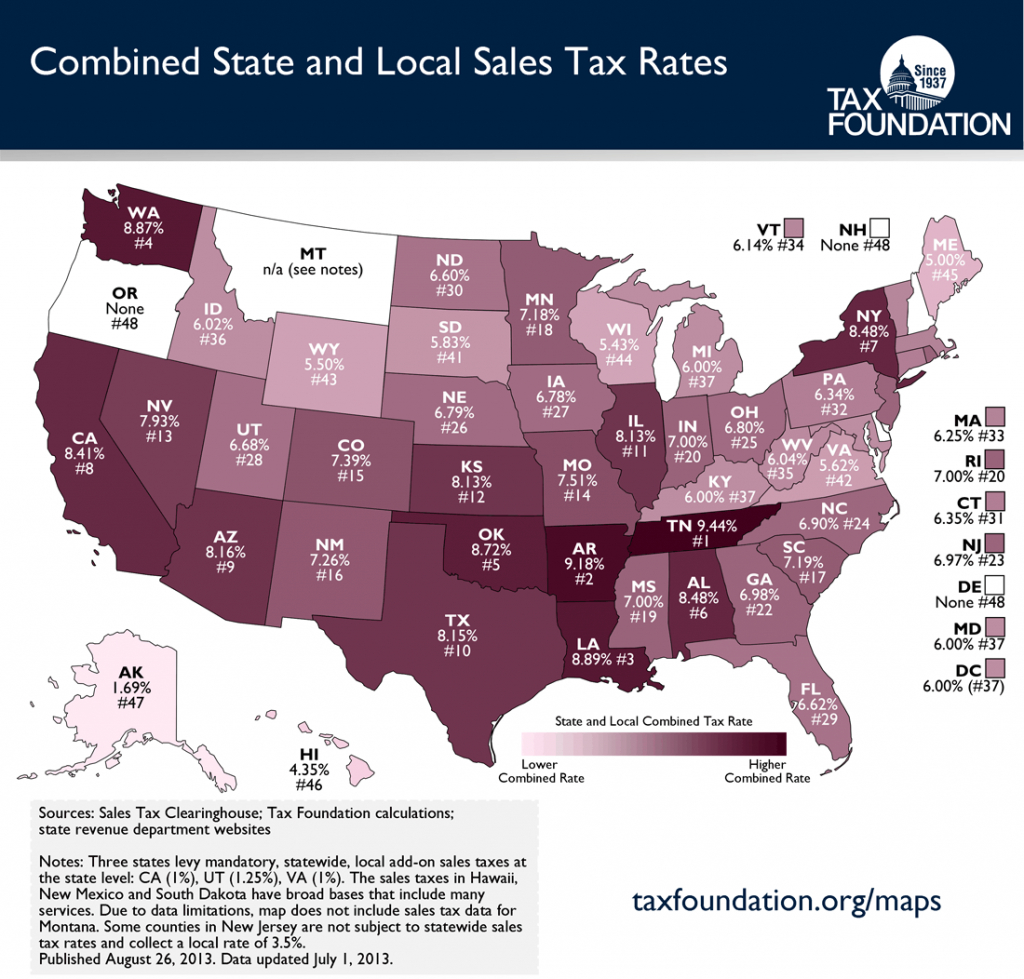

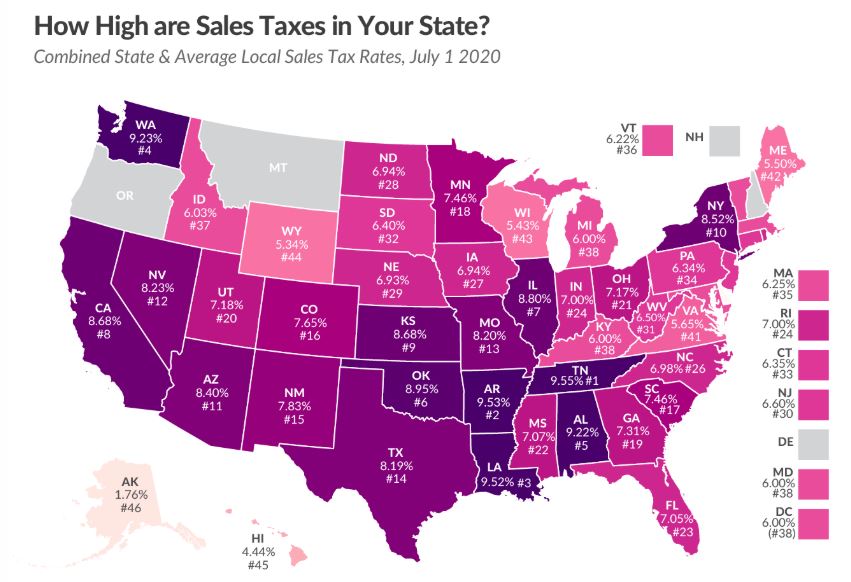

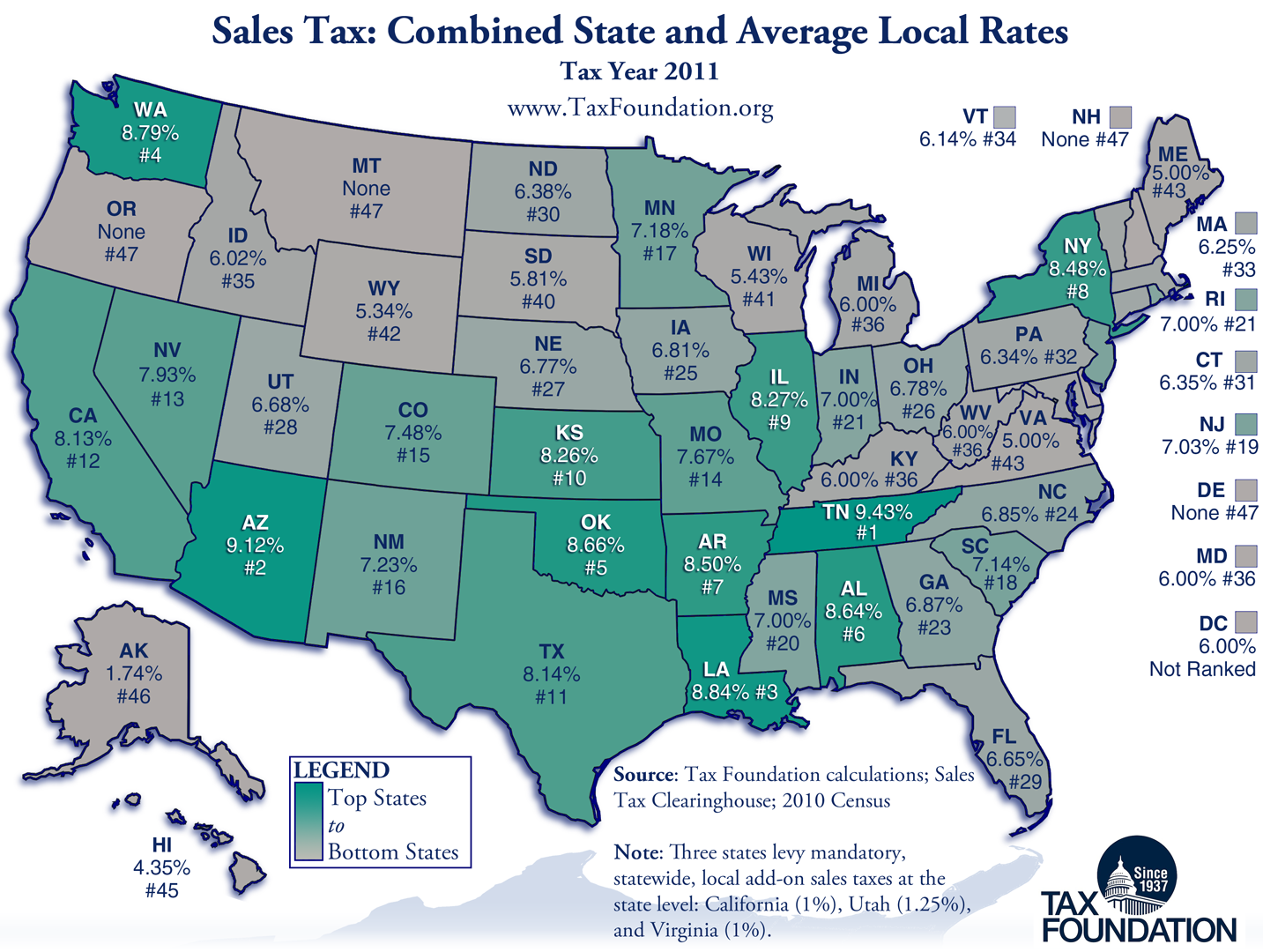

Combined State and Average Local Sales Tax Rates Tax Foundation

For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The cupertino, california sales tax rate of 9.375% applies in the zip code 95014. Click for sales tax rates, 95014 sales tax calculator, and printable sales tax table from sales. An alternative sales tax rate of 9.125% applies.

Nc State Sales Tax Rate 2024 Caryn Cthrine

The combined rate used in this calculator (9.375%) is the result of the california. Click for sales tax rates, 95014 sales tax calculator, and printable sales tax table from sales. Our calculator helps you determine exact tax amounts for any. The 95014, cupertino, california, general sales tax rate is 9.375%. Simply enter your zipcode to instantly find local tax rates.

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

The combined sales tax rate for cupertino, california is 9.13%. The 95014, cupertino, california, general sales tax rate is 9.375%. An alternative sales tax rate of 9.125% applies in the tax region. Our calculator helps you determine exact tax amounts for any. The cupertino, california sales tax rate of 9.375% applies in the zip code 95014.

Washington's combined statelocal sales tax rate ranks 5th in the

The sales tax rate in cupertino is 9%, and consists of 6% california state sales tax, 0.25% santa clara county sales tax and 2.75% special district tax. Look up the current sales and use tax. The 95014, cupertino, california, general sales tax rate is 9.375%. Your total sales tax rate is the sum of the california state tax (6.25%), the.

Kansas has 9th highest state and local sales tax rate The Sentinel

The 95014, cupertino, california, general sales tax rate is 9.375%. The combined sales tax rate for cupertino, california is 9.13%. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The sales tax rate in cupertino is 9%, and consists of 6% california state sales tax, 0.25% santa.

Texas Sales Tax Rate 2024 Jeanne Maudie

The combined sales tax rate for cupertino, california is 9.13%. Simply enter your zipcode to instantly find local tax rates and calculate sales tax. The combined rate used in this calculator (9.375%) is the result of the california. The 95014, cupertino, california, general sales tax rate is 9.375%. Click for sales tax rates, 95014 sales tax calculator, and printable sales.

Austin Texas Sales Tax Rate 2024 Wilow Lisetta

Simply enter your zipcode to instantly find local tax rates and calculate sales tax. Our calculator helps you determine exact tax amounts for any. The sales tax rate in cupertino is 9%, and consists of 6% california state sales tax, 0.25% santa clara county sales tax and 2.75% special district tax. An alternative sales tax rate of 9.125% applies in.

NY Sales Tax Chart

The cupertino, california sales tax rate of 9.375% applies in the zip code 95014. An alternative sales tax rate of 9.125% applies in the tax region. Your total sales tax rate is the sum of the california state tax (6.25%), the santa clara. The 95014, cupertino, california, general sales tax rate is 9.375%. Look up the current sales and use.

Louisiana has nation’s highest combined state and local sales tax rate

For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The cupertino, california sales tax rate of 9.375% applies in the zip code 95014. Click for sales tax rates, 95014 sales tax calculator, and printable sales tax table from sales. Simply enter your zipcode to instantly find local.

Sales Tax Rate Texas 2024 Margaret Hendren

The cupertino, california sales tax rate of 9.375% applies in the zip code 95014. An alternative sales tax rate of 9.125% applies in the tax region. The current sales tax rate in 95014, ca is 9.38%. The 95014, cupertino, california, general sales tax rate is 9.375%. The combined rate used in this calculator (9.375%) is the result of the california.

Click For Sales Tax Rates, 95014 Sales Tax Calculator, And Printable Sales Tax Table From Sales.

The cupertino, california sales tax rate of 9.375% applies in the zip code 95014. Look up the current sales and use tax. The combined rate used in this calculator (9.375%) is the result of the california. The sales tax rate in cupertino is 9%, and consists of 6% california state sales tax, 0.25% santa clara county sales tax and 2.75% special district tax.

An Alternative Sales Tax Rate Of 9.125% Applies In The Tax Region.

The current sales tax rate in 95014, ca is 9.38%. Your total sales tax rate is the sum of the california state tax (6.25%), the santa clara. The 95014, cupertino, california, general sales tax rate is 9.375%. Simply enter your zipcode to instantly find local tax rates and calculate sales tax.

Our Calculator Helps You Determine Exact Tax Amounts For Any.

The combined sales tax rate for cupertino, california is 9.13%. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage.

.png)